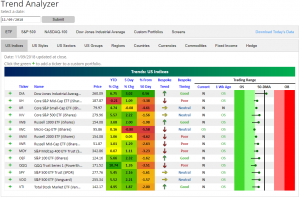

Trend Analyzer – 11/12/18 – Back to Oversold?

The major US Index ETFs that are tracked through our Trend Analyzer tool moved higher within their trading ranges last week. The Dow 30 (DIA) gained enough to push back above its 50-day moving average, but all of the other ETFs highlighted remain below their 50-DMAs. Smallcaps have struggled the most recently and are trading the furthest below their 50-DMAs.

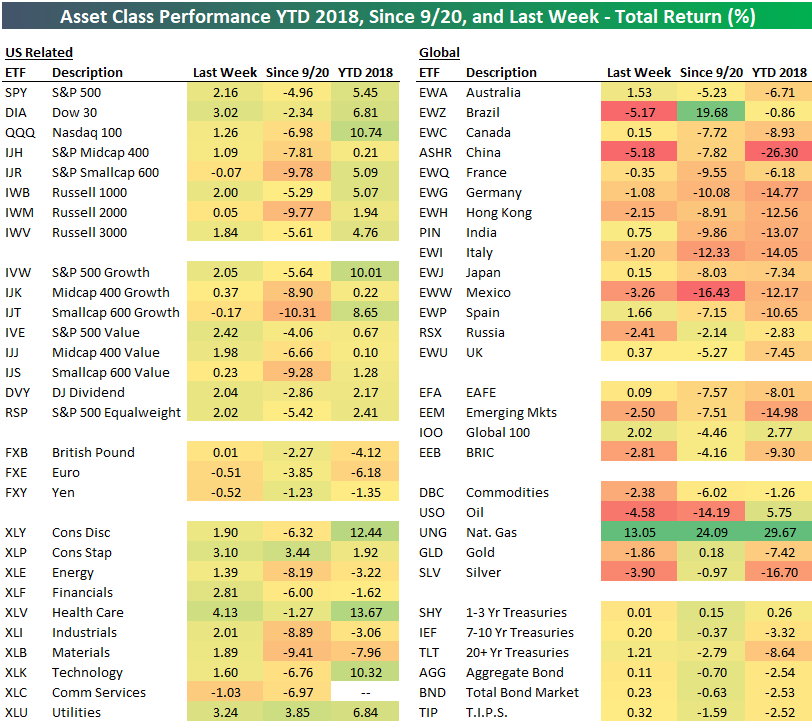

Bespoke’s Asset Class Performance Matrix

As we enter another trading week, below is a snapshot of our asset class performance matrix. For each ETF shown, we highlight its performance last week, since the 9/20 peak for the S&P 500, and year-to-date so far in 2018.

The S&P 500 (SPY) ended up gaining 2.16% last week, while the Dow (DIA) gained 3.02% and the Nasdaq 100 (QQQ) gained 1.26%. Smallcaps were essentially flat, while Health Care (XLV) outperformed every other sector with a gain of 4.13%. Communication Services (XLC) was the only sector down last week with a drop of 1.03%.

Outside of the US, Brazil (EWZ) and China (ASHR) both fell 5%+ last week, while other countries like Hong Kong (EWH), Mexico (EWW), Russia (RSX), and Italy (EWI) were all down 1%+. Australia (EWA) and Spain (EWP) both gained 1%+.

Commodities fell sharply last week as well with the exception of natural gas (UNG), which spiked by 13%.

Bespoke Morning Lineup: 11/12/18

As if the stock market being open on a bond market holiday isn’t bad enough, pre-opening futures are making bulls feel even worse as all three major averages are set to open lower on the day. Futures aren’t down by a large amount, but they are getting progressively worse as the morning goes on. One catalyst for the weakness is a profit warning from iPhone supplier Lumentom (LITE), which cited a decline in orders from “one of our largest Industrial and Consumer customers” as the reason for the shortfall. Outside of that, though, there is little data on the schedule and the bond market is closed for Veterans Day, so don’t expect much in the way of major news to come.

