Country ETFs Falling Below Pre-COVID Highs

Headed up to the two-year anniversary of the COVID crash low (3/23/20), equities around the globe have been experiencing some of the worst pullbacks since that period. In the table below, we show the country ETFs of the countries tracked in our Global Macro Dashboard as well as their year and month to date performance, performance since each respective 52-week high as of 2/19/20 (the S&P 500 and a handful of other global indices last high before entering bear markets during the COVID crash) and current 52-week high. We also show where they are currently trading with respect to their 50-DMAs.

Given the degree of declines recently, nearly everything is oversold with six countries’ readings now ‘off the chart’ as they trade well over three standard deviations below their 50-DMAs. The average country ETF is also down double digits on both a YTD basis and relative to their respective 52-week highs. Of the countries shown below, only Brazil (EWZ) and South Africa (EZA) are higher YTD with gains of 17.56% and 9.27%, respectively. Russia (RSX), meanwhile, is obviously down the most having been cut by over 75%.

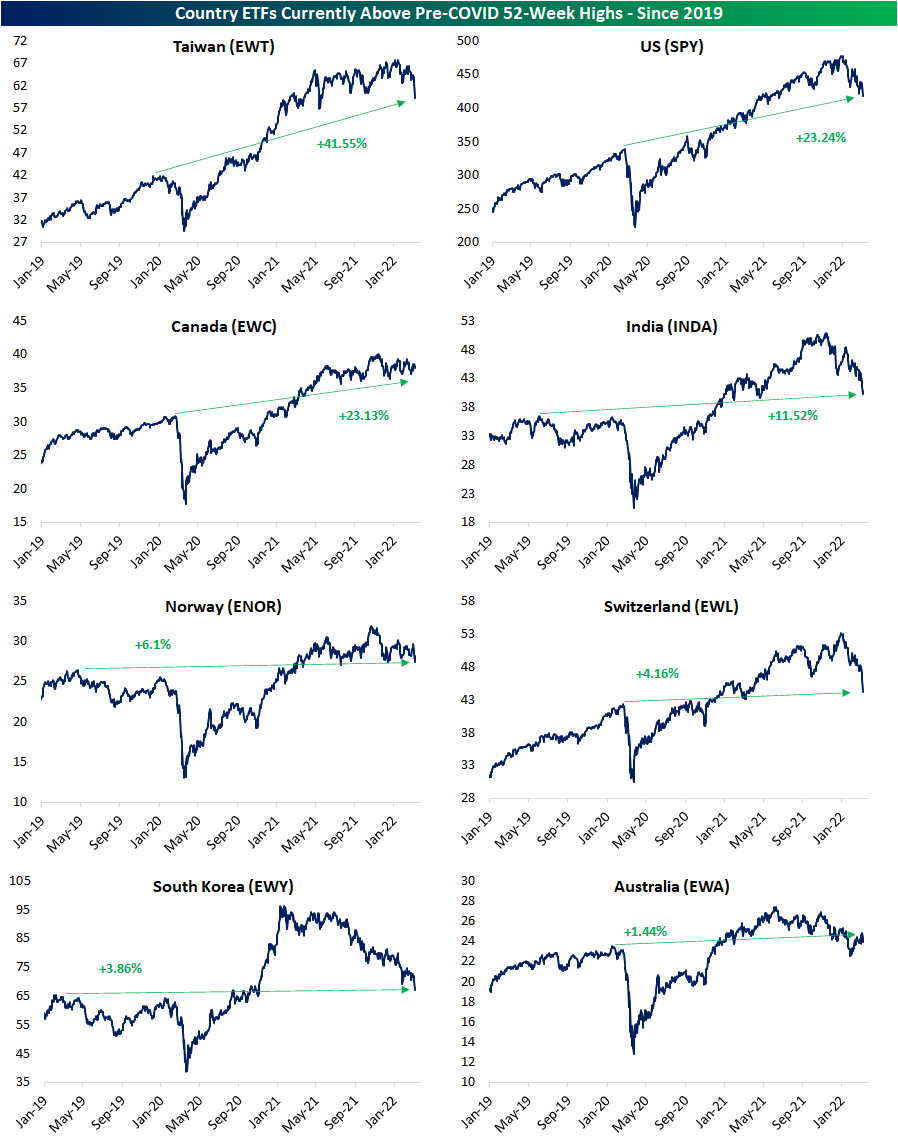

The average country ETF is now down over 20% from its 52-week high, and only four of those 52-week highs have come since the start of 2022 whereas most were set last spring. As for how the current drawdowns have eaten into the post-COVID rallies, below we also show the percent change of these ETFs relative to their 52-week highs as of 2/19/20. In other words, where each ETF is trading with respect to their pre-COVID highs. Currently, there are only 8 country ETFs that remain above their respective pre-COVID highs. Seven others, meanwhile, have now declined more than 20% below their pre-COVID highs. Of course, Russia is once again down the most dramatically from those levels falling more than 75%.

Below we show the charts of those eight countries that are currently still in the green relative to pre-COVID highs. The recent rough patch is not exactly identical for all countries though. Whereas the downtrends for some like Taiwan (EWT) or the US (SPY) are bringing these ETFs to multimonth lows, others like Canada (EWC) and Norway (ENOR) have more or less trended sideways. Since retaking pre-COVID highs, only Australia (EWA) has gone on to recently retest/fall back below those levels which it did in late January. While it would mean much further downside for the likes of EWT, SPY, and EWC, those prior highs could mark one area of tangible support for these other countries. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 3/8/22 – Trying to Climb Out of the Hole

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No fact begins with if” – Nicholas II

