Bespoke’s Weekly Sector Snapshot — 9/9/21

Largest 25 Stocks in the S&P 500, Now vs 10 Years Ago

In the last 10 years, the composition of the largest 25 companies by market cap in the S&P 500 has changed dramatically. Only 40% of the companies that were in the top 25 in 2011 remain there today. Additionally, the sector breakdown has shifted considerably. Sectors like Technology, Communication Services, and Consumer Discretionary have seen increases in their representation in the top 25 while the Energy, Consumer Staples, and Industrial sectors have seen declines.

Of the companies listed on both the 2011 and 2021 lists, the median total return excluding dividends over the last 10 years has been 312.33%, while the mean total return excluding dividends has been 606.65%. Apple ($AAPL), Microsoft ($MSFT), Alphabet ($GOOGL), and Amazon ($AMZN) have seen the largest appreciation of this group and are currently the four largest companies in the index.

As noted above, just 40% (10) of the companies on the list in 2011 made the cut in 2021, and as shown in the table below, while Apple (AAPL) and Microsoft (MSFT) remain in the top four, Exxon Mobil (XOM) and IBM not only fell out of the top four but also the top 25 altogether. Which top companies on the list now won’t be there in 2031? We wish we had a crystal ball!

Whereas the market cap of the S&P 500 has increased by 270% since 2011, the total value of the four largest companies has increased by 673%. In terms of market cap, the four largest companies account for just over 20% of the entire S&P 500’s market cap, and the 25 largest companies make up 49% of the total. In 2011, by contrast, the four largest companies had a weighting of 10% and the 25 largest accounted for about 36% of the total market cap. Click here to view Bespoke’s premium membership options.

Neutral Sentiment Surge

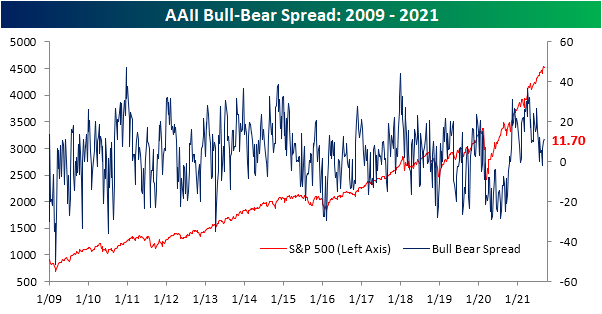

As we noted in today’s Morning Lineup, the S&P 500 has been pulling back over the past week but it has not been a particularly sharp pullback as the index remains within 1% of its all-time high. Bullish sentiment on the other hand has seen a more significant turn lower. The percentage of respondents reporting as bullish to the AAII survey this week fell 4.5 percentage points versus last week. At 38.9%, bullish sentiment is about in line with its historical average of 38%.

That pullback in bullish sentiment was not met with any pickup in bearish sentiment. In fact, bearish sentiment saw an even larger decline, falling 6.1 percentage points to 27.2%. That is the lowest level of bearish sentiment since the end of July.

Given those moves in bullish and bearish sentiment, the bull-bear spread was actually higher this week. The spread rose to 11.7 which is just below the recent high of 12.1 from the final week of July.

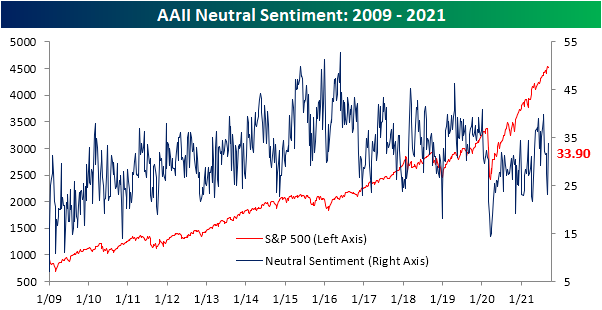

Given both bullish and bearish sentiments were lower this week by several percentage points, a large share of respondents shifted to neutral sentiment this week. That reading rose double digits to 33.9%. That is the first time since July 2018 that neutral sentiment has risen at least 10 percentage points in just one week.

