Bespoke’s Morning Lineup – 8/4/22 – Fading into the Open

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Far and away the best prize that life offers is the chance to work hard at work worth doing.” – Theodore Roosevelt

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures were higher earlier but have given up much of their gains as we head into the open. Initial Jobless Claims were just released and came in at 260K which is just 1K shy of a post-COVID high. Continuing Jobless Claims saw a larger increase hitting the highest levels since April. In the UK, the BoE raised rates by 50 bps which was the largest hike since 1995. What’s ironic about the move is that at the same time the central bank raised rates by the most in more than 25 years, it also warned of a long recession.

Today’s Morning Lineup discusses earnings and market news out of Europe and the Americas, rate hikes in Brazil and the UK, a look at LNG markets on news of a sooner-than-expected restart at the Freeport terminal, and much more.

Yesterday was the 58th time in 2022 that the Nasdaq experienced a one-day rally or decline of 2% or more, and it is only August 4th! To put that in perspective, we’re just under 150 trading days into the year, so at the current pace, we’re seeing an average of about two 2%+ daily moves per week! How does that stack up relative to history? Going back to 1971, even if there aren’t any more 2% moves for the rest of the year, 2022 would rank as the 6th highest number of 2% days in a calendar year in the Nasdaq’s history. That’s just four less than the total for 1999, 25 behind the total for 2008, but well more than 40 below the triple-digit totals seen in 2000, 2001, and 2002. The record for the greatest number of 2% days in a calendar year came in 2000 when the 2% threshold was crossed 134 times or more than once every other day.

2022 already ranks as the sixth highest number of 2% days in a calendar year in the Nasdaq’s history, but when we compare the number of 2% days this year through the end of July to the first seven months of all other years, it ranks as the third most. As shown in the chart below, the only two years that had more 2% daily moves YTD through 7/31 than 2022 (57) were 2000 (84) and 2001 (74). Other years that were close were 2002 (54) and 2009 (51).

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day: Triple Plays Get More Love

The July Respite

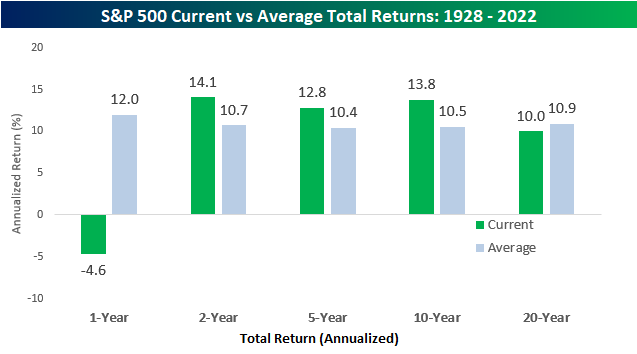

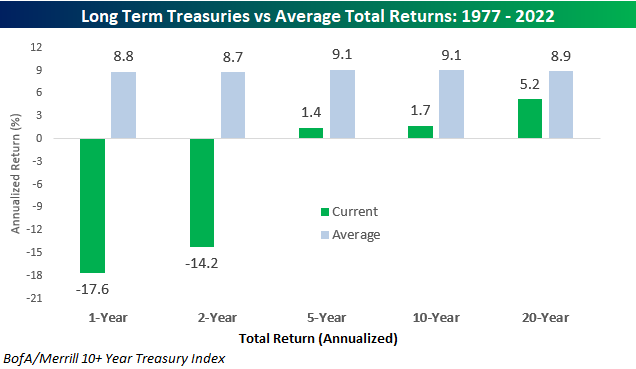

After what had to be one of the worst combined first halves of a year for stocks and bonds on record, July provided a respite as the S&P 500 rallied more than 9% and long-term treasuries, as measured by the BofA/Merrill 10+ Year US Treasury Index, jumped over 3%. Even after those rallies in July, though, trailing 12-month returns for both asset classes remain firmly in negative territory and well below the historical average.

