Bespoke’s Morning Lineup – 12/28/21 – Green Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s how tenacious you are that will determine your success.” – Steve Ballmer

After the 69th record high close for the S&P 500 yesterday, equity futures are pointing to a higher open again this morning which would be the fifth straight positive day. After a rocky first half of December, the last four days have put the index firmly into positive territory with 1%+ gains in three of the last four trading days and a gain of 0.62% in the one day where we didn’t reach 1%.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With the last four days of gains, it didn’t take long for the S&P 500 to move back to what are generally considered ‘extreme’ overbought levels. As shown in the chart below, the S&P 500 made two brief trips below its 50-DMA in December (12/1 and 12/20) but has quickly rebounded. Moves like the last four trading days show how difficult timing the market can be. Even in a year where the S&P 500 is up 27%, nearly one-fifth of the year’s gains have come in the last four trading days alone.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Texas Manufacturing Moderation

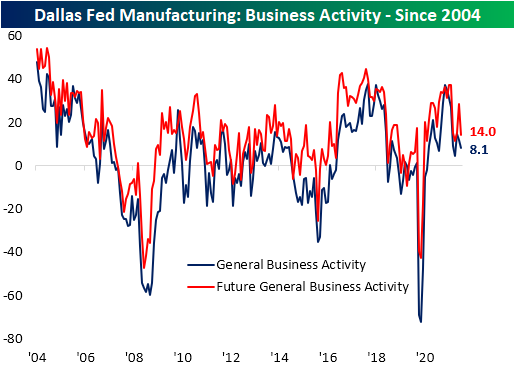

The only piece of economic data on the docket today was the Dallas Fed’s read on the region’s manufacturing sector for the month of December. Overall activity continued to grow albeit at a decelerated pace. The index last peaked this past April at one of the strongest levels on record. The grind lower since then that includes a 3.7 point drop in the most recent month leaves the index at 8.1.

That current reading is in the middle of the historical range, but many other categories of the report remain at far healthier levels from a historical standpoint. In spite of generally elevated readings and given the decline in the headline number, more components fell this month than moved higher. The declines in indices for expectations were both broader and more pronounced with several month over month declines ranking in the bottom decile of all monthly moves.

One general area of weakness in December was demand. New orders decelerated modestly while there was a more substantial decline in unfilled orders. That being said, unfilled orders remains one of the most elevated indices of the report. Shipments were also lower, but the drop in expectations is probably more notable, setting a new post-pandemic low.

The employment situation generally improved with the index for number of employees rising to the second-highest level on record behind the April 2021 reading. Although more people were hired, wage and benefit growth slowed, even as it continues to run at unprecedentedly high levels. Hours worked were little changed. Bigger and inverse moves were seen in expectations and current conditions of Capital Expenditures. The former saw the largest one-month drop since March 2020 while current conditions saw the largest one-month uptick since this past March. In other words, businesses continue to take on new workers, invest in capital, and pay higher prices for labor, but they do not expect this trend to be as strong in the months ahead.