With the entire world focused on the Russia-Ukraine war and possible scenarios under which President Putin can either ratchet up or dial back the tensions, it’s ironic that today marks the 105th anniversary of the start of the ‘February Revolution’ which essentially ended the reign of czarist rule in Russia when Nicholas II abdicated his throne. Historians cite a number of factors for the February Revolution including frustration with government corruption, a poor economy, and autocratic rule, but the Russian military’s poor performance in World War I was the primary catalyst for the Revolution. Russians came out in droves to protest the conditions and despite an attempted crackdown Russian police and ultimately the military, the protestors refused to back down. Within less than a week, Nicholas II abdicated the throne ending the era of czarist rule in the country.

Not long after Nicholas abdicated, Vladamir Lenin returned from exile in Switzerland to lead the Russian Revolution, and as he is often credited with saying, “There are decades where nothing happens, and there are weeks where decades happen.” During the February Revolution, it took less than a week for protests to lead to the abdication of the throne by Nicholas II and usher in the communist era. The current Russia-Ukraine war hasn’t even been two weeks yet, and several years from now, with the benefit of hindsight will we be looking back on this period as another one of those moments where ‘decades’ occurred within a matter of weeks?

Futures are looking pretty boring at current levels as we type this with little change in any of the major averages, but since the close yesterday, we have seen them trade down more than 1% and trade up by close to 1%. One thing we can pretty much bank on here is that equity indices will not finish the day where futures are currently trading.

In the commodity space, we’re still seeing some intense moves as nickel prices more than doubled to over $100,000 per metric ton resulting in a halt of trading for the remainder of the day. Given that move, the 2% rally in crude oil looks downright pedestrian.

Lastly, on the economic calendar, the NFIB Small Business Optimism Index came in lower than expected falling from 97.1 last month to 95.7.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With all of the volatility we’ve seen so far this year, the average daily change of the S&P 500 and Nasdaq has been ticking higher, and over the last 50-trading days, both indices have seen average daily moves of at least 1%. For the S&P 500, the current rate of daily volatility is still below the highs from December 2020, but the Nasdaq’s average daily move of 1.51% is on the verge of eclipsing that peak from the same period. For some perspective, though, the current pace of volatility in stocks is nowhere near the levels experienced during the COVID crash when both indices were experiencing average daily moves of more than 3%.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

B.I.G. Tips – Nasdaq Bear Markets

Nickel Skyrockets

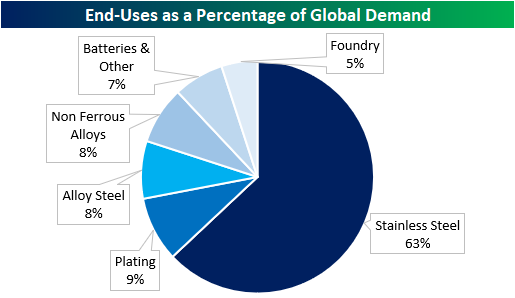

Nickel futures surged 64% today as Russian supply concerns sparked a massive short squeeze in the commodity. There was a modest pullback into the close but remained extremely elevated nonetheless. Today’s move put nickel at an all-time high and it was also the largest single-day move in the history of the commodity. The skyrocketing price of nickel has implications for a variety of industries and countries, which we outline below.