The chart below compares the S&P 500’s annualized total return over the last one, two, five, ten, and twenty years to the historical average for all other periods since 1928. Historically, the S&P 500’s average annual total return has been a gain of 12.0%. With a decline of 4.6% over the last year, the current period ranks in just the 19th percentile relative to all other one-year periods. While one-year returns have been below average, it follows a period of strength for stocks which is evident by the fact that two, five, and ten-year returns are all still at least two full percentage points above their historical averages. Over a 20-year window, however, the S&P 500’s annualized total return of 10.0% is nearly one percentage point below the historical average of 10.9%. The last year has been bad for stocks, but it follows what has been a very good period for investors. Click here to learn more about Bespoke’s premium stock market research service.

The experience of fixed-income investors has been an entirely different story. While bonds, and US Treasuries specifically, are supposed to be considered a safe asset class, over the last year, long-term US Treasuries are down over 17.5%, and the two-year annualized performance is a decline of 14.2%. Yup, that’s a cumulative decline of 26.4%- in Treasuries! Longer-term, the performance of long-term US Treasuries isn’t negative, but with annualized gains of less than 2% over the last five and ten years and just 5.2% over the last twenty years, calling the recent history of investing in this asset class the dark ages, wouldn’t be an understatement.

Big Moves in Treasuries

It’s the way things always work out in the market. Just when everyone starts to think one thing, the complete opposite occurs. It happened in the US Treasury market yesterday when the yield on the 10-year traded down near 2.5% prompting some sell-side firms to suggest a move to 2% was in the cards. 24 hours later, though, yields have reversed higher, and at just under 2.8%, the 10-year yield is now closer to 3% than 2.5%. After starting out the week with a rally of 2.22%, the iShares 20+ Year US Treasury ETF (TLT) pulled back over 2% Tuesday. You may be used to back-to-back 2% moves in the stock market, but they’re much less common in long-term US Treasuries. Before this week, the last time TLT had 2%+ daily moves on consecutive days was all the way back in March 2020 at the depths of the COVID crash, and since TLT was launched in 2002, there have only been 16 other periods where the ETF had back-to-back moves of 2%. Of those, just six went on for a third day, and only two of those (both in March 2020) went on to more than three days. Click here to learn more about Bespoke’s premium stock market research service.

The red dots in the chart below show every time that TLT had a 2%+ daily move on back-to-back days. Of the prior occurrences, the majority all took place during and in the year or two after the Financial Crisis, but besides that, the only other occurrences were in June 2016 (Brexit) and the COVID crash. We probably don’t need to spell it out, but prior back-to-back 2%+ moves in TLT have occurred during periods of short and/or long-term stress in the markets. Click here to learn more about Bespoke’s premium stock market research service.

It isn’t just individual days where Treasuries have experienced volatility lately. TLT’s average daily move over the last 50 trading days has now moved to above 1% (red line), and since its launch in 2002, the only periods where its average daily move was higher was during the Financial Crisis (Q4 2008 through Q4 2009), after the US debt downgrade (Q3 2011 to Q1 2012) and during the COVID crash (Q1 2020). If you were looking for an August slowdown, Treasuries don’t look like they’re ready to chill.

Bespoke’s Morning Lineup – 8/3/22 – Yields on the Move

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Economics is extremely useful as a form of employment for economists.” – John Kenneth Galbraith

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Normally on the first Wednesday of the month, we’d be discussing the release of the ADP Private Payrolls, but that report is still on the DL as economists work on revising its methodology to make it a more accurate gauge of payroll trends in the economy. The only reports on the calendar today are Durable Goods, Factory Orders, and the ISM Services report which will all be released at 10 AM Eastern. It’s been another busy day for earnings, and the results continue to surprise to the upside with EPS and revenue beat rates that are higher than most analysts and strategists would have expected heading into earnings season.