Throughout the history of the AAII survey, it has been rare for neutral sentiment to rise double digits in only one week. Since the survey began in 1987, there have been 85 other times that neutral sentiment has seen such a move. Looking across those instances, the S&P 500 has averaged a move higher over the following months, but returns are typically worse than the norm. Click here to view Bespoke’s premium membership options.

Maybe GameStop (GME) Should Stop Reporting Earnings Altogether

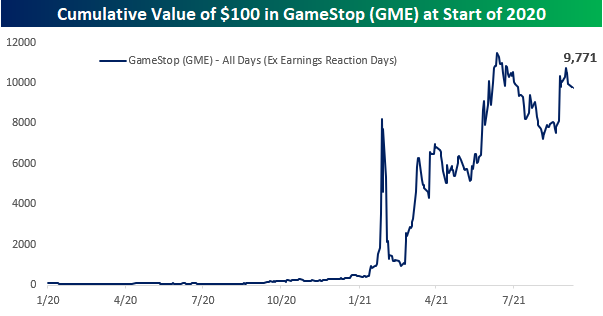

If there were a high scorer list in terms of stock performance since the start of 2020, the letters “GME” would be near the top. One hundred dollars worth of GameStop (GME) at the start of 2020 would currently be worth $2,925!

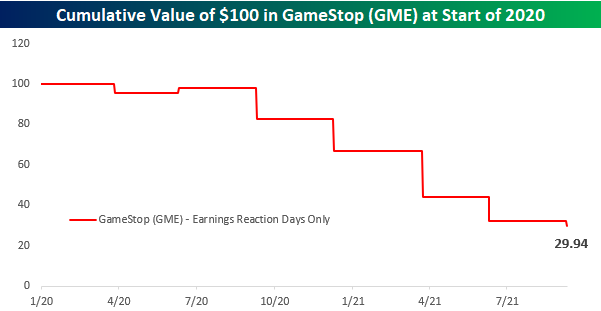

Today, though, shares of GME are trading down over 7% following a disappointing earnings report after the close yesterday. Given the performance of GME since the start of 2020, you would think that a day like today where the stock trades sharply lower in reaction to earnings would be an outlier. Hardly. Following its six prior earnings reports since the start of 2020 leading up to today, GME has traded lower on its earnings reaction day five times for an average decline of over 16%. The only positive reaction the stock has had in reaction to earnings during this period was a 2.2% gain in June 2020. In fact, going all the way back to September 2018, that June 2020 gain was the only positive earnings reaction day for the stock. How bad have earnings reports been for GME’s stock since the start of 2020? While $100 in GME stock since the start of 2020 is worth nearly $3,000 today, if you only had exposure to the stock on the day of each of its earnings reaction days during this period, that $100 would be worth less than $30 today!

The cumulative effect of GME’s weak reaction to earnings also shows up if you look at its cumulative performance since 2020 and excluding the trading days following GME’s quarterly earnings reports. Not including those seven trading days, $100 worth of GME at the start of 2020 would be worth nearly $10,000 today! Following its earnings conference call after the close yesterday, GME management was criticized for not taking any questions and providing little insight into its strategy moving forward. Based on how the stock has historically reacted to earnings, though, management probably wishes they could just do away with the whole earnings process entirely. Click here to view Bespoke’s premium membership options.

