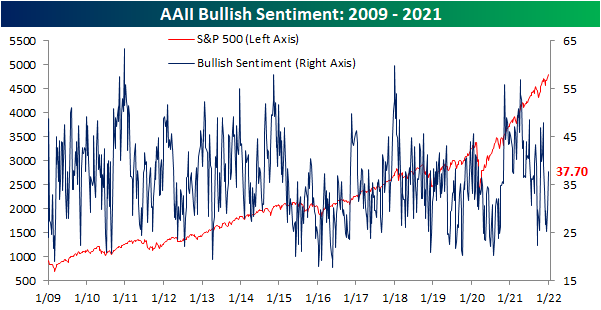

Bulls Bounce Back

Only two weeks ago, bullish sentiment according to the AAII had collapsed to some of the weakest readings of the post-pandemic period. Over the past two weeks, sentiment has gradually recovered with a significant pick up in this final week of the year. Now at 37.7%, bullish sentiment gained 8.1 percentage points this week for the largest increase since October. While recovered, the actual level of bullish sentiment is far from notable essentially in line with the historical average of 38%.

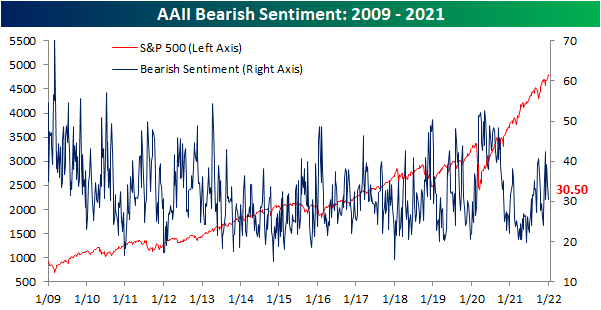

The increase in bullish sentiment over the past two weeks largely borrowed from bears. Bearish sentiment fell 3.4 percentage points in the most recent week following a 5.4 percentage point drop last week. Now at 30.5%, the share of respondents reporting as bearish is right in line with the historical average.

Given the inverse moves of the two readings, the bull-bear spread is now back into positive territory after five weeks of negative readings. At 7.2, the spread is not particularly elevated and only 0.2 points away from the historical average of 7.4.

Not all of the gains to bullish sentiment have come from former pessimists. The share of respondents reporting neutral sentiment has also unwound this week falling from 36.6% to 31.8%. That is the lowest reading since the first week of the month when exactly 31% of respondents reported neutral sentiment. Click here to view Bespoke’s premium membership options.

Sub-200K Claims Come Back

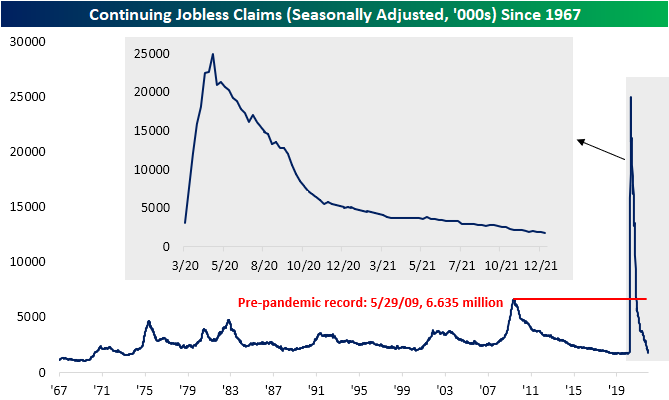

After holding above 200K the past two weeks, seasonally adjusted initial jobless claims dropped back below that level coming in at 198K. That compares to expectations of an unchanged reading from the revised level of 206K. While lower, claims remain above the multi-decade low of 188K from the first week of December.

On an unadjusted basis, claims were slightly higher rising by a little over 1K to 256.15K. With the continued unwinding of the program, PUA claims fell below 1K for the first time. Over the past few months, we have been noting the change in seasonal trends for initial claims. Historically, the final quarter has been marked by a period of rising claims whereas the opposite has generally been true in Q4 2021. The current week of the year, in particular, has seen claims rise over 90% of the time since 1967; ranking second behind the 27th week of the year (typically the last week of June/first week of July) as the week of the year that NSA claims most consistently increase on a week over week basis. While the rise in claims this week could have been expected, the uptick was much lower than normal as the current week of the year has averaged an increase of almost 50K. In other words, the trend in claims to close out 2021 has diverged from the normal trend.

