Bespoke’s Morning Lineup – 6/21/21 – Equities Look to Regroup

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“I’m the fellow who takes away the punch bowl just when the party is getting good.” – William McChesney Martin, Jr.

Investors got the first hints of the punch bowl being taken away in the post-COVID world last Wednesday, and they haven’t taken it well. The Dow was down every day last week which was the first “o-fer” an entire week the index has experienced since February 2020 just as the COVID crash was getting underway. Bulls are attempting to regroup this morning after last Friday’s plunge with all of the major US indices trading higher in the pre-market, but it’s still early. The economic and earnings calendars are light today with the only economic report being the Chicago Fed National Activity Index missing expectations (0.29 actual vs 0.70 forecasts). While quiet on the data front, there will be plenty of Fedspeak to contend with.

Read today’s Morning Lineup for a recap of all the major market news and events, the latest economic news from around, a discussion of elections in Europe, South Korean trade data, and the latest US and international COVID trends including our vaccination trackers, and much more.

Last week was a rough one for most sectors, and the most damage was done in cyclical sectors. Materials, Financials, and Energy were all down over 5% while another three sectors were down over 3%. The only sector to successfully swim against the tide was Technology which managed to trade up a mere 0.08%. In the wake of last week’s decline, no sectors are overbought, four are oversold, and one (Utilities) is at ‘Extreme’ oversold levels.

As mentioned above, Technology was able to buck the trend last week and finish the week higher, and because of that the Nasdaq 100 remains just shy of record-high levels. The S&P 500, meanwhile, doesn’t look nearly as strong as it closed below its 50-DMA on Friday for the first time since March 8th. These two indices are both telling different stories.

Bespoke Brunch Reads: 6/20/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

History

The “Quaker Comet” Was the Greatest Abolitionist You’ve Never Heard Of by Marcus Rediker (Smithsonian Mag)

A fascinating biography of little-known Quaker abolitionist Benjamin Lay, whose fiery condemnation of slavery was among the first of the faith in America, long before the Delaware Valley became a hotbed of anti-slavery sentiment. [Link]

Who were the world’s first bakers? by Sarah Reid (BBC)

New evidence has pointed to the use of flour and bread baking in Australia tens of thousands of years before the previous consensus start of baking in the Middle East much closer to our contemporary period than it was to the ancient breadmaking of Aborigines 50 millennia ago. [Link]

Personal Profiles

This Is the Story of a Man Who Jumped Into Lake Michigan Every Day for Nearly a Year by Julie Bosman (NYT)

A revealing story of a man driven to frigid plunges into Lake Michigan by the pain of pandemic, politics, and at first anyways, a truly nasty hangover. [Link; soft paywall]

Three Hurricanes. A Deep Freeze. A Biblical Flood: Lake Charles Is America’s Climate Future by Zahra Hirji and Brianna Sacks (BuzzFeed)

The brutal stories of Lake Charles, Louisiana families that have lived through a brutal series of weather events. Houses and lives destroyed; they stand as a cautionary tale of climate change risks which loom over large swathes of the country. [Link]

Investing

Turn Turn Turn: Rotations Persist by Liz Ann Sonders (Charles Schwab)

While US markets have generally ground higher over the last couple of quarters, there has been a lot more going on under the surface, and that’s likely to continue. [Link]

Crypto

Bitcoin and the wealthy by Eva Szalay (FT)

An interesting dive into how some of the largest holder of bitcoin and other cryptocurrencies are thinking about managing their fortunes. [Link; paywall]

Crypto’s Weimar by Frances Coppola (Coppola Comment)

A post-mortem on the complete collapse of cryptocurrency TITAN and its stablecoin IRON, driven by poor design of the ecosystem that generated a “Weimar moment”. [Link]

Banking

Goldman Sachs reportedly plans to move more than 100 bankers to Florida by Lydia Moynihan (NYP)

A new Palm Beach office is luring dozens of Goldman employees who are marching south as their New York colleagues march back into the office. [Link]

