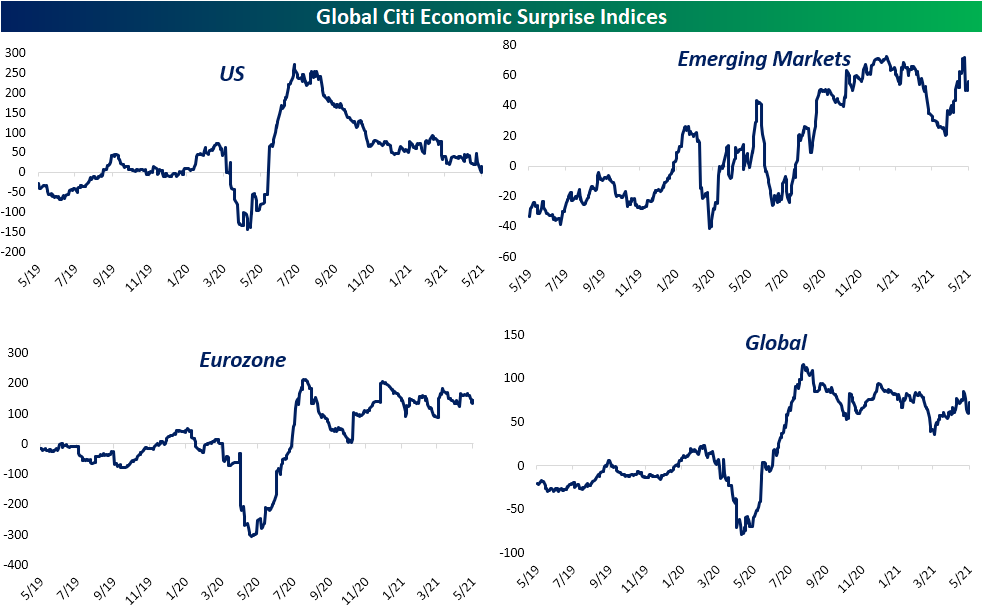

Economic Surprise Index Tips Negative For The First Time In A Year

While the overall trend of economic data has been for further improvement, things have slowed recently relative to expectations. In the charts below, we show the charts of the Citi Economic Surprise indices for the US, Emerging Markets, the Eurozone, and the entire world. Broadly speaking, positive readings indicate that economic data is coming in better than forecasts while negative readings indicate the opposite. Every region of the globe has pulled back over the past couple of months but for the most part, current readings remain at the high end of their historical ranges. In fact, the indices for Emerging Markets, Eurozone, and the whole globe all sit in the top 3% of all readings in their histories. The one place that is not the case is the US. Since last summer, the surprise index has been trending lower off of record levels, and just yesterday, it hit it tipped negative for the first time since June 2nd of last year.

Lasting 248 trading days, this was the longest streak of consecutive positive readings in the index’s history dating back to 2003. The only other streak that lasted nearly as long was a 189 day long one which came to an end in June 2018. Click here to view Bespoke’s premium membership options for our best research available.

The Bespoke Report – 5/21/21 – Churn

This week’s Bespoke Report newsletter is now available for members.

In this week’s report, we highlight the market’s churn this week along with movements in the dollar, commodities, crypto, a review of the earnings season and economic data, and much more. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Bespoke’s Morning Lineup – 5/21/21 – Nasdaq Lunging For the Finish Line

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“It’s not so important who starts the game, but who finished it.” – John Wooden

While the week came in like a bear, it’s looking to go out like a bull as US equity futures are in the green across the board. The Nasdaq is already in positive territory for the week, and if current pre-market levels hold, the S&P 500 could make it just barely into positive territory, but a win is a win no matter what the score. The economic calendar is relatively quiet to close out the week with flash PMI readings for May at 9:45 and Existing Home Sales at 10 AM. In addition to those reports, four Fed officials are also scheduled to speak throughout the day.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight economic and earnings data, an updated look at global PMI readings as well as the latest US and international COVID trends including our vaccination trackers, and much more.