Continuing claims saw a substantial drop this week with the adjusted number falling by 140K. That was the largest one-week decline since mid-October and the lowest level since the first week of March 2020.

Adding in all programs delays the data an extra week making the most recent reading as of the week of December 10th. That week saw regular state claims rise by over 93K to 1.828 million. Albeit higher, that was still below the levels from two weeks prior. Other programs similarly saw higher readings, but the Extended Benefits program provided a boost to the aggregate read on claims after being cut by 45.7%. At only 67.5K versus 124.3K, this program has now seen the lowest reading since July 2020. As expected headed into year-end, this is another point showing pandemic era programs continue to account for increasingly insignificant portions of jobless claims. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/30/21 – Almost There

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Time sometimes passes quite quickly.” – Jimmy Page

Futures are higher but not rising as fast as the number of daily Omicron cases in the United States which has now reached the parabolic stage. Given the light volumes, it’s hard to read too much into this morning’s market moves, so we won’t try to force any narrative to what’s behind the strength. Initial jobless claims came in both below 200K and consensus expectations while continuing claims also experienced a large drop falling to 1.716 mln which is consistent with levels prior to Covid. The last economic release of the year will be the Chicago PMI at 9:45.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

When it comes to small-cap stocks, not all indices tracking the sector are created equal. The chart below compares the performance of the ETFs that track the Russell 2000 (IWM) and the S&P Small Cap 600 (IJR). Early on in 2021, both indices tracked each other very closely, but late in the first quarter, the two ETFs started to diverge and have continued to do so throughout the year. Through yesterday’s close, IJR was up 25.3% YTD while IWM was up just 13.9%. One lesson from 2021, therefore, is that sometimes even picking the right asset class isn’t enough. You also have to pick the right vehicle to put that investment thesis into place.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Battered BRICS Breaking Down

In the table below, we show a breakdown of US-listed ETFs for the equity markets of the 23 major global economies that we track in our Global Macro Dashboard. In 2021, the United States’ S&P 500 (SPY) is headed out on top of the world with a year-to-date gain of 27.57%. December alone has been a solid month with a 4.7% gain as SPY reached a 52-week high only a few days ago. That being said, SPY’s MTD gain pales in comparison to Mexico (EWW) which has rallied double digits in December for the 21st best month on record in its history dating back to March 1996. But that has not brought it to a new high. In fact, in addition to the US, only Taiwan (EWT) and Switzerland (EWL) have also hit 52-week highs this month and these two countries also rank as the runner-up and fourth-best performing country ETFs in 2021. At the moment, SPY and EWL are also the most overbought with EWL currently over 2 standard deviations above its 50-DMA. Panning across its peers, most country ETFs are below their own 50-DMAs with many down by at least a full standard deviation, though most have also been rallying this month.

The BRIC countries have been a particular area of weakness for US investors lately. The Brazil (EWZ) and China (MCHI) ETFs have had a rough year with each being cut by around 25%. December in particular has seen sizable declines of 6.67% for MCHI and 5.52% for EWZ, which leaves it at a new 52-week low today. Russia (RSX) has been hit even harder though having declined over 7% month to date. India (INDA) too is lower, granted, it remains up double digits year to date. Click here to view Bespoke’s premium membership options.

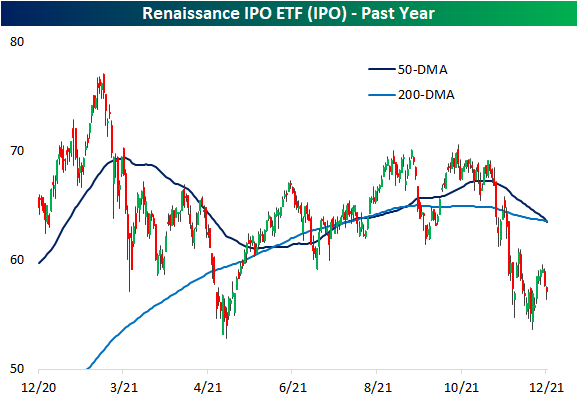

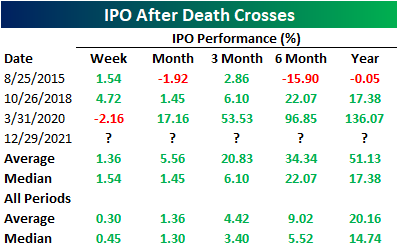

IPO Death Cross

The past two years have seen an explosion in new equity issuance in terms of the number of deals, and especially in terms of the dollar value of those deals. According to Bloomberg data, US average monthly issuance has been $23.83 billion over the past year. That is well above any point in the past few decades including the late 1990s. The actual number of stocks hitting the market has also set records this year, surpassing the 1990s peak.