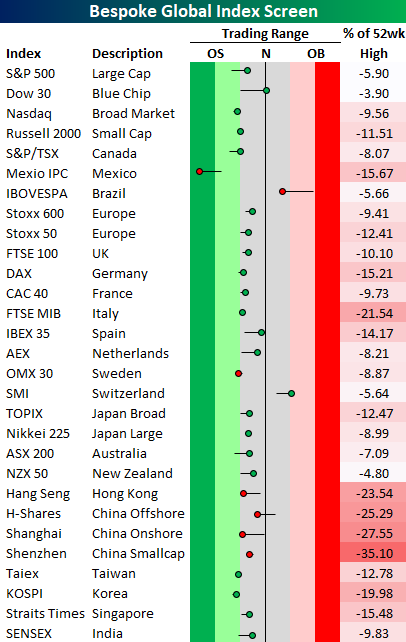

Although higher on the week, US equities finished Friday with a thud leaving the S&P 500 well below its 50-day moving average and down just under 6% from its recent highs. While equities remain in a bit of a funk, they have plenty of company. As shown in the graphic below, of the 29 major global indices highlighted in our Global Index screen, all but two (Brazil and Switzerland) are below their 50-day moving average, and the average distance from recent 52-week highs is over 13%. It may be bad here, but it could be worse. Like the US, most indices aren’t quite oversold, but they are also below their 50-DMAs, so it’s a little bit of a holding pattern in search of a catalyst.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 11/11/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, try a two-week free trial to Bespoke’s premium stock market research!

First off, our week 10 picks.

Voting

Why Does It Take So Long To County Ballots? (Arizona Secretary of State)

Given vote tabulations are still under way in a number of states, four days after election night, this explanation of what takes Arizona specifically so long to count is very helpful. [Link]

An 82-year-old Texas woman voted for the first time. Then she died. by Lindsey Bever (WaPo)

The heartwarming story of a North Texas woman who managed to make it to the polls for the first time in her life just days before she passed away. [Link; soft paywall]

How Fox News Called the 2018 Midterms Before Rivals by Brian Steinberg (Variety)

Fox News got way ahead of the rest of the field in calling that the House would be won by Democrats on Tuesday night; here’s a the story of that early call. [Link]

Politics

Mike Bloomberg and Tom Steyer become kingmakers for Democrats as both billionaires mull a 2020 run by Brian Schwartz (CNBC)

Billionaire former New York mayor Mike Bloomberg saw 21 of the 24 House candidates his PAC supported win on Tuesday, while Steyer helped flip at least 12 races with his support. [Link]

Policy

Did Scott Walker And Donald Trump Deal Away The Wisconsin Governor’s Race To Foxconn? By Dan Kaufman (The New Yorker)

This piece was published a few days ahead of the midterm elections and race for governor in Wisconsin, but it was prescient as Walker lost his re-election bid at least in part thanks to the catastrophic boondoggle Foxconn’s new factory is turning into. A cautionary tale about the race to the bottom attracting large employers. [Link]

Their Soybeans Piling Up, Farmers Hope Trade War Ends Before Beans Rot by Binyamin Appelbaum (NYT)

It’s worth pointing out that soybeans can be stored for years without rotting, so the headline to this story is a bit excessive, but the general gist of pain in the farm economy exacerbated by tariffs is noteworthy. [Link; soft paywall]

Finance

Why ‘Free Trading’ on Robinhood Isn’t Really Free by Alexander Osipovich and Lisa Beilfuss (WSJ)

By receiving a rebate for directing trades to specific venues, Robinhood makes it possible to execute trades commission free, but that creates hidden costs for customers which aren’t immediately clear. [Link]

Spicy Distributions by Jamie Catherwood (Medium)

One of the best dividends ever: mace, pepper, and nutmeg handed out to investors in the Dutch East India company when it couldn’t come up with cash. [Link]

3 Things to Know About Factor Investing, an Increasingly Popular Way to Invest by Evie Liu (Barron’s)

Passive investors have started to shift invested dollars towards factors, which seek to generate active outperformance coupled with passive costs. [Link; paywall]

Asia

Where to Find Treasury Buyers? Not Asia by Daniel Kruger (WSJ)

Investors in Asia are much less interested in US Treasury debt than they have been previously, with foreigners buying Treasury debt at half the pace they did last year worldwide despite a huge uptick in issuance. [Link; paywall]

Once an Optimist on U.S.-China Relations, Henry Paulson Delivers a Sobering Message by Greg Ip (WSJ)

On Wednesday in Singapore, Paulson warned that “a long winter” could be brewing between the US and China, despite a long career aimed at bolstering engagement between the two countries. [Link; paywall]

China Telecom’s Internet Traffic Misdirection by Doug Madory (Internet Intel)

Large amounts of internet traffic (including US-US traffic) have been filtering through China Telecom, in a possible (but not definitive) effort to intercept traffic; the more speculative Naval War College paper (link; 11 page PDF is also worth a read). [Link]

Tech Troubles

Facebook Portal Non-Review: Why I Didn’t Put Facebook’s Camera in My Home by Joanna Stern (WSJ)

