Mar 21, 2022

Shares of Boeing (BA) are down nearly 4% in today’s session as of this writing on news of a fatal crash of one of the company’s 737 jets in China. Any plane crash which results in fatalities is obviously a tragedy, and our hearts go out to all the victims and their families. While it’s hard to pivot to the market-related implications of these types of events, investors in Boeing and related companies are obviously interested in how these types of events, whether due to mechanical or other issues, will impact their investments. Today’s crash involved one of the company’s 737-800 planes and not the 737-MAX (the variant which was involved in crashes in 2018 and 2019). At this point, there are no details regarding the cause of the crash, but details will likely be forthcoming in the days and weeks ahead.

In the chart below, we show the chart of BA since the start of 2000 and include red dots indicating each time that there has been a fatal incident involving a 737 (any generation of the plane). There have been a total of three dozen incidents internationally prior to today, and historically, these past events have not had any consistent impact on the performance of BA stock.

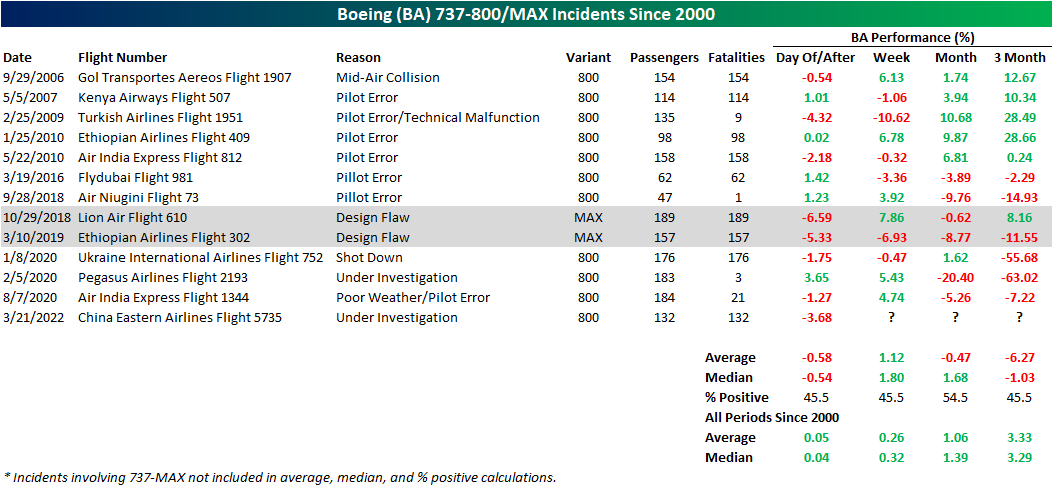

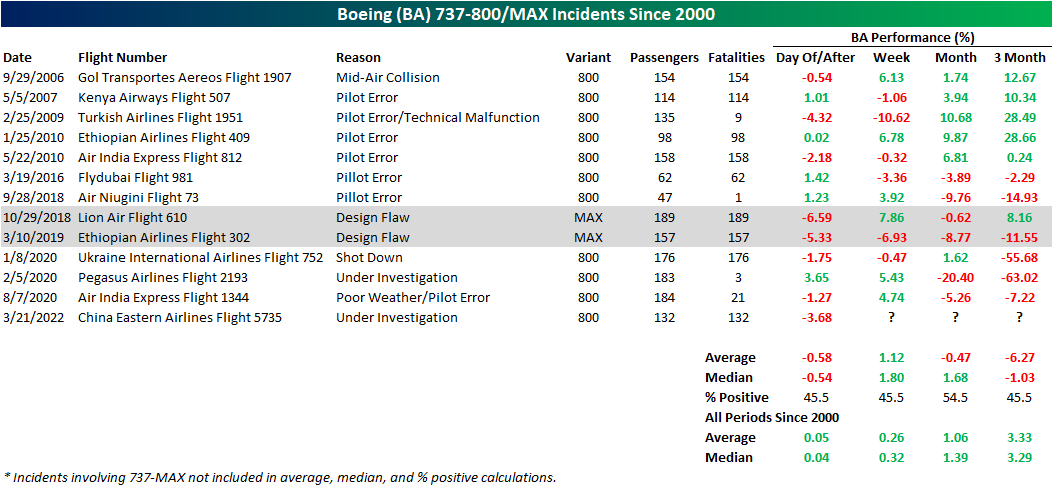

That being said, the immediate reaction in today’s session is set to rank pretty high up on the list of worst declines after a crash involving a 737. Below we show the daily percent change of BA in the first session after a 737 variant had a fatal incident. As might be expected, the 737-MAX crashes in 2018 and 2019 were the two worst single-day declines for the stock of these instances with drops of 6.59% and 5.33%, respectively. The Turkish Airlines Flight 1951 crash in 2009 ranks as the next largest drop of 4.32%. In general, since the 737 MAX issues surfaced, on news of any fatal incident involving 737s, investors have been quick to sell first and ask questions later.

The 737 Next Generation (abbreviated 737NG) which includes the 737-600, 700, 800, and 900 variants is the generation that Boeing produced from 1996 and ceased assembly of in 2019 as the company’s production switched to the 737 MAX. Of the 737NG generation, the 800 variant (the variant involved in today’s crash) is the most common. Given this, in the table below, we show those fatal incidents involving the 800 series since 2000 as well as the two MAX crashes given their importance in recent years. This was the seventh fatal incident involving this plane without any survivors.

