Get Ready for a Reversal of This Trend

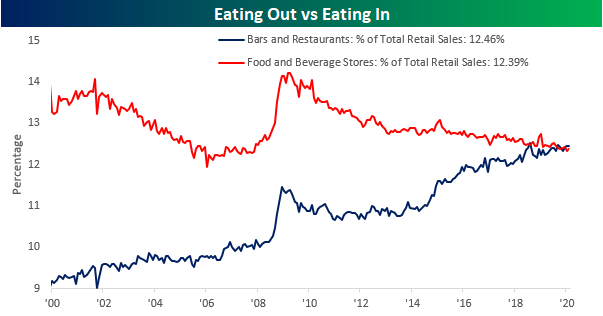

One of the trends we have been highlighting in the monthly retail sales report over the years has been the growing trend of eating out versus eating in. For years we have seen the Bars and Restaurants category of retail sales consistently gaining share at the expense of the Food and Beverage Stores category. Just last month, Bars and Restaurants saw their share of total sales rise to 12.46%, which was just below the record high of 12.47% from October 2018. That total share of sales was also 0.07% greater than the share of Food and Beverage Stores (12.39%) which is also right near record highs.

The run was fun while it lasted. With restaurants all over the country being forced to shut due to fears of the Covid-19 virus, even if American consumers wanted to go out to eat, the only way they can is by ordering takeout. With everybody stuck at home, more Americans will undoubtedly be eating at home in the coming months, and that is going to cause the share of total sales for Bars and Restaurants to come crashing down. The only question is whether other sectors besides Food & Beverage Stores will pick up the slack or if the pie will only get smaller as consumers reign in spending.

The trend of dining out is likely to take a hit in the coming months, but one trend that will only accelerate is ‘clicks’ over ‘bricks’. After overtaking the category of General Merchandise in September 2018, Nonstore retailers have been picking up share at a steady pace ever since. Through February, the current spread in share of 1.3 percentage points is not far from the record seen last September. Again, though, with physical stores all over the country simply closing for an indefinite period in recent days, online is going to become the only option for consumers whether they can leave their homes or not. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Homebuilders Not Worried Yet

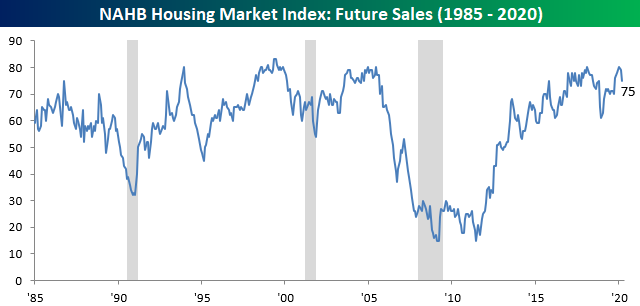

This morning the NAHB released results from their monthly survey of homebuilders. The index showed some weakening in sentiment as it fell to 72 in March from 74 in February. As with many other recent indicators released, that is a fairly modest decline given the current environment and likely would not have captured the full extent of equity market declines and shutdowns to enforce social distancing. Granted, those effects are also not entirely absent either seeing as the NAHB noted half of the responses to the survey came after March 4th.

The headline index fell on lower readings pretty much across the board. Each of the sub-indices with the exception of the Midwest fell in March. Additionally, perhaps the biggest negative shift this month was for future outlook with that index falling 4 points. By comparison, the index for present sales only fell by 2 points. In other words, homebuilders seem to have experienced some slowdown in activity and are anticipating for it to get worse.

Again the index for the Midwest in March was a bit of an outlier. It was the only region to rise in March, but that is after it was a bit weaker than other regions recently. In fact, the rise to 67 also still leaves the index for the Midwest 6 points off of the December high of 73. Overall, as with the headline index, across different regions, sentiment has shifted lower although this is likely just the tip of the iceberg.

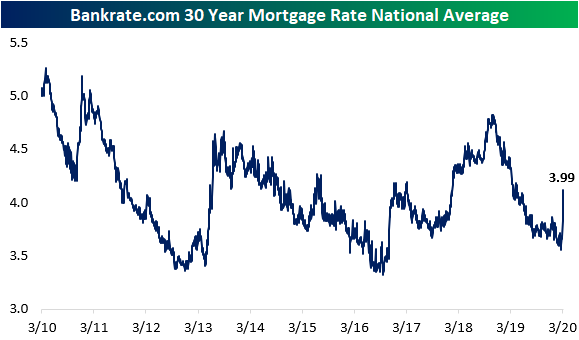

One factor at play that that may be balancing itself out is mortgage rates. The national average for a 30 year fixed rate mortgage was sitting at the low end of the past few years’ range earlier this month. In the past week, though, mortgage rates have moved sharply higher and are now at similar levels to where they were last year. In other words, while low rates may have temporarily bolstered homebuilder confidence earlier this month, given the move in the past week, those effects have likely eased. Turning to next month’s survey, there is likely to be a large downward shift lower in homebuilder sentiment, especially if rates continue to drift higher. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