When even technology reporters are skeptical about the idea of letting you into their home to review your products, you may have a public relations problem. [Link; paywall]

Instagram Can’t Hide Behind Facebook Anymore by Scott Greer (Medium)

While the larger Facebook brand has been hit by privacy concerns, Instagram has been bulletproof, but the parent company’s concerns may trickle down along with the massive ad load. [Link]

The Tech Backlash Just Hit San Francisco. Where Next? by Nitasha Tiku (Wired)

A review of the current tug-of-war between tech and politics, especially popular politics, after the passage of Prop C (which taxes revenue of roughly 400 companies in order to double San Francisco’s homeless services budget). [Link]

Amazon Said No to Cactus, Yes to Data in Hunt for New Office by Olivia Carville and Spencer Soper (Bloomberg)

Instead of bestowing a brand new headquarters on a single city and becoming a lynchpin of the local economy, Amazon split the difference between either end of the Acela Corridor in Washington, DC and New York City. [Link; soft paywall, auto-playing video]

Justice

Dubai police training on flying motorbikes ahead of planned 2020 launch (Sky News)

Ever wanted to get into a high speed chase in three, rather than a boring old two, dimensions? Head to Dubai, where cops will start flying hoverbikes in 2020. [Link]

About (Caselaw Access Project)

CAP is trying to publish every piece of American law from 1658 to 2018, machine-readable and full of metadata. [Link]

Brexit

You Do the Math: Can May Get Her Brexit Deal Through Parliament? by Robert Hutton (Bloomberg)

In order to confirm the possible Brexit deal currently being negotiated UK PM Theresa May she’ll have to fight for roughly 85 votes which currently look very hard to win. [Link; soft paywall, auto-playing video]

Information

The Power of Explanation by nifteynei (Foolproof Ink)

A review of systems of information and how they help us think about the world, as well as how they can help reveal other truths. [Link]

Meet the Press: Survey Evidence on Financial Journalists As Information Intermediaries by Andrew C. Call, Scott A. Emett, Eldar Maksymov, and Nathan Y. Sharp (SSRN)

A large study of financial markets reporters, which shows incentives to produce original information, largely informed by sell-side analysts, and further incentives for accurate, timely, and informative reporting while also having incentives for quid pro quo with sources at companies. [Link]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

2018 Week 10

Week 9 Results: 6-6, Overall: 68-52 (56.7%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). Let’s see how we do…on to Week 10. (Lines as of 8:45 PM ET on 11/10/18.)

We were 6-6 in week 9, bringing our overall record through 9 weeks to 68-52 (56.7%).

2018 NFL Week 10 Bespoke Picks:

Buffalo at NY Jets (-7): Buffalo +7

Atlanta (-6) at Cleveland: Cleveland +6

New Orleans (-5.5) at Cincinnati: Cincinnati +5.5

Washington at Tampa Bay (-3): Washington +3

New England (-6.5) at Tennessee: New England -6.5

Miami at Green Bay (-10): Green Bay -10

Jacksonville at Indianapolis (-3): Jacksonville +3

Detroit at Chicago (-7): Detroit +7

Arizona at Kansas City (-16): Arizona +16

LA Chargers (-10) at Oakland: LA Chargers -10

Seattle at LA Rams (-9.5): Seattle +9.5

Dallas at Philadelphia (-7): Dallas +7

NY Giants at San Francisco (-3): NY Giants +3

2018 NFL Week 9 Bespoke Results:

Chicago (-10) at Buffalo: Buffalo +10 (Loss)

Kansas City (-8) at Cleveland: Kansas City -8 (Win)

NY Jets at Miami (-3): NY Jets +3 (Loss)

Detroit at Minnesota (-5): Detroit +5 (Loss)

Atlanta at Washington (-2): Atlanta +2 (Win)

Tampa Bay at Carolina (-6.5): Tampa Bay +6.5 (Loss)

Pittsburgh at Baltimore (-2.5): Pittsburgh +2.5 (Win)

Houston at Denver (-1): Houston +1 (Win)

LA Chargers at Seattle (Even): LA Chargers (Even) (Win)

LA Rams (-2) at New Orleans: New Orleans +2 (Win)

Green Bay at New England (-5.5): Green Bay +5.5 (Loss)

Tennessee at Dallas (-5): Dallas -5 (Loss)

The Closer: End of Week Charts — 11/9/18

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

The Bespoke Report — Votes Tallied, Markets Rallied

Midterm votes have been (mostly) tallied and Democrats retook the House, while equity markets extended their move off recent lows despite a soft end to the week. Earnings data, the strength of the US dollar, and producer price inflation all feature heavily in this week’s report, along with a full breakdown of midterm results and implications. We also review economic data, year-to-date performance by sector, equity market trends in Europe and emerging markets, the tight US labor market, and collapsing oil prices in this week’s Bespoke Report.