Wall Street Banks Warn Their Trading Boom Is Over by David Benoit (WSJ)

Volatility and portfolio turnover drove a massive increase in trading activity during the pandemic, but banks are expecting that across FICC and equities Wall Street trading desks will book much less business going forward than they did during the last five quarters. [Link; paywall]

Boom & Bust

U.S. Housing Market Needs 5.5 Million More Units, Says New Report by Nicole Friedman (WSJ)

The shortfall in construction following the financial crisis has left US housing markets badly undersupplied and population has continued to grow steadily, leaving the US housing market badly short of units across the spectrum of housing types. [Link; paywall]

Honeywell Shuts Two Mask Factories as Face-Covering Demand Drops by Thomas Black and Shira Stein (Bloomberg)

As demand for N95 masks recedes, two manufacturing facilities spun up by Honeywell earlier this year will shutter, though another factory in the US continues to push out the masks. [Link; soft paywall]

Regulation

Lina Khan: The 32-year-old taking on Big Tech by James Clayton (BBC)

A profile of the surprisingly young chair of the Federal Trade Commission and her effort to target large digital companies with century-old antitrust regulations. [Link]

On this day in 2015, the Irish government accidentally legalised drugs for 24 hours by Rachael O’Connor (Irish Post)

Six years ago, a host of drugs were made totally legal for consumption and sale in Ireland thanks to a legal loophole that made the 1977 act banning 125 substances unconstitutional. [Link]

Psychology

How Humans Think When They Think As Part of a Group by Annie Murphy Paul (Wired)

Working together may not only improve efficiency by distributing tasks, but actually increase the total cognitive power of a group of people to something larger than the sum of their individual capabilities. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Daily Sector Snapshot — 6/18/21

The Bespoke Report – Do What Your Father Tells You!

This week’s Bespoke Report newsletter is now available for members.

In the spirit of Father’s Day weekend, how many times as a child do you remember hearing the phrase above? Maybe not so much anymore, but growing up in the past, kids have always been told from a young age that ‘father knows best.’ If he said to do something, you better be obedient and do it – or else. While it remains as temperamental and prone to outbursts as ever, in recent weeks, the market has not necessarily been the obedient child that investors would prefer to see.

For going on months now, you can’t look at a newspaper without reading about out-of-control prices or inflation and what it means for interest rates and a number of other parts of the financial world. The only problem is that interest rates haven’t been following orders.

From the FOMC to the big rotation from value to growth, there was a lot to cover this week, and we do so in this week’s Bespoke Report. Enjoy this week’s report, and have a great weekend. Happy Father’s Day!

To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels.

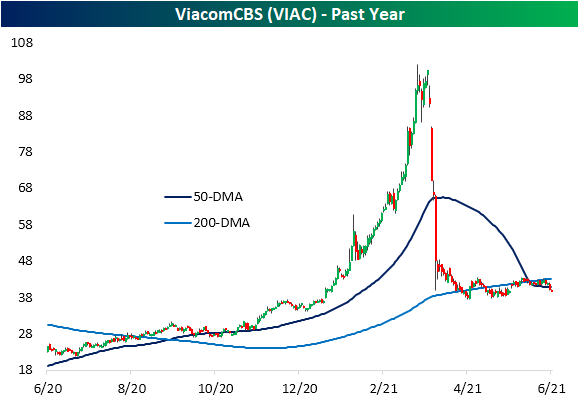

Archegos Stocks Back to “Normal”

With the return of meme stocks and a focus on monetary policy, the blowup of Archegos Capital Management is a distant memory roughly three months in the rearview. Two stocks that were the main victims of the Archegos saga were Discovery (DISCA) and ViacomCBS (VIAC). At their respective highs in March, DISCA had rallied 156.8% YTD and VIAC was up an even larger 169.3%. But as fast as those stocks ripped higher, they have erased the bulk of their moves. Both stocks have fallen over 60% from their respective peaks.