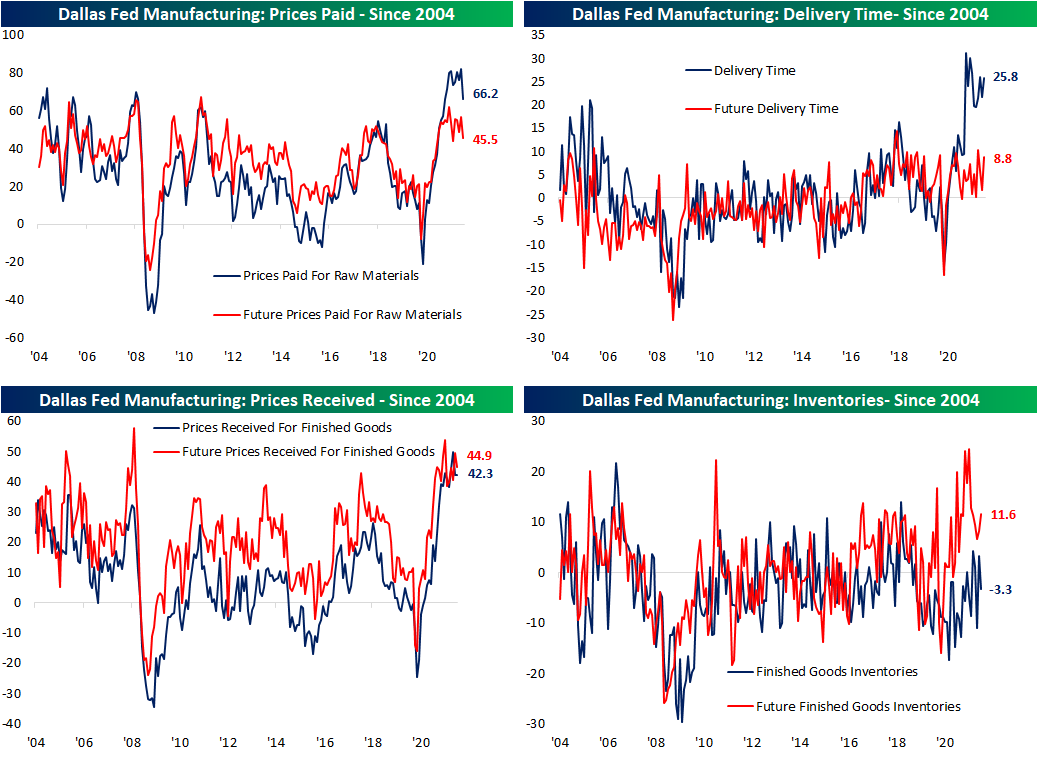

The other notable area of this month’s report concerned prices. Prices Paid experienced the biggest single-month decline since March 2020. That decline ranks in the bottom 5% of all monthly moves and it also is off of a record high. Prices received, meanwhile, moved slightly higher gaining 0.1 point. As for some further insights into supply chains, while firms were paying less they were waiting longer as Delivery Times continue to rebound after declines in the spring and summer. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/27/21 – Beginning of the End

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Amateurs want to be right. Professionals want to make money.” – Alan Greenspan

Welcome to the beginning of the last week of 2021. It’s been quite a year and while in some ways, it’s ending just as it started, there’s change afoot as we head into 2022. US futures are trading higher this morning and bitcoin is rallying and gaining strength as it trades back above $51,000. The economic calendar is light today with the Dallas Fed Manufacturing report the only release on the calendar. As one might expect given the time of year, there’s not a whole lot of news driving markets this morning.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

While it didn’t quite hit a new record on an intraday basis last week, the S&P 500 did manage to close at a new record high last Thursday making for the 68th record closing high in 2021. While the all-time record of 77 from 1995 is now out of reach, 2021 is guaranteed to rank second in terms of the most record closing highs in a given year.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

