As if the stock market being open on a bond market holiday isn’t bad enough, pre-opening futures are making bulls feel even worse as all three major averages are set to open lower on the day. Futures aren’t down by a large amount, but they are getting progressively worse as the morning goes on. One catalyst for the weakness is a profit warning from iPhone supplier Lumentom (LITE), which cited a decline in orders from “one of our largest Industrial and Consumer customers” as the reason for the shortfall. Outside of that, though, there is little data on the schedule and the bond market is closed for Veterans Day, so don’t expect much in the way of major news to come.

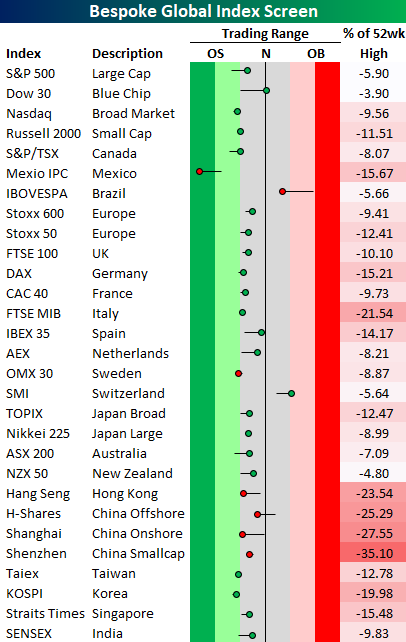

Although higher on the week, US equities finished Friday with a thud leaving the S&P 500 well below its 50-day moving average and down just under 6% from its recent highs. While equities remain in a bit of a funk, they have plenty of company. As shown in the graphic below, of the 29 major global indices highlighted in our Global Index screen, all but two (Brazil and Switzerland) are below their 50-day moving average, and the average distance from recent 52-week highs is over 13%. It may be bad here, but it could be worse. Like the US, most indices aren’t quite oversold, but they are also below their 50-DMAs, so it’s a little bit of a holding pattern in search of a catalyst.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.