As for where the two stocks stand today from a charting perspective, the moving averages provided DISCA with little to no support as it currently sits 15% below its 50-DMA. Additionally, the 50-DMA has recently crossed below its longer-term 200-DMA in the past couple of sessions. While DISCA has been in a steady downtrend, the chart of VIAC is a bit more constructive. After the initial drop during the Archegos episode, the stock found support around its 200-DMA and has been fluctuating around that moving average ever since then. Like DISCA, the 50-DMA of VIAC has also recently fallen below the 200-DMA too.

From a longer-term perspective, the parabolic move earlier this year resulted in DISCA smashing out of the past five year’s range. But the decline over the past few months has meant the stock is right back within that range once again. It is a similar story for VIAC. VIAC broke its multi-year downtrend in dramatic fashion earlier this year, but the declines over the past few months have brought the stock right back down to that trendline. Click here to view Bespoke’s premium membership options.

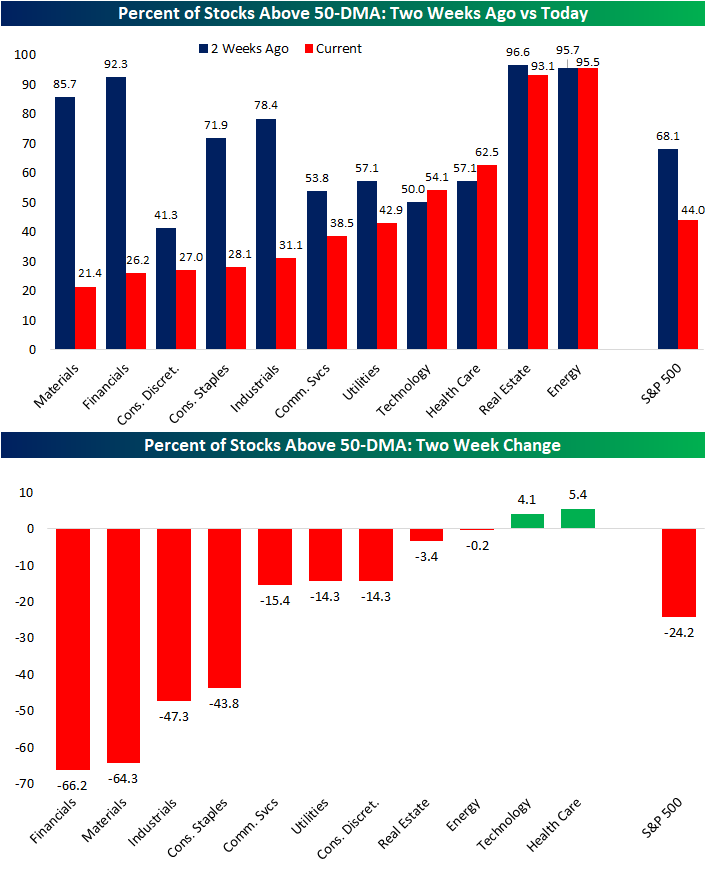

Big Drops In The Percent of Stocks Above Their 50-DMAs

In yesterday’s Sector Snapshot, we highlighted how the internals of several sectors have weakened dramatically in recent days. One such measure in which there are drastic differences versus a couple of weeks ago is the reading on the percentage of stocks above their 50-DMAs. In the charts below, we show the changes in this reading across sectors and for the broader S&P 500.

As shown, the two sectors which have seen the largest share of their stocks fall below the support of their 50-DMAs are Financials and Materials. Two weeks ago, both of these sectors boasted some of the strongest readings of all sectors, but through yesterday, those readings have fallen over 60 percentage points. Meanwhile, Energy and Real Estate have seen almost all of their stocks trade above their 50-DMAs over the past two weeks without much change. While the declines were not as dramatic as Materials and Financials, Industrials and Consumer Staples have also seen a significant share of their members fall below their 50-DMAs. While most sectors have seen a decline in this reading, Tech and Health Care have been notable standouts with both sectors having more stocks above their 50-DMAs now than two weeks ago. This is indicative of the rotation that has been going on underneath the surface throughout the entire bull market that began when the S&P made its 2020 low after the COVID Crash last March. Click here to view Bespoke’s premium membership options.