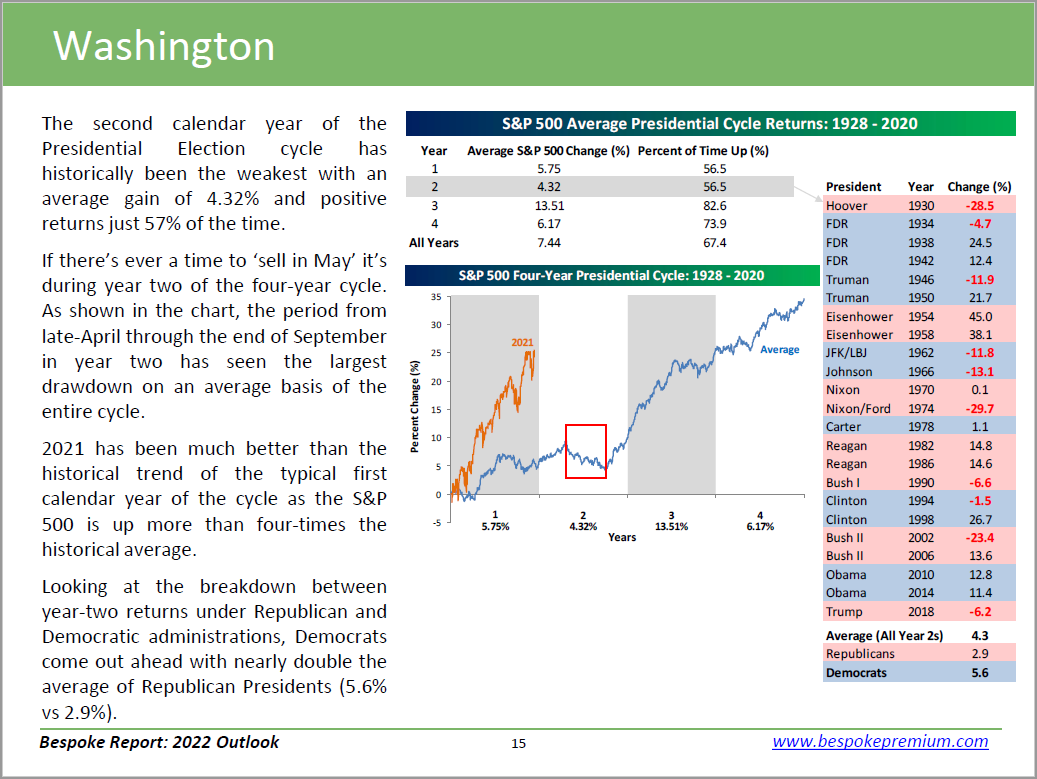

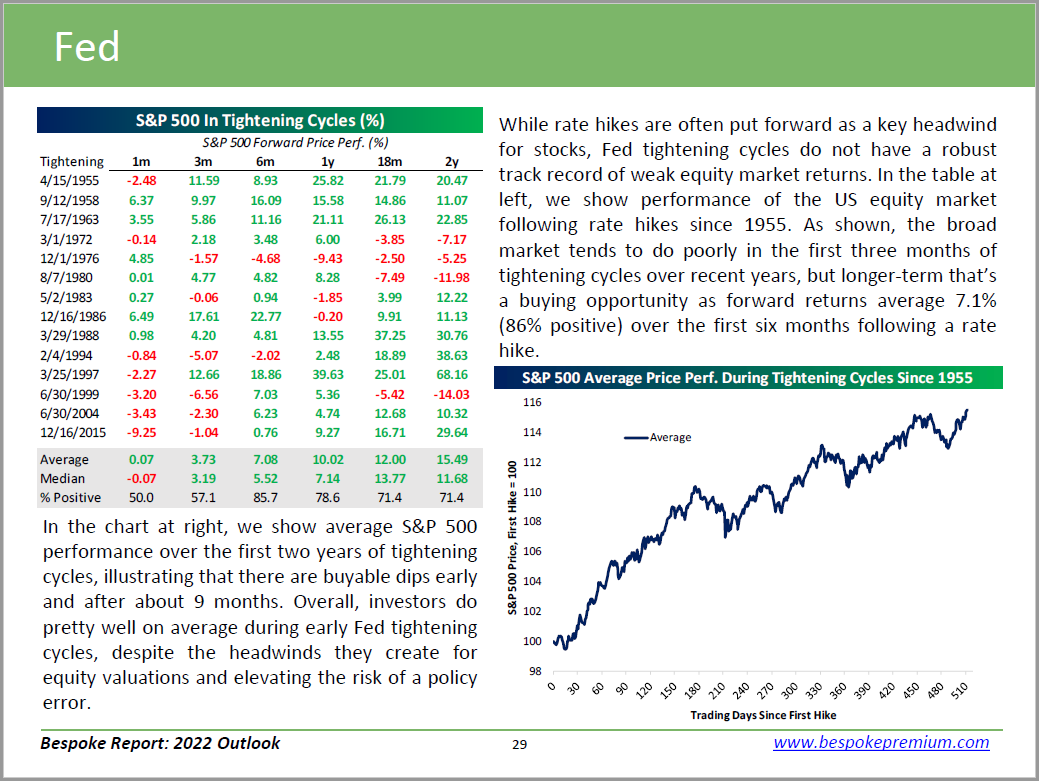

Bespoke Annual Report Teaser

In our 2022 Outlook, we cover numerous topics to both sum up the year and give insights into 2022. This report is available at all three subscription levels. If you are not yet a member, sign up below to get access to the entirety of the repot by clicking any of the links below:

Bespoke Newsletter — $395 annually or $49 monthly (includes 14-day trial)

Bespoke Premium — $995 annually or $99 monthly (includes 14-day trial)

Bespoke Institutional — $1995 annually or $195/month (includes 14-day trial)

If you’re already a member, click here for the whole report.

Below is a complimentary look at a handful of pages from our 2022 Outlook. You can view the table of contents below as well. Join our community today and give it a read!

