Bespoke Brunch Reads: 7/10/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Autos

Registrations for electric vehicles soar, signaling increasing mainstream acceptance by Jayme Deerwester (USA Today)

Electric vehicle sales industry-wide were up 60% YoY in Q1 despite an 18% drop in overall registrations. Fully electric vehicles in the US are just below 5% of total passenger sales in the US with roughly 60% of sales driven by Tesla. [Link; auto-playing paywall]

Monthly car payments have crossed a record $700. What that means by Brittany Cronin (NPR)

The combination of car price inflation and more feature-laded vehicles along with soaring interest rates are driving a surge in the monthly payment required to cover a car purchase. [Link]

New York Waterways

Give Me Your Tired, Your Poor, Your Pods of Dolphins—New York Welcomes New Immigrants by Alyssa Lukpat (WSJ)

As the rivers around New York have gotten cleaner, dolphins have returned to New York harbor in pursuit of a snack. Fins have been spotted from Brooklyn to Harlem, delighting residents. [Link; paywall]

She died in a Manhattan penthouse but was buried on an island for the poor by Mary Jordan (WaPo)

A tiny one mile slice of Long Island Sound is the largest public cemetery in America, serving as the final resting place for more than 1 million souls interred since 1869. [Link; soft paywall]

Real Estate

Roaring US Rental Market Shows Early Signs of Slowing Down by Paulina Cachero (Bloomberg)

High frequency indicators suggest that rents are starting to fall in a range of markets that were absurdly hot during 2020 and 2021, with large drops for 1- and 2-bedroom apartments alike. [Link; soft paywall, auto-playing video]

The Suburban Lawn Will Never Be the Same by Brian Eckhouse and Siobhan Wagner (Bloomberg)

As drought wracks the American West, homeowners have started to replace dead, dried out grass with artificial turf which doesn’t have the same thirst for scarce water that real blades would soak up. [Link]

Crypto

‘It’s Ruined Me’: Voyager Customers Fear Life Savings Gone After Crypto Firm’s Bankruptcy by Maxwell Strachan (Vice)

A crypto brokerage that promised huge yields for deposits of fiat currency has suspended withdrawals and declared bankruptcy, leaving customers holding the bag. [Link]

Sports

World Cup stadiums in Qatar to be alcohol-free – source (i24)

Thirsty footy fans are going to be totally out of luck at the World Cup this fall, with host country Qatar banning alcohol consumption in public…including the stands of matches at the iconic sporting event. [Link]

Fiscal Policy

Was the Paycheck Protection Program Effective? by William R. Emmons and Drew Dahl (FRB St Louis)

As COVID smashed the US economy in 2020, Congress traded off speed for precision. The consequence is that Paycheck Protection Program loan/grants were much less useful in supporting workers than unemployment insurance or economic impact payments. [Link]

Energy Shortage

Germany dims the lights to cope with Russia gas supply crunch by Guy Chazan (FT)

Russia is cutting off natural gas supplies to Germany, and the result is a nationwide energy crisis that is forcing rationing and massive price inflation onto households used to cheap and reliable gas supplies. [Link; paywall]

That’ll Leave A Mark

Markets Had a Terrible First Half of 2022. It Can Get Worse. by James Mackintosh (WSJ)

Stocks collapsed in the first half of the year, but the pessimist’s perspective offers little hope of a major rebound in the second half given how much risk still remains. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 7/8/22

This week’s Bespoke Report newsletter is now available for members.

In this week’s Bespoke Report, we’ve recapped today’s nonfarm payrolls report, provided an update on inflation trends, taken a look at sector breadth and internals, previewed the upcoming earnings season, and highlighted the recent price action in mega-caps and uber-growth stocks. To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform offers, start a two-week trial to one of our three membership levels.

