Pumped For Some Relief

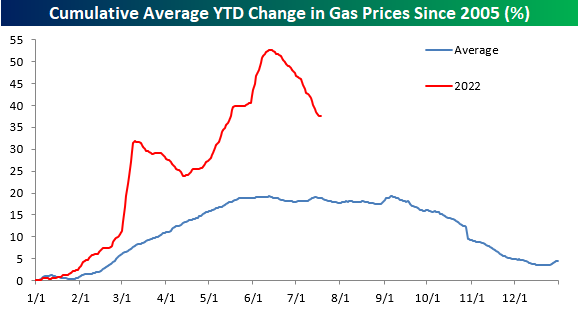

After one of the sharpest YTD surges on record, US consumers have seen a bit of relief at the pump over the last month as gasoline prices, as tracked by AAA, have seen a sharp pullback. The national average price of a gallon of gas currently stands at $4.52, which at any other point in history would have been astronomical, but compared to mid-June when the national average briefly topped $5, current prices seem downright cheap – at least on a relative basis!

The table below shows prices as of 7/18 each year going back to 2005 and where they stood on both a MTD and YTD basis. At $4.52, the national average has never been higher at this time of year, and the only year it was above $4 per gallon on 7/18 was in 2008. On a YTD basis, the average price is still up 37.6%, which is roughly double the average and median YTD gain at this point in the year, but 2021 (40.6%) and 2009 (52.6%) both saw larger YTD increases. One notable aspect of this year so far is that despite the big increases on a YTD basis, this month’s 6.6% MTD decline actually ranks as the largest MTD decline in prices through 7/18.

While the moves this year have been much more extreme than normal, average gasoline prices are following their typical seasonal pattern. Historically, prices tend to peak right around Memorial Day or into early June, and this year’s peak in prices was on June 13th. Granted, this year’s peak (50%+) was much larger than the typical YTD increase leading up to the peak, but the magnitude of the decline in percentage terms has also been steeper than normal. In order to get back down to a more normal YTD pattern, we’re going to need to see continued weakness in prices going forward. But from a seasonal perspective (and barring any hurricanes), there is a tailwind for lower prices. Click here to learn more about Bespoke’s premium stock market research service.

Besides the fact that gas prices hit record levels this year, what has made the period especially painful for consumers is how consistent the increase in prices has been. The chart below shows the y/y change in prices going back to 2005. The current level of 42.71% isn’t necessarily extreme in terms of its magnitude, but what stands out in the chart below is how long the y/y increase has stayed at elevated levels. Back in March 2021, the year-over-year change for gas prices first crossed 30%, and it hasn’t looked back since. When you start lapping 30% y/y increases, it really starts to add up! Let’s hope that this recent dip really starts to have some legs.

Bespoke’s Morning Lineup – 7/18/22 – An Up Monday For A Change

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Let me assert my firm belief that the only thing we have to fear is fear itself” – Franklin D. Roosevelt

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

What was looking like a very strong start to the week a couple of hours ago is now looking more like merely a positive start to the week as S&P 500 futures went from up well over 1% to up about 75 basis points (bps). Given the market’s tendency to kick off the week on a down note this year, though, and positive start to the week is a win. Consider this, including today, of the 29 weeks so far in 2022, the S&P 500 tracking ETF (SPY) has only opened higher on the first trading day of the week ten times.

Economic data is light today with Homebuilder Sentiment the only report on the calendar. The pace of earnings will pick up as the week goes on, but already we’ve already had reports from Bank of America (BAC) and Goldman Sachs (GS). Neither company had any major landmines, and while BAC is flat in the pre-market, GS is up over 3%.

Today’s Morning Lineup discusses earnings news out of Europe, action in Asian and European markets, and economic data from around the world.

Last Friday’s rally helped to end what was a lousy week up until that point on a positive note. Heading into the day, the S&P 500 was down for five straight days, and even after the rally, finished the week down nearly 1%. But with a strong finish and futures trading where they are right now, both the S&P 500 and the Nasdaq are poised to erase just about all of last week’s losses at the opening bell.