Bears Still Outnumber Bulls Despite Rally

The S&P 500 is currently at record highs, but recent sentiment readings are still relatively bearish. However, this isn’t necessarily negative for markets, as it gives the opportunity for bears to shift their position, which would likely be accompanied by an increase in equity purchases. AAII‘s reading on bullish sentiment moved from 25.2% last week to 29.6% this week. This week’s reading is still 6.7 percentage points below the average since 2009.

In turn, bearish sentiment dropped from 39.3% down to 33.9%, which is only 1.8 percentage points higher than the historical average level. This week’s reading was also the second-largest week-over-week decline in bearish sentiment since September 9th.

Neutral sentiment ticked higher by 1.2 percentage points, resulting in 36.6% of respondents reporting a neutral view of the market. This is the lowest absolute change in a month and is 5.0 percentage points higher than the average level.

The NAAIM Exposure Index moved higher this week alongside bullish sentiment. The index ranges from +200 (levered long) to -200 (levered short) and this week the index moved from 52.2 to 67.0, essentially erasing last week’s significant drop. That indicates reporting investment managers’ exposure to US equities is roughly 67%. Click here to view Bespoke’s premium membership options.

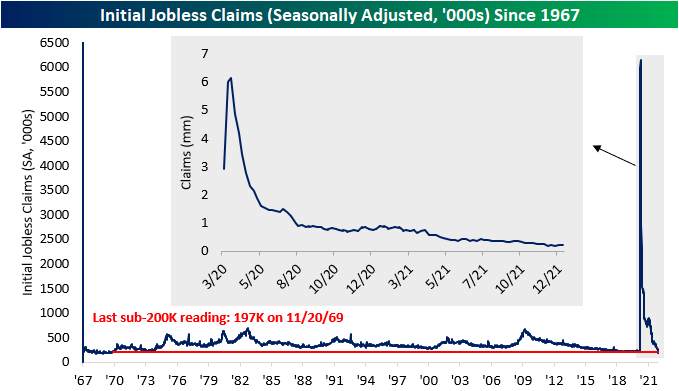

Claims Inline With Last Week

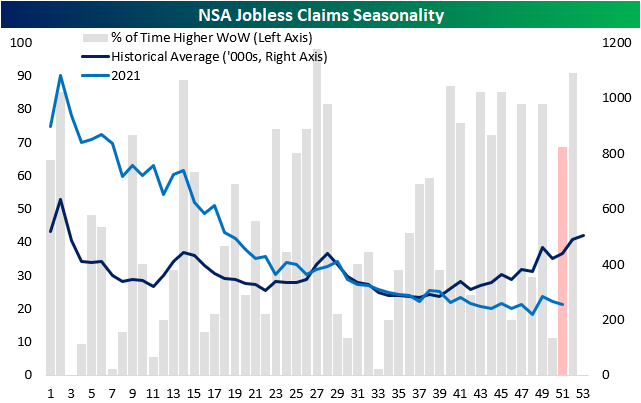

Three weeks ago, seasonally adjusted initial jobless claims hit a multi-decade low, breaking below 200K. Last week, claims moved slightly higher to 205K, and the reading was identical this week. Although we are not at our lows, the reading of 205K is historically strong.

While claims are at a healthy level, the seasonal adjustment has had a flattering effect recently. Historically, the number of non-seasonally adjusted claims has moved higher this week 68.5% of the time but moved lower this week. This comes as NSA claims have broken historical trends over the last 15 weeks, moving lower when the average of all years moves higher. Non-seasonally adjusted claims decreased from 266K to 254K.

Continuing claims, which are delayed by a week, came in slightly lower than the previous week at 1.86M, setting a new pandemic low. This is the lowest level since March 13, 2020.

Including all other programs creates an additional week of lag making the most recent data through the first week of December. In that week, total continuing claims ticked lower, moving from 2.46M to 2.12M. The decrease in claims was consistent across all programs. Click here to view Bespoke’s premium membership options.

