B.I.G. Tips – Charts We’re Watching

Chart of the Day – Tech Sector and Yields

Bespoke’s Morning Lineup – 11/24/21 – Data Incoming

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Those who are not grateful soon begin to complain of everything.” – Thomas Merton

If you were expecting a quiet day in the markets ahead of Thanksgiving, you may want to think again. While we got most of the earnings data out of the way yesterday (with some big losers), today we’ll be squeezing in three days worth of economic data including Jobless Claims, Wholesale Inventories, GDP, and Durable Goods at 8:30. Then, at 10 we’ll get Personal Income and Spending as well as Michigan Confidence. Don’t worry, though, there’s more! At 10:30, the DoE will release weekly oil inventory data, and then at noon, the EIA will release Natural Gas inventory data. At 1 PM, Baker Hughes will release the weekly rig count, which usually comes out on Friday. Then, to cap things off, at 2 PM, the FOMC will release the minutes from its latest meeting, and then after that ‘feast’ of data, we’ll all need a nap!

Futures are lower heading into today’s data deluge but off their overnight lows. With all the data releases, though, we’re likely to see some back and forth action with each one. Happy Thanksgiving!

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

While it hasn’t been a positive week for the Nasdaq, if you’ve been long the index this year, you have a lot to be thankful for as the index is still up over 20% YTD. While 20% is nothing to sneeze at, going back to 1972, this year would be the 17th year in 50 where the Nasdaq was up 20%+ YTD through Thanksgiving. Looking ahead, the index’s median performance from Thanksgiving through year-end was a gain of 3.05% with positive returns three-quarters of the time. That compares to a median gain of 2.44% and positive returns 67% of the time for all years since 1972. So, while the Nasdaq has historically closed out the year on a positive note, performance in years that were already strong has been even a little bit better.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 11/23/21

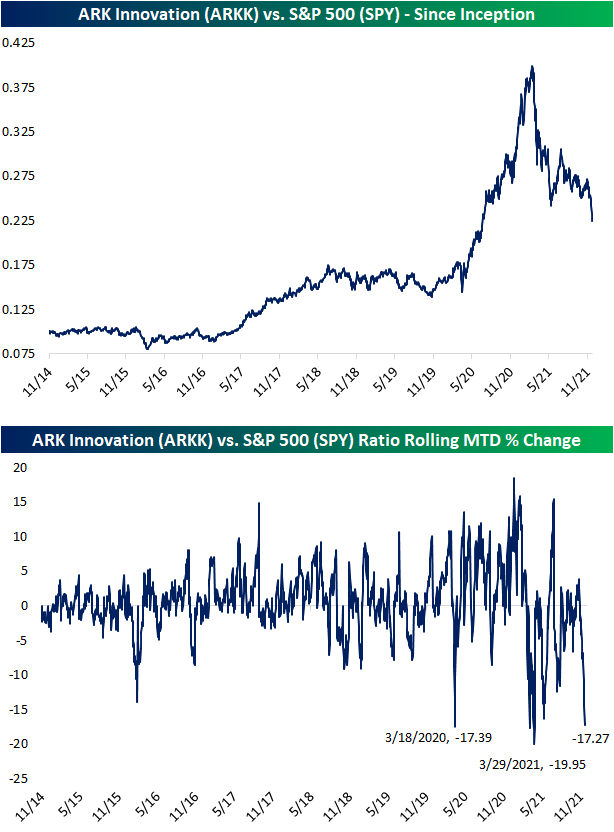

Near Record ARKK Underperformance

As we first highlighted yesterday, and the trend is continuing again today, the growth trade is underperforming. The ARK Innovation ETF (ARKK) and other ETFs in the ARK universe have been proxies of hyper-growth/futuristic trends, and as such, it too has fallen victim to underperformance this week. As shown below, the ETF peaked on November 1st and has since fallen 16.7% through today with losses accelerating this week. Today alone, ARKK is down 3.85% which has brought it below support at the March and October lows. While it has set a new low, it would still need to fall another 7.3 percentage points until it reaches the next intraday low set back in mid-May.

On a relative basis, the declines are even starker. The ratio of ARKK to the S&P 500 (SPY) has been on the decline all year with a particularly sharp collapse this month which has left it at the lowest level since June of last year. As mentioned above, ARKK peaked right at the start of the month. That means the ratio of ARKK vs SPY also peaked on that day. Month to date, the ratio has now fallen 17.27% which puts it on pace for the greatest degree of underperformance to the S&P 500 since this past March. The only other month in the ETF’s history with a steeper MTD drop in the ratio at any point of a month was March of last year during the COVID Crash. Click here to view Bespoke’s premium membership options.

