Mar 11, 2020

It’s been a tumultuous month for the Dow Jones Industrial Average since its closing high on February 12th as the index has declined over 5,500 points or 18.8%. Below we have provided a breakdown of which stocks have had the largest and smallest impact on the decline. For each stock listed below, we have included its performance since the close on 2/12 in both percentage and price terms. The reason, of course, for including price changes is because the index is price-weighted. Therefore, a stock with a low share price but a large percentage decline may not have as large an impact on a stock with a larger share price but a smaller percentage decline. Because of this, the table is sorted by stocks with the largest weighting in the index (highest share price) at the top.

Remember the days when Boeing (BA) was the most heavily weighted stock in the DJIA? Well, it was only a month ago! Back on 2/12 when the DJIA last peaked, BA was the most heavily weighted stock. But after a decline of nearly 40% since then, it’s now the fourth most heavily weighted behind UnitedHealth (UNH), Apple (AAPL), and Home Depot (HD). Since 2/12, BA’s decline has accounted for almost 17% of the DJIA’s decline, or more than 900 points! Not only has BA been the largest contributor to the DJIA’s downside, but the next closest drag on the index (Goldman Sachs – GS) has had less than half the impact to the downside. Other relatively large contributors to the downside have been Apple (AAPL), United Technologies (UTX), and JPMorgan Chase (JPM). On the upside, there hasn’t been much. Since the DJIA’s closing high on 2/12, the only stock that is up is Walmart (WMT), but with a gain of 0.1%, its impact on the DJIA’s level has been less than a point. I guess we’ll take what we can get! Start a two-week free trial to Bespoke Institutional to access our full range of research and interactive tools.

Feb 19, 2020

For more than a year now, Boeing (BA) has been plagued by the 737 MAX crisis which has weighed on shares of the plane manufacturer with it now currently down nearly 20% from when the initial groundings took place on March 10th of last year. Despite this, while underperforming the broader market due to the 737 issues, the stock is actually still up just over 5% since the start of 2019.

Even though BA has lagged, it is still the highest-priced of the 30 stocks in the price-weighted Dow Jones Industrial Average. Currently trading around $338.50, the only stocks in the index holding a candle to BA are Apple (AAPL) and UnitedHealth (UNH), which also trade north of $300 per share. That means these stocks have the highest weighting in the index and therefore have a much larger impact than other stocks on the Dow’s performance.

With BA’s issues, a number of people have pondered the what-ifs for the Dow had the company not had the issues with the 737. Would we have already broken out the Dow 30K hats were it not for BA? In the chart below, we show the actual performance of the DJIA and have overlaid the performance of an ‘alternate Dow’ showing its performance if BA had not been in the index since the start of 2019. We used the start of 2019 instead of the actual date of the groundings as it is a little less arbitrary. By our calculations, while we would be a bit closer, even if BA wasn’t in the index since the start of 2019, we wouldn’t quite be at Dow 30K yet. As shown, our alternate Dow would be almost 1% or 266 points higher if Boeing was not included in the index since the start of 2019.

While BA has been a drag on the DJIA since last March, it also provided a big boost to the index in early 2018 before the 737 issues hit the stock. In fact, at the start of March 2017, BA was up over 36% YTD and the spread between the Dow’s performance with and without BA was around 700 points in the other direction as it is now!