With three down days to start, a down week for the Nasdaq was looking like a foregone conclusion on Wednesday. Thursday’s rally changed that script, and instead of the fifth straight week of losses, the Nasdaq is on pace for its first positive week in May. Ever since the index failed to take out its February high in late April, the Nasdaq has been under pressure, but this week’s rally, or more accurately, the rally off Wednesday’s lows has put the 50-DMA into play. Futures are indicated higher this morning which would put the Nasdaq back above its 50-DMA to close out the week, but there’s still six and a half hours of trading left in the week. One encouraging sign is that along with the gain in the Nasdaq, semis have also shown some leadership for a change after weeks of underperformance.

Bespoke’s Weekly Sector Snapshot — 5/20/21

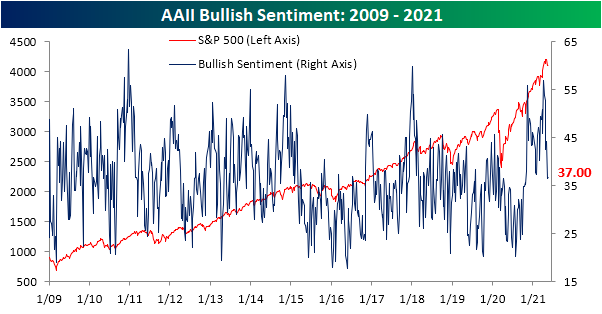

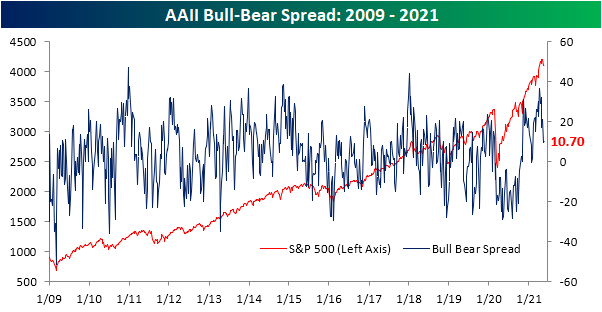

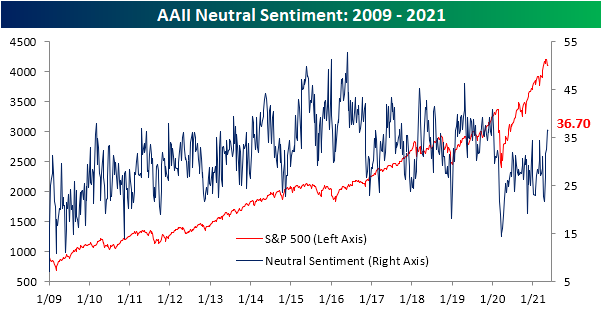

Increased Caution Across Sentiment Indicators

The S&P 500 has been holding up at its 50-DMA in the past week while more speculative areas of the market (i.e. crypto) have experienced wild swings. As a result, sentiment on the part of individual investors has not seen much of a move. The American Association of Individual Investors‘ weekly reading on bullish sentiment was little changed this week climbing half of one percentage point to 37%. Although that was not a large move in the past week, sentiment has taken a big hit over the past month having fallen from well above 50%. In spite of that big drop and even though sentiment is around the lowest levels of the past half-year, the current sentiment level is within one percentage point of the historical average. In other words, optimism is low versus recent history but is very much middling from a longer term perspective.

Meanwhile, bearish sentiment fell 0.7 percentage points to 26.3%. Unlike bullish sentiment, that is a bit lower than the historical average of 30.5%

Those corresponding moves meant the bull-bear spread climbed to 10.7 from 9.5 the prior week. Excluding last week, that is still one of the lowest readings since February.

Neutral sentiment has been the star of the show recently. The gain this week was tiny at only 0.2 percentage points, but nonetheless, it marked the fifth consecutive week in which neutral sentiment has risen. At 36.7%, it is now at the highest level since the second week of 2020.

The Investors Intelligence survey of equity newsletter writers took a less optimistic tone this week as bullish sentiment fell 4.1 percentage points to a ten-week low of 54.5%. Bearish sentiment was unchanged at the highest level since the end of March. The survey also questions respondents on whether or not they expect a correction. That reading rose 4.1 percentage points to 28.3% in the biggest one-week uptick since the last week of April when it rose 4.7 percentage points. That leaves the reading at the highest level since the week of March 10th. Before that, you would need to go back to September 23rd to find as high of a reading.