Equity futures are higher this morning, oil is higher as OPEC+ only agreed to a small increase in daily output, and Treasury yields are continuing their steep run higher which began yesterday morning at right around this time. After trading well below 2.6% yesterday, the yield on the 10-year is now pushing 2.8%.

Today’s Morning Lineup discusses earnings and market news out of Europe and the Americas, Pelosi’s visit to Taiwan, a detailed look at PMI and economic data from around the world, and much more.

As oil prices have pulled back in the last couple of months, stocks in the Energy sector have also experienced a hiccup as growth-oriented names have enjoyed some time in the sun. Technology is one sector that has experienced a rebound, and that bounce has shown up in the chart of Energy’s relative strength versus the Technology sector. From the summer of 2020 through late last year, there was a push and pull with lots of noise between the two sectors, but neither one had anything to show for it as they essentially performed in line with each other during that entire period. Beginning in late 2021, though, when the Fed apparently got religion with respect to surging inflation, tech stocks plunged while energy names surged. That run essentially continued uninterrupted right up to mid-June. In the span of under two months, though, Energy has given up 40% of its outperformance versus Technology. Easy come easy go.

Given its outperformance in the years coming out of the Financial Crisis, there’s almost a Pavlovian instinct for investors to look towards the technology sector for outperformance. Over the last two years, though, the sector has essentially generated zero alpha. Comparing the sector’s relative strength to the S&P 500, Technology is barely positive versus August 2020.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

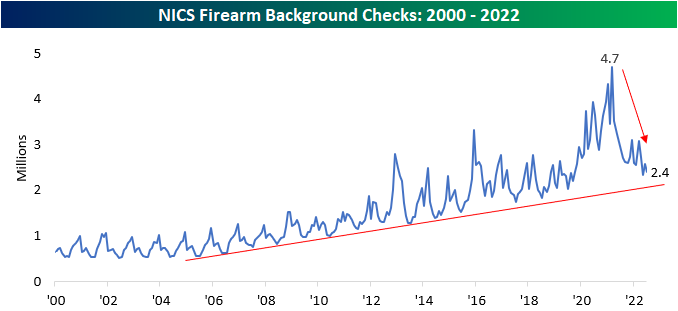

Firearm Background Checks Decline

Although not a widely-utilized indicator, we like to look at the number of firearm background checks conducted by the NICS every month to gauge geopolitical uncertainty and volatility within the US. In uncertain times, firearm background checks tend to increase, as individuals increasingly acquire the means to protect themselves in a worst-case scenario. On the contrary, when times are ‘good’, background checks tend to decline. An additional factor that impacts background checks is the outlook on firearms legislation. When the populous fears that they may not be able to purchase certain firearms in the future, they will step up purchases in the short term to ‘stock up’. At the end of June, the Supreme Court ruled against the state of New York in regards to carry laws, which could help to expand demand for firearms, at least in that part of the country. Click here to learn more about Bespoke’s premium stock market research service.

In the month of July, firearm background checks declined by 6.5% sequentially and by 16.6% year over year continuing a recent trend of sharp declines. While checks are down, it followed a period of surging demand in 2020 as geopolitical unrest ran rampant throughout the US (BLM protests, claims of election fraud, COVID lockdowns, etc.). Nonetheless, background checks have declined by 33.9% on a two-year stack.

However, background checks are still in a longer-term uptrend. At 2.4 million, July’s background checks rank in the 16.2% of all months since NICS began reporting this data in 1998, and outside of late 2019 and into early 2021, there were only a few months that the number of checks was higher. Still, they are down 48.8% from the all-time high in March 2021. This may be because demand was pulled forward, but it could also be due to a more normalized domestic situation.

Through July, the 22.4% YTD decline in background checks in July versus December has actually been smaller than average. Background checks in July are practically always lower than in December, and the only year where that wasn’t the case was in 2020 when the country was gripped by riots in cities nationwide. Going back to 2000, background checks in July were typically more than a third (-33.8%) lower than in December. Click here to learn more about Bespoke’s premium stock market research service.