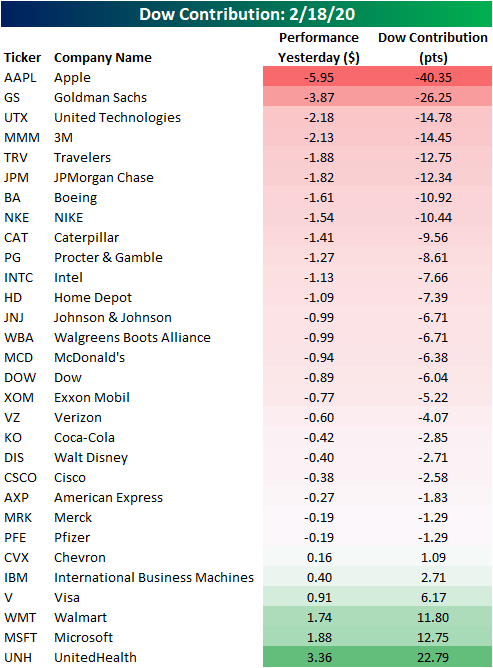

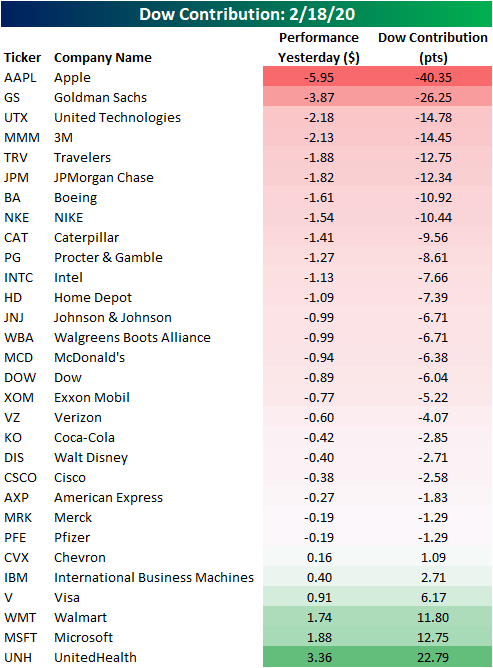

Another example of this dynamic in which high priced stocks have a greater impact on the index was observed on Tuesday when Apple’s (AAPL) stock fell after the company warned that Q1 revenues would be shy of prior guidance due to the coronavirus. The warnings sent shares down over 3% at its intraday lows, but the stock only finished down 1.83%. While there were equivalent or larger declines like Dow (DOW) or Walgreens Boots Alliance (WBA) in Tuesday’s session, AAPL’s declines by far weighed on the index more than any other stock. Of the Dow’s 165.89 point decline, AAPL contributed 40.35 points. Fortunately, UNH helped to mitigate some of those losses as it had a positive impact on the index of +22.79 points. Start a two-week free trial to Bespoke Institutional to access our Closer, full list of interactive tools, and much more.