There’s been an awful lot of bottom talk circulating over the last few days, and the charts of the Nasdaq 100 (QQQ) and S&P 500 (SPY) have been showing some positive signals as they both managed to make higher lows last week. There’s still a lot of resistance to work through on the upside, though, as the 50-day moving averages and prior highs from this summer loom above. Given the market’s tendency to disappoint bulls in prior rallies this year, traders are increasingly less likely to give the market the benefit of the doubt and give an all-clear.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 7/17/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Labor Markets

Here’s where Tesla’s recently laid-off talent is going by Fred Lambert (electrek)

Workers who have been laid off or otherwise departed Tesla recently has headed to other tech firms, with Rivian, Apple, and Lucid Motors among the biggest recruiters. [Link]

Netherlands Poised to Make Work-From-Home a Legal Right by Lucy Papachristou (WSJ)

Dutch legislation will force employers to consider remote work requests and provide a covered reason denying their request. [Link; paywall]

Food

Learning to Love an Induction Stove by Hannah Goldfield (NYer)

While gas remains a favored cooktop for chefs, home cooks are likely to reduce greenhouse gas emissions, protect their family’s air quality, and reduce cook time. [Link; soft paywall]

Rising prices curb consumers’ taste for chocolate by Maytaal Angel and Jessica DiNapoli (Reuters)

Sweet treats are an easy item to give up for many consumers, especially when high prices for chocolate mean choco-holics are paying out the nose for their fix. [Link]

In Portugal, Taking a Dive Into Sardines by Lily Puckett (NYT)

A look into the very old and very big business of fish canning, an industry dominated by women that is having a moment thanks to foodies’ search for intense and widely available flavors. [Link; soft paywall]

China

Chinese Homebuyers Across 22 Cities Refuse to Pay Mortgages (Bloomberg)

With apartment development timelines dragging out in part due to builders’ financial challenges, owners already on the hook for payments are starting to boycott their loans in protest. [Link; soft paywall]

China Is Stealing Taiwan’s Sand by Elisabeth Braw (FP)

Taiwanese islands close to the mainland regularly see thousands of dredgers and support vehicles trespass with the goal of removing sand for use in a huge range of applications from land reclamation to concrete or glass manufacturing. [Link]

Subscriptions

Instagram now lets creators publish feed posts just for their subscribers by Chris Welch (The Verge)

Content on Instagram can now be pushed exclusively to paid subscribers, following in the steps of Twitter and adding to a similar feature for Stories. [Link]

Netflix Changes Tack With Marketing Spree for $200 Million Film by Lucas Shaw (BNN Bloomberg)

Instead of just letting users discover a new movie, Netflix is actively marketing its new blockbuster (featuring Ryan Gosling) in a bid to re-start subscriber growth and maintain its position within the streaming wars. [Link]

BMW starts selling heated seat subscriptions for $18 a month by James Vincent (The Verge)

The German auto manufacturer is testing a feature that would allow users to pay full freight for heated seats up front or pay less in monthly installments…all to access a feature that comes built into the car but can be turned on or off with software. [Link]

Market Innovation

‘The market is just dead’: Investors steer clear of 20-year Treasuries by Kate Duguid and Colby Smith (FT)

Since being reintroduced in 2020, the 20y Treasury bond has found very little interest from investors as low liquidity and weak real money interest have made it attractive to nobody. [Link; paywall]

Lumber Futures Are Getting a Makeover by Ryan Dezember (WSJ)

In a bid to expand volumes, the CME is reducing the size of its lumber future by 75%, changed the delivery point, and broadened eligible species to allow for more participation on both sides of the contract. [Link; paywall]

Approval

Most Democrats Don’t Want Biden in 2024, New Poll Shows by Shane Goldmacher (NYT)

With President Biden deep underwater in broad polling, a majority of Democrats would prefer someone else in a primary challenge; that said, a failure to renominate a sitting President would be a major shocker in the longer-term history of the US two-party system. [Link; soft paywall]

Too Much of A Good Thing

A new ‘miracle’ weight-loss drug really works — raising huge questions by Hannah Kuchler (FT)

Last year the FDA approved a weight loss drug that led to patients losing 15% of their body weight on average. Its history and approval are controversial: patients will likely need to take it long term at a monthly list price of $1,350. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Daily Sector Snapshot — 7/15/22

The Bespoke Report – 7/15/22 – Inversion, Earnings, Oh My!

This week’s Bespoke Report newsletter is now available for members.

