Biden: An Above Average President?

As President Biden concludes his first year in office, we took a look at the performance of the Dow Jones Industrial Average during his presidency thus far. Compared to previous administrations since 1900, performance during Biden’s first year in office has exceeded the historical average by just under two percentage points (12.3% vs 10.4%). In the chart below, it would appear as if Biden’s first year in office was more volatile than it was under previous administrations, but that’s because we’re comparing a single year to an average. In looking at the median absolute daily change under Biden, it was actually quite similar to prior administrations (46 bps vs 47 bps). Even though the Biden administration had a tough start, the Dow was able to recoup all of its initial losses rather quickly and booked a solid first-year return when all was said and done.

Although a strong historical reading, the Dow’s performance during Biden’s first year in office underperformed the first year of the previous two administrations, and Biden ranks ninth versus all other Presidents in first-year performance since 1900. On a median basis, the Dow has outperformed by seven percentage points. Historic first-year returns vary greatly, and the standard deviation for this data set is astoundingly high at 24.7 percentage points. Historically, when the Dow appreciates by over 10% during a President’s first year in office, the average annualized return for the remainder of the Presidency is 5.0% (median: 5.7%), which is about 40 basis points above the average of all periods but below the median.

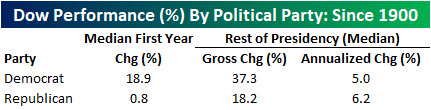

In addition to the Dow underperforming the last two administrations under Biden, the index has underperformed relative to the median for all Democratic Presidents since 1900 by 6.6 percentage points. Historically, the first-year performance under Democratic leadership tends to be significantly higher than first years under Republican leadership (18.9% vs 0.8%). However, Republican Presidents tend to have higher annualized returns for the remainder of their Presidencies when looking at the median (6.2% vs 5.0%). Stay on top of market trends by becoming a Bespoke subscriber today. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – Another Attempt At An Advance

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you absolutely can’t tolerate critics, then don’t do anything new or interesting.” – Jeff Bezos

The set-up in pre-market futures looks similar today to what it looked like yesterday, but hopefully, the outcome isn’t. After trading up as much as 1% in early trading yesterday, the Nasdaq quickly gave up all of its gains and more throughout the trading day and finished down more than 1% by the closing bell. Economic data just released includes jobless claims and the Philly Fed. Regarding claims, both initial and continuing claims came in significantly higher than forecast, while the Philly Fed actually surprised to the upside even after the big miss from the Empire Manufacturing report earlier this week.

Recent weakness in the market is starting to show up in sentiment surveys, though. In this week’s survey from AAII, for example, just 21% of respondents reported as bullish while 46.7% were bearish. In terms of bulls, that’s the lowest reading since July 2020, and for bears it was the highest reading since September 2020.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

The Nasdaq made it official yesterday and reached the 10% threshold for a correction. In the post-global financial crisis (GFC) period, the current period ranks as the 14th correction for the Nasdaq with the most recent before the current one spanning mid-February through early March 2021. Overall, post-GFC Nasdaq corrections have seen an average total decline of 15.2% over a span of 53 days. The median during this period is a bit milder at 12.0% over the span of just 36 days. Going all the way back to 1970, the ‘average’ Nasdaq correction has seen a total decline of 19.5% putting them just shy of bear market territory (median: -16.6%) over a span of 75 days (median: 60 days). At just 10.2%, therefore, the current correction is still more modest than average, but at 61 days its been longer than average for the post-GFC period.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Baskets Update — January 2022

