Those Chicago Guys: Chi PMI Rocks Despite Weaker Regional Surveys

After weak manufacturing sentiment was reported by the Kansas City and Richmond Fed surveys over the past week, our tracking of the five different manufacturing indices suggested that ISM PMI was likely to come in much weaker than the 59.3 reported in November. The Chicago PMI released this morning had a very different message. As shown, it forecasts an ISM PMI only very slightly lower MoM. Of course, the Chicago PMI has lagged other surveys in recent months, as shown in the chart below. Still, it seems clear that the impact of stock market declines on manufacturing sentiment isn’t universal. The current reading for the Chicago PMI index is actually higher than 95% of readings since 1990, and higher than all but two months from the peak of the mid-2000s cycle.

Morning Lineup – Three in a Row?

It wasn’t looking that way early yesterday afternoon, but with two positive days in the books and futures pointing to a higher open today, the S&P 500 could have its first three-day winning streak since the end of November. The fact that asset allocators are being forced to buy equities to get their portfolios back into balance with their benchmark weightings could add further fuel to the fire. After all, we saw the same trend play out in the last few days of October and November as well. Then again, nothing is guaranteed in this market lately, and the difference between a big up day or down day is simply the timing of when the last buy or sell program of the day hits, sending stocks careening in one direction or the other.

Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and commentary.

Bespoke Morning Lineup – 12/28/18

Yesterday’s reversal which followed a big up gain the day before certainly has helped to provide a boost to sentiment, but as we mentioned in yesterday’s commentary, while the type of action we have seen in the last couple of days has ultimately led to better than average returns over the following year, in the short-term, there was usually more downside.

Take yesterday’s reversal in the Nasdaq. After trading down over 3% intraday, the late-day rally in the Nasdaq to finish in positive territory was just the 20th time since 1985 that the index was down at least 3% intraday and finished in positive territory. Of the 19 prior occurrences, 18 of them occurred either between 2000 and 2002 or in 2008. Chasing those rallies didn’t turn out particularly well.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

