Chart of the Day: Tarnished Gold and Copper

Small Business Expectations Disconnect

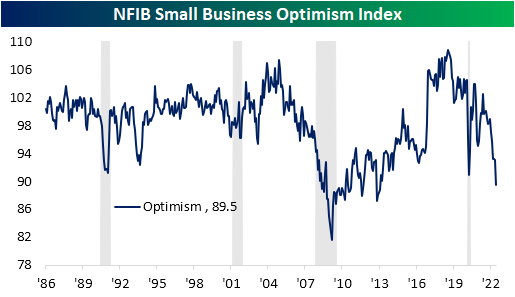

The only US release on the economic calendar today was the NFIB’s Small Business Optimism Index, and it was a big dud. Compared to last month’s low reading of 93.1, the index fell to 89.5 versus expectations for a much more modest decline to 92.8. As a result of that larger than anticipated drop, the index is now below the COVID low and down to the lowest level since January 2013.

As the headline number is now in the 6th percentile of its historical range, several other components are similarly depressed including a record low reading in expectations for the economy to improve. Although some indices have managed to hold up decently—for example, reported inventory levels and the difficulty in filling openings remain in the top few percentiles since the survey began—breadth in June was very weak with many of the declines being historically large.

As we noted in today’s Morning Lineup, labor market indicators within the report have cooled off in recent months but remain at historically impressive levels. Meanwhile, inflation readings are also continuing to come in very elevated in spite of coincident declines in sales expectations.

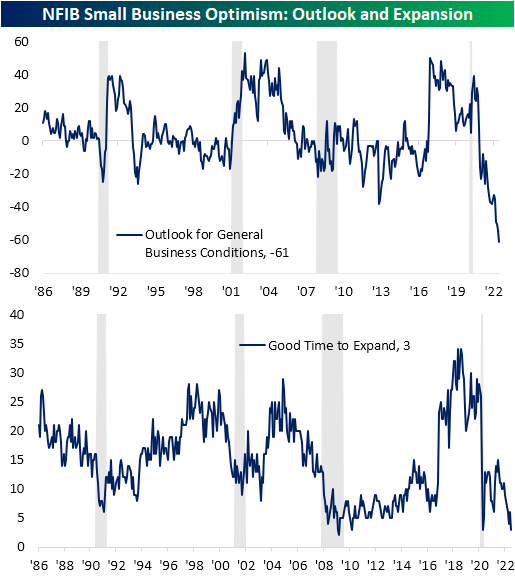

Again, the worst category of the report was the reported outlook for general business conditions. This index set the bar for a record low even lower as a net 61% of respondents reported that they expect the economy to worsen in the months ahead. Given this, there is also a historically muted share of respondents reporting now as a good time to expand their businesses. That reading came in at a meager 3, which alongside April 2020 and March 2010, was the joint lowest level since March 2009.

The NFIB also provides some detail as to why businesses are reporting such a soured outlook regarding expansion. Half of the responses blamed broader economic weakness as the reason. Ironically, that goes against the fact that only 2% reported weak sales would be a reason while another 3% reported strong sales would be the reason to expand. Additionally, while inflation remains such a major concern, only 4% blamed higher costs as a reason to not expand. So while half blamed economic conditions as the reason not to expand, there were some contradictory cross currents.

While it is a drastically lower share at only 10%, the next biggest reason for not expanding was the political climate. As we have frequently noted in the past, one issue with the NFIB survey is that there has been a sensitivity to politics, namely a bias in favor of Republicans. Given the Democratic administration, it is not exactly surprising that political climate would come in second.

Another interesting point to note on this month’s survey regarded the uncertainty index. This measure essentially tracks the number of times respondents select “uncertain” or “don’t know” as an answer to a survey question. Here was another index that has reached the lowest level in over a decade. This month’s low reading would imply that firms have a decidedly negative outlook for the economy.