Earnings started this week, offering updates from corporate America as economic data and macroeconomic policy points towards a looming recession. Commodity prices have continued on their recent declines, while interest rates have been torn between growth concerns and a Fed that feels pressed to do more amidst high inflation. While consumer and producer prices this week we higher than expected, inflation expectations fell and presented a challenge to how the FOMC will communicate its plans for July rates policy amidst broadening core inflation, falling gasoline prices, volatile expectations numbers from consumer surveys, and big declines for market-based measures. We also discuss growth in China, retail sales data, Canada’s own 100 bps tightening this week, Italian political drama, and more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

B.I.G. Tips – Retail Sales Bounce Back

Bespoke’s Morning Lineup – 7/15/22 – Crisis of Confidence 43 Years Later

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The erosion of our confidence in the future is threatening to destroy the social and the political fabric of America.” – President Jimmy Carter 7/15/79

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

43 years ago today, President Carter addressed the nation in what has become the now famous crisis of confidence speech. Today, we find ourselves in a very similar situation with rampant inflation and sentiment among Americans at multi-decade lows. Reading through Carter’s speech today, you would have thought he was talking about the present-day United States.

Unfortunately, from an economic perspective, Carter’s speech was followed by two separate recessions (the double-dip) in the next four years. The first started five months later in January 1980 and lasted just six months. The expansion that followed lasted only a year, and in January 1981 a second contraction began lasting 16 months in what at the time was tied for the longest recession since the Great Depression. On a more positive note, there have only been 35 trading days where the S&P 500 closed at a lower level than where it was at the time of Carter’s speech, and the maximum downside was 4%.

This morning, futures are indicated higher in what bulls hope will end a five-day losing streak for the S&P 500, but first, we’ll have to get through the July Empire Manufacturing report, Retail Sales, Industrial Production, Capacity Utilization, Business Inventories, and Michigan Confidence. In other words, look out for landmines.

Speaking of confidence, the Michigan Confidence index is at lower levels now than it was when Carter gave his ‘malaise’ speech and for that matter, at any time since the survey started in the late 1970s. As we all remember, in the preliminary release of that report last month, inflation expectations ticked higher leading to a more aggressive rate hike from the Federal Reserve. Ultimately, that uptick in inflation expectations was revised away, so that will be the key aspect to watch of that report today.

Today’s Morning Lineup discusses policy moves out of DC ahead of the midterms, earnings, news, action in Asian and European markets, and economic data from China.

Carter’s ‘Crisis of Confidence’ speech focused a lot on high energy prices and his proposals to help reduce the US dependence on foreign oil. Ironically, today President Biden is in the Middle East asking Saudi Arabia to pump out more oil into the global market. Thankfully for Americans, we’ve already started to see relief as oil prices are well off their highs from earlier in the year and below $100 per barrel. That has negatively impacted the Energy sector where prices have cratered in recent weeks. Just yesterday, the sector fell another 1.9% taking its peak to trough decline (on a closing basis) down to 26.3% which is actually five percentage points more than the S&P 500 is down from its peak!

In the process of yesterday’s decline, the Energy sector also closed below its 200-DMA for the first time in over 200 trading days (September 2021). While it has been nearly ten months since the Energy sector last traded below its 200-DMA, the streak that just ended wasn’t particularly extreme relative to history. As recently as early 2017, there was a slightly longer streak, and back in August of last year, there was a streak that lasted 185 trading days. The most extreme streaks for the sector occurred back in the late 1990s and early 2000s when there were two separate periods that stretched roughly three years each!

Following its 25% haircut, the Energy sector may have broken support at its 200-DMA yesterday, but it is also right around two other potentially important levels. As shown in the chart below, yesterday’s close coincided with the high from 2019 and is now only modestly above its uptrend line from late 2020 which began when the sector made a higher low following the COVID crash.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Weekly Sector Snapshot — 7/14/22