B.I.G. Tips – Confidence Shaky

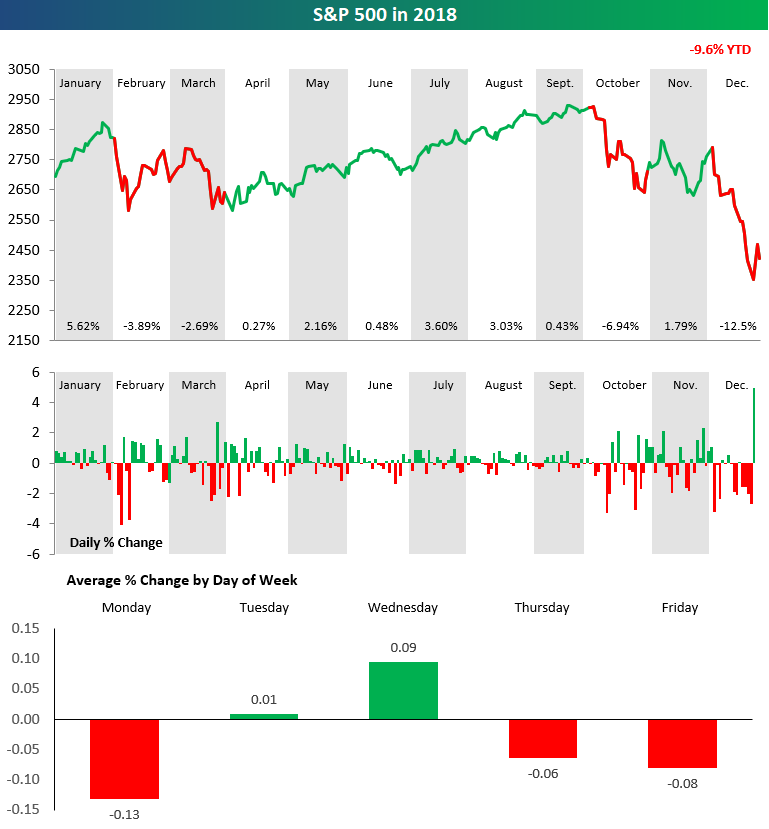

S&P 500 US Stock Market Snapshot — 2018

Below is a snapshot of the S&P 500’s performance in 2018. After a huge gain of 5.62% in January, the index stumbled in February and March before setting out on a six-month winning streak from April through September. Once October rolled around, though, you-know-what hit the fan. A 7% drop in October provided a jolt to the senses for investors. In November, the S&P saw a small gain, but then the bottom completely fell out in December with a 12.5% decline (thus far).

In the second chart below, we show the daily percentage change for the S&P throughout the year. You can clearly see that during the two downturns (in Feb/Mar and Oct-Dec), volatility picked up significantly, while it was smooth sailing during the spring and summer.

Finally, in the third chart, we show the S&P’s average change by weekday this year. As shown, Monday has been the worst day of the week this year with an average decline of 0.13%. Friday has been the second worst, while Thursday ranks third worst. Tuesday and Wednesday both averaged gains. Be sure to read our 2019 Bespoke Report for a more in-depth recap of the year and our expectations on the year ahead.

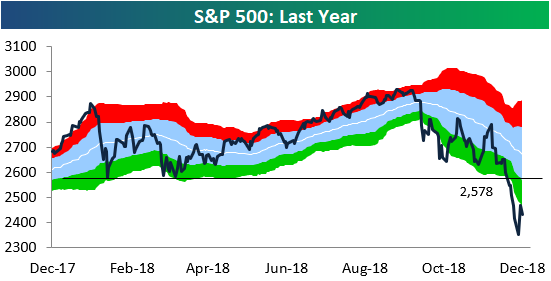

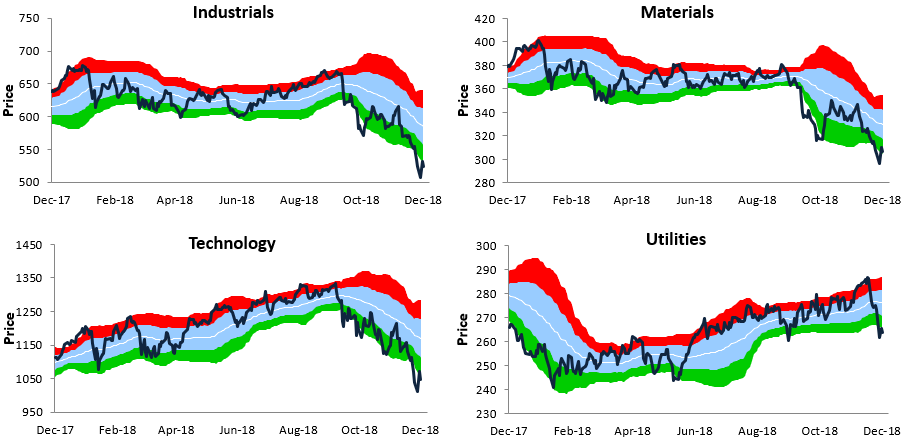

S&P 500 Sector Trading Range Charts

Below is an updated look at our trading range charts for the S&P 500 and ten sectors. It’s not a pretty sight.

In each chart, the red shading represents overbought territory, while the green shading represents oversold territory. Investors certainly don’t have to worry about overbought levels right now! In fact, the S&P and all ten sectors are trading roughly 2 or more standard deviations below their 50-day moving averages even after yesterday’s big rally.

For the S&P 500, you shouldn’t even start to get excited until the index can re-take 2,578, which we point out in the first chart below. That level is now a big resistance point. Unfortunately, it will take a rally of 7.2% to get there! The bulls certainly have their work cut out for them.

