Bespoke’s Morning Lineup – 12/1/21 – Loves Me, Loves Me Not

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I am a warrior, so that my son may be a merchant, so that his son may be a poet.” – John Quincy Adams

You may think that the market has been volatile over the last several trading days, but just be thankful it’s not 1824. Back in November of that year, no candidate for President received the required majority of electoral votes in the election which forced Congress, on December 1st, to turn the election over the House of Representatives and basically choose between Andrew Jackson and John Quincy Adams. The actual winner wasn’t decided for more than two months when John Quincy Adams came out on top in early February 1825. Despite coming in second in the actual election, Adams’ victory came thanks to the backing of Henry Clay in what was called the ‘Corrupt Bargain’, and because he wasn’t the most popular candidate in the election, Adams’ presidency was largely considered to be unimpactful. Can you imagine in this political climate if the House was actually deciding an election today?

Futures are higher this morning as investors can’t decide which way they want the market to go as the S&P 500 goes back and forth between 1% losses and 1% gains in a game of ‘Loves Me, Loves Me Not’. One thing to note is that just as Monday’s 1% rally was weaker in magnitude than Friday’s drop, we’re seeing the same pattern play out today where the S&P 500 is on pace to open higher by 1.4% after Tuesday’s 1.95% decline.

In yesterday’s rout, only seven stocks in the S&P 500 finished the day higher, which was the weakest breadth reading since June 11th, 2020. Breadth in small caps wasn’t nearly as weak as the S&P 500 yesterday (more than 400 stocks traded higher), but its breadth reading on Friday was also the weakest since June 11th.

On the data docket today, the ADP Private Payroll report for November was released at 8:15 AM and came in higher than expected with little impact on futures. The only two other reports on the calendar today are Construction Spending and ISM Manufacturing which will be released at 10 AM. Powell and Yellen will also be testifying in front of the House this morning, and yesterday, the S&P 500 was only down modestly while the Nasdaq was actually higher before Powell’s testimony.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

2021 has really been a pretty crazy year for small-cap stocks. After doubling from its COVID lows, the Russell 2000 peaked in early March and traded in a sideways range through the summer and into the fall. After several close calls at a 10% correction, including a 9.7% drop on a closing basis through mid-July, the Russell finally broke out of its trading range in early November to trade at a new record high. From its first new high on 11/2, though, the breakout for IWM didn’t last long. After rallying an additional 3.4% in the four trading days since its first new closing high since March, it’s been a one-way trip lower for small caps ever since, and through yesterday’s close, IWM closed down 10.1% from its record high earlier this month. What the Russell couldn’t do in more than six months from early March through the end of Summer, it did in just 15 trading days this month!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 11/30/21

Bespoke Stock Scores — 11/30/21

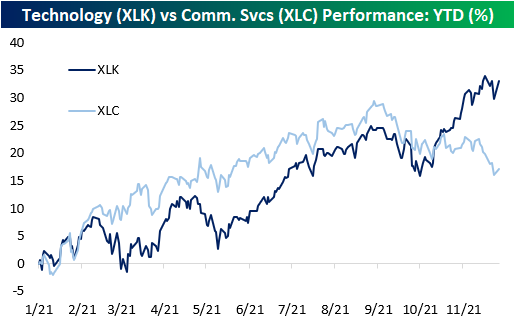

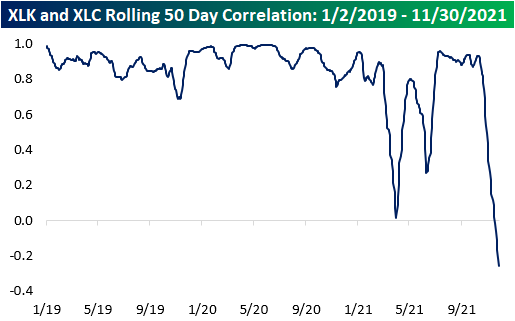

Technology and Communication Services Diverge

Typically, the Technology and Communication Services sectors tend to have high levels of correlation. However, beginning in mid-October, that relationship started to change course. While there have been other performance divergences between the two sectors this year, the current disparity is particularly noteworthy. Since mid-October, the Technology Select Sector SPDR Fund (XLK) and the Communications Services Select Sector SPDR (XLC) have been moving in opposite directions causing the YTD performance spread between the two sectors to widen out to the most extreme level of the year with Technology outperforming by 15.9 percentage points.

Since the start of 2019, just after Standard and Poors switched major stocks like Facebook (FB) and Alphabet (GOOGL) out of the Technology sector and into Communication Services the two ETFs tracking these sectors have had a median 50-day rolling correlation coefficient of +0.89, which implies a strong relationship between the two. For the years 2019 and 2020, the minimum correlation coefficient was +0.68, which still signifies a strong relationship. In 2021, though, the relationship has reversed and actually inverted this month, meaning that over the last 50 days, the two sectors are moving in opposite directions.Click here to view Bespoke’s premium membership options.