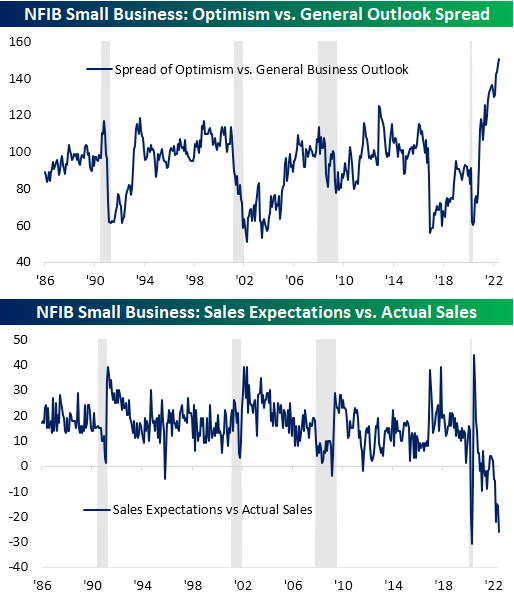

While sales expectations are down near the worst levels since the Global Financial Crisis and the COVID Crash, actual observed changes in sales have not yet cratered in the same way. That being said, on net there are more firms reporting lower sales than higher.

In other words, small businesses expect sales to get much worse than what current levels of sales would have historically implied. As shown below, the spread between those two indices has only been lower once on record and that was at the start of the pandemic. Similarly, the record low in General Business Outlook starkly contrasts with where the headline optimism index has been sitting. That spread is at a record high meaning again economic outlook is far worse than the overall level of optimism.

Another Curve Inverts

As of today, the percentage of inverted points on the yield curve reached the YTD highs seen in mid-June of 17.9%. This comes as the 10-year and 1-year invert, as well as the 5-year and 2-year. The inversion of points on the yield curve (particularly 2s&10s) tends to be cited as a leading recession indicator, due to the fact that higher near-term yields imply a higher risk in the near-term rather than the long-term, the inverse of what is typically true. The graph below shows the rolling percentage of inverted points on the curve over the last six months. Click here to learn more about Bespoke’s premium stock market research service.

As mentioned above, the spread between the 10-year and 1-year treasury inverted today, which is the first occurrence since October of 2019. Following prior inversions of this part of the yield curve since 1970, a recession has followed in the next two years 99.8% of the time which would suggest that a recession at some point in the next two years is almost certain. Following the first inversion in at least one year when a recession did follow, it has taken an average of 271 trading days to officially enter a recession. The shortest time it took to enter into a recession following 1s and 10s inversion was in 1973, when it took just 191 trading days. As mentioned, going back to 1970, recessions have followed within two years of an inversion 99.8% of the time. The only time that this part of the curve inverted and a recession did not follow within two years was after a brief stint in the fall of 1998.

Bespoke’s Morning Lineup – 7/12/22 – Euro Not Gonna Believe This

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The euro was born with great hopes. Reality has proven otherwise.” – Joseph Stiglitz

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

As the European economy continues to crater given rampant inflation, geopolitical instability, and labor/supply issues, the collapse in the bloc’s currency continued overnight as the euro reached parity with the US dollar for the first time since December 2002. While the round number generates a lot of headlines, it really means little in the broader picture of a weak European economy and what looks to be an even weaker outlook in the months ahead.

Over here in the US, things don’t seem all that much better. The week has started off slowly in terms of economic data, but this morning’s report from the NFIB on small business optimism came in much weaker than expected at 89.5 versus estimates for a reading of 92.5. Would you believe that sentiment among small businesses is now lower than it was at any point during the COVID lockdowns? Admittedly, the NFIB survey does tend to lean Republican, so with Democrats in control of DC, it’s not a complete surprise to see sentiment so weak. Given the macro backdrop, though, you can’t fault small business owners for being pessimistic. The last time the headline index from the NFIB was as low as it is now was in January 2013 at the beginning of President Obama’s second term. With the NFIB report behind us, the focus will now shift to tomorrow’s CPI.

In today’s Morning Lineup, we discuss moves in Asian and European markets, the latest developments on the war in Ukraine, and economic data from around the world.

Here is a surprising aspect of recent market events. With what seems like a near-constant focus that the ARK Innovation ETF (ARKK) gets, we were surprised that given the near 7% decline in the ETF yesterday there wasn’t more attention given to the fact that it had one of its 15 worst days since its inception in late 2016. The chart below shows the performance of ARKK since the start of 2017, and we have included red dots to show each of the 15 largest daily percentage declines in the ETF’s history. In the five-plus years that the ETF has been trading, all fifteen of the largest daily percentage declines occurred in either 2020 or 2022. Even more surprising is the fact that seven of the fifteen largest declines have all occurred since the start of May. What does it mean when extreme moves become the norm?