B.I.G. Tips – Above 50-DMAs

Chart of the Day: Play Defense With P&G

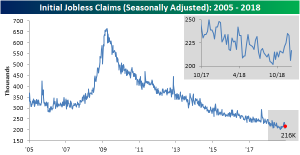

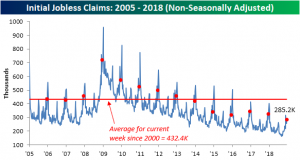

No Surprises From Jobless Claims

This week’s initial jobless claims data came in without any surprises and little changed after some large movements only a few weeks ago. Claims came in this week at a seasonally adjusted 216K, down 1k from a revised 217K for the prior week. This is right in line with consensus economist expectations for 216K. This week marks the 64th week in a row that claims have come in at or below 250K. The indicator is also closing in on 200 weeks in a row of coming in below 300K. This week is the 199th week below that level. It should have no problem hitting that milestone this time next week.

With the elevated levels from late November now rolling off, the four-week moving average ticked down this week to 218K from 222K last week.

Claims came in higher on a non-seasonally adjusted basis at 285.2K; roughly a 30K increase from last week. This increase is not of any concern seeing as it is entirely in line with seasonal patterns. This week’s non-seasonally adjusted print of 285.2k is the lowest for this specific week of the year since at least 2000.

Bespoke Stock Scores — 12/27/18

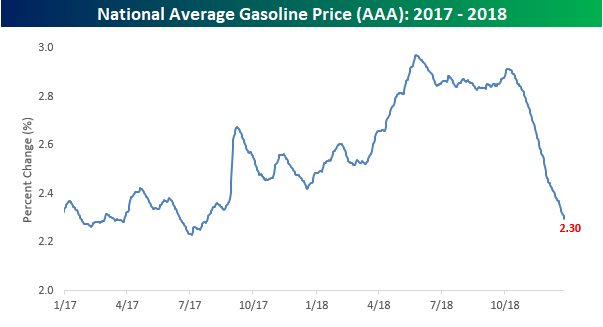

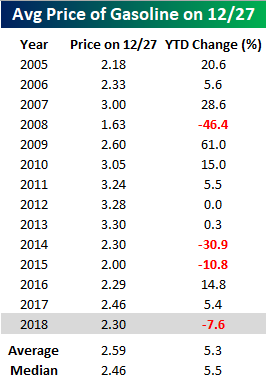

Gas Prices Plummet

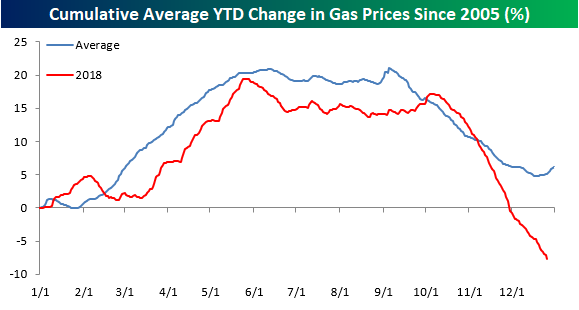

While falling stock prices have provided a beat down to the values of Americans’ 401ks in the fourth quarter of 2018, falling prices at the pump have added a little bit of a cushion to their wallets. Through yesterday, the national average price of a gallon of gas was just under $2.30, which is down from just under $3 a gallon back around Memorial Day weekend. That’s the lowest national average price since the Summer of 2017.

With the recent decline, gas prices are poised to decline over 7% for the year, which would make this just the fourth year since 2005 that prices were down. The other three years were 2008 (-46.4%), 2014 (-30.9%), and 2015 (-10.8%). Compared to the average annual increase of over 5%, consumers got off easy this year!

While gas prices have been considerably weaker than normal in 2018, the weakness was primarily a fourth-quarter story. The chart below compares average prices this year to a composite of all prior years since 2005. Right up until the start of October, prices were tracking their average very closely, and while the late year weakness came right on cue this year, its intensity was much stronger than normal as crude oil prices plummeted. While market watchers figured stock market weakness would crimp holiday sales, the positive impact of gas prices seems to have more than counteracted that negative pull.