Chart of the Day – Turnaround Tuesday and the Rest of the Week

Natural Gas Tanks

Since Friday’s close, US natural gas future prices have declined 16.4% as of 11:00 AM on Tuesday, but there have been price discrepancies across the globe. We discussed these differences between natural gas prices in the US versus Europe in today’s Morning Lineup. In the US, natural gas prices have not seen a two-day decline in excess of 15% since 12/31/18 and going back to 2000, two-day pullbacks of this magnitude have only occurred 12 other times, four of which occurred within a month and a half time period (12/13/2000 – 1/30/2001). Heading into the current decline, the speculator net position was in a normal range, so dramatically offsides positioning from futures traders is likely not the driving factor behind this move. For more information on that positioning data, check out Monday’s Closer.

Looking ahead, forward returns of natural gas after a two-day pullback of more than 15% (without another occurrence in the prior three months) tend to be negative (which can be seen as a positive for consumers as it translates to lower energy costs). The day after the six prior periods shown, the average next-day performance for natural gas was a decline of 0.7% (median: -2.9%). Over the next week, the average decline was just 0.4% but the median decline was much greater at 6.1%. Looking out over the next one and three months, performance continued to weaken with average declines of 8.8% (median: 9.2%) and 4.9% (median: -8.7%), respectively. Downside momentum in natural gas was also pretty consistent across as natural gas was only positive across all the time windows shown one-third of the time. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/30/21

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“History doesn’t repeat itself, but it often rhymes.” – ???

On this day in 1835, Samuel Clemens aka Mark Twain, considered by many to be one of the greatest American writers, was born. While the quote above has often been attributed to Twain, there is no documented evidence that he ever said the last part of the quote. One variation he has written was “History never repeats itself, but the Kaleidoscopic combinations of the pictured present often seem to be constructed out of the broken fragments of antique legends.” Not quite as succinct but along the same lines.

Whoever said it, the fact that history doesn’t repeat itself, but it often rhymes is often on display in financial markets. While there’s no historical parallel to the current period of COVID and the unprecedented amount of stimulus that has been put into the system, human emotions are always a driving factor in market movements, and when faced with increased uncertainty, many investors choose to sell first and ask questions later- even if the headlines driving the market lower today (vaccines and COVID treatments potentially being less effective against the Omicron variant) were also in the market yesterday as well.

Equity futures are indicating a sizable decline at the open with the Dow leading things lower. The moves in the Energy and Treasury market have been even more notable with WTI trading under $68 a barrel, nat gas down over 6% after a 10% decline yesterday, and the yield on the 10-year down below 1.44% to its lowest level since late September.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

There’s been quite a bit of bifurcation in sector performance over the last several trading days. While four sectors are up over the last five trading days, they’re all among the smallest sectors in the market. At the bottom of the list, two sectors (Communication Services and Industrials) are down over 2% while another two are down more than 1.5% (Consumer Discretionary and Materials). Technology, the S&P 500’s largest sector is also down but by a more modest 0.68%.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 11/29/21

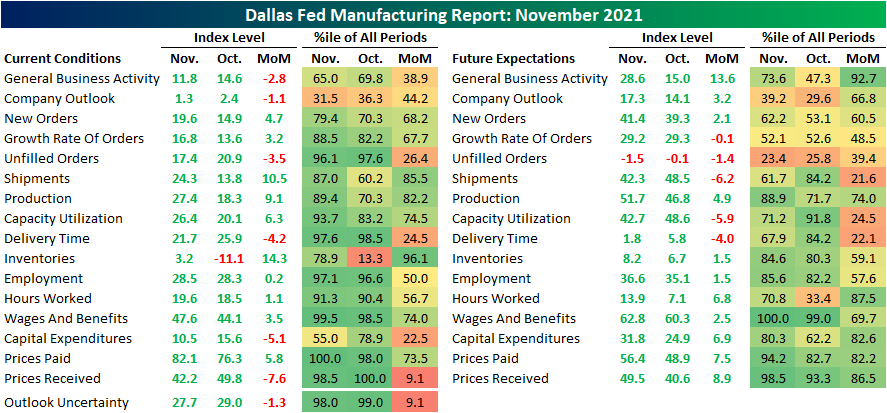

Another Deceleration Out of Dallas

November regional Fed manufacturing surveys have been pretty mixed but generally have shown activity decelerating. The fifth and final report out of the Dallas Fed released this morning reiterated that slowdown in manufacturing activity. The Dallas Fed’s headline reading was expected to show a modest increase from 14.6 to 15.0. Instead, as with other regional Fed surveys, activity decelerated with Business Activity falling to 11.8. While current conditions did not improve as rapidly as expected, expectations were relatively optimistic and have risen sharply over the past two months recovering most of the decline since June’s high.