There are two publicly traded stocks directly exposed to these trends: Sturm Ruger (RGR) and Smith & Wesson (SWBI). The monthly performance of these two stocks tends to be highly correlated to trailing twelve-month NCIS background checks, as this is a clear read into the demand picture for these two companies. Just like background checks in general, both stocks are still in sustained downtrends. Click here to learn more about Bespoke’s premium stock market research service.

Rotating in August

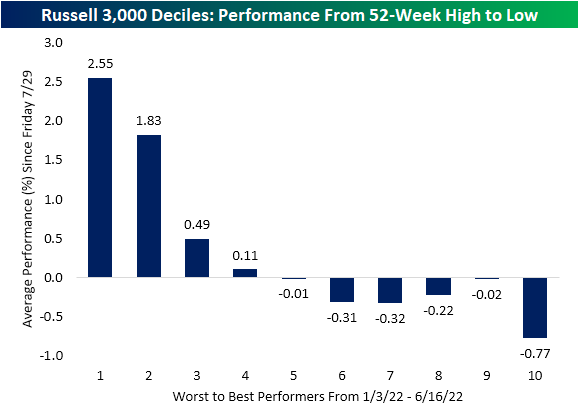

Following the best July of the post-WWII era, equities have been getting off to a slower start in August with the Russell 3,000 experiencing a modest decline yesterday and the index fighting to move into the green as of midday today. Most of the move to start August appears to a degree to be rotational in nature. In the chart below, we show the average performance of deciles of Russell 3,000 stocks grouped by their performance in the month of July. As shown, both the best and worst performers last month have rallied in early August with the deciles of the worst performers seeing slightly larger gains. The losers this month have been in the middle of the performance spectrum as deciles 4 through 7 are each flat to lower over the past couple of sessions.

Equities bottomed in mid-June and have been in rally mode ever since. As for how performance the past couple of days relates to the first half of the year’s declines, again the worst performers have generally been outperforming. However, by this measure, the top performers from the 52-week high just after the New Year through the low in June have continued to fall this week. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Crude Oil Finally Closes Below 200-DMA

Bespoke’s Morning Lineup – 8/2/22 – Oil’s Not Well

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The more you sweat in peace, the less you bleed in war.” – Norman Schwarzkopf

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

With Speaker Pelosi reportedly en route to Taiwan as we type this, markets are on edge this morning as China has threatened military action if the planned trip takes place. Only Chinese authorities know exactly what the response will be, but we would expect more bluster than bite. After a relatively slow day of earnings news yesterday, today will be a busy day, and there have already been a number of important reports this morning from the likes of Caterpillar (CAT), Uber (UBER), and Marriot (MAR) among others. After the close, among others, we’ll hear from AMD, Gilead (GILD), Occidental (OXY), PayPal (PYPL), and Starbucks (SBUX).

Today’s Morning Lineup discusses earnings news out of Europe and the Americas, the rate hike in Australia, a detailed look at other economic data from around the world, and much more.

32 years ago today, Iraq invaded Kuwait, spurring a monumental surge in oil prices. In the first five trading days of August alone, WTI surged more than 35% and nearly doubled in price through the fall as tensions in the region boiled over. There are still more than enough geopolitical issues around the globe today to worry about, but unlike in August 1990, crude oil prices have been moving in the opposite direction.

After briefly trading above $130 per barrel earlier this year, crude oil has declined nearly 30% from its peak to under $95 per barrel, and just yesterday, closed below its 200-DMA for the first time in over six months.

As shown in the chart below, yesterday’s close below the 200-DMA ended what was the 12th longest streak of consecutive closes above the 200-DMA for WTI since the early 1980s. The streak that just ended was the longest since the 269 trading day streak that ended last November. That streak was the third longest on record trailing only the 276 trading day streak that ended in April 2000 and the 330 trading day streak that ended in August 2008.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Market Calendar — August 2022

Please click the image below to view our August 2022 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.