Daily Sector Snapshot — 1/19/22

S&P 500 Sector Weightings Report – Q1 2022

Sovereigns Soar

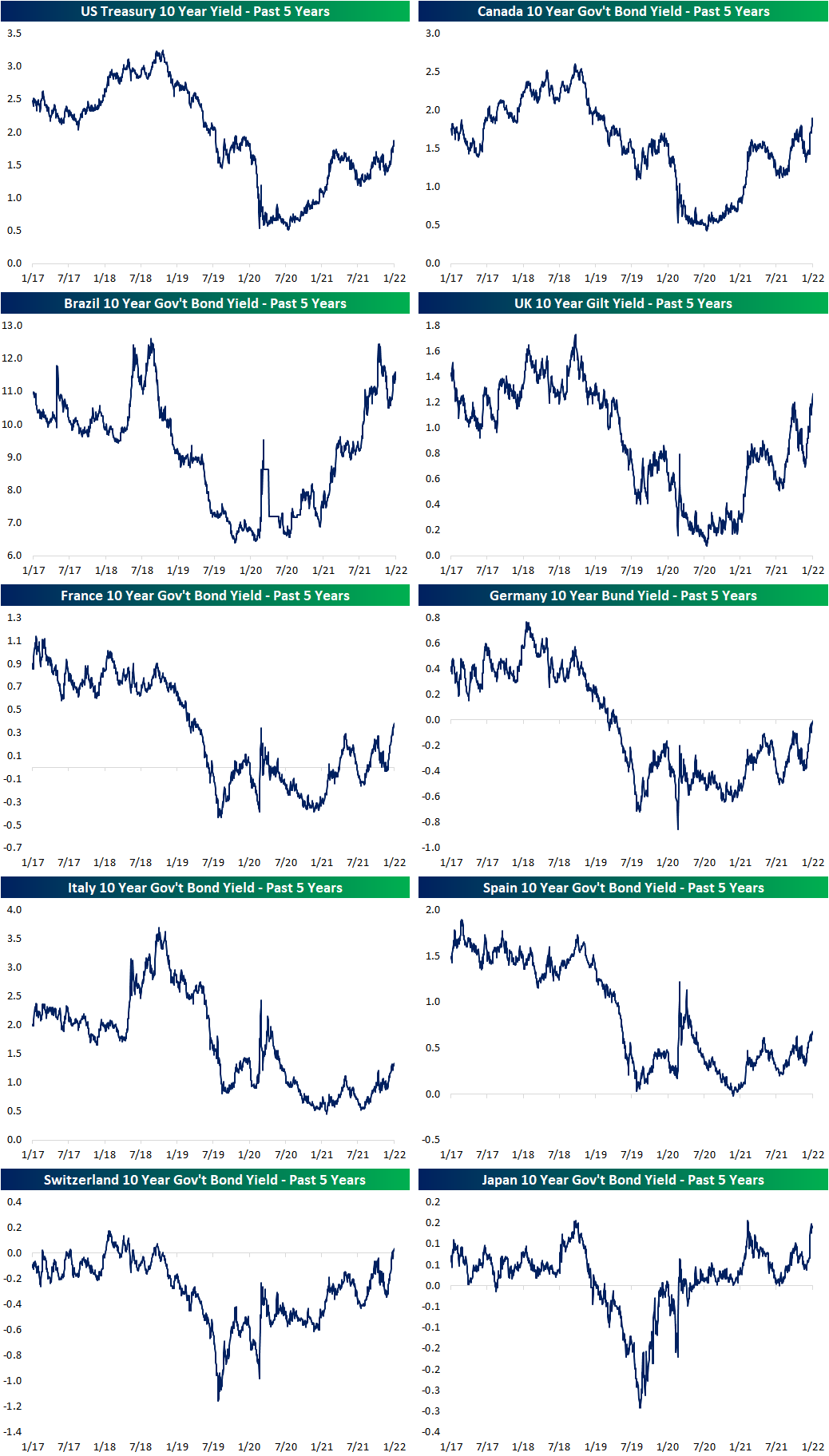

All around the world, government bond yields are on the rise and hitting some significant levels. In many cases, the rapid increase in yields over the past month has resulted in multi-month, if not multi-year, highs. For Spain and Italy, today’s level of yields are the highest since May and June 2020, respectively. The 10 year US Treasury yield has reached the highest level since January 2020 as Canada, France, the UK, and Germany meanwhile have the highest yields since the spring of 2019. In the case of Germany, the bund yield even moved back into positive territory for the first time since 2019. As the 10-year yield on Swiss bonds has reached the highest level since the fall of 2018, it too has moved back into positive territory in recent weeks. While it has also seen a big rise in yields, Brazilian bond yields remain further off of prior highs.

As previously mentioned, the broad move in yields in the past month has been rapid. In the charts below, we show the one-month change in the 10-year yields for these countries’ bonds going back over the past five years. In most cases, the current run has been the sharpest increase since around the time of the COVID crash. For each country shown, those one-month changes also rank in the top few percent of all monthly changes over the past two decades. In fact, for Canadian bonds and UK Gilts, the moves rank in the top 1% of all monthly moves over the past twenty years. In today’s Fixed Income Weekly, we take a closer look at the moves in yields for a range of countries, and the implications for foreign exchange. Click here to view Bespoke’s premium membership options.

B.I.G. Tips – Small Cap Death Cross

Bespoke’s Morning Lineup – 1/19/22 – Strong Housing Data

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“A good first impression can work wonders.” – J.K. Rowling

Futures are attempting a bounce after yesterday’s wallop, and positive reactions to earnings from Bank of America (BAC) and Morgan Stanley are contributing to the positive tone. The only economic reports for the morning were Housing Starts and Building Permits, and both came in significantly higher than expected and at their second-highest levels since the financial crisis. The only readings that were strong for each series were in Q1 of 2021.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

First impressions are always important, but they’re not always accurate, and that’s the hope of bulls following the first days of earnings season. Banks kicked off the Q4 earnings season late last week, and two of the largest to report were Goldman Sachs (GS) and JP Morgan Chase (JPM). The stocks of both banks had abysmal reactions to their reports.

Following Friday’s report from JPM, the stock declined 6.15% which ranks as the worst earnings reaction day performance for the stock in at least 20 years beating out the 6.06% decline the stock experienced in January 2009 during the thick of the financial crisis. The reaction in GS to its earnings report on Tuesday wasn’t much better with the stock falling just under 7%. That was large enough to rank as the second-worst earnings day reaction for the stock behind only the 11.56% decline in April 2009 just as markets were coming out of the financial crisis.

As disheartening as a bad first impression can be, one potential bright side is that it can have the effect of resetting the bar low, and in early trading, both Bank of America (BAC) and Morgan Stanley (MS) are trading up close to 3% in reaction to their reports. Whether those gains can hold through the opening and closing bell, though, is another story.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.