BIG Charts of the Week – 11/12/21

You’ve likely seen Bespoke’s premium research before, but we continue to publish unique and timely analysis in reports like our Morning Lineup, BIG Tips, Sector Snapshot, Bespoke Baskets, Closer, and more.

Additionally, we’ve just published this week’s Bespoke Report newsletter — a detailed PDF that is easily digestible but super informative. You can see Bespoke’s current thoughts on global markets and the economy in this report.

Gain access by simply starting a two-week trial to any of the three Bespoke membership levels listed below. You can revisit our membership options here.

Join Bespoke Newsletter (Weekly Bespoke Report + COTD; Lowest price)

Join Bespoke Premium (Newsletter research + Morning Lineup, BIG Tips, and more)

Join Bespoke Institutional (Access to everything!)

The S&P 500 fell slightly this week as we move towards the unofficial end of earnings season in mid-November.

Below is a look at a handful of charts published this week that we thought were interesting or noteworthy. Additionally, we included a few quotes from Corporate America that we heard on earnings calls this week that have implications for the broader economy. Receive charts and analysis like this in your inbox daily by signing up for a two-week trial to Bespoke Premium.

The prospects of continued inflation have made headlines over the last few months, and the issue is yet to abate. In October’s reading, the trimmed-mean CPI was up a record 8.9% annualized, while the median CPI was up 7.1% annualized. Based on October’s CPI, inflation has outpaced compensation growth over the last year, resulting in less buying power for consumers.

In addition to inflation concerns, the cost and quality of labor is also a significant factor impeding business outlooks. The percentage of businesses in the monthly NFIB survey reporting that the cost or quality of labor was their single most important problem pulled back in October from highs reached in September by about 6 percentage points, but 34% of respondents still indicated that the quality and cost of labor was their largest concern.

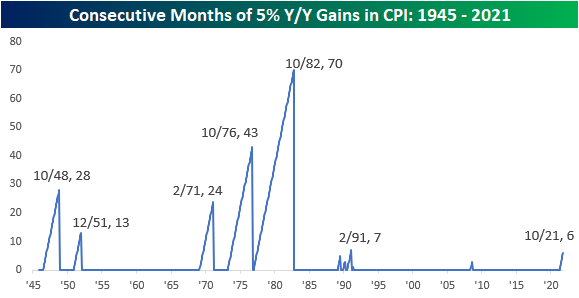

After October’s inflation data, the streak of consecutive months where y/y CPI increased 5% or more reached six, which is the highest level since early 1991 (7). In the post-WWII era, there have only been six other periods where CPI increased by 5%+ for six consecutive months. When these streaks have occurred, most extended over a significant period of time while just two others proved to be transitory.

After the close on Monday of this week, every major US index ETF was in ‘extreme overbought’ territory. Our Trend Analyzer (available with Bespoke Premium or Bespoke Institutional) classifies ‘extreme overbought’ as any time price rises more than two standard deviations above its 50-day moving average.

As shown below, earnings and revenue beat rates have begun to normalize (lower) after spiking in the quarters following the initial COVID shock that caused Wall Street analysts to lower (unnecessarily in hindsight) their estimates.

As the market has been in a consistent bull run since the pandemic low, it is only natural for investors to think about downside potential. For some perspective, the chart below shows that a 20% bear market drop from here would only take the S&P back down to levels seen earlier this year. A very steep drop of 27% would only take us down to the pre-COVID high seen for the stock market in mid-February 2020.

In addition to this week’s charts, we wanted to highlight that throughout this earnings season, we have been reporting on and summarizing select conference calls for our Bespoke Institutional subscribers. Here are some of the notable quotes from this week’s calls with implications for the broader economy:

Flower Foods (FLO) CEO Ryals McMullian commented, “The labor market remains challenging. Unemployment claims are declining, and job openings are at record levels.”

In regards to cruise bookings, Disney CEO Bob Chapek stated, “booked occupancy… is already ahead of historical ranges at significantly higher pricing.”

Chapek added, “we don’t expect to see a substantial recovery in international attendance at our domestic parks until toward the end of fiscal 2022.” This implies that international travel volumes will remain suppressed into the first half of 2022.

TripAdvisor CFO Ernst Teunissen commented, “we’re not out of the woods yet with COVID still impacting us and although we are cautious about Q4, we remain very optimistic that the recovery is taking root and are bullish about travel in our business in 2022.”

PayPal CEO Dan Schulman stated, “We are seeing the impact of global supply chain shortages in our merchant base. Consumer confidence has weakened with the absence of stimulus payments.”

To see the summaries of the earnings reports we covered, you can start a two-week Bespoke Institutional trial, or click here if you are already a subscriber.

In addition to this earnings coverage, Bespoke Institutional subscribers also have access to our recently debuted Little Known Stocks (LIKS) report. On Wednesday, we published our third LIKS report.

In these reports, we provide an in-depth breakdown of a stock that likely remains under the radar of most investors. In this week’s report, we analyzed a ‘pick-and-shovels’ play to a ‘pick-and-shovels’ industry. Over the last three years, this company has grown its revenues at a compounded annual growth rate of 33.2% and is currently trading at a discount relative to its competitors. Over the last year, this stock has outperformed both the Russell 2000 and its broader industry. Again, you can start a two-week trial to Bespoke Institutional to see this LIKS report and others.

Receive charts and analysis like the ones above in your inbox daily by signing up for a two-week trial. Sign up now to read this week’s Bespoke Report!

That’s it for this week. Have a great weekend and we’ll be back at it on Monday!

Best and Worst S&P 500 Stocks Since September 30th

The past month has seen the S&P 500 pivot and rally higher after declines throughout the month of September. Since the end of Q3, the S&P has now gained 8.6%, which is slightly off the highs from earlier this month. Earnings season has been in full swing over the past few weeks meaning there have been plenty of stocks with catalysts for big moves since the end of September. Below we show the stocks that have risen and fallen the most since September 30th.