We’ve just published our latest weekly Bespoke Report newsletter, which is available to subscribers across all three of our membership levels. Sign up here to read the report.

To get up to speed on our thoughts regarding the market’s direction going forward, choose any membership option and access this week’s full Bespoke Report newsletter after signing up! You won’t be disappointed. Some of the topics discussed in this week’s report include:

- How Do These Midterms Compare To The Past?

- Why Results Don’t Mean Too Much For Markets Going Forward

- US Stock Market Outlook: End Of The Bull Market Unlikely

- European Equity Drivers Amidst Huge Undeperformance

- Industrial Productions And Exports Sag In The Eurozone

- EM Equity Downside Momentum

- Dollar Nears New Highs, Dollar Rate of Change Starting To Bite

- 10 Year Yields Making New Highs

- Inflation Expectations Ticking Up, Producer Prices Firm For Now

- Companies Concerned About Inflation

- Labor Markets Still Looking Tight

- Investor Sentiment On The Global Economy Worsens

- Auto Sales Slow In China, Mexico, Canada, and Brazil

- Oil Price Collapse, Refining Margins Pummeled

- Earnings Update

- Intraday Versus Overnight Price Action Across Asset Classes

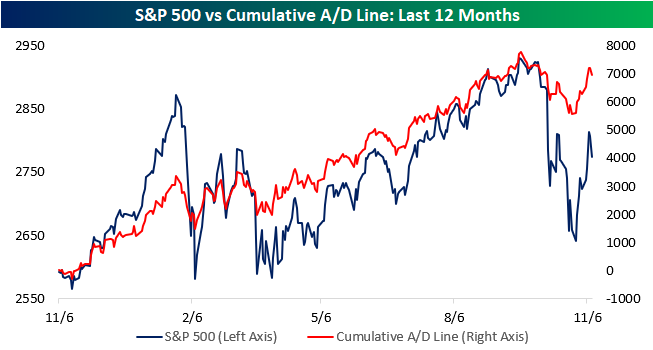

S&P 500 Cumulative A/D Line Tracking Price

We monitor all sorts of different breadth indicators in order to get a feel for how market internals compare to moves in the major market averages, and one of the most widely followed of these indicators is the S&P 500’s cumulative A/D line. The cumulative A/D line is simply a running total of the daily net number of stocks in the S&P 500 rising or falling.

The chart below shows the cumulative A/D line for the S&P 500 (red line) and the index’s price over the last 12 months. At first glance, it looks like the cumulative A/D line has generally been tracking the price of the index during this period, but if you look closely, there are some key periods that are telling. Looking back at the late January through early Spring period, you can see that while equities sold off sharply in the initial leg lower, breadth held up relatively well. In fact, while the first bounce in February stalled out well short of the prior highs, the cumulative A/D line came close to making a new high. More importantly, though, when the S&P 500 tested the February lows, the cumulative A/D line didn’t come close to making a new low, and then the rally that followed, it actually made a new high well before the market. This was a key positive divergence at the time and suggested that the S&P 500 would eventually retake its prior highs.

In the current period leading up to the S&P 500’s peak right up until now, we haven’t seen much in the way of divergences in either direction. Both the price and cumulative A/D line of the S&P 500 made new highs on the same day in September, sold off hard, and then in the ensuing rally retraced right around 60% of the high to low decline. Unfortunately, at this point breadth isn’t saying much good or bad. Looking forward, though, the key things to watch will be how breadth reacts if Friday’s decline is the beginning of a new leg lower, or what happens if the S&P 500 rebounds and makes a run for new highs.

If you are a bull, you’ll want to see breadth remain above the recent low on any retest of the lows in price or a new high in breadth ahead of a new high in price. Bears, on the other hand, will want to see breadth accelerate to the downside on any weakness and lag prices on any upside.