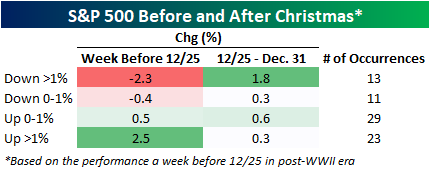

S&P 500 Performance Around Christmas

With Christmas just two days away and markets closed tomorrow, many investors are on the watch for a ‘Santa Claus’ rally. In all periods in the post-WWII era, the average S&P 500 performance in the week leading up to Christmas is a gain of 0.5% with positive returns just over two-thirds of the time. The average performance in the week after Christmas is slightly higher at 0.7%, but the consistency of positive returns is the same. This year, the S&P 500 has performed considerably better than its pre-Christmas average gaining 2.25% through midday Thursday. Since 1945, the S&P 500 has traded up more than 1% in the week leading up to Christmas 23 times (30.3%), and in those prior 23 years, the average week after Christmas performance was actually a bit weaker than normal with an average gain of 0.3% and positive returns just over 60% of the time. That compares to an average gain of 0.7% in the same week for all years since 1945.

The table below lists each year since 1945 that the S&P 500 was up over 1% in the week leading up to Christmas along with how it performed in the final week of the year. Of those 23 prior years, there were actually 14 where the S&P 500 rallied 2% or more in the week leading up to Christmas with the last occurrence seven years ago back in 2014. While those types of gains may have put investors in a good mood for the Christmas holiday, it didn’t leave much powder left for the last week of the year as the median gain was just 0.05% with positive returns half of the time. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/23/21 – Busy Data Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Economics is extremely useful as a form of employment for economists.” – John Kenneth Galbraith

Economists will be working hard this morning as a large batch of economic data was just released. Initial Jobless Claims were right in line with forecasts while Continuing Claims were modestly higher than expected. Personal Income and Spending were both right in line with forecasts at 0.4% and 0.6, respectively. PCE inflation data was slightly higher than expected while Durable Goods Orders rose 2.5% which was ahead of expectations. Even after all that data, though, equity futures are little changed from where they were before the data was released. Still on the docket, we have Michigan Confidence and New Home Sales at 10 AM and natural gas inventories at 10:30.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Since its intraday low on Monday, the small-cap Russell 2000 has rallied more than 5.5% and yet still only modestly above the level it opened at last Thursday. Talk about a volatile stretch! A lot of bullish investors want to call the bottom of the small-cap correction. While the downtrend from the November high appears to have been broken, the Russell still has something to prove with both the 50 and 200-day moving averages, which are both now sloping downwards, looming above. In a bearish tape, these levels typically act as resistance. If the tape is really turning bullish for small caps, these moving averages will need to be taken out.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Best and Worst Performers Since Thanksgiving

Although the Russell 1000 is now pretty much right back in line with its pre-Thanksgiving level, certain stocks have seen dramatic moves during that same span. Of the 25 stocks that have experienced the largest gains since 11/25, 19 were down on the year leading up to Thanksgiving, and the average stock had declined by 20.0%. Since then, those 25 stocks have gained an average of 13.1%, with Smartsheet (SMAR) and Chegg (CHGG) leading the group with gains of 22.2% and 20.4%, respectively.

Of the Russell 1000 members that have performed the worst since Thanksgiving, their average YTD performance leading up to Thanksgiving was a gain of 85.7% while the median performance was much less but still an impressive +25.6%. Of these 25 stocks, 18 were positive YTD through Thanksgiving, and the average decline since then is 23.6%. Everbridge (EVBG) and DocuSign (DOCU) topped this list with declines of 37.2% and 36.6% since Thanksgiving, respectively.

Based on the data above, it appears as if there was some rotation in the Russell 1000 as investors shifted from leaders to laggards. Essentially, the worse a stock performed between the start of the year and Thanksgiving, the better it has performed since, at least for the top 25 movers to the upside. For the 25 stocks that have declined the most since Thanksgiving, there seems to be very little correlation between the size of the move to the upside before Thanksgiving and performance since then. In the charts below, GameStop (GME) Upstart (UPST) were omitted from the chart but included in the R squared calculation due to visual distortion. Click here to view Bespoke’s premium membership options.

The Bespoke Report – 2022 Annual Outlook

Our Bespoke Report – 2022 Outlook is now available for Bespoke subscribers. This report covers everything you need to know about the set-up for financial markets and the economy heading into 2022. If there’s ever a “must-read” Bespoke report, this is it!

You can read our 2022 Outlook by signing up for any of our three membership levels. You can review our membership levels here or simply start a two-week trial to one of them using the links below.

Bespoke Newsletter $49/month – Includes 14-day trial

Bespoke Premium $99/month – Includes 14-day trial

Bespoke Institutional $195/month – Includes 14-day trial