Bespoke Briefs — Treasury Auctions

Bespoke’s Morning Lineup – 6/18/21 – Down into the Weekend

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“I think it’s natural we’ve tilted a little bit hawkish.” – James Bullard

So much for a quiet summer Friday. While futures were already lower, a CNBC interview with St Louis Fed President James Bullard (non-voter) where he had some relatively hawkish comments has only caused the losses to snowball. The S&P 500 is now on pace to open down about 1%. Today is an options expiration day with an unusually large amount of contracts expiring so that coupled with the fact that it’s now a Federal Holiday (Juneteenth) where volumes will likely be low, may only add to any potential volatility.

Read today’s Morning Lineup for a recap of all the major market news and events, the latest economic news from around the world overnight, a discussion of the latest delta COVID variant, the post-FOMC moves in markets, and the latest US and international COVID trends including our vaccination trackers, and much more.

We’ve seen quite a divergent move in the growth and value spaces over the last two days. While the S&P 500 Growth index closed at an all-time high, its Value counterpart has been subjected to selling pressure. As a result, the performance gap between the two indices over the last two trading days has shot up to 2.64 percentage points. That may sound like a relatively wide gap, but relative to the last year, it’s not all that extreme. Back in January, we saw a wider performance gap, and last year we saw numerous two-day periods where the two-day gap widened out more.

Memory Lane: June 18th

The S&P 500 is poised to open down about 1% this morning, but in order for today’s weakness to get anywhere near record territory for this day of the year (6/18/1930), it would need to drop a lot more from the open to close.

While most extreme market days have a clear catalyst behind them, others don’t. June 18th, 1930 (-3.50%) was the worst June 18th in the S&P’s history but a decline that came with little in the way of a concrete catalyst. With the market still in a tenuous position following the Black Tuesday crash, June 18th was a day of heavy volume where blue-chip stocks suffered some of the largest losses Selling reached a climax in the morning with shares of well known “glamour stocks” like Gillette, Mack Trucks, and Sears Roebuck trading below the levels they traded at on Black Tuesday.

After a lull in the volume in the mid-day, equities rebounded in the afternoon, but the damage was still done as a blue-chip stock like Eastman Kodakdropped 8.2%. Although the Dow and S&P did not make new lows relative to the lows in 1929, several key stocks exhibited negative divergences and took out their Black Tuesday lows. With a lack of a precise source for the erratic price action, it was thought that a combination of a negative “loadings of railway freight” report and seasonally low steel production contributed to a belief that hopes for recovery were premature, and rational investors, therefore raised cash. The downward slide in stocks would continue until 1932, where the market would reach its lowest level of the 20th century and lose an additional 70% of its value.

54 years later on June 18th, 1984, the S&P 500 jumped 1.81% with the rally ascribed to bargain hunters and short covering. In the grand scheme of things, most one-day rallies of 1.8% don’t burn themselves into your permanent memory bank, but June is not known for being a particularly volatile month. Heading into this day in 1984, market participants were still licking their wounds from the previous week’s rate-induced beatdown that was part of a broader sell-off that has been in place since late 1983. Some weaker economic data, though, raised hopes that the Fed would actually loosen policy, and that’s all it took for big buyers, including Salomon and other institutions, to step in and do some bargain hunting. The uptick in institutional activity showed itself as the number of large block trades (10,000+ shares) increased from 1,558 the prior day to 1,668.

In the weeks that followed June 18, 1984, the S&P 500 continued to drift lower, but by late July, the lows were in. From there, the S&P 500 never looked back and hasn’t traded at those levels again since. Click here to view Bespoke’s premium membership options.