Boeing’s stock has mostly seen a negative reaction in response to these incidents and even though the next week has typically seen the stock rebound, performance over the next one and three months, especially since the issues with the MAX began, have tended to be followed by declines. Of course, each of these incidents has a fair degree of nuance to each one. For example, there are numerous reasons as to why these crashes occurred, and the majority had nothing to do with an inherent flaw in the BA aircraft. Whereas the 737-MAX problems were accredited to a design flaw, and thus are more directly negative for Boeing, many of the other incidents were on account of the flight crew or pilot error. Additionally, there is also the issue of poor timing like the early 2020 instances which lined up with the COVID crash. In other words, the weak performance following these crashes had more to do with factors outside of the crashes themselves. Again, any crash, whatever the cause, is a tragedy, but from a market perspective, it’s important to differentiate between the cause behind them. Click here to view Bespoke’s premium membership options.

Jun 8, 2020

In recent weeks, we have highlighted how there has been rotation away from the best performing stocks in the first leg of the rally off of the 3/23 low while the stocks that had been the laggards have become the new market must-haves. Boeing (BA) is a prime example of this trend. Heavily connected to the decimated airline industry, BA only rose 15.04% in the first part of the rally from 3/23 to the recent 5/13 low. While not the worst stock in the index during that time, it lagged the Dow Jones Industrial Average which rose over 25%. But along with others in the industrial sector like the airlines, recent performance has been much more impressive with BA up 69.08% from 5/13 through Friday’s close. Today alone the stock is up another 11% after rallying 11.47% on Friday and 12.95% last Wednesday! That leaves it at its highest level since early March.

With such large gains in a little less than a month for a stock with one of the higher stock prices in the index, BA has added roughly 575 points to the price weighted Dow. That has by far been the largest contributor to the Dow since 5/13 accounting for roughly 14.9% of the overall move and nearly double the next biggest contributor, Goldman Sachs (GS), which added 316.32 points to the Dow, or roughly 8.19% of the overall move since 5/13. Other major contributors from the Financials sector like Travelers (TRV), American Express (AXP), and JPMorgan Chase (JPM) are some more examples of the recent rotation into stocks that lagged in the immediate wake of the bear market. Click here to view Bespoke’s premium membership options for our best research available.

