B.I.G. Tips – Last Two Days of BAD Months

Wire to Wire Selling

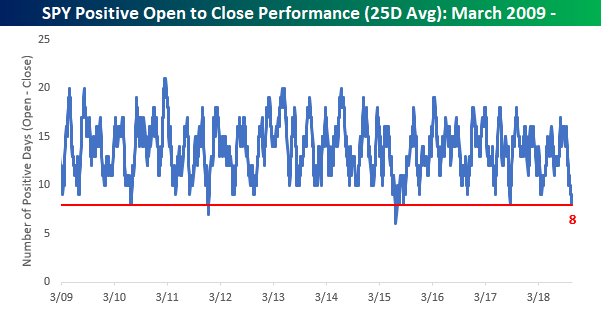

We’ve highlighted this trend a number of times and most recently this morning as well as in last Friday’s Bespoke Report, but the hours from 9:30 AM to 4:00 PM Eastern just haven’t been friendly to the bulls. Over the last 25 trading days, the S&P 500 tracking ETF (SPY) has closed higher than its opening price on just 8 trading days. The chart below shows the historical rolling 25-day total of days where SPY finished a trading day higher than its opening price going back to 2009. During that span, there have only been a handful of periods where we saw similar amounts of selling pressure over a five-week period and only two periods where there was even more relentless selling.

The two periods where the rolling 25-day total fell even lower were in December 2011 and July 2015, while the only two other periods of similar selling pressure were in July 2010 and August 2017. In three of these four prior periods, the S&P 500 was quick to regain its upward trend, but in July 2011, it was another six months before equities finally bottomed and started to rally again.

Clicks to Bricks?

“Rumors of my death have been greatly exaggerated.” — Mark Twain

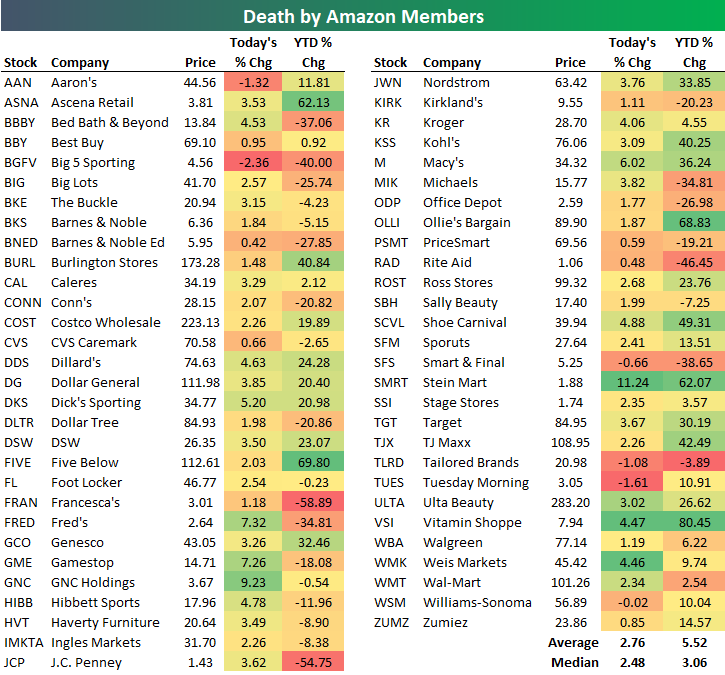

Traditional brick and mortar retailers are soaring today with the average stock in our Death by Amazon index up 2.76% on the day. As shown below, around half of these retailers are up 3-5% on the day with just a handful in the red.

As brick-and-mortar retailers see buying, Amazon.com (AMZN) has seen another wave of selling today with a drop of more than 4.5% as of mid-afternoon. This is on the heels of AMZN’s 7.82% drop on Friday after the company missed revenue estimates and lowered guidance for the second quarter in a row.

The chart for AMZN is really breaking down. After trading in a tight uptrend channel from October 2017 through August 2018, the stock is currently in free-fall in what appears to be a straight path towards $1,500/share. What’s remarkable is that even after the stock’s 23.6% decline from its highs, it’s still up 34% year-to-date!