The US is heavily reliant on Nickel imports, as only about one percent of the Nickel mined globally originates in the US. Indonesia, the Philippines, and Russia are the three largest producers of the commodity, and Australia, Indonesia, and Brazil have the largest share of global reserves (as per the United States Geographical Survey). Russia’s leadership in global nickel mining largely explains the recent price spike, but many countries are poised to benefit from the price appreciation. While it will take time to ramp up production, countries with the largest share of reserves are likely to increase their mining operations to capitalize on higher prices, especially given the fact that many of the countries with the highest amount of reserves are emerging economies that do not play a substantial role in global geopolitical conflicts.

Over the last few years, investors have focused on the electric-vehicle use case to justify nickel positions, but over 70% of first-use demand for Nickel originates from steel products. The spike in this commodity will increase construction costs, mitigate the impact of Biden’s infrastructure package, slow the EV transition, and make batteries, in general, more expensive for consumers and enterprises alike. Put simply, a lot of industries have exposure to the recent hike in nickel and related metals prices.

Although it is hard to view this as a positive for the US economy or global inflation, one country poised to benefit from the surge in nickel prices is Indonesia. Pre-pandemic, around five percent of Indonesia’s GDP came from Nickel exports which is not an insignificant amount. Not surprisingly, the MSCI Indonesia ETF (EIDO) has been one of the top-performing country ETFs on a YTD basis gaining 3.5% through Monday’s (3/7) close. Click here to view Bespoke’s premium membership options.

Daily Sector Snapshot — 3/7/22

Chart of the Day – Gold and US Dollar at 52-Week Highs

Gasoline National Average Above $4

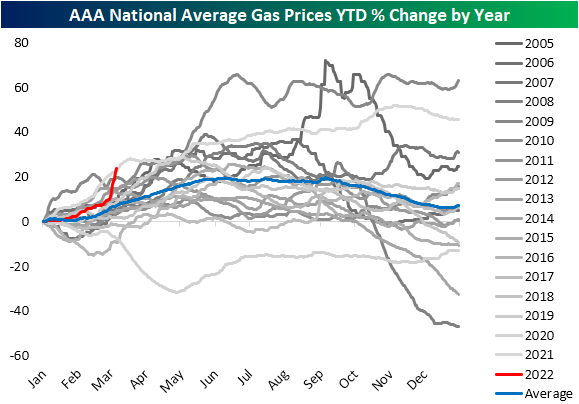

We have consistently been covering the surges in commodity prices over the past couple of weeks, and over the weekend there was yet another major development on this front. As shown below, for the first time since June/July 2008, the national average for a gallon of regular gasoline crossed above $4. As the post-pandemic period has progressed, gas prices have been rapidly on the rise but the move since the late December low of $2.83 has been outright parabolic.

With regards to seasonality, this point of the year tends to see gas prices rise up through the late spring where they then plateau through the summer and fall until year-end. Whereas prices had been following the usual seasonal pattern, albeit growing at a slightly above-average rate, the recent surge has brought the year-to-date gain up to 23% which puts it back on the pace with the historically large year-to-date gains last year.

AAA also provides a breakdown of prices by state. While the national average sits at $4.065, there are 22 states with an average price also above $4 compared to only two states (California and Hawaii) one month ago. Today, those two still have the highest price of the 50 states. In fact, California gas prices are now well above $5. The cheapest gas in the country can be found in Missouri, Oklahoma, Kansas, and Arkansas all with prices in the $3.60 range.

As for which states have seen prices rise the most dramatically, those East of the Mississippi have all seen prices rise by over $0.50 over the last month; Alabama (+$.75) and Rhode Island ($+0.74) marking the largest increases in dollar terms. On the West Coast, California and Nevada also have seen price increases over the past month that are larger than the average for the whole country ($0.60).