August 2021 Headlines

Ida Impacts Claims

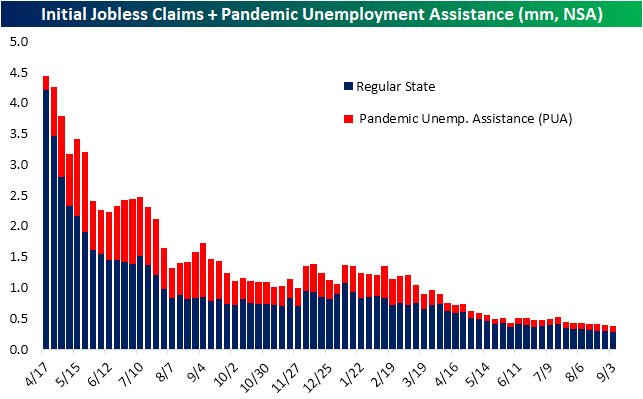

Last week’s initial jobless claims number was revised higher by 5K to 345K. Partially thanks to that upwards revision and a big drop this week, claims fell by 35K for the biggest one-week decline since the last week of June. That sizeable decline brings initial claims to the lowest level of the pandemic at 310K on a seasonally adjusted basis.

On a non-seasonally adjusted basis, claims are actually below 300K as has been the case for the past three weeks now. This week marked the seventh in a row that unadjusted regular state claims have fallen week over week making for the longest stretch of consecutive declines in the number since a 13-week long run ending in the first week of July last year. Factoring in Pandemic Unemployment Assistance (PUA), claims totaled a pandemic low of 380.5K thanks to a drop back below 100K by the PUA program. With that said, the program is also nearing its end.

Lagged an additional week to the initial claims number, continuing claims also set a new low this week. Through the final week of August, continuing claims dropped for a second week in a row to 2.783 million (2.74 million expected) from 2.8 million the prior week. That reading is roughly 1 million above the pre-pandemic reading (1.784 million on March 13, 2020.

There is yet another week of lag to the data when all programs are included. Factoring in all auxiliary programs, the most recent data is through the week of August 20th. Total claims for that week were still above the low of 11.8 million from the last week of July, but they did cross back below 12 million. The biggest contributors to that decline were PUA claims which fell by 322.7K to 5.051 million and regular state claims which fell by 135K. Other programs, namely extended benefits, weighed on claim counts. The extended benefits program has been notably volatile over the past few months now, and that continued in the most recent week of data. The program rose from a near pandemic low of 114.4K to 311.3K which is at the upper end of the past several months’ range.

One other interesting point to note on this week’s claims data was the impact of Hurricane Ida. Regular state claims fell by 8K nationally on a non-seasonally adjusted basis this week, and that count would have been much better without the epicenter of recent hurricane news: Louisiana. With the state still recovering from the storm, claims more than quadrupled this week. In fact, the increase was even larger than that of the most populous state, California, which saw claims rise by 5.6K. Click here to view Bespoke’s premium membership options.

Chart of the Day: Weekday Wandering

Bespoke’s Morning Lineup – 9/9/21 – Four in a Row?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Today I will do what others won’t, so tomorrow I can accomplish what others can’t” – Jerry Rice

It’s not often that you see the S&P 500 on pace for its fourth straight down day and it’s still within 0.6% of an all-time high, but it’s been a rather listless market in the days straddling the Labor Day weekend. The economic calendar is light again today with Jobless Claims the only report on the calendar. While the earnings calendar is light today, we’re currently in a relatively busy time of year when it comes to investor conferences, so there’s always the chance that a company drops a surprise at one of these conferences. Today, some of the more notable conferences are the Morgan Stanley Health Care Conference, Barclays Energy Conference, and the Deutsche Bank Technology Conference. In Europe, the ECB just announced its latest policy decision, and while rates were left unchanged, the central bank did take a moderately hawkish tone at the margin by announcing that it would conduct bond market purchases at a ‘moderately lower pace’ than recent activity.

In economic news, both initial and continuing jobless claims came in at post-COVID lows.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

One notable trend in this morning’s corporate announcements comes from the airline sector as not one, not two, and not three, but four different airlines have hit the tape this morning to lower Q3 guidance citing weakness related to the uptick in COVID cases (actually make that five as Delta just recently hit the tape as well). As one might expect after a company lowers guidance, all four stocks are trading moderately lower on the news. While the airline companies are just announcing the news of softer demand and a higher rate of cancellations, their stocks have been telling us this for months. Take a look at the charts below. All four have been in steady downtrends all summer.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.