While General Business Activity was lower, under the hood the report was pretty good with more categories moving higher than lower. Additionally, the bulk of these categories remain at historically strong levels. In fact, Company Outlook is the only one in the lower half of its historical range. General Business Activity and Captial Expenditures are the only others that are not in the upper quartile of readings.

Demand has continued to rebound with New Orders rising from 14.9 in October to 19.6 this month. Given the higher Order Growth Rate, Unfilled Orders also continue to rise at a historically elevated rate, though, that reading did fall in November as Shipments have picked up.

That increase in Shipments also likely had to do with alleviation for supply chains as the index for Delivery Times fell by 4.2 points. Other regional Fed surveys echoed those results this month with declines in Delivery Times of their own. That being said, the index remains historically elevated, and the commentary of the report points to a slew of supply chain-related issues holding back business. Given Delivery Times were not as long and production has risen, Inventories rose back into positive territory.

While there is evidence of improving supply chains, prices for raw materials are still rising. The index for Prices Paid has resumed its move higher and set the first record high since June. Conversely, Prices Received experienced a sharp reversal lower from a record high set last month.

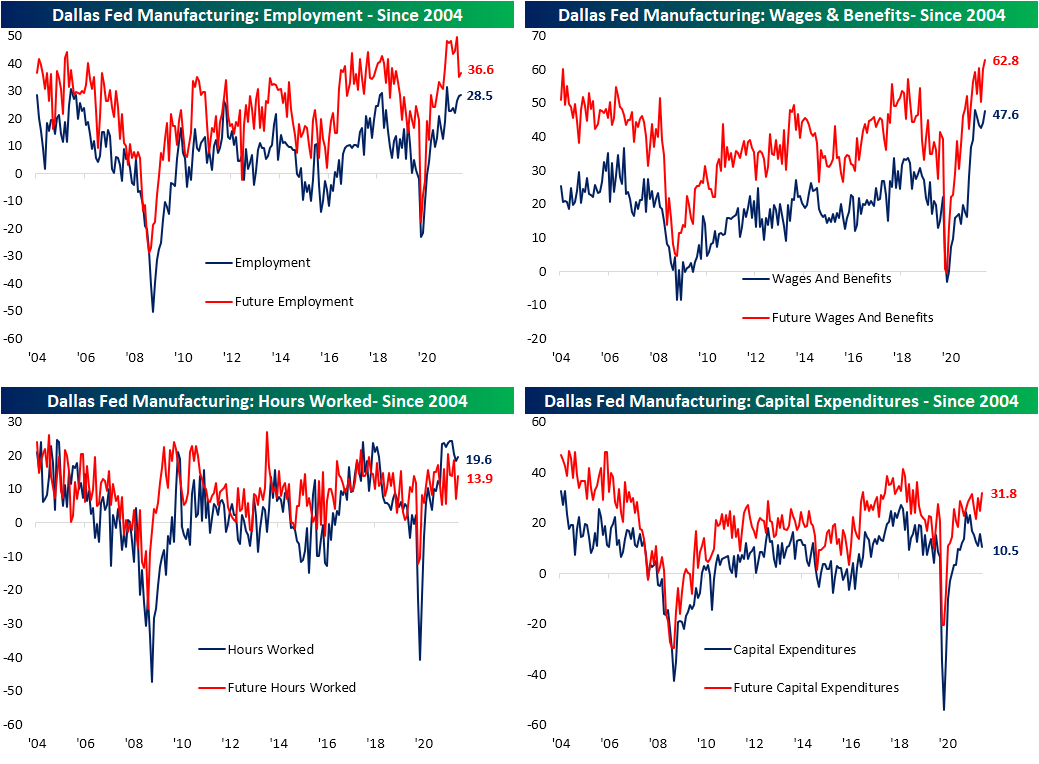

The price of labor is also continuing to rise. The index for Wages and Benefits came in only a half-point below the June record high. Even though current conditions narrowly missed a new high, expectations did set a new record. Not only did firms report that they expect to pay more for labor, but the same goes for Capital Expenditures. That category’s expectations index hit the highest level since March 2019 in November even while the current conditions index came in at the lowest level since the end of 2020. Pivoting back to labor, the index for Employment and Hours Worked were both moderately higher in November. Expectations for these two categories also rebounded after steep drops in October. Click here to view Bespoke’s premium membership options.

Bespoke’s Matrix of Economic Indicators – 11/29/21

Our Matrix of Economic Indicators provides a concise summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!