As prices surge and will likely weigh on the average American’s budget, consumers are understandably looking for a deal where possible. In the charts below, we show Google Trends data for the search terms “Gas Prices”, “GasBuddy”, “Cheap Gas”, and “Cheap Gas Near Me.” Google’s indices index the period which searches for a given term were the most popular to 100. Thus a reading of 75 would be when interest was three-quarters of the peak, 50 would be a time that searches were half of the peak, and so on. As shown, each of these terms has taken off this month and is at or approaching record highs. For the broadest search of “Gas Prices,” September 2005 was the only time search interest was more elevated. “Cheap gas” has also made a sharp move higher hitting levels last seen over a decade ago. A perhaps more actionable search of “Cheap gas near me” meanwhile is at the highest level ever by a massive margin. Searches for the app “GasBuddy” which helps to find the gas stations with the lowest prices around a user’s area has also made an explosive move higher. The only points in time with higher readings in the index were last May and September 2017. Click here to view Bespoke’s premium membership options.

Biden a Boon for Energy

This morning we updated our key ETF performance matrix to see how various asset classes have performed since President Biden was elected back in November 2020 and since Inauguration Day in January 2021. In the matrix below, we also include performance over the last six months, which has been downright awful for most areas of financial markets outside of the commodity space.

Since Election Day 2020, the S&P 500 (SPY) has posted a strong total return of 30.7%, with Value outperforming Growth significantly across all market cap ranges. Looking at US sector ETFs, Energy (XLE) has absolutely walloped every other sector. As shown, XLE is up 173% since President Biden was elected, while the next best sector has been Financials (XLF) with a gain of 51%. Outside of the US, country ETFs like China (ASHR), Germany (EWG), and of course Russia (RSX) are in the red since Election Day 2020, while Canada (EWC) and Mexico (EWW) are up the most at 45% (15 percentage points better than SPY).

The broad commodities ETF (DBC) is up 109% since Election Day, with oil (USO) up 198%, agriculture (DBA) up 50%, gold (GLD) up just 3%, and silver (SLV) up 4.8%. Fixed-income ETFs have posted negative total returns since Biden was elected, with the 20+ Year Treasury ETF (TLT) down the most at -10%.

Returns are much weaker since Inauguration Day on 1/20/21. SPY is still up 13.9% since then, but the Nasdaq 100 (QQQ) is up just 4.8% and the Russell 2,000 (IWM) is down 6%. Looking at sectors, Energy (XLE) is easily on top with a gain of 82%. Over this same time period, Consumer Discretionary (XLY) is up just 1.9%, and Communication Services (XLC) is down 2.7%. Outside of the US, along with Russia (RSX), a number of country ETFs are down double-digit percentage points, including China (ASHR), Germany (EWG), Hong Kong (EWH), Japan (EWJ), and Spain (EWP).

Over the last six months, SPY is down 3.8%, but the Tech-heavy Nasdaq 100 (QQQ) and the small-cap Russell 2,000 (IWM) are both down more than 11%. Of the sector ETFs, Energy (XLE) is up an incredible 61.5% over the last six months, while Communication Services (XLC) is down 22.5%. The only other sector ETFs that are up over the last six months are the two main defensives — Utilities (XLU) and Consumer Staples (XLP).

Across the world, we’ve seen declines over the last six months, but Brazil (EWZ) and Canada (EWC) have bucked the trend with small gains. Commodities ETFs are solidly green, while Treasury ETFs are solidly red.

The current administration came into office solely focused on COVID, but is now facing a two-front battle against inflation and Russia’s invasion of Ukraine. Energy prices were already on the rise when the Trump administration passed the baton to the Biden administration, but things have ramped up to a completely different level over the last few months. Click here to try out Bespoke’s premium stock market research for the next two weeks.

Bespoke’s Morning Lineup – 3/7/22 – The Market’s Case of the Mondays

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Facts do not cease to exist because they are ignored.” – Aldous Huxley

It hasn’t been a fun morning for equity investors around the world this morning as futures have been in the red everywhere you look. German stocks, while currently off their morning lows are currently on pace to close in bear market territory. Here in the US, futures are also lower, but well off their overnight lows.