GDP Forecasts Relative to History

Yesterday, Goldman Sachs’ lead economist cut the bank’s GDP forecasts for the first half down to 0.0% in Q1 and a decline of 5.0% for the second quarter. Based on how things are moving and in the direction they are going, 5% may sound like an optimistic scenario. While all sorts of numbers have been thrown around regarding just about everything lately, we wanted to help put in perspective just how severe a quarterly decline in GDP of 5% really is.

The chart below shows US quarterly GDP going back to 1950. First of all, negative quarters for GDP have been uncommon for the US economy over time. In the 291 quarters since 1950, the US economy has only contracted in 41 (14%) of those quarters. 5% declines, however, are incredibly rare. SInce 1950, there have only been six prior quarters where GDP declined by 5% or more with the most recent being back in December 2008.

Obviously, the circumstances surrounding each contraction in GDP is different, but prior quarters where there was such a large shock to the system were typically not ‘one and done’ events. In fact, all six of the prior quarterly contractions of 5% or more were either immediately preceded or followed by another quarter of negative growth averaging a decline of over 2%. Start a two-week free trial to Bespoke Institutional to access our full suite of research and interactive tools.

Bespoke’s Morning Lineup – 3/17/20 – Market Could Use a Little Luck

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

When the only thing you have left to fall back on is a little luck, things are bad out there. Futures were limit up at one point overnight, but those gains have faded as we near the close. Conditions in the credit markets aren’t faring as well, though. Despite all of the central bank actions over the last several days, credit spreads continue to widen.

Retail Sales were just released and came in much weaker than expected (-0.5% vs +0.2%), so despite all that shopping at Costco and stores like that as consumers stocked up on supplies, the overall total was weak.

Read today’s Bespoke Morning Lineup for a discussion of overnight moves in the credit markets, the latest stimulus plans coming out of Washington, and the trading in Asia and Europe.

Normally, when the equity market reaches extreme overbought or oversold levels it doesn’t stay that way for long. That hasn’t been the case recently, though, as the S&P 500 has been consistently at extreme oversold levels for a number of days now. There’s only so much time that the market or investors can stand these types of oversold readings.

The Closer – Washington Wakes Up – 3/16/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the historic session as DC makes plans to provide stimulus to the American public. We then show what the drop in GDP could look like as a result of Covid-19. Next, we the massive move in the S&P 500 and dollar as well as the normalization in Treasury markets. We finish with a look at just how bad breadth has been in the past couple of weeks.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

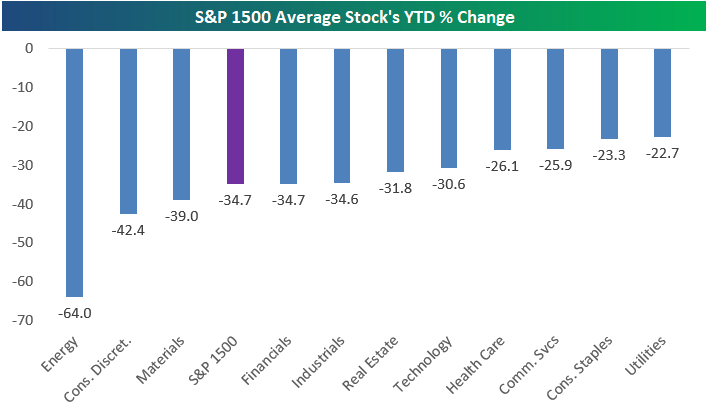

S&P 1500 Sector Declines

The average S&P 1500 stock is now down more than 25% month-to-date, 35% year-to-date, and 44.5% from its 52-week high. Below is a look at the carnage across S&P 1500 sectors. Start a two-week free trial to Bespoke Institutional to access our full suite of research and interactive tools.