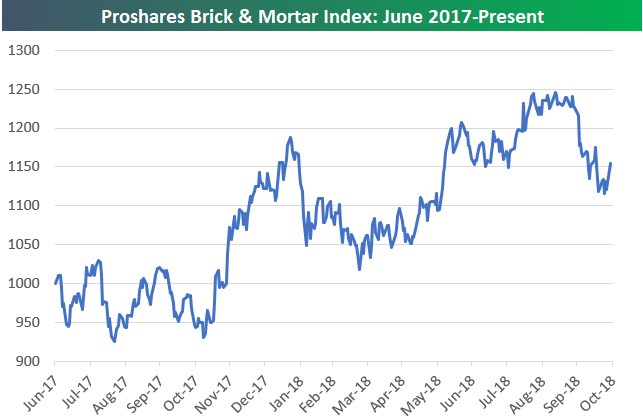

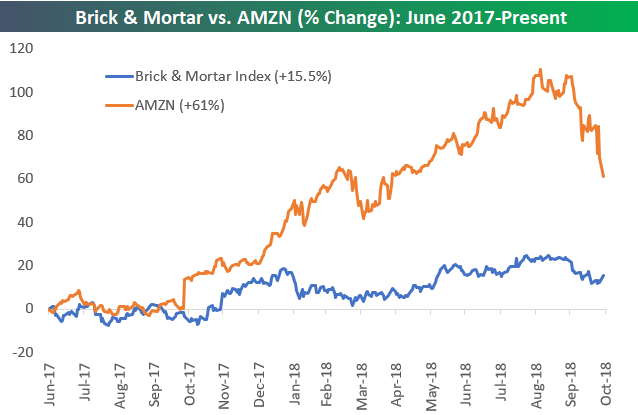

The chart for the Proshares Brick & Mortar index (which was created years after we formed the Death by Amazon index) has fallen a bit from its highs, but it still looks much more constructive than AMZN’s chart at this point, especially with today’s big bounce.

Since the Proshares Brick & Mortar index began back in June 2017, AMZN still holds a commanding lead on it. AMZN is up 61% versus a gain of 15.5% for Brick & Mortar. However, the fact that Brick & Mortar is in the green at all over the last 16 months is the real story. From mid-2015 through mid-2017, traditional retailers most at risk of online were slammed, but they’ve actually been performing quite well recently.

Chart of the Day: Semi Sell-Off Only Semi-Complete?

Bottom Line Fine, Top Line Decline

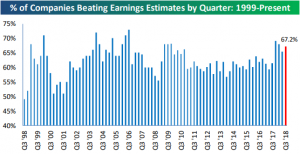

So far this earnings season, 67.2% of companies have beaten bottom-line consensus EPS estimates. As shown in the chart below, earnings beat rates are doing just fine relative to other quarters over the last few years.

While bottom line numbers aren’t raising any red flags this season, revenues certainly appear to have a problem. Only 56% of companies that have reported have beaten top-line revenue estimates. The drop from previous quarters is clear in the chart below. As it stands right now, this season is tracking to be the worst quarter for revenue beat rates since late 2016. There is still time for the revenue beat rate to turn around before mid-November when earnings season ends, but for a market grown accustomed to strong top and bottom line numbers, it is easy to see why investors have been selling early on this season.

As always you can check in on our Interactive Earnings Calendar to see all of the upcoming earnings reports over the next few months.

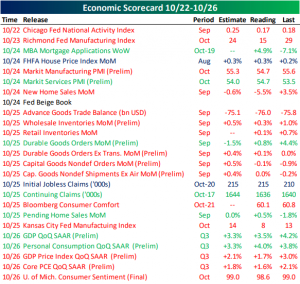

This Week’s Economic Indicators – 10/29/18

There were some significant economic data releases last week including Q3 GDP data, the latest Fed Beige Book, and two more Fed manufacturing activity indexes. The data missed forecasts at basically 2 to 1. There were 15 misses and only 7 beats.

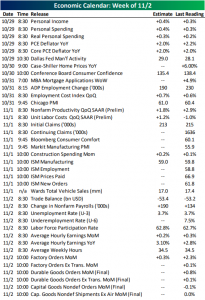

Coming up this week is a much busier slate. This morning personal consumption numbers will release followed by the last input of our Five Fed Manufacturing average with the Dallas Fed’s data. Tuesday will be a lighter day with just Case-Shiller Home Prices and Consumer Confidence. Wednesday is also on the quiet side. Things will pick up at the end of the week with 26 releases over the course of the first two days of November. The most important of these releases will be the Nonfarm Payrolls report on Friday which can swing the Fed into a more hawkish or dovish tone.

Most Important Earnings to Watch This Week

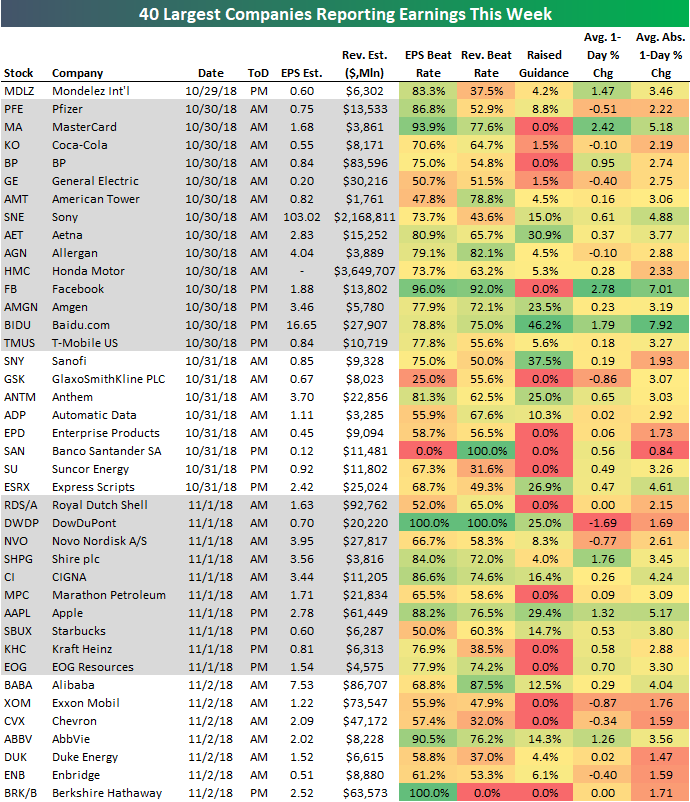

We’re smack dab in the middle of earnings season right now, and below is a list of the 40 largest companies set to report Q3 numbers this week. For each stock, we include a number of key data points that you won’t find in most earnings calendars. Data points like historical earnings and revenue beat rates, the percentage of the time that the company has raised guidance, and the stock’s average one-day price change in reaction to earnings are all included in the table after pulling them from our popular Earnings Screener tool.

After a slow Monday, we get a number of big reports on Tuesday from the likes of MasterCard (MA), Coca-Cola (KO), General Electric (GE), Facebook (FB), and Baidu (BIDU). Wednesday is relatively slow as well, but Thursday makes up for it with Apple’s (AAPL) release after the close. On Friday, we’ll hear from big oil companies Chevron (CVX) and Exxon Mobil (XOM) as well as the “Amazon of China” — Alibaba (BABA).

Of the stocks on the list, MasterCard (MA), Facebook (FB), and Apple (AAPL) have some of the strongest earnings and revenue beat rates, while Baidu (BIDU) has raised guidance the most. In terms of stock price reaction to earnings, Facebook (FB) and MasterCard (MA) show up again with average one-day gains of more than 2% when they have reported earnings throughout their history. Exxon (XOM), Chevron (CVX), General Electric (GE), and Pfizer (PFE) are four stocks that have historically averaged declines on their earnings reaction days.

Stay on top of everything earnings-related with a Bespoke Institutional membership. Start a two-week free trial to gain access now!

Morning Lineup – Big Blue’s Big Buy

US stock futures are higher this morning giving hope to the idea that last week’s sell-off may have run its course. The Nasdaq is leading the way higher as tech stocks outperform on news of IBM’s purchase of Red Hat (RHT) for more than a 50% premium over Friday’s closing price. The $190 cash offer is also $13 above RHT’s all-time high of $177 earlier this year. In international news, politics is dominating the headlines with important election results in Germany and Brazil.