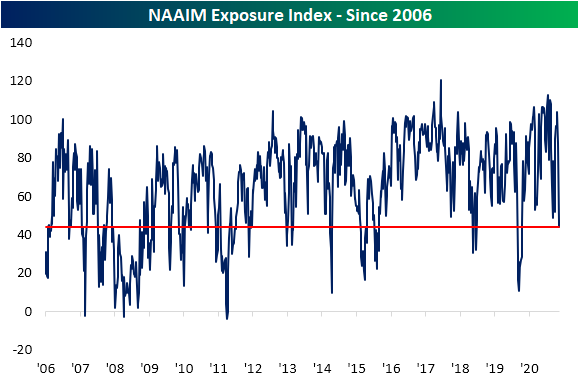

Another sentiment reading that has taken an even more dramatically negative tone lately has been the National Association of Active Investment Managers Exposure Index. This index measures how exposed to equities managers are where readings of 200 would mean they are leveraged long, 100 would be fully invested long, 0 would be neutral, -100 is fully short, and -200 is leveraged short. This week saw the index fall another 2.65 points after a massive 40-point decline last week. That is the lowest level since last March and April of last year. Altogether, while sentiment still favors bulls, there has been a more cautious tone that has been reflected in managers reducing exposure to equities. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: EV Pickups Take The Stage

PUA Claims Below 100K As States Plan To Drop The Program

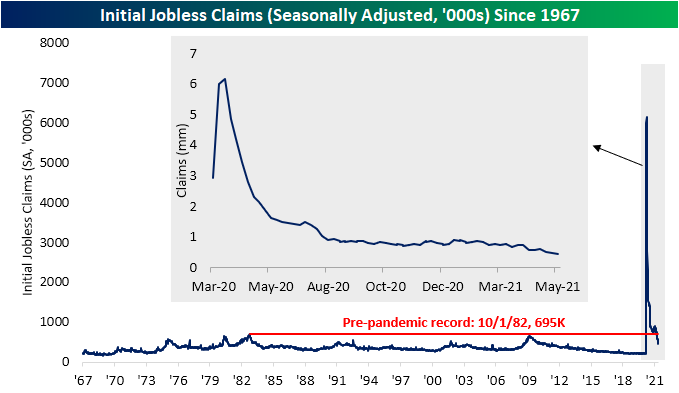

Recent jobless claims prints have seen the readings on initial claims consistently fall to pandemic lows while continuing claims have been a bit weaker moving sideways or even slightly higher. This week, it was more of the same. Initial claims came in at the lowest level since the week of March 13th of last year; the last week before the pandemic caused claims to rise by the millions per week. At 444K this week claims dropped by 34K from last week’s revised level of 478K (original of 473K). That was also better than expected as forecasts were calling for a decline to only 450K. Initial claims have now fallen three weeks in a row with the drop totaling 146K in that time.

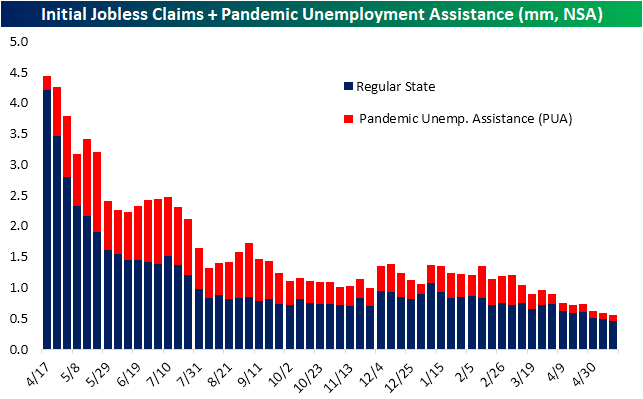

On a non-seasonally adjusted basis, claims were likewise lower for a third week in a row coming in at 454.6K which again is the strongest reading since last March. With regards to Pandemic Unemployment Assistance (PUA), there have been several states to recently announce that they are to various extents doing away with certain programs like PUA early even though on a federal level the American Rescue Plan extended benefits through September. Without getting into the weeds on the implications of this, we would note those announcements do come in the context of very small inflows into auxiliary claims programs like PUA. This week, PUA claims fell below 100K for the first time after falling 8.6K to 95.09K.