Mar 25, 2020

Turnaround Tuesday has carried into hump day with the Dow up well over 5% again today as of this writing. As we mentioned in an earlier post, that means the Dow is on track for its first back-to-back up days for the first time since early February. Remarkably, even with only two consecutive up days, the index is closing in on exiting a bear market. For that to happen, the Dow would need to close above the 22,310.32 level which is 20% off of the bear market closing low (Monday’s close at 18,591.93). At today’s high, the Dow was less than 300 points or 1.32% from that level.

As for the individual stocks contributing to the rally, Boeing (BA) deserves a lot of thanks. The stock has been hit very hard during the sell-off. Whereas the stock has traded in the mid-$300 for much of the past two years and up to mid-February, as of late last week BA had fallen below $100. That massive drop in price means that day to day movements in the stock would have a lesser impact on the level of the price-weighted Dow. In spite of this, BA has contributed over 400 points to the Dow’s rally in the past two days alone! That is much more than any other stock in the index with the next biggest contributor being UnitedHealth (UNH) who’s 335.44 point contribution comes as its share price is currently around $100 more than BA. BA’s contribution is also almost 200 points more than those of McDonald’s (MCD), Visa (V), and Apple (AAPL). Of all 30 Dow stocks, there is only one that is down over the past couple of days, subtracting from the index’s rally: Walmart (WMT). Given WMT has held up fairly well recently, its performance is yet another example of investors’ focus on the more beaten down names that we have noted earlier today and in last night’s Closer. Start a two-week free trial to Bespoke Institutional to access Closer and full range of research and interactive tools.

Mar 12, 2020

Yesterday, we showed a table of how much each component of the DJIA has impacted the index since its peak on 2/12. Given the continued decline in the market today, we wanted to provide an update showing the stocks with the largest negative impact on the index over the last month. Of the roughly 7,700 points that the DJIA has dropped over the last month, Boeing’s 53% has accounted for more than 1,250 of those points. Cut in half in just a month! Boeing was close to a $200 billion company in February, and now it’s less than $100 billion!

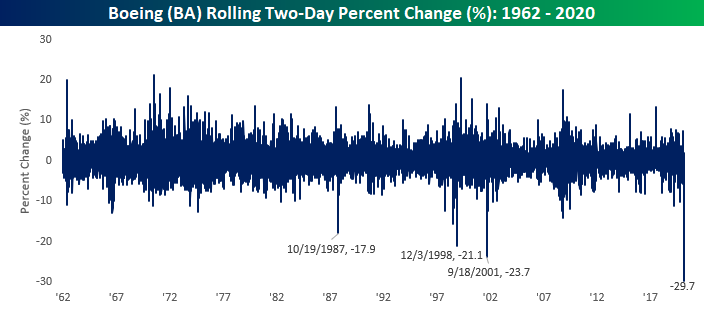

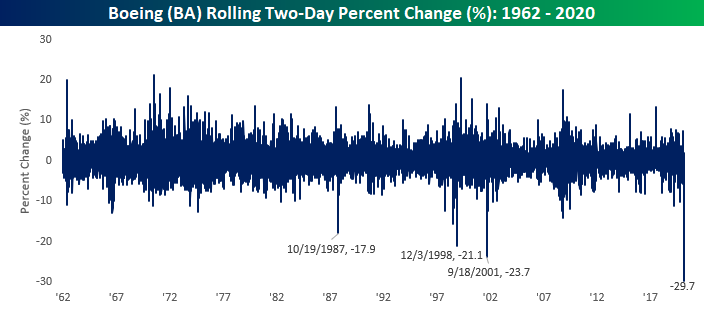

The decline in Boeing (BA) over the last two days is literally unlike anything the stock has ever seen before. The chart below shows the rolling two-day performance for BA going all the way back to 1962. If this morning’s levels remain in place (and prices have been moving wildly), it will be the largest two-day decline (-29.7%) for the stock on record. While the stock saw declines of over 20% in 1998 and after 9/11, those declines were nowhere close to what we are seeing today. Looking to make some sort of sense of all these crazy market moves? Start a two-week free trial to Bespoke Institutional for full access to all of our research and tools.