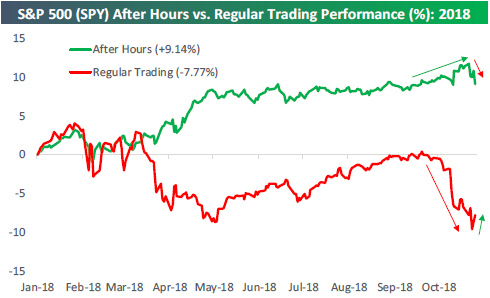

The S&P 500 is set to open over 1% higher this morning, which represents just a continuation of this year’s trend where virtually all of the equity market’s strength has taken place outside of regular trading hours. As highlighted in this week’s Bespoke Report, normally during pullbacks we’ll see a number of big gaps down at the open of trading due to negative news events that occurred either after the prior day’s close or ahead of the open that morning. During this sell-off, though, there has actually been a lack of specific news events that investors can point to and say “that’s the reason everything is down.” These types of sell-offs that can’t be tied to any one specific event are the scariest ones because it suggests that the market knows something that we (as in, we, investors) don’t know.

As shown, below, had you bought SPY at the close every trading day this year and sold it at the next open, you’d still be up 9.14% this year (and another 1% today!). Had you only bought SPY at the open every trading day and sold it at the close, you’d be down 7.77%! Over the last month or so as the market has collapsed, the intraday selling has been extreme, to say the least. Earlier this week we noted that 70% of the time that the market has been open over the last three weeks, it has been down, which is not seen very often. The key test for the market today will be whether it can finally hang on to early strength for a change.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 10/28/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, try a two-week free trial to Bespoke’s premium stock market research!

Science

Redrawing the Map: How the World’s Climate Zones Are Shifting by Nicola Jones (Yale Environment 360)

A review of shifting boundaries for temperate or fertile regions around the world. Some of the shift is driven by our own impact on the broader climate through fossil fuel emissions and other factors but those aren’t the only reasons that arid regions are expanding. [Link]

Toxin or treatment? by Jennifer Couzin-Frankel (Science)

New treatments for extreme allergies are focused on gradually exposing children to very small amounts of allergen, gradually ramping up doses to build a tolerance and cure their allergy. [Link]

History

Joachim Ronneberg: Norwegian who thwarted Nazi nuclear plan dies (BBC)

In 1943 a daring team of saboteurs orchestrated the most under-appreciated mission of the Second World War, blowing up a key Nazi installation that could have allowed progress on a nuclear bomb. Its last member and a long-time advocate of peace has died. [Link]

Weird News

The Unsolved Murder of An Unusual Billionaire (Boomberg)

A penetrating investigation of the death of one of Canada’s richest men, whose philanthropy and idiosyncrasies drew attention but nothing even approaching the ire that could motivate his murder and that of his wife. [Link; soft paywall]

Disney World’s Big Secret: It’s a Favorite Spot to Scatter Family Ashes by Erich Schwartzel (WSJ)

Roughly once per month, guests scatter the ashes of loved ones somewhere in Walt Disney World or Disneyland, in a combination of touching gesture and extremely weird tie-in of consumerism to last rites. [Link; paywall]

Flops

This Bank Lost 50% Of Its Value And Taught Us All A Lesson We Forgot by The Dividend Guy (Seeking Alpha)

We talked about Bank OZK last week, but this write-up is a nice summary with investing lessons in addition to the specific facts related to portfolio write-downs at the bank. [Link]

Auto dealers see slowing sales, sparking fears that a long-expected decline is here by Phil LeBeau (CNBC)

Auto dealers are reporting slowing traffic and declines in business amidst higher interest rates, though declines in volumes are not uniform by any means. [Link]

Business Models

Apple News’s Radical Approach: Humans Over Machines by Jack Nicas (NYT)

A look at how Apple News aggregates its top stories each day, and an even closer look at Apple News’s business model and its ungodly 30% rake. [Link; soft paywall]

Uber’s Secret Restaurant Empire by Kate Krader (Bloomberg)