While there has been a huge slug of new issuance, the performance of these names have been lackluster. The Renaissance IPO ETF (IPO) does not necessarily track every new name to hit the market, but it does act as a reasonably good proxy for the space. IPO reached an all-time high early in the year in February, but since then it has generally been rangebound fluctuating around its moving averages. Since the fall, and particularly in the past month and a half, the ETF has taken a significant leg lower. IPO has now fallen over 18% since the October 25th closing high, taking out its moving averages in the process. Today, IPO is setting up for what is typically viewed as a negative technical pattern: the death cross (when a downward sloping 50-DMA falls below a downward sloping 200-DMA).

IPO does not have an extremely extensive history only going back to October 2013, and as such, there is only a small handful of prior examples of other death crosses without another instance in the prior three months. In the table below, we show those past instances. Albeit there is a small sample size, contrary to the name and pattern’s reputation, prior death crosses have generally been followed by decent performance going forward. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/29/21 – Quiet Wednesday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Coaches have to watch for what they don’t want to see and listen to what they don’t want to hear.” – John Madden

After trading with a positive bias overnight, US equity futures have turned lower and are now indicated to open flat to slightly lower. Given the light flow of news and data that is typical of year-end, there isn’t much of a catalyst driving the reversal, although Samsung did announce that it would be adjusting production schedules in China due to an outbreak of the Omicron virus in Xi’an. Any indications of further disruptions to the supply chain because of rising COVID cases would be viewed negatively at the margin by the market even if they are only temporary.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

The S&P 500 is up just under 5% over the last five trading days, and the rally has been led by Consumer Discretionary (thanks mostly to Tesla) and Technology which are both up over 6%. Other sectors that have outperformed the broader market include Energy (+5.75%), Materials (+5.25%), and Industrials (+5.11%). On the downside, four sectors are up less than 4% over the last five trading days, and ironically enough, they are also the only sectors trading more than two standard deviations above their 50-day moving averages as they outperformed the market during the weakness that preceded this latest rally. Even after the big Christmas rally and the fact that the S&P 500 is right near record highs, two sectors – Energy and Financials – are still below their 50-day moving averages while Communication Services is just barely above its 50-day.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Morning Lineup – 12/28/21 – Green Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s how tenacious you are that will determine your success.” – Steve Ballmer

After the 69th record high close for the S&P 500 yesterday, equity futures are pointing to a higher open again this morning which would be the fifth straight positive day. After a rocky first half of December, the last four days have put the index firmly into positive territory with 1%+ gains in three of the last four trading days and a gain of 0.62% in the one day where we didn’t reach 1%.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With the last four days of gains, it didn’t take long for the S&P 500 to move back to what are generally considered ‘extreme’ overbought levels. As shown in the chart below, the S&P 500 made two brief trips below its 50-DMA in December (12/1 and 12/20) but has quickly rebounded. Moves like the last four trading days show how difficult timing the market can be. Even in a year where the S&P 500 is up 27%, nearly one-fifth of the year’s gains have come in the last four trading days alone.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

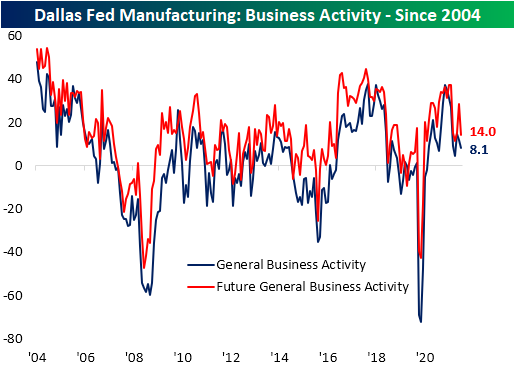