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 7/11/22

KWEB Gaps Down 4%+

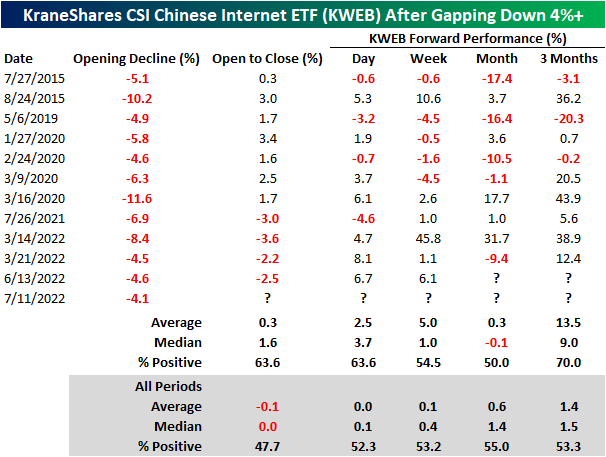

Today, the KraneShares CSI Chinese Internet ETF (KWEB) gapped down by 4.1% due to regulatory pressures from the Chinese Communist Party and an uptick of COVID cases in a few Chinese cities. Since KWEB’s inception in August 2013, the ETF has only gapped down by 4%+ 12 times, the largest of which was an 11.6% drop in March of 2020 during the height of the COVID crash. Following these weak opening gaps, KWEB has tended to partially recover throughout the day, booking a median gain of 1.6% between the open and the close. However, today the stock bucked that pattern and continued to decline from the open to close falling an additional 2%, resulting in a total loss of over 6%.

Following prior downside gaps of 4%+, KWEB has bounced back by a median of 3.7% the next day, with positive returns nearly two-thirds of the time. Over the course of the next week, KWEB has posted a median gain of 1.0%, which is 0.6 percentage points better than the average of all periods. For all the time periods that we looked at, KWEB’s median performance following these occurrences has outperformed the median of all periods, apart from the following month. Three months later, KWEB has booked a median gain of 9.0%, which is 7.5 percentage points higher than the 1.5% average for all periods. Click here to learn more about Bespoke’s premium stock market research service.

Elon Musk: The 2022 Twitter (TWTR) Catalyst

On the front page of most news sites today is the headline that Elon Musk has officially sent notice terminating his deal to acquire Twitter (TWTR). Similar to the way other celebrities have appeared to be major catalysts for a stock in the past year, like Joe Rogan and Spotify (SPOT), Musk’s interest in one of the cornerstones of social media has played a major role in the movements of TWTR’s stock this year. Below, we show a timeline of the saga overlaid on the charts of TWTR’s stock price and the daily percent change since the start of the year.

Back in early April—only a little more than a week after Musk tweeted a poll regarding the platform and free speech then following up with a tweet mentioning the “consequences of this poll will be important”—markets got confirmation that one of history’s wealthiest people had become the company’s largest single owner of Twitter with a 9.2% passive stake. That sent the stock surging 27.12% in a single day. The following day, TWTR rose another 2% when the company extended an offer for him to join the Board of Directors. That was an offer that would be rejected only a few days later as the stock began to reverse some of the massive gains. TWTR would not go on to turn around until Musk officially offered to buy the company at $54.20 per share (4/14), his financing was confirmed (4/21), and finally, when a deal was reached (4/25).

We always say how the market is forward-looking, and it appears as though Mr. Market knew the deal was fake news the entire time. On the day the deal was announced, TWTR peaked a few dollars short of Musk’s proposed price and has been on the decline ever since. The worst of the reversal occurred in mid-May as Musk expressed a hold-up regarding the company’s tracking and reporting on fake/bot accounts. A lack of resolution to Musk’s reservation has been the justification for the undoing of the deal which was confirmed last Friday, resulting in Twitter shares to fall 13.74% since last Thursday’s close.

Finally, we would also note that even though Twitter (TWTR) is a major player in the social media space, it is way down the list in terms of the S&P 500’s largest stocks; especially after the recent drop. Conversely, Musk’s Tesla (TSLA) is currently the fifth-largest stock in the index based on market cap indicating it has an outsized impact on the moves of the S&P. Given all the recent events and Musk’s involvement, Twitter and Tesla have been trading increasingly in sync with one another over the past few months implying these moves in Twitter to some extent actually have ripple effects for the broader market via sympathetic moves in TSLA. For example, while Twitter is down 9.5% today as of this writing, TSLA is falling 6.5%.

Below we show the correlation between the daily moves in TWTR and TSLA on a rolling 2-month basis which would roughly cover the period when the Twitter deal came into question and shares began to roll over. Historically, the two stocks have had a modest positive correlation with a handful of stints in which that relationship became very strong like late 2018, the COVID Crash, and the first quarter of this year when growth stocks broadly fell together. This year, that correlation weakened a bit as the Twitter acquisition news began to develop, but since the deal began to fall apart, it has started to rip higher once again with the current level entering the top decile of historical readings. Click here to learn more about Bespoke’s premium stock market research service.

Consumers Run From Stocks

The New York Fed runs a monthly survey of consumer expectations (SCE) which covers topics ranging from inflation, the labor market, and household finances, and while its history is limited (starts in 2013), it provides a great look at where US consumers see the state of the economy and financial markets. The latest update for the month of June was released earlier today and provided some really interesting insights regarding different trends, but one we wanted to focus on here is how Americans view the prospects for stock prices.

As the equity market has weakened this year amid higher inflation and the Fed’s rate hike cycle, consumer sentiment towards the stock market has been declining, but the pace has really picked up in the last two months taking the total percentage of consumers expecting higher stock prices to its lowest level (33.8%) in the history of the survey. Put another way, just about two-thirds of US consumers expect stock prices to remain flat or decline over the next 12 months. Add this to the long litany of other sentiment surveys showing investors and consumers alike have little confidence in the stock market. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – What About That Yield Curve?

Bespoke’s Morning Lineup – 7/11/22 – Slow Start to a Busy Week

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I have thought it my duty to exhibit things as they are, not as they ought to be.” – Alexander Hamilton

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After a nice week to kick off the quarter, we are seeing some giveback this morning as all of the major US averages are indicated to open lower. Along with weaker stock prices, crude oil, gold, and crypto are joining the downward bias. Treasuries, however, have bucked the trend with the 10-year yield trading down near 3%.

This week will be an important one for the markets with some key economic data (CPI, PPI, and Retail Sales) as well as the start of earnings season, but it’s starting off slow as there are no significant economic reports and the only earnings report of note is from Pepsi (PEP) after the close.

In today’s Morning Lineup, we discuss moves in Asian and European markets and economic data from around the world.

Last week was a pretty good one for US equities with the S&P 500 up nearly 2% and the Nasdaq up over 4%. Even after the gains, both the Nasdaq and the S&P 500 failed to close above their 50-day moving averages (DMA). The Nasdaq is just fractionally below that level, and the S&P 500 is over 1.5% below its 50-DMA. While the Nasdaq wasn’t able to re-take its 50-DMA, it does appear to have broken a downtrend that has been in place since the Spring. The S&P 500, on the other hand, also remains below its downtrend from the Spring, so it still has more work to do on the upside. Just as the 50-DMA tends to act as support in uptrends, it tends to act as a headwind during downtrends, so this week should prove to be a critical one as we get deeper into Q3. A failure on the part of the indices to break above their respective downtrends or reclaim their short-term moving averages could set the market up for a long earnings season.

Last week’s rally was dominated by the ‘trash’ as the year’s three worst performing sectors were the leaders last week. Consumer Discretionary rallied 6.5% over the last five trading days (July 1st through last Friday), while Technology and Communication Services both surged 4%. Even after these gains, all three sectors are still down well over 20% YTD. On the downside, it was generally the year’s winners that lagged last week as Energy and Utilities both experienced fractional declines. One outlier to the trend was Materials. It was the worst-performing sector over the last five trading days and it is also the fifth worst-performing sector YTD, and one of just two oversold sectors.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.