The Bespoke 50 Growth Stocks — 7/14/22

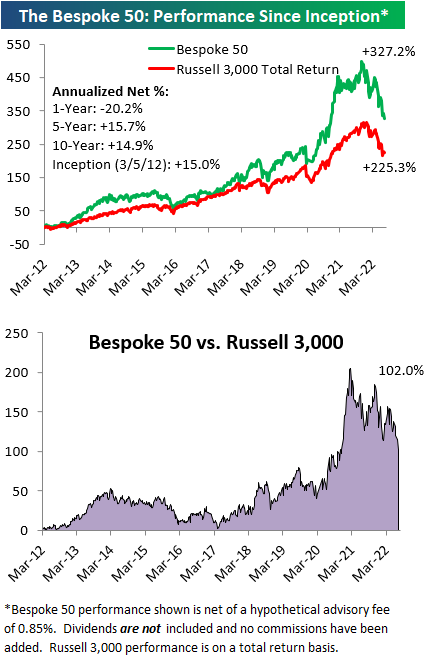

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

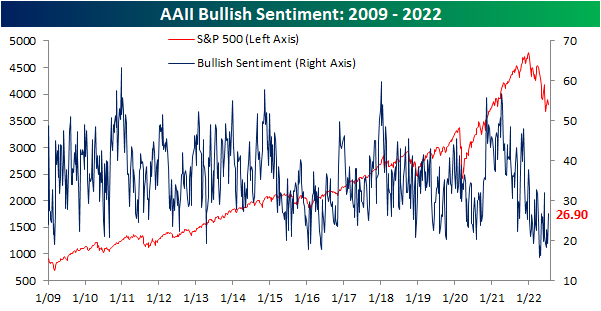

Bulls Back Above 25%

In spite of the S&P 500’s consistent declines in the past week as it failed to take out its late June highs, investor sentiment has turned around (relatively speaking) with this week’s reading from the AAII showing 26.9% of respondents reporting as bullish for the first time since early June. The 7.5 percentage point increase in the percentage of bullish responses this week was a large week-over-week increase by historical standards, although there have been multiple even bigger larger weekly increases over the past few months.

With the increase in bullish sentiment, over a quarter of respondents reported as bullish for the first time in five weeks. Such extended streaks with as depressed readings have been few and far between with the last five-week streak occurring all the way back in the summer of 1993. Overall, there have now only been six streaks in which bullish sentiment remained below 25% for at least 5 consecutive weeks. The longest of these was in December 1990 when it went on for 9 weeks in a row. Albeit a small sample size, historically the end of these streaks have not been raging buy signals for the S&P 500 in the short term with inline performance versus all periods and somewhat weak returns one month out. However, three, six, and twelve months later the S&P 500 has been higher almost every time with slightly stronger than normal performance (six months out from the March 1990 occurrence was the only decline).

The increase in bullish sentiment was met by bears falling back below 50% to 46.5%. Mirroring bullish sentiment, that made for the lowest reading since the first week of June.

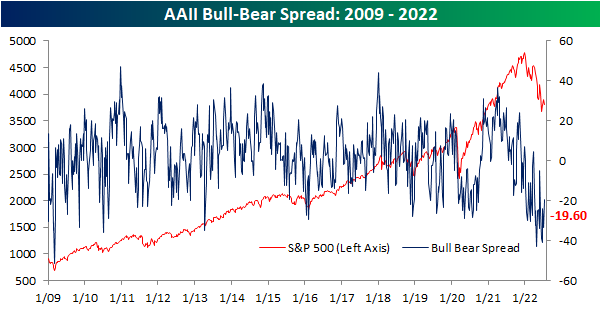

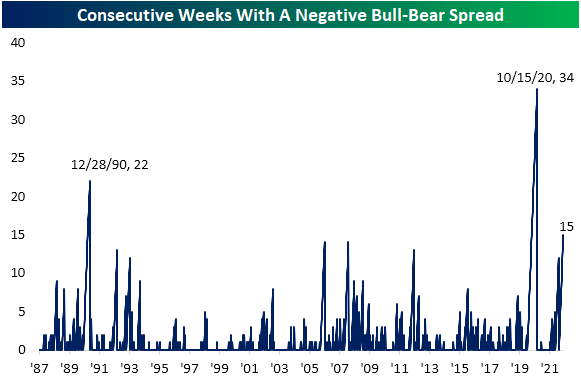

As a result of those moves, the bull-bear spread remains firmly in favor of bears. With the percentage of bearish responses outnumbering bulls by 19.6 points, for the 15th week in a row the bull-bear spread remains negative. That steak has grown to be the third largest on record behind a 22-week streak ending in late 1990 and a 34-week streak ending in October 2020.

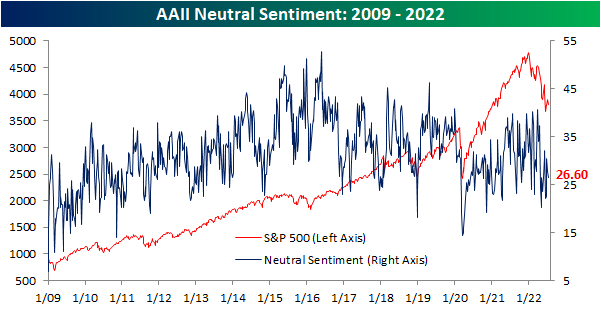

Neutral sentiment has managed to avoid major shifts in sentiment in recent weeks and this week was no exception. This reading fell modestly from 27.8% to 26.6%. That is well within the range of the past couple of years’ readings and is only the lowest since three weeks ago. Click here to learn more about Bespoke’s premium stock market research service.