Housing Data and Housing Stocks Erase Pandemic Gains

The past week has seen the national average for a 30 year fixed rate mortgage once again rocket higher. The average currently sits only a few basis points below 6%, the highest rate since the mid-2000s, as it has risen an astounding 42 basis points versus one week ago. As shown in the second chart below, that is one of only a handful of similar rapid upticks since at least 2000. The most recent of these is March 2020, and prior to that the December 2016 surge came close. Looking further back, only June 2013, the fall of 2008, and September 2003 have seen anywhere close to the same size short-term surges in mortgage rates.

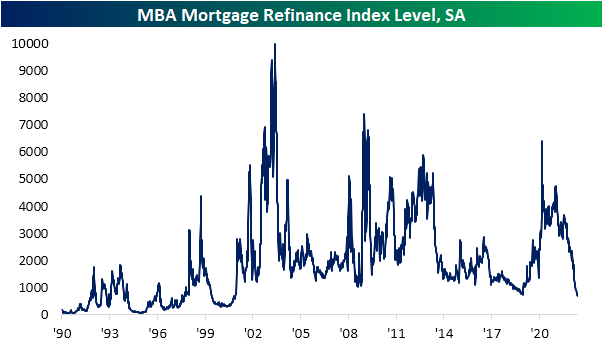

Ironically, weekly data from the Mortgage Bankers Association actually got some relief this week. Seasonally adjusted purchases rose 8% week over week. That was the biggest one-week uptick since March but only brings the index back to levels last seen three weeks ago. Even though this week’s 3.66% increase ended a five-week losing streak, outside of last week, refinance applications are at the lowest level since 2000.

Also on the housing docket today was homebuilder sentiment from the NAHB. This report too shows a souring sentiment on the part of builders as higher prices (through both cost of a home and the cost to finance) dampen demand. Each category is dropping sharply and back in the middle of their ranges from the few years before the pandemic at best. The Future Sales index has gotten hit the hardest as it fell to 61 in June. Outside of the much more dramatic drop at the start of the pandemic in early 2020, such a low reading has not been observed since December 2018.

As quickly as homebuilder sentiment rose to historic heights and then erased its pandemic gains, the same applies to homebuilder stocks. The iShares US Home Construction ETF (ITB) had finally broken out of a sideways range at the end of last year but has consistently grinded lower in the months since then. In the past week alone it has fallen another 11% and failed at last month’s support in the process. That leaves two interesting next areas to watch. The first is only 2% away from current levels and traces back to the fall of 2020. A little further below that, and 5.25% away from current levels, is the pre-pandemic February 2020 peak. Click here to learn more about Bespoke’s premium stock market research service.

B.I.G. Tips – Retail Sales Turn Negative

NY Fed Provides More Positives For Supply Chains

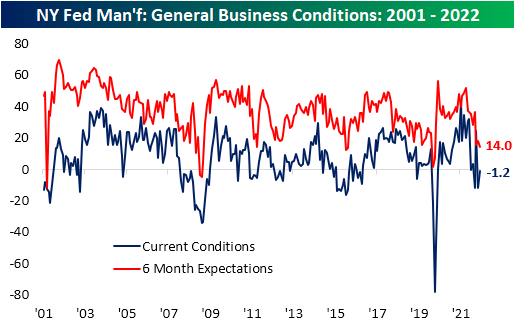

The Empire Fed Manufacturing survey was one of a number of disappointing economic data points released this morning. The headline index did bounce off a near post-pandemic low last month, rising back up to -1.2, but that was below expectations for a move up to an expansionary reading of 2.5. Six-month expectations, meanwhile, have continued to collapse with another post-pandemic low being set as it dropped to 14.

Although the reading on General Business Conditions disappointed, the rest of the report contained some silver linings. Breadth was mixed with four different categories falling month over month while the remaining five improved. In addition to the headline number, only the index for Unfilled Orders came in with a contractionary reading for current conditions. Around half of the categories also continue to have readings in the top few percentiles of their historical range.

Two categories that were major components in the improvement of the headline number were new orders and shipments. After deep contractionary readings last month, these two indices saw month-over-month increases ranking in the top decile of all monthly moves on record. That lifted each of those back into expansionary territory meaning the region’s manufacturers are once again seeing growth in demand. That being said, demand is not growing at the same historic rate as most of the past year, and as such, order backlogs are finally beginning to unwind as inventories are building at a historically strong clip.