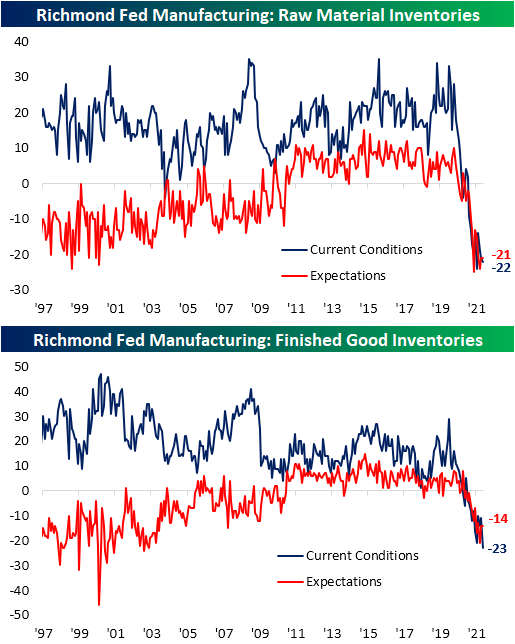

Some Supply Chain Relief in Richmond

The Richmond Fed released their most recent update on the region’s manufacturing sector this morning with the headline index matching expectations falling to 11. While that indicates a modest deceleration in business activity, the current level is healthy in the 73rd percentile.

Breadth in this month’s report was generally pretty weak with most components falling month over month. The only three indices that were higher were Shipments, Service Expenditure, and Average Workweek. A couple of other indices like Local Business Conditions and Number of Employees were unchanged. Overall, the report showed improvements on the inflation and supply chain front with decelerating demand and employment metrics.

As previously mentioned, Shipments was one of the only indices to move higher in November but even after that improvement, the index is still in the bottom half of its historical range. The same goes for New Orders which fell 5 points in November. Meanwhile, supply chains appear to be getting some relief with a decline in Vendor Lead Times that ranks in the bottom 1% of all monthly moves. With that said, the reading remains historically elevated. That is likely part of the reason there was an improvement in Shipments and Order Backlogs grew at a slower rate.

Even if lead times improve, inventories might be of concern. The past year has seen historic lows in the indices tracking inventory changes. In November, Finished Good Inventories set another record low and Raw Material Inventories fell and are now only slightly above the July record low.

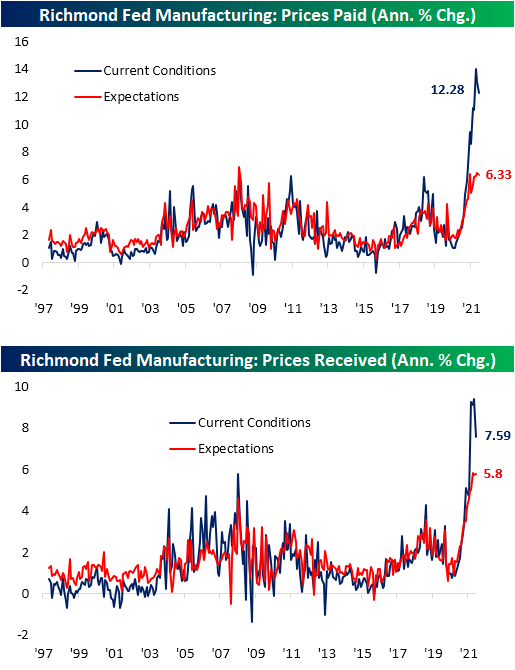

Vendor Lead Times was not the only index in orbit that has been coming back down to Earth. Prices Paid and Prices Received were both significantly lower in November with the latter coming off of a record high. Click here to view Bespoke’s premium membership options.

B.I.G. Tips – Brazil Bear Market

The Bespoke Metaverse Index

Bespoke’s brand new Metaverse Index tracks 40 companies with exposure to the continued rollout of the metaverse. We outlined seven components of the metaverse and selected the companies that have either spoken about their metaverse plans or have the capabilities to fulfill metaverse needs within these categories.

Bespoke’s Metaverse Index is available at the Bespoke Premium level and higher. You can sign up for Bespoke Premium now and receive a 14-day trial to read our Metaverse report. To sign up, choose either the monthly or annual checkout link below: