The Bespoke Report Newsletter – 1/14/22 – The Fed Versus Growth

This week’s Bespoke Report newsletter is now available for members.

In The Bespoke Report this week we discuss the huge rotation out of growth and in to value stocks, preview earnings season, discuss the “buy-the-dip” mentality from US markets, review valuations, discuss the drivers of emerging markets outperformance, highlight the divergence between stock prices and analyst estimates by sector, review economic data from the US and around the world this week, and more.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Daily Sector Snapshot — 1/14/22

B.I.G. Tips – Retail Sales On the Path to Reality

Bespoke’s Morning Lineup – 1/14/22 – And They’re Off

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When you expect things to happen – strangely enough – they do happen.” – J.P. Morgan

If you were hoping for a quick bounceback following yesterday’s decline, think again. While futures were higher overnight, all of those prior gains have evaporated. Tech is leading the way lower once again, but Financials aren’t providing any support as investors have generally been selling JP Morgan (JPM), Wells Fargo (WFC), Citigroup (C), and Blackrock (BLK) following their reports. The only one of those four that’s higher this morning is WFC, while JPM and C are both down over 4%. As noted in our Earnings Season Preview yesterday, the major financials typically react negatively to their Q4 reports, so far this earnings season doesn’t appear to be an exception.

It may be Friday, but it’s a relatively busy day for economic data to close out the week with Retail Sales, Import and Export Prices, Industrial Production, Capacity Utilization, Business Inventories, and Michigan Confidence all on the calendar. Retail Sales just hit the tape and came in much weaker than expected.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday was a gut punch for the technology sector. Take semiconductors, for example. Boosted by a strong earnings report from Taiwan Semiconductor (TSM), the Philadelphia Semiconductor Index (SOX) traded more than 2% higher in early trading but then reversed lower finishing right near its low of the day and down more than 2% from Wednesday’s close. That marked the first time the index was up 2%+ intraday but finished the day down more than 2% from its prior day close since April 2020.

In the entire history of the SOX dating back to the mid-1990s, there have only been 42 prior occurrences where it was up 2%+ intraday but finished the day down 2%+, and only three of those occurred in the post-Global Financial Crisis period. As shown in the chart below, the majority of the prior occurrences came during the unwind of the dot-com bubble from March 2000 through October 2002. What makes yesterday’s reversal unique is that even after the decline, the SOX is still just 6.3% below its 52-week high. The average distance from their respective 52-week highs of the other 42 occurrences was over 40%, and there wasn’t a single time where the SOX was as close to a 52-week high as it is now. The only other occurrence where the SOX was even within 10% of a 52-week high was on 3/14/00.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke 50 Growth Stocks — 1/13/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were twelve changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Bespoke’s Weekly Sector Snapshot — 1/13/22

Chart of the Day: International Revelations

Bulls Back Off

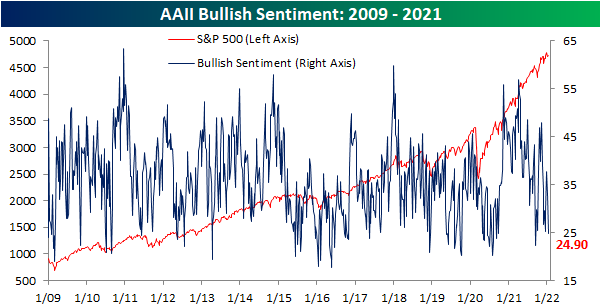

The past week has seen the S&P 500 pull back to retest its 50-DMA which has put a dampener on investor sentiment. This week’s AAII survey showed that less than a quarter of respondents reported bullish sentiment. That is down from 32.8% last week and the lowest since 9/16.

Bearish sentiment picked up most of the difference rising five percentage points to 38.3%. This brings bearish sentiment to a fairly elevated level relative to its historical average of 30.56%, though, it is still within a standard deviation of that reading. While higher, this week’s increase was actually only the biggest uptick and highest level of bearish sentiment since the week of 12/16.

Given those moves in bullish and bearish sentiment, the bull-bear spread has fallen deeper into negative territory. At -13.4, the spread is now at the lowest level since mid-December.

Whereas bearish sentiment jumped 5 percentage points this week, neutral sentiment has gained 5 percentage points after the back-to-back increases over the past two weeks. Neutral sentiment now stands at 36.8% which is the highest level since 12/9.

As for other sentiment readings, both the Investors Intelligence survey and NAAIM Exposure index took more bearish tones in the most recent week. As a result, our Sentiment Composite, which combines the bull-bear spreads of the AAII and Investors Intelligence surveys with the NAAIM exposure index’s reading, has fallen back below zero meaning overall sentiment is broadly bearish, but not to a degree in which it is outside the range of recent readings. Click here to view Bespoke’s premium membership options.

