Mar 12, 2019

Today’s Morning Lineup is brought to you by the letter “B” as Brexit and Boeing are the major drivers of headlines this morning. Regarding Brexit, while things looked promising ahead of today’s vote after last night’s deal between PM May and EU President Juncker, reality has set in overnight, and the prospects of the deal passing a vote in Parliament aren’t looking entirely promising at this point. Meanwhile, Australia and Singapore joined the growing list of countries grounding flights of the 737 Max, and just now Malaysia announced the same. While the FAA deemed the 737 Max airworthy overnight, it also sent a mixed message mandating Boeing to push certain changes to the 737’s flight control system by ‘no later’ than April.

In economic news, the NFIB Small Business Optimism Survey increased versus January but came in lighter than expected, while CPI was right in line with forecasts at both the headline and core levels.

Please click the link below to read today’s Bespoke Morning Lineup.

Bespoke Morning Lineup – 3/12/19

Software has been a key group for the market over the last year, and yesterday’s rally took the S&P 500 Software group back within 1% of an all-time high. On Friday, the index bounced right at what was former resistance levels which was an encouraging sign. This group is dominated by Microsoft (MSFT) but is also comprised of Oracle (ORCL) Adobe (ADBE), and salesforce.com (CRM). Watch this group in the coming days to see if it can lead the broader market higher.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Mar 11, 2019

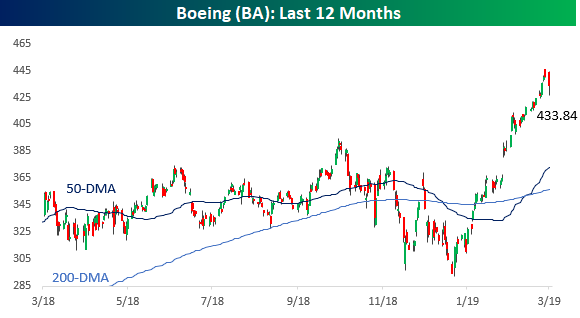

As great as things were for the DJIA when Boeing (BA), with its high price and weighting in the index, was on the way up, today the DJIA is feeling the pain of what happens when a high priced (weighted) stock in the index declines. With shares of Boeing set to open down over 10% this morning, its decline is set to have a negative impact of around 250 points (or 1%) at the open. Outside of BA, US equities are generally indicated higher following the lead of both positive starts to the week in Asia and Europe.

Please click the link below to read today’s Bespoke Morning Lineup.

Bespoke Morning Lineup – 3/11/19

As mentioned in today’s Morning Lineup, both China and European equities bounced this morning right at short term support from a brief late February consolidation. The S&P 500, meanwhile, finished off last week below its 200-DMA for the second straight day. While in a bit of a tougher hole than its international counterparts, the S&P 500 is also right at a potential support area from a period of consolidation in early February. Friday’s rebound off the early lows was a positive sign, and if equities can follow through today, it might just be enough to finally break out of the congestion area around the 2,800 level.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Mar 4, 2019

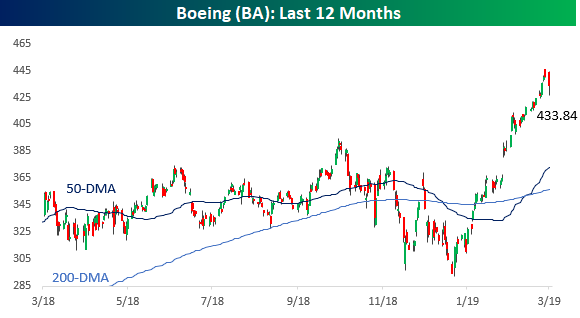

To say that Boeing shares have had a good start to 2019 would be like calling the 747 a puddle jumper. With a gain of over 50% from its late 2018 low and a YTD gain of over 36% through last Friday’s close, it has been one of the strongest starts to a year (through 3/1) for a current DJIA component in decades.

Making its move even more noteworthy is that with a share price of more than $400 and the fact that the Dow is a price-weighted index where each component’s weighting in the index is based on its share price, BA’s rally has had a ‘jumbo’ impact on the overall index. BA’s weight in the DJIA currently stands at 11.5%, while its weighting in the S&P 500, which is a market cap weighted index, is less than 1%. As a result, through Friday’s close the DJIA had gained 2,807 points so far in 2019 and BA accounted for 812 of them. That works out to 29% of the DJIA’s entire gain this year! Without BA’s rally, the DJIA would only be up about 8% this year versus its 11.5% gain through Friday. Behind BA, the next closest stock in terms of its impact on the DJIA this year has been Goldman Sachs (GS) which has accounted for 216 points of the DJIA’s YTD gain (7.7%).

As mentioned above, BA’s strong start to the year is one of the best for current DJIA components going back to 1995. Of the 30 current members, there have been just four prior occurrences where a stock rallied more than 30% YTD through the close on 3/1, and two of those were in the stock of Apple (1998 & 2005) well before it was even added to the DJIA. The only two other occurrences were Intel’s (INTC) 41% gain in 2000 just after it was added in late 1999 and then Microsoft (MSFT) the next year in 2001 when it rallied 37%. The key difference between those two occurrences and Boeing, though, is that because of their share prices at the time, they didn’t have nearly the positive impact on the overall index when they rallied.

While bulls have nothing to complain about regarding BA’s big rally this year, the impact of high price stocks on the DJIA cuts both ways. Barring any future stock splits, even just a 10% correction in shares of BA would clip the DJIA by more than 250 points.

Jan 30, 2019

Big earnings from Apple (AAPL) last night after the close and Boeing (BA) this morning have pushed the Dow futures sharply higher. While the gains aren’t as large in the S&P 500 and Nasdaq, they are also both pointing in the right direction for bulls. Now, all we have to do is get through this afternoon’s rate decision from the FOMC and the subsequent press conference. The number one wish from the bulls for Fed Chair Powell? Stick to the script and end the record streak of declines on FOMC days since he became the Chair! Read today’s Bespoke Morning Lineup for more on what’s driving the markets this morning.

Bespoke Morning Lineup – 1/30/19

Even as the equity market has recovered in January, the percentage of consumers who are bullish on the market declined to 30.9%, which is the lowest reading since July 2016. Even more extreme, the percentage of consumers who are negative on stock prices increased to 38.6%, which is the highest reading since December 2012!

Like a lot of sentiment measures, this reading from the Consumer Confidence report also tends to be contrarian in nature. The last time the spread was this skewed to the bearish side was in February 2016, and if you don’t remember, that was right around the lows of the 2015/2016 market correction.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.