As Average a Year as You Can Get for Gas Prices

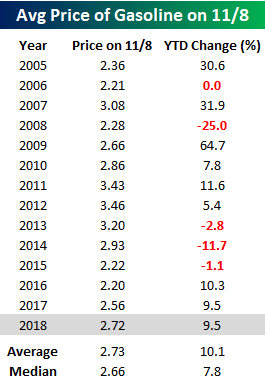

With oil prices crashing over 20% from their recent highs, one welcome effect of the decline is less pain at the pump. According to AAA, the national average price of a gallon of gas is currently $2.72 per gallon which is down 6.5% from just one month ago. The table below lists the average price and YTD change of a gallon of gas as of 11/8 going back to 2005. What’s really amazing about the current price and performance is that it is about as average as it gets. The current price of $2.72 is just 1 cent below the average price of $2.73 as of 11/8 going back to 2005, and the YTD change of 9.5% is within one percentage point of the average 10.1% YTD change.

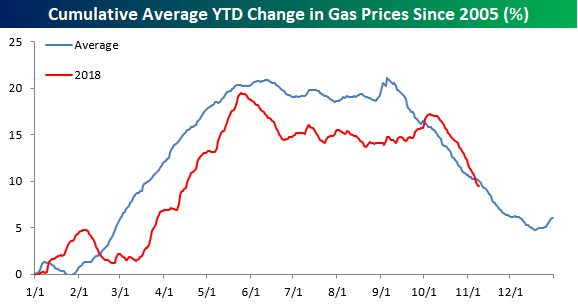

Gas prices have followed their typical seasonal movement throughout the year pretty perfectly in 2018. The chart below compares the YTD percentage change in gas prices this year to a composite of the YTD change in prices for all years since 2005. As you can see, the pattern this year has been extremely similar to the historical pattern.

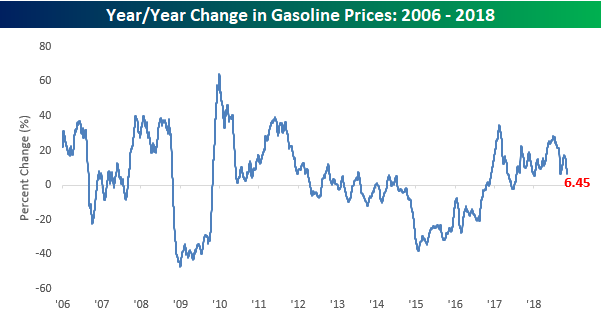

When looking at gas prices, a good way to think about things is how do prices this year compare to where they were at this same time last year? Along those lines, the chart below shows the y/y change in gas prices since 2006. At current levels, the average price of a gallon of gas is up 6.5% from the same point last year. While prices are higher, we would note that the y/y rate of change is right near its lowest level in a year, and if recent trends continue, that y/y rate of change is likely to keep drifting lower.

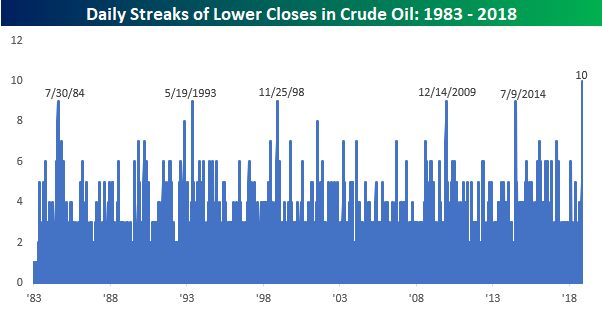

Morning Lineup – Record Streak in Oil

Equity futures and commodities were weak heading into the 8:30 PPI report and picked up steam to the downside after a much stronger than expected PPI report for the month of October (0.6% vs 0.2%). In fact, it was the strongest report relative to expectations since the initial release of the January 2017 report last February.

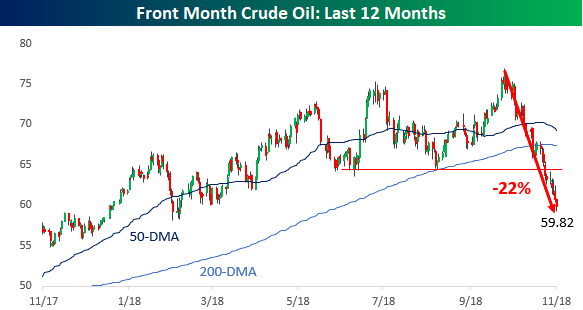

As mentioned above, WTI crude is trading below $60 today and headed deeper into bear market territory with a decline of 22% from the recent peak. As the chart below illustrates, it’s been practically a straight drop lower for crude oil. Recent trading, in fact, has been so one-sided that crude is on pace for its 10th straight day of declines. That’s the longest streak of consecutive declines, not in the last five, ten, or twenty years, but at least 35 years! Going back to 1983, there has never been a streak of more than 9 straight days where crude oil traded down on the day. While increased supplies are putting downward pressure on prices, is this the type of chart you see when the economy is overheating?

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.