Because Uber Eats restaurants don’t need a storefront, they’re creating opportunities for businesses within businesses or other unusual firm arrangements. [Link; soft paywall]

This Thermometer Tells Your Temperature, Then Tells Firms Where to Advertise by Sapna Maheshwari (NYT)

Your thermometer may be feeding the fact that you’re sick to companies that want to sell you bleach, one of the major downsides to internet-connected devices. [Link; soft paywall]

Saving money should be easy. Automate it with Trim. (Trim)

This start up is trying to do the tough work of negotiating with companies for you, saving consumers hundreds of dollars on their bills for cable or cell phones. [Link]

Credit

New Type of Credit Score Aims to Widen Pool of Borrowers by Ann Carrns (NYT)

The creator of FICO credit ratings is testing a way to ultimately let more consumers borrow big money. Have they not seen the housing data lately?? [Link; soft paywall]

Crypto

Coinbase and Circle announce the launch of USDC — a Digital Dollar (Coinbase)

Crypto exchange Coinbase and payments company circle are launching a fully-collateralized USD-linked stablecoin tied to the value of the US dollar. [Link]

Autism

500,000 teens with autism will become adults in next 10 years. Where will they work? by Suzanne Garofalo (Houston Chronicle)

Autism diagnosis rates have surged, and there are hundreds of thousands of young people on the spectrum who could benefit from the social and developmental challenges of employment, but training them is challenging and requires a very different approach from employers. At the same time, business could benefit from either direct hiring or public-private partnerships seeking to place folks with autism in either internships or full time employment. [Link]

Intellectual Property

Copyright Office Ruling Issues Sweeping Right to Repair Reforms by Kyle Wiens (iFixIt)

Some background on a ruling by the US patent office that gives consumers the right to jailbreak voice assistant devices, unlock new phones, repair smartphones, home appliances, and home systems, and repair motorized land vehicles including tractors by changing their software. None of this had been permitted explicitly prior to the ruling this week. [Link]

AI

Generating custom photo-realistic faces using AI by Saobo Guan (Insight Data Science)

An interesting tool that can change someone’s facial features using a few specific metrics while not making them look unrealistic. [Link]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

2018 Week 8

Week 7 Results: 11-2, Overall: 55-40 (61.1%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). Let’s see how we do…on to Week 8.

We were 11-2 in week 7, bringing our overall record through 7 weeks to 55-40 (61.1%).

2018 NFL Week 8 Bespoke Picks:

Philadelphia (-3) at Jacksonville (in London): Jacksonville +3

NY Jets at Chicago (-9.5): NY Jets +9.5

Tampa Bay at Cincinnati (-3.5): Tampa Bay +3.5

Seattle at Detroit (-3): Seattle +3

Denver at Kansas City (-9.5): Kansas City -9.5

Washington (-1) at NY Giants: NY Giants +1

Cleveland at Pittsburgh (-8): Cleveland +8

Baltimore (-2.5) at Carolina: Carolina +2.5

Indianapolis (-3) at Oakland: Indianapolis -3

Green Bay at LA Rams (-8): Green Bay +8

San Francisco (-1.5) at Arizona: Arizona +1.5

New Orleans (-1.5) at Minnesota: Minnesota +1.5

New England (-13.5) at Buffalo: New England -13.5

2018 NFL Week 7 Bespoke Results:

Tennessee at LA Chargers (-7): Tennessee +7 Win

New England (-3) at Chicago: Chicago +3 Loss

Buffalo at Indianapolis (-7.5): Indianapolis -7.5 Win

Detroit (-3) at Miami: Miami +3 Loss

Minnesota (-3.5) at NY Jets: Minnesota -3.5 Win

Carolina at Philadelphia (-4.5): Carolina +4.5 Win

Cleveland at Tampa Bay (-3.5): Cleveland +3.5 Win

Houston at Jacksonville (-4): Houston +4 Win

New Orleans at Baltimore (-2.5): New Orleans +2.5 Win

LA Rams (-9.5) at San Francisco: LA Rams -9.5 Win

Dallas at Washington (Even): Washington Even Win

Cincinnati at Kansas City (-6): Kansas City -6 Win

NY Giants at Atlanta (-4): NY Giants +4 Win