Dec 16, 2019

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Mar 13, 2019

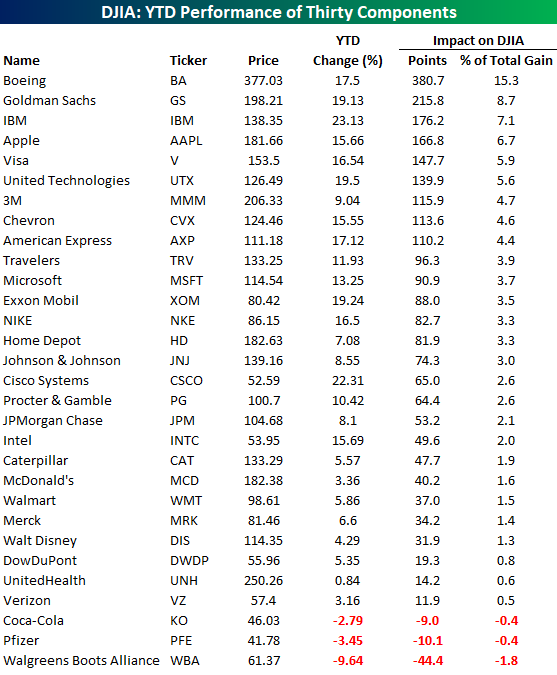

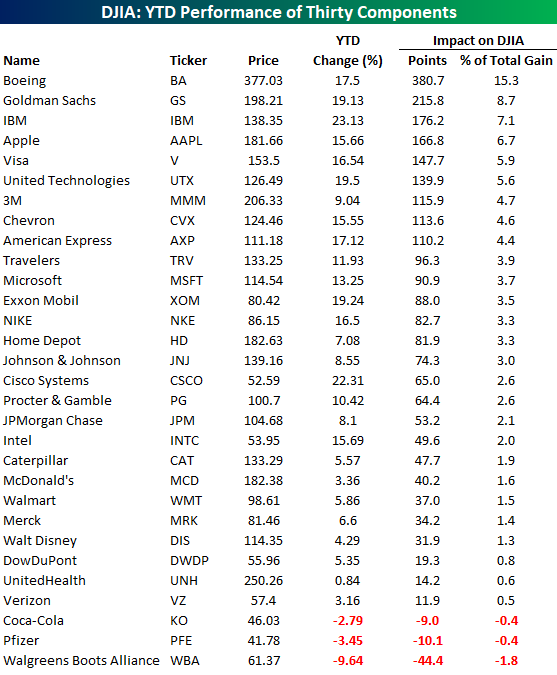

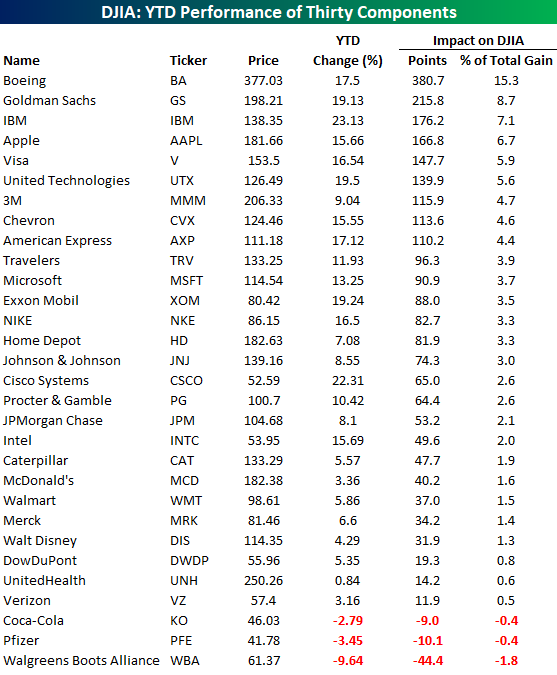

To say it has been a tough couple of days for anyone connected to Boeing (BA) would be an understatement. In terms of the company’s stock, the last two days have seen the first back to back declines of 5%+ in close to a decade (June 2009). As a result of this week’s decline, BA has lost its perch at the top of the DJIA in terms of best performers YTD, now coming in at number six. That being said, the stock is still up over 17% on the year, and because of the DJIA’s unique way of weighting components by their share price rather than market cap, BA has still been the largest contributor to the DJIA’s YTD gains. Even more amazing? It’s still not even close.

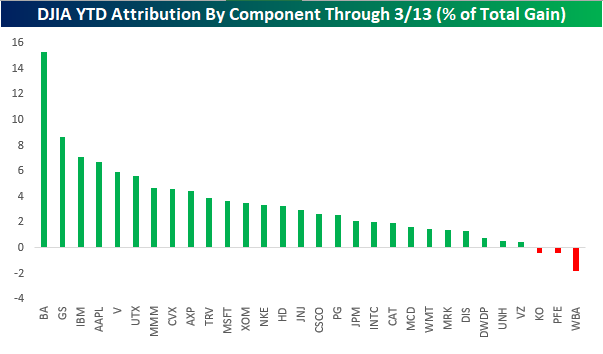

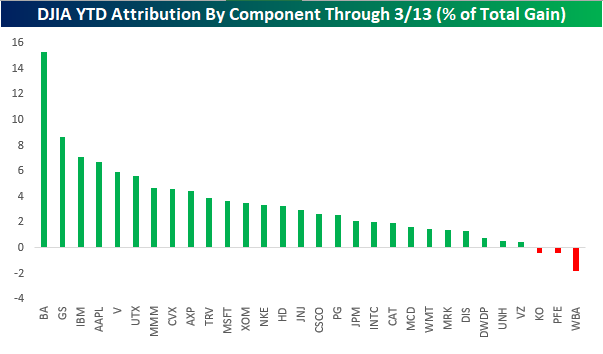

The chart below shows the YTD attribution of each of the DJIA’s 30 components to the index’s total gain YTD. Accounting for still more than 15% of the DJIA’s YTD gain, BA has had nearly twice the YTD impact on the DJIA so far this year as the next closest stock (Goldman Sachs – +8.7%). The fact that BA still has had such an outsized impact on the DJIA even after its big decline this week shows not only how extreme its move higher to kick off the year was, but also how odd it is to weight a stock index by an arbitrary measure like each component’s share price. One final note — it was somewhat ironic to see that the one stock that has had the most negative impact on the DJIA YTD is also the index’s newest component: Walgreen’s Boots Alliance (WBA) added last June.

Mar 12, 2019

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we provide a recap of today’s rejection of the Brexit deal and the continued turbulence in Boeing (BA). Next, we break down the S&P 500 industries distance from their 52-week highs. We note that the three industries closest to their 52-week highs are all Utilities. On the other hand, we look at Metals and Mining which currently sits the furthest from its highs, though, we show why the industry is not necessarily unattractive. We finish with a look at today’s release of NFIB Small Business Optimism and CPI.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!