Daily Sector Snapshot — 7/8/22

B.I.G. Tips – Energy Attempts to Catch its Breath After a Record Decline

Bespoke’s Morning Lineup – 7/8/22 – Jobs Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Our predecessors overcame many troubles and much suffering, but each time got back up stronger than before.” – Shinzo Abe

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

US futures have been negative most of the morning ahead of today’s jobs report, but they have been improving from earlier levels, and the Dow is even indicated to open slightly higher as we type this. This is all subject to change, though, as the June employment report will be released shortly. Expectations are for an increase of 268K, which would be the lowest monthly reading since the start of 2021, but the real focus will likely be on average hourly earnings which are expected to increase by 0.3%.

Outside of equities, US treasury yields are modestly lower, but the 2s10s yield curve remains inverted for the fourth straight day. Crude oil and gold are basically flat, and copper is down nearly 2%.

In today’s Morning Lineup, we discuss moves in Asian and European markets and economic data from around the world.

With a good deal of emphasis being placed on today’s employment report, we wanted to take a quick look at how the headline payrolls report has come in relative to expectations over the last year. In the last 12 monthly reports, the headline number has exceeded expectations seven times and missed forecasts five times. Looking at the chart, though, the margin of the misses has been much larger than the magnitude of the beats. In four of the five misses, the actual reading came in more than 250K below forecasts, and the overall average miss was 291K. In the seven beats, however, the average beat was just 143K or less than half of the magnitude of the average miss. Applying the average miss to today’s report, if the June report missed expectations by the ‘average’ amount of the last year, it would be a negative reading. A lot of ifs there, but just helps to put things in perspective.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Weekly Sector Snapshot — 7/7/22

B.I.G. Tips – On Pins and Needles Ahead of Earnings Season

We’re on the cusp of another earnings season as next Thursday will unofficially kick off the Q2 reporting period when the major banks and brokers start to report their results. After a second-quarter where commodity prices spiked, the dollar surged, and economic data slowed, investors have been looking ahead to earnings season like a cow feels walking into the slaughterhouse. The general consensus seems to be that overall expectations remain way too high given the tough macro backdrop.

For a more detailed rundown of the earnings schedule for the upcoming season, please see our Earnings Explorer Tool (available to all Institutional clients) on the Tools section of our website, and to see our quarterly preview of the upcoming earnings season with respect to analyst sentiment heading into it, start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Chart of the Day: Earnings Still In Decent Shape

Bulls Back Below 20%

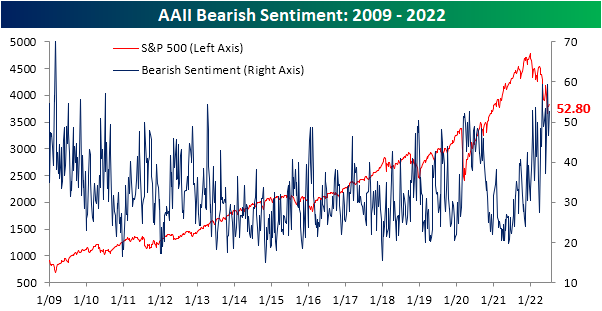

Even though the second half of June and first week of July have seen the S&P 500 climb back from its lows, sentiment appears to show that investors are not buying it. In today’s update of AAII sentiment survey, there was an overall push toward more bearish tones. For starters, the percentage of respondents reporting as bullish fell back below 20%. Even though that is not any sort of new low, this week is the fifth in a row with less than a quarter of respondents reporting as bullish. As shown in the second chart below, such a streak has been unprecedented with the last example of such an extended streak of depressed sentiment being May of 1993.

As bulls have been no where to be found, bears are plentiful with over half of respondents reporting bearish sentiment. This week’s reading came in at 52.8%, up from 46.7% last week. Mirroring bullish sentiment, that is not any sort of new pinnacle for bearish sentiment as there were even higher readings that closed in on 60% last month. Regardless, sentiment remains historically pessimistic with few other periods having seen such elevated readings for as extended of periods.