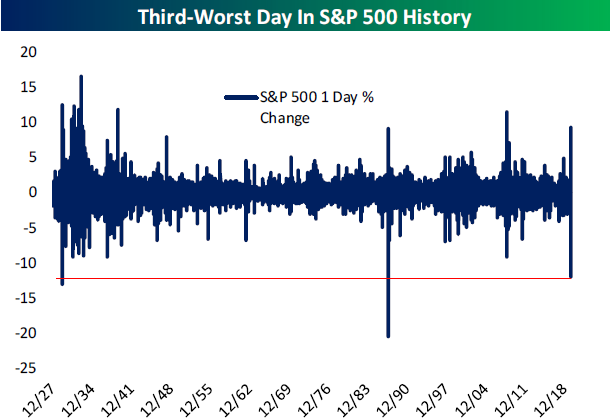

S&P 500 Drawdowns From Record Highs

With US equities down another 10% today, the S&P 500 is moving increasingly closer to reaching the threshold of a 30% decline. As of this afternoon, the S&P 500 is down 26.7% from its record high less than one month ago. The chart below shows S&P 500 drawdowns from record closing highs since the start of 2000. The last twenty years have really been a period to behold for US equities. Even though it includes one of the longest bull markets in history, the S&P 500 has seen drawdowns of 49.1%, 56.8%, and now 26.9%. Start a two-week free trial to Bespoke Institutional to access our full suite of research and interactive tools.

Fall of the Empire

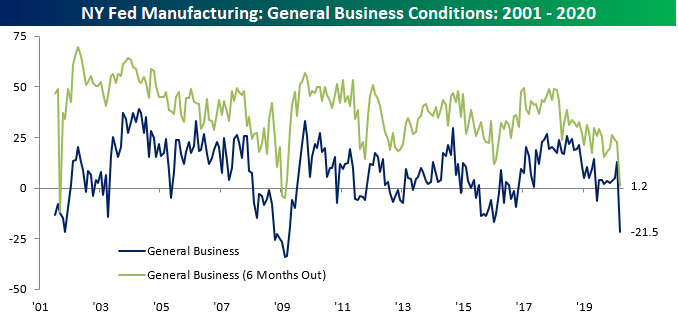

One of the first big drops in US economic data showed its face today in the form of the first of the regional Fed indices covering the month of March. The NY Fed’s headline reading on general business conditions experienced it largest drop on record in March, falling 34.4 points from 12.9 in February to -21.5. That is the first negative reading since June of last year, but the lowest level of the index for current conditions since March of 2009 during the financial crisis. Back then, the index remained below -20 for six consecutive months. Prior to then, the only similar readings can be found early in the survey’s history in November of 2001.

As for expectations six months out, this month’s reading of 1.2 is again the lowest reading since early 2009, and as with the current conditions index, you would need to go back to 2001 to find similarly low readings before that. The 21.7 point decline in expectations this month is also the largest one month decline since January 2009 when it dropped by slightly more (24.9 points). Overall, New York area businesses’ outlook in both the near term and further out have deteriorated dramatically in just one month.

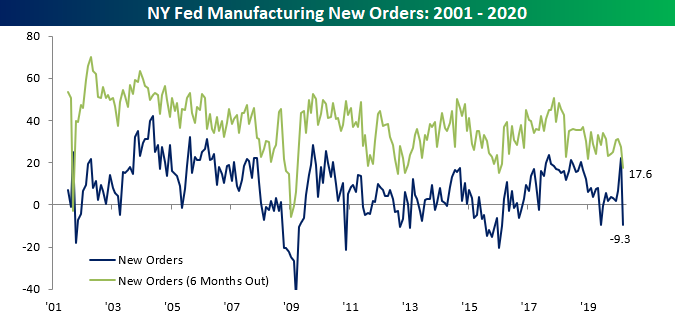

Of the individual components, pretty much everything was weaker this month for both current conditions and expectations. Only two categories (expectations for unfilled orders and inventories) rose this month. Other than the headline index, the two categories who’s declines stand out the most, and likely drove the large declines for the headline number, are for new orders and shipments. While other categories’ declines are much more modest by comparison, they too are significant nonetheless.

The index for new orders fell from 22.1 last month to -9.3. This was slightly lower in June of last year when it had fallen to -9.7, but the 31.4 point month-over-month decline was the third largest on record behind October of 2001 (43.2 point drop) and November of 2010 (31.8 point drop). With current demand drying up, expectations for the future are also weak as the index for expectations six months out fell to 17.6 from 27.5 in February. While this does not draw parallels to the financial crisis like other aspects of this month’s survey, this is the lowest level since January 2016.

Given the weaker demand, the index for shipments has also come down a lot. The current conditions index for shipments is in negative territory, -1.7, for the first time since October of 2016. The 20.5 point decline from last month is the largest decline since August of 2015. As for the forward looking indicator, conditions have not fallen off of a cliff in the same way, but are at the low end of the past several year’s range. Now at 20.5, it is at its lowest level since only October.

