US stock futures are higher this morning giving hope to the idea that last week’s sell-off may have run its course. The Nasdaq is leading the way higher as tech stocks outperform on news of IBM’s purchase of Red Hat (RHT) for more than a 50% premium over Friday’s closing price. The $190 cash offer is also $13 above RHT’s all-time high of $177 earlier this year. In international news, politics is dominating the headlines with important election results in Germany and Brazil.

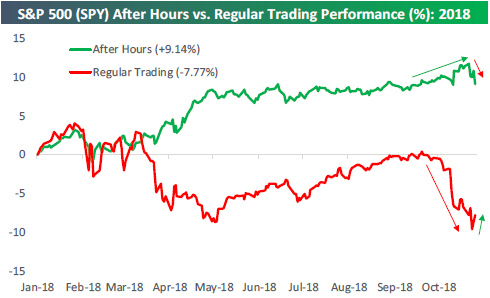

The S&P 500 is set to open over 1% higher this morning, which represents just a continuation of this year’s trend where virtually all of the equity market’s strength has taken place outside of regular trading hours. As highlighted in this week’s Bespoke Report, normally during pullbacks we’ll see a number of big gaps down at the open of trading due to negative news events that occurred either after the prior day’s close or ahead of the open that morning. During this sell-off, though, there has actually been a lack of specific news events that investors can point to and say “that’s the reason everything is down.” These types of sell-offs that can’t be tied to any one specific event are the scariest ones because it suggests that the market knows something that we (as in, we, investors) don’t know.

As shown, below, had you bought SPY at the close every trading day this year and sold it at the next open, you’d still be up 9.14% this year (and another 1% today!). Had you only bought SPY at the open every trading day and sold it at the close, you’d be down 7.77%! Over the last month or so as the market has collapsed, the intraday selling has been extreme, to say the least. Earlier this week we noted that 70% of the time that the market has been open over the last three weeks, it has been down, which is not seen very often. The key test for the market today will be whether it can finally hang on to early strength for a change.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.