Topping the list is Enphase Energy (ENPH) having rallied 67.77% in the past month and a half. The bulk of that gain came after earnings as the stock leaped 24.65% the day after reporting and plenty of follow-through in the days after. Arista Networks (ANET) is also up over 50%. Like ENPH, a large portion of ANET’s move came from an over 20% gain on earnings in response to a triple play. There are 18 other stocks in the S&P 500 that have risen by more than 25% since the end of September. The largest of those are NVIDIA (NVDA) and Tesla (TSLA).

Only 18% of the S&P 500 has traded lower since September 30th, and by far the biggest decliner has been Moderna (MRNA). Although it has fallen a dramatic 41% in a short span, that eats into what have been very strong gains this year. Even after its decline so far in Q4, MRNA has still more than doubled year to date. The only other biggest decliners since September that are still up year to date are Garmin (GRMN), Allstate (ALL), Carnival (CCL), and Dish Network (DISH). Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/12/21 – Splits-ville

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Life’s tragedy is that we get old too soon and wise too late.” – Ben Franklin

First, it was General Electric (GE) and now it’s Johnson & Johnson (JNJ) which has announced that it will split up and separate its consumer business from its pharma and medical device unit. The stock is trading up 3% on the news but is still well off its recent highs from August.

The rally in JNJ has provided a lift to Dow futures along with the S&P 500 and Nasdaq, but unless equities can meaningfully build on these early gains during the trading day, all three major averages will finish the week in the red ending a five-week streak of gains.

On the economic calendar today, the only two reports are JOLTS and Michigan Confidence. The JOLTS reading is expected to show a modest decline from last month’s reading, which you may recall came in significantly weaker than expected. Michigan Confidence is expected to show a small bounce, but the key in that report will be where inflation expectations stand.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

While the S&P 500 is lower over the last five trading days heading into today, the majority of sectors have actually experienced gains during that five-day stretch. Leading the way higher, Materials (XLB) has rallied more than 2.5%, followed by Industrials (XLI), Consumer Staples (XLP), and Energy (XLE). On the downside, Consumer Discretionary (XLY) has dropped more than 3% while Communication Services (XLC) is down more than 1%. The only two other sectors that have declined are Health Care (XLV) and Technology (XLK).

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Weekly Sector Snapshot — 11/11/21

The Bespoke 50 Growth Stocks – 11/11/21

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were six changes this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Chart of the Day: Rivian Drives Huge Week For US IPOs

Sentiment Steadily Moving Higher

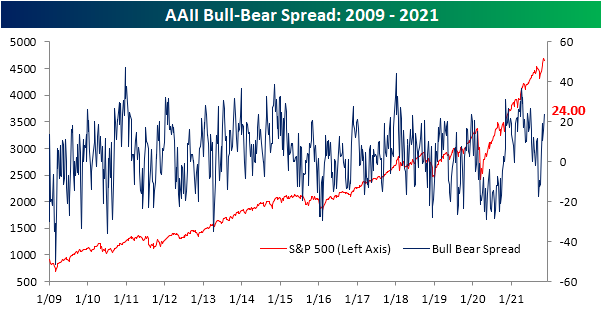

The S&P 500 has encountered some selling pressure this week, but that hasn’t stopped sentiment from continuing its grind higher. The weekly AAII sentiment survey saw 48.0% of respondents report as bullish this week up from 41.5% last week. That puts bullish sentiment at the highest level since the first week of July when it was 0.6 percentage points higher than it is now.

The increase in bullish sentiment borrowed from bears as less than a quarter of respondents reported having negative sentiment for the first time since the last week of July. Similar to bullish sentiment, bearish sentiment is now at the lowest level since the first week of July when it came in at 22.2%.

Overall, sentiment continues to favor bulls to a wide margin. As a result of the inverse moves in sentiment, the bull-bear spread rose to 24 from 15.5 last week. Again, that is levels not seen since early July.

Neutral sentiment also declined this week falling by 4.5 percentage points to 28%. Unlike bullish and bearish sentiment, that reading is basically in the middle of the past several months’ range as the reading has generally hovered around the 30% level. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/11/21 – Tentative Rebound

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“He died unquestioning, uncomplaining, with faith in his heart and hope on his lips, that his country should triumph and its civilization survive.” – Warren G Harding

In observance of Veterans Day, the Federal government and banks are closed today. That means that for today at least, stocks will not be able to fall because of rising yields. Equity futures are modestly higher this morning with the Nasdaq leading the gains. There’s no economic data on the calendar due to the holiday, and even the earnings calendar is relatively quiet.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday was one of those relatively uncommon days where it didn’t matter if you were in stocks or bonds- they both had a rough day. While the S&P 500 was down around 0.80%, long-term treasuries dropped more than twice as much as the iShares 20+ Year US Treasury ETF (TLT) fell 1.83%. Over the last ten years, there have been just 34 other days where SPY and TLT both finished the day down more than 0.75%, and in the charts below we summarize the performance of both ETFs in the day, week, and month following each prior occurrence.

Starting with SPY, the day after the 34 prior occurrences its median gain has been 0.17% with gains 57% of the time which is better than the average one-day performance for all one-day periods over the last ten years. However, as you move out over the next week and month, median performance following these days where both SPY and TLT were down 0.75% or more, returns have actually been negative and well below the long-term average. In fact, both one week and one month later, SPY was higher less than half of the time.

Although SPY has tended to show weaker than average performance over the following week and month, TLT’s median one-week and one-month performance has been better than average. In fact, one month following the 34 prior occurrences, TLT only fell five times.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.