In spite of the improvement in current conditions, reported expectations for future new orders is only slightly above levels observed at the depths of the pandemic. Given that more pessimistic outlook for order growth, backlogs are anticipated to fall at a near-record rate. The only lower reading in the history of the data for Unfilled Order expectations was in September 2012.

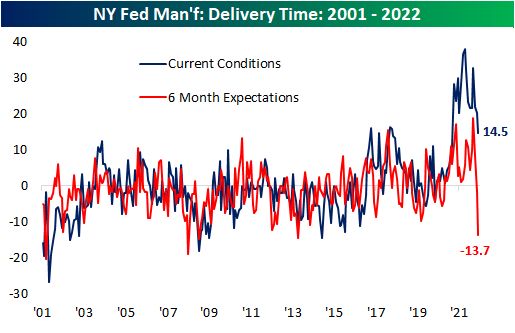

Another key explainer for those improvements in shipments, order backlogs, and inventories has been relieved supply chain stress. Echoing other supply chain-related data that we have touched upon (for a couple of examples see here and here), the index for Delivery Time has continued to plummet. In June, it hit the lowest level since last March. Although that remains a historically elevated reading well above most pre-pandemic levels, expectations have absolutely fallen off a cliff. That index has gone from one end of its historical range (a record high in March) down to the bottom percentile of readings and the lowest level since October 2013.

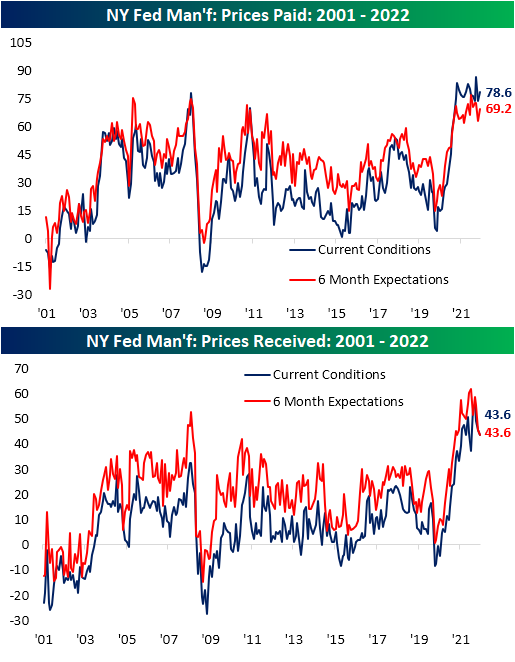

Those massive improvements in supply chain stress should also be positive on the inflationary front, granted, it has not exactly shown in the same way through the report’s prices indices. Both indices for Prices Paid and Received continue to sit at elevated levels in spite of somewhat promising moves in recent months. Prices Paid have plateaued as Prices Received have begun to roll over.

Pivoting over to employment-related categories, the region’s firms accelerated hiring in June even though the average workweek fell with expectations even weaker dropping into contractionary territory. Meanwhile, the indices for Technology Spending and Capital Expenditure have been rolling over indicating manufacturers have been slowing down non-labor spending, but in June both indices saw modest bounces. Click here to learn more about Bespoke’s premium stock market research service.

Asset Class Performance During QT

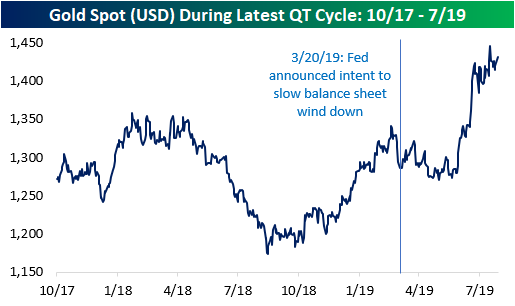

As mentioned in our piece from earlier today, gold did not necessarily deliver superior performance during the last QT cycle. This leaves investors to ponder: which asset classes did deliver substantial returns? Is there anywhere to hide? Although the macroenvironment is vastly different this time around, it is still helpful to look at past occurrences to attempt to put a frame of reference around today’s markets. Major differences include rampant inflation (particularly in commodities), supply chain constraints, lapping stimulus benefits, and weakening economic data. Below, we summarize the performance of the S&P 500, bonds, agricultural commodities, and oil during previous QT cycles.