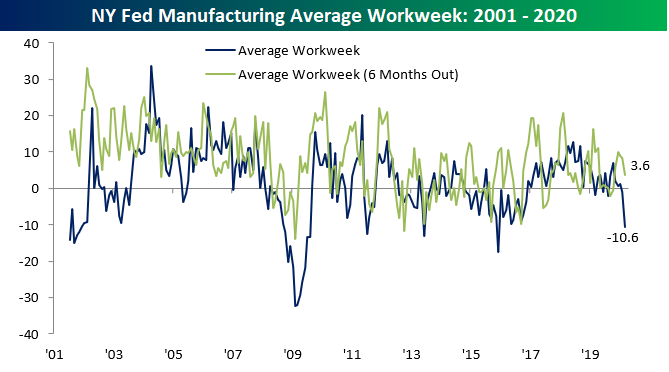

Weekly jobless claims have been one economic indicator that have been closely watched over the past several weeks given their higher frequency and potentially more timely reading on the impacts of Covid-19 on the American workforce. While nothing has shown up there, the NY Fed’s indices for number of employees and average workweek have turned lower. The index for number of employees has been significantly lower multiple times in the past few years making the drop to -1.5 nothing too crazy, but the 8.1 point decline was the largest in over a year. Meanwhile, expectations for increasing the number of workers six months out is at its lowest level since 2017. Not only are NY area businesses not taking on more workers, but the index for average workweek fell to -10.9 which is the lowest level since December 2015. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup – 3/16/20 – Off the Charts

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Despite unprecedented stimulus from the Federal Reserve last night, US and global equity futures are trading limit down while US Equity Index ETFs are trading down roughly 10%. In fixed income markets, which were extremely stressed last week, conditions have shown some signs of not getting any worse, but major problems remain as the US economy and economies of countries around the world have essentially clogged to a halt.

Read today’s Bespoke Morning Lineup for a discussion of all the Fed’s moves, the troubling increases in Covid-19 cases in Europe, and a look at how the FOMC’s actions have impacted credit markets.

The chart below is from page two of today’s Morning Lineup and shows where sectors finished off last week relative to their trading ranges (as measured by standard deviations below their 50-DMA). The circle shows where each sector most recently closed and the tail shows where it closed a week ago. Finally, the boundary for each sector is three standard deviations above or below their 50-day moving average.

Even after Friday’s monster rally in the final minutes of trading all but one sector (Technology) was at least two standard deviations below its 50-DMA. With US equities on pace to open down by roughly 9% today, many of these sectors will likely be going off the charts once again.

Bespoke Brunch Reads: 3/15/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2020 Annual Outlook special offer.

Social Distance Immediately

Cancel Everything by Yascha Mounk (The Atlantic)

A compelling argument that governments and corporations need to immediately reduce human contact that spreads Covid-19 in order to reduce the total number of people who contract the virus. [Link; soft paywall]

The City That Never Sleeps Is Brought to Standstill by Virus by Olivia Rockeman, Katya Kazakina, and Henry Goldman (Bloomberg)

A summary of what sort of massive impact Covid-19 is having on the swirling heart of finance and media for the entire world. [Link; auto-playing video]

Housebound Italian Kids Strain Network With Fortnite Marathon by Daniele Lepido and Niclas Rolander (Bloomberg)

With tens of millions (if not more) people shuttered into their homes across Europe and the rest of the developed world, networks which facilitate streaming and gaming are under increasing strain. [Link]

Coronavirus is mysteriously sparing kids and killing the elderly. Understanding why may help defeat the virus. by William Wan and Joel Achenbach (WaPo)

While a tiny fraction of those under the age of 40 (and an even smaller one under the age of 20) suffer serious cases of Covid-19, the WHP estimates a death rate of over 20% for those above 80. [Link]

Coronavirus case from November could be patient zero by Amanda Woods (New York Post)

The earliest-known coronavirus patient was a 55-year old man in Wuhan during mid-November, one of more than 250 infections from 2019, long before the virus burst on to the scene. [Link]

About Half of Cruise Virus Cases Asymptomatic, Study Suggests by Tim Loh (Bloomberg)

Comprehensive testing regimes for of small populations suggest that a very large fraction of those who have Covid-19 either do not ever or do not yet present symptoms of the disease. [Link; soft paywall]

Two Women Fell Sick From the Coronavirus. One Survived. by Sui-Lee Wee and Vivian Wang (NYT)