The Russia-Ukraine war continues to drive headlines, and the place it is being felt the most is in crude oil prices. While prices of WTI still remain elevated at a price of more than $118, they actually briefly traded as high as $130 in overnight trading. How desperate is the market for additional barrels of oil given the disruption of Russian supplies? This weekend, US government officials actually visited with the Venezuelan government in an effort to boost ties with a country we cut off diplomatic relations with back in 2019.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Mondays (or the first trading day of the week when Monday was a holiday) have not been friendly to bulls this year. In the nine weeks so far this year, the S&P 500 has opened the day lower seven times by an average of 0.54%, and today looks like it will be the eighth). The rest of the week has also been negative, but with an average gap lower of 0.03% for all other days of the week, Mondays have been notably weak.

While stocks have opened the day lower to kick the week off, selling hasn’t necessarily followed through to the rest of the trading day. After opening down by an average of 0.54% to start the week, SPY has averaged an intraday gain of 0.42% with positive returns just over half of the time. That compares to an average intraday decline of 0.20% for all other days of the week.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 3/6/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Ukraine

The bleak market outcome for Russia after Ukraine invasion by Paul McNamara (FT)

The removal of Russia from major financial markets indices is only the start of a long process of capital starvation for the country’s economy, which will have lasting and terrible consequences for Russian state capacity. [Link; paywall]

As Tanks Rolled Into Ukraine, So Did Malware. Then Microsoft Entered the War by David E. Sanger, Julian E. Barnes and Kate Conger (NYT)

Close coordination between the US intelligence community and security experts at Microsoft led to a rapid response against Russian cyberattacks in near-real time as the country sought to cripple Ukraine during the initial invasion. [Link; soft paywall]

The Terrible Truth So Many Experts Missed About Russia by Ben Judah (Slate)

Analysts and strategists across the Western world were operating under the assumption that the Russian President faced a series of constraints that he did not in fact pay any attention to. [Link]

Ripple Effects

Could Congress let you seize this Russian oligarch’s yacht? by Philip Bump (WaPo)

A downright unbelievable proposal is seeking to give private American citizens the right to seize assets of Russian oligarchs via Letters of Marque, a 19th century legal construct that hasn’t been used in almost two hundred years. [Link]

Ukraine war threatens to make bread a luxury in the Middle East by Maya Gebeily and Mena A. Farouk (Thompson Reuters Foundation)

On a combined basis, Russia and Ukraine supply a huge share of the grain that countries with relatively arid climates and weak farming capacity across the Middle East and North Africa rely on for basic calories. [Link]

State Capacity

‘Ways and Means’ Review: Financing the Civil War by Harold Holzer (WSJ)

A new book examines the role that innovative financial arrangements played in winning the Civil War for the Union, ranging from fiat currency to new debt instruments. [Link; paywall]

At cartel examination site; Mexico nears 100k missing by María Verza (AP)

Drug cartels operate with near-impunity in Mexico, and occasionally authorities discover the aftermath. One such example currently under investigation is a 75,000 square foot site miles from the border. [Link]

Former Police Chief Faked Death to Evade Charges, Officials Say by Eduardo Medina (NYT)

A small town police chief facing more than 70 felonies and fled to South Carolina after faking his death on a boat in the Lumber River. The former chief had stolen drugs and firearms from the town’s evidence locker and sold them for thousands. [Link; soft paywall]

Real Estate

L.A.’s most extravagant mansion sells for less than half its list price by Laurence Darmiento (Yahoo!/LAT)

A developer’s dream project collapsed with a mansion listed at $295mm selling for just $126mm, despite carrying a $256mm debt load from its construction. [Link]

COVID

Pfizer Covid vaccine was just 12% effective against omicron in kids 5 to 11, study finds by Spencer Kimball (CNBC)

A New York state study found a huge decline in efficacy among children during the Omicron variant surge, possibly due to lower dosages for young children compared to adults. [Link]

Economic Development

The Jolt: David Perdue targets Gov. Brian Kemp’s prized Rivian deal by Patricia Murphy, Greg Bluestein, and Tia Mitchell (The Atlanta Journal-Constitution)

Most state-level politicians would be thrilled to see $5bn invested in their state by a rapidly growing industrial company, but Georgia Governor candidate David Perdue apparently isn’t a fan. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!