The S&P 500 outperformed Gold during the last QT cycle, gaining 19.2%, which constitutes an annualized return of 10.1%. The graph below outlines the performance of the S&P 500 ETF (SPY) during different cycles of QE and QT. As you can see, equities were not particularly steady during the last QT cycle, but SPY gained significantly after the Fed announced its intent to slow the balance sheet winddown.

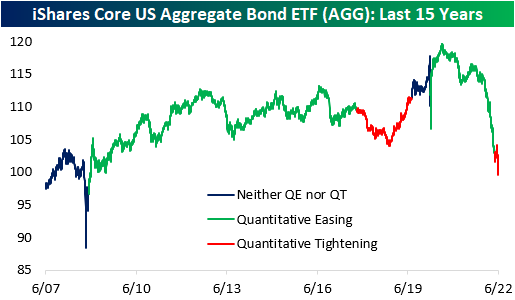

In the last QT cycle, the bond market initially sold off but managed to finish higher for the entire period. The iShares Core US Aggregate Bond ETF (AGG) bottomed at a drawdown of 4.7% about a year after the cycle began but proceeded to gain 6.7% through the final 203 trading days of the cycle. When all was said and done, AGG finished the cycle with gains of 1.7%. Similar to what we saw in gold, much of the gains were seen after the Fed announced its plan to slow the wind-down of the balance sheet. This suggests that rates rose at first but then reversed course when the Fed announced the impending end of QT. So far in the current cycle, AGG has already dropped by 2.7%, but bonds sold off hard in anticipation of QT in late 2021 and early 2022. On a YTD basis, the ETF is down a whopping 12.7%.

Agricultural commodities performed poorly during the last QT cycle, dropping 15.7%. This constitutes an annualized return of -8.9%, but the broader agricultural space was in a downtrend before QT began. Currently, agricultural commodities are in an uptrend, so it will be interesting to watch the price action as QT ramps up. On a YTD basis, the Invesco DB Agriculture Fund (DBA) is up 10.2% and is essentially flat since QT began in early May.

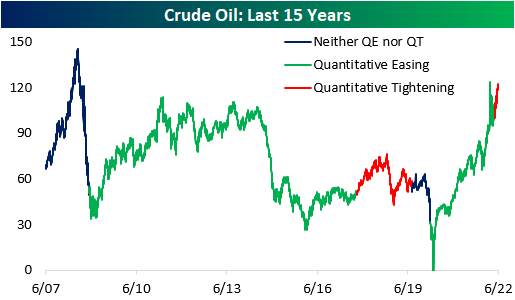

During the last QT cycle, crude oil gained 15.8%, but it would be difficult to attribute these gains to quantitative tightening. Since the Fed began tightening this year, crude oil has jumped 16.0% higher. In the last cycle, oil rallied higher before subsequently crashing, which would certainly be welcomed by many in this cycle. Click here to become a Bespoke premium member today!

Gold Performance During QT

Quantitative tightening (QT) has wide-spanning effects on the economy, as it puts upward pressure on risk-free interest rates due to increased supply in debt markets (assuming all else equal). The Fed announced its QT strategy just one meeting (5/3/22) after hiking its target rates for the first time since 2018 back in March. The previous QT cycle in 2017 did not begin until about two years after the Fed first started hiking rates. The reason for the quick turnaround this time around, though, stems from the fact that inflation has been running rampant, and the balance sheets of consumers and corporates are in relatively strong positions.

In terms of how various asset classes may perform in the current period of QT, some investors have looked back to the prior period of QT for insight. As mentioned above, there are some important distinctions between the current period and the last period of QT, so it may not be an apples-to-apples comparison, but there are certainly some similarities that can make knowing what happened back then helpful. Using the price of gold over the last 15 years as a backdrop, the chart below shows key events related to periods of quantitative easing (QE) and QT. The event surrounding each dot is summarized in the table below. Click here to learn more about Bespoke’s premium stock market research service.

Between October 2017 and July 2019 (the last QT cycle), the price of gold rose by 12.6%, which works out to an annualized return of 6.5%. Over the last 15 years, the price of gold has held an annualized return rate of 6.8%, so there was no clear differentiation in the performance of gold during that period of QT and the last 15 years as a whole. Looking at the chart, though, much of the gains from the last cycle of QT came late in that cycle as the Fed had already announced its intent to end the running off of assets from its balance sheet. In fact, the S&P 500 outperformed gold by more than six percentage points during the last QT cycle. In fact, before the March 2019 announcement that the Fed would wind down its balance sheet, gold was practically unchanged relative to the start of the QT cycle. Click here to become a Bespoke premium member today!