With inverse moves in bulls and bears, there is now a 33.4 percentage point gap between the two readings which is in the 2nd percentile of all readings since the survey began in 1987.

That leaves neutral sentiment to be the only normal reading of the survey. At 27.8%, neutral sentiment is in the middle of its pandemic range and only 3.6 percentage points below its historical average.

The more bearish turn at the expense of bulls witnessed in this week’s AAII survey was echoed by other readings on sentiment like the Investors Intelligence survey and NAAIM Exposure index. Combining all three of these sentiment readings into one composite, overall outlooks for the market took a further bearish turn this week with the average survey currently 1.8 standard deviations below its historical norm. That is slightly better than earlier this spring, but still, the only period since the mid-2000s with similarly pessimistic readings was in late 2008 and into 2009. Click here to learn more about Bespoke’s premium stock market research service.

Worst Week of the Year For Claims

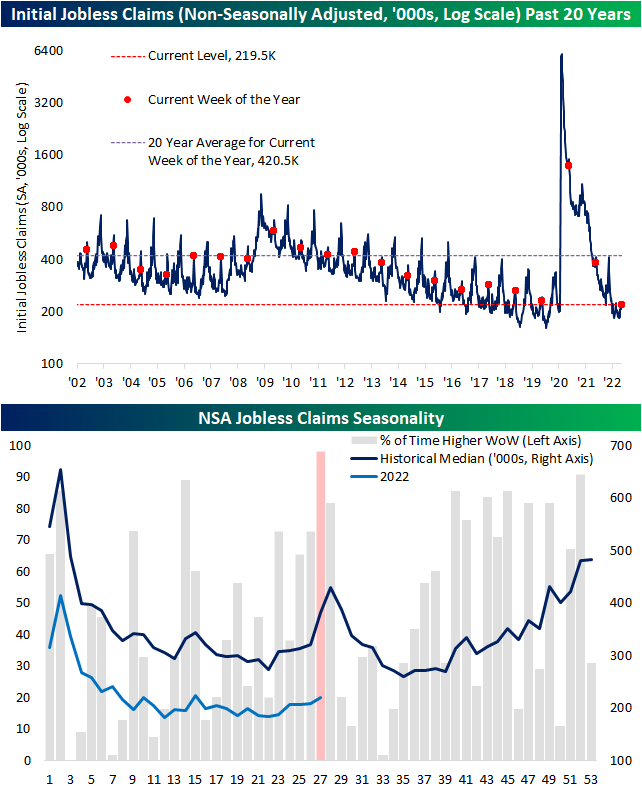

Initial jobless claims remain historically healthy in the low 200K range, but the most recent week’s data did mark one of the highest readings of the year. Coming off of last week’s unrevised 231K, claims rose 4K to the highest level since the second week of the year when they clocked in at 240K. That remains a much better reading than what was observed throughout much of the history of the data, but it is at the higher end of pre-pandemic readings (those from roughly 2017 through 2019).

As for the non-seasonally adjusted number, the current week of the year is essentially guaranteed to see a week-over-week increase. The current week has historically been the worst of the year in terms of week-over-week moves only having seen unadjusted claims fall once since 1967. That one decline was in 2020 when claims were working off unprecedented record highs. Given that historically consistent drift higher in claims during this point of the year, next week has historically averaged a temporary peak in claims. While that lends to the possibility of claims continuing to rise next week, the current reading is below that of comparable weeks of pre-pandemic years. In other words, claims are following standard seasonal patterns and are doing so at historically strong levels even if they have come off the absolute strongest levels of the pandemic.

Continuing claims have also begun to come off of the best levels of the pandemic. Adjusted continuing claims were expected to go unchanged at 1.328 million this week. Instead, they rose up to 1.375 million; the highest level since the week of April 22nd when claims were 12K higher. Click here to learn more about Bespoke’s premium stock market research service.