The line between easily overcoming Covid-19 and falling victim to the virus is often imperceptible to the naked eye, even among workers who draw huge viral loads from constant exposure to the disease. [Link; soft paywall]

More Coronas

The Dismantled State Takes on a Pandemic by Alex Pareene (The New Republic)

A multi-decade project to strip the federal government of capacity is coming home to roost amidst a bungled and haphazard response to a global pandemic that is now running entirely out of control in the United States. [Link; soft paywall]

Coronavirus burial pits so vast they’re visible from space by Erin Cunningham and Dalton Bennett (WaPo)

With Covid-19 running unchecked throughout Iran, the Shia holy site of Qom has proven ground zero for both cases and deaths, leading to so many bodies that authorities appear to be burying them in mass graves. [Link]

Testing

Gates-funded program will soon offer home-testing kits for new coronavirus by Sandi Doughton (Seattle Times)

As Covid-19 spreads widely, rapid testing has been a focal point of innovation which might allow those with the virus to be able to avoid spreading it; one kit offers at-home testing kits that would not require leaving the house. [Link]

Colorado changes policy for drive-up COVID-19 testing facility by Blair Miller (NBC KOAA)

A drive-through testing facility that makes it possible for Colorado residents to get tested without leaving their vehicles has seen massive demand. [Link]

The Cost of Not Getting Tested For Coronavirus: A $10k ER Bill (The City)

After coming back from Italy, a Brooklyn public school teacher was told she couldn’t be tested for the deadly epidemic but the total cost of her brief ER visit was still five figures. [Link]

Covid-19 Effects

U.S. Recession a Coin Toss as Chances Climb to 53% Within Year by Reade Pickerty, Yue Qiu, and Alexander McIntyre (Bloomberg)

Exploding credit spreads, plunging bond yields, and stock prices 25% below where they sat a few weeks ago; these are just some of the financial market signals that indicate imminent recession. [Link; soft paywall]

Coronavirus will change how we shop, travel and work for years by Enda Curran (MSN)

An exploration of how the current global pandemic might change consumer behavior, from tourism hiring to regulation of cleaning regimes. [Link]

Leaked Emails: Norwegian Pressures Sales Team to Mislead Potential Customers About Coronavirus by Alexi C. Cardona (Miami New Times)

In an effort to prevent cancellations, salespeople from Norwegian Cruise Lines tried to play down the risks Covid-19 posed to guests as the industry teetered on the edge of total free-fall. [Link]

Europe

Germany to offer companies unlimited credit to withstand coronavirus crisis by Jill Petzinger (Yahoo!)

In order to keep companies’ doors open during a catastrophic collapse in demand, the German government is getting ready to grant billions in loans, with no upper limit on the liquidity being deployed. [Link]

‘We Are Like Animals’: Inside Greece’s Secret Site for Migrants by Matina Stevis-Gridneff, Patrick Kingsley, Haley Willis, Sarah Almukhtar and Malachy Browne (NYT)

As finger-pointing and recriminations resound across the Greco-Turkish border (as has been the case for a very long time indeed), migrants are caught in the crossfire…sometimes literally. [Link; paywall]

How We Live Now

A no-savings generation is cashing in its sneaker collections by Ronald D. White (MSN)

As precarity mounts even in the midst of a long economic expansion, consumers are turning to some unusual places to find some cash during times of need. [Link]

Sit, stay forever: Americans willing to pay top dollar to keep old dogs alive by Barbara Goldberg (Reuters)

Americans are investing thousands in health care to prolong the lives of pets that were once regarded as a much less important destination for funds. [Link]

Why 30-50 Feral Hogs Went Viral After Two Mass Tragedies by Casey Johnston (Vice)

An investigation into the virality of a uniquely horrible (but also darkly hilarious) argument against gun control in the wake of multiple mass shootings. [Link]

Malfeasance

SEC Votes to Ease Audit Requirements for Smaller Companies by Paul Kiernan (WSJ)

In a move that seems almost guaranteed to radically increase the number of frauds operating in US equity markets, the SEC voted this week to remove the requirements that small companies have external auditors review their systems for external controls. [Link; paywall]

Secret Users Of Clearview AI’s Facial Recognition Dragnet Included A Former Trump Staffer, A Troll, And Conservative Think Tanks by Ryan Mac, Carolione Haskins, and Logan McDonald (BuzzFeed News)

As part of our ongoing tally of misdeeds from facial recognition company Clearview, this story reviews the long line of non-law enforcement users who had access to the software. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!