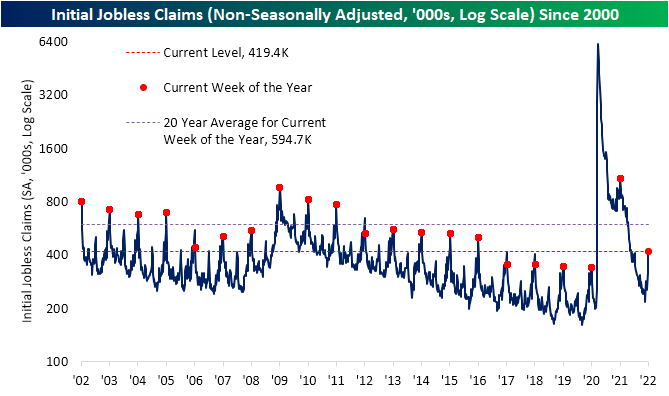

Seasonal Peak in Claims

After hitting multi-decade lows at the beginning of December, initial jobless claims have been on the rise with the most significant increase in that time occurring in the latest week. The seasonally adjusted reading increased by 23K to 230K this week which is the highest level since the week of November 12th. While there has not been much improvement in claims in the past month, current levels are still right around those from just before the pandemic. On a longer-term basis, these readings are also some of the strongest since the early 1970s.

On a non-seasonally adjusted (NSA) basis, the current week of the year typically marks a seasonal peak in claims. In fact, the current week of the year has historically seen claims rise 85.2% of the time week over week. As such, NSA claims surged over 100K this week from 315.8K to 419.4K. In spite of that seasonal headwind alongside the additional issue of rising COVID cases—which we cannot parse out how much each factor is contributing to the rise in claims—that was actually slightly below the average weekly change of 111.6K for the current week of the year. Of course, the current level of claims is a major improvement from where things stood this time last year, but it is still decently above levels from comparable weeks of the few years prior to the pandemic. Assuming this week marks the seasonal high as it has in the past, claims will now have tailwinds combating any COVID headwinds in the coming months.

Although initial claims were somewhat disappointing this week, seasonally adjusted continuing claims were very strong coming in at the lowest level since the week of 6/1/73. Claims by this measure are delayed an extra week to initial claims, but the most recent reading for the last week of 2021 showed only 1.559 million claims. The 194K week over week decline was the largest since mid-October when the reading fell by 241K. Click here to view Bespoke’s premium membership options.

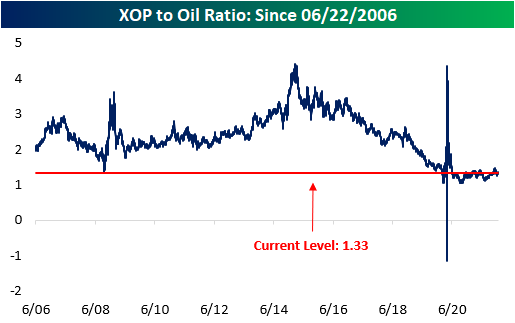

Energy Stocks to Oil Ratio Below Average

Oil has had a strong start to the year thus far, and Energy has been the best performing equity-market sector on a year to date basis by a wide margin. This is due to the fact that the performance of the Energy sector (XLE) tends to be highly correlated to the price of oil, holding a correlation coefficient of 0.81. Currently, the ratio of the price of XLE versus oil is below historical averages. The current level is 0.77 and the average since XLE began trading is 0.99, suggesting there may be upside in the energy sector should oil hold its current levels. However, the ratio is still in a ‘normal’ range, as it is less than one standard deviation away from the historical average.

The Oil and Gas Exploration and Production industry (XOP) tends to be correlated with the price of oil as well (coefficient of 0.80). Historically, the ratio of XOP versus Oil has an average of 2.36, but the current level is far lower at 1.33. Additionally, the ratio is 1.7 standard deviations away from the average, which may imply that there is an opportunity to capitalize on a mispricing of XPO relative to the price of oil. However, since the start of 2020, the ratio has been suppressed and there is little evidence to suggest that this will change any time soon. Stay tuned as we will be releasing a deeper dive into oil tomorrow! Stay on top of market trends by becoming a Bespoke subscriber today. Click here to view Bespoke’s premium membership options.

As always, past performance is not a guarantee of future results. This is for informational purposes only and is not a recommendation to buy or sell a specific security.