Bespoke’s Morning Lineup – 6/15/22 – Fed Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Everything you’ve ever wanted is on the other side of fear.“ – George Adair

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

With last week’s CPI report behind us, the market shifted its focus to the FOMC rate decision, and that day has now arrived. Futures are higher heading into the report, but we just got a slug of economic data (Retail Sales, Empire Manufacturing, and Import and Export Prices). Overall, the results weren’t pretty with Export Prices the only indicator that came in higher than expected. Both Philly Fed and Retail Sales were not only weaker than expected, but they were also negative at the headline level. Economic data is going one way (down), and interest rates are going the other (higher).

In today’s Morning Lineup, there’s a lot covered as we discuss the latest moves in crypto (pg 4), the ECB emergency meeting to address spreads widening in peripheral countries (pg 4), a preview of tomorrow’s BoJ meeting (pg 4) and today’s Fed decision (pg 5), a recap of market moves in Asia and Europe (pg 5), overnight economic data in Asia and Europe (pg 6), and much more.

After four days in a row of 1% to multi-percentage point daily declines, yesterday’s 0.38% drop in the S&P 500 almost seemed like an up day. Nevertheless, yesterday’s decline was large enough to bring the S&P 500’s five-day decline to over 10% which is a magnitude of decline we haven’t seen since the COVID crash (when there were multiple). The chart below shows the S&P 500 (on a log scale) going back to 1960, and the red dots indicate any time when the trailing five-day return was greater than 10%. What’s really interesting to note about this chart is that prior to 2000, the only times since 1950 that the trailing five-day decline exceeded 10% were in May 1962, October 1987, and August 1998. Since 2000, though, these types of declines have become much more commonplace with spikes in downside volatility occurring every few years.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 6/14/22

Inflation Concerns Peak

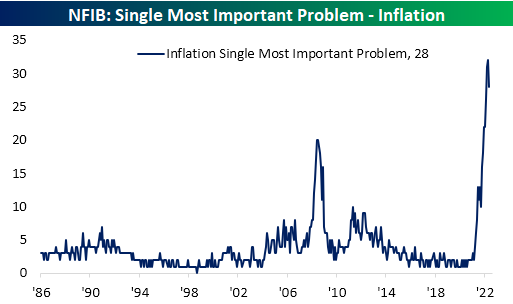

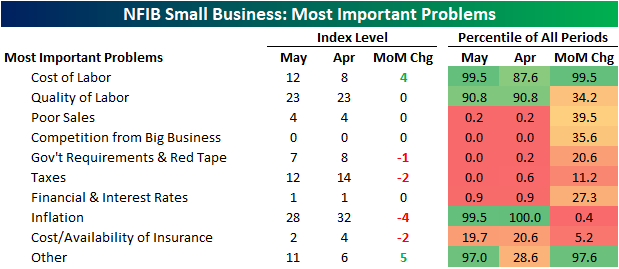

The NFIB released the results of its May survey of small businesses this morning, and even though the report showed the outlook for business conditions collapsed to a record low, there were other at least partially promising signs under the hood. Primarily, the percentage of respondents reporting inflation as their biggest concern finally appears to have peaked. After reaching a record high of almost a third of responses in April, a still-elevated but improved, 28% of small businesses reported inflation as their biggest concern. The decline in concerns over inflation ranked as the largest decline of any reported problem, but conversely, “other” saw the largest increase as it rose 5 percentage points month over month. Now at 11%, that reading is near some of the highest levels on record going back to 2008 (this response does not have as long dated of a history as the others which go back to 1986)

While the percentage of respondents reporting inflation as their biggest concern has peaked for the time being, that is not to say fewer businesses are concerned about rising costs. Behind the increase in “Other”, the next biggest month-over-month increase was cost of labor which rose four percentage points. That brings it to the highest level since December on its own as well as on a combined basis with quality of labor (which was unchanged month over month).

Inflation was not the only reading to fall month over month as fewer respondents also reported taxes as their biggest concern. Alongside another government-related reading, government requirements and red tape, the combined reading is at a record low.

Government-related indices were not alone with record low readings. 0% of respondents indicated that competition from big businesses was their most pressing issue as well while poor sales and financials & interest rates are just off record lows of their own. Click here to learn more about Bespoke’s premium stock market research service.