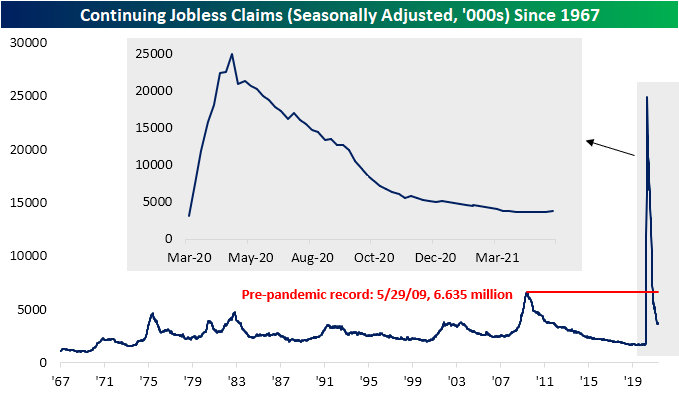

In spite of decelerating inflows into the unemployment insurance systems, the continuing claims picture continues to worsen. Continuing claims were expected to fall from last week’s revised reading of 3.64 million to 3.62 million, but instead, they rose 111K. That brings continuing claims to the highest level since mid-March and makes this week’s increase the largest in a single week since the last week of November.

Factoring in all other programs for a more complete picture adds an extra week’s lag to the data. By this measure, things look better than looking purely at regular state claims. Total claims across all programs fell to just above 16 million at the end of April compared to 16.891 million the week before; a new low for the pandemic. PUA claims contributed the most to that overall decline with the program seeing 678.7K fewer claims week over week. At 6.6 million, continuing PUA claims reached the lowest level since the first week of May of last year. Regular state claims and Pandemic Emergency Unemployment Compensation (PEUC) had the next biggest contributions to the overall decline with drops of 81.9K and 150.2K, respectively. Click here to view Bespoke’s premium membership options for our best research available.

The Bespoke 50 Top Growth Stocks — 5/20/21

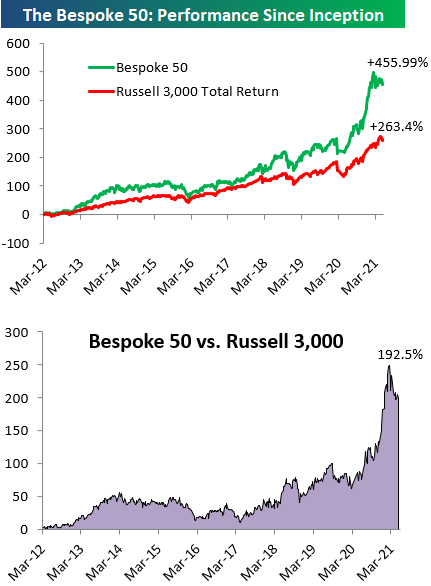

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” list is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 455.99% excluding dividends, commissions, or fees. Over the same period, the Russell 3,000’s total return has been +263.4%. Always remember, though, that past performance is no guarantee of future returns. (Please read below for more info.) To view our “Bespoke 50” list of top growth stocks, please start a two-week trial to either Bespoke Premium or Bespoke Institutional.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, fees, or dividends are not included in the performance calculation. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities.

Bespoke’s Morning Lineup – 5/20/21 – Modest Weakness in Stocks and Data

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The typical trader wants to be right on every single trade. He is desperately trying to create certainty where it just doesn’t exist.” – Mark Douglas

Futures are modestly lower heading into the second to last trading day of the week, and the just-released economic data has been a modest disappointment. Initial Jobless Claims came in slightly lower than forecasts (444K vs 450K), but continuing claims were modestly higher (3.751 mln vs 3.63 mln). The Philly Fed Manufacturing report came in at 31.5, which is generally a strong number, but relative to April’s reading (50.2) and expectations (41.0), it was a disappointment.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight economic and earnings data, as well as the latest US and international COVID trends including our vaccination trackers, and much more.

After big losses early on in the session, yesterday almost finished off as a major reversal day. The Nasdaq came up just shy of finishing the day in positive territory, but the Philadelphia Semiconductor Index (SOX), which traded down over 2% early on in the session, finished the day up just shy of 2%. Yesterday’s reversal also began just as the SOX was testing its lows from last week and the bottom of its six-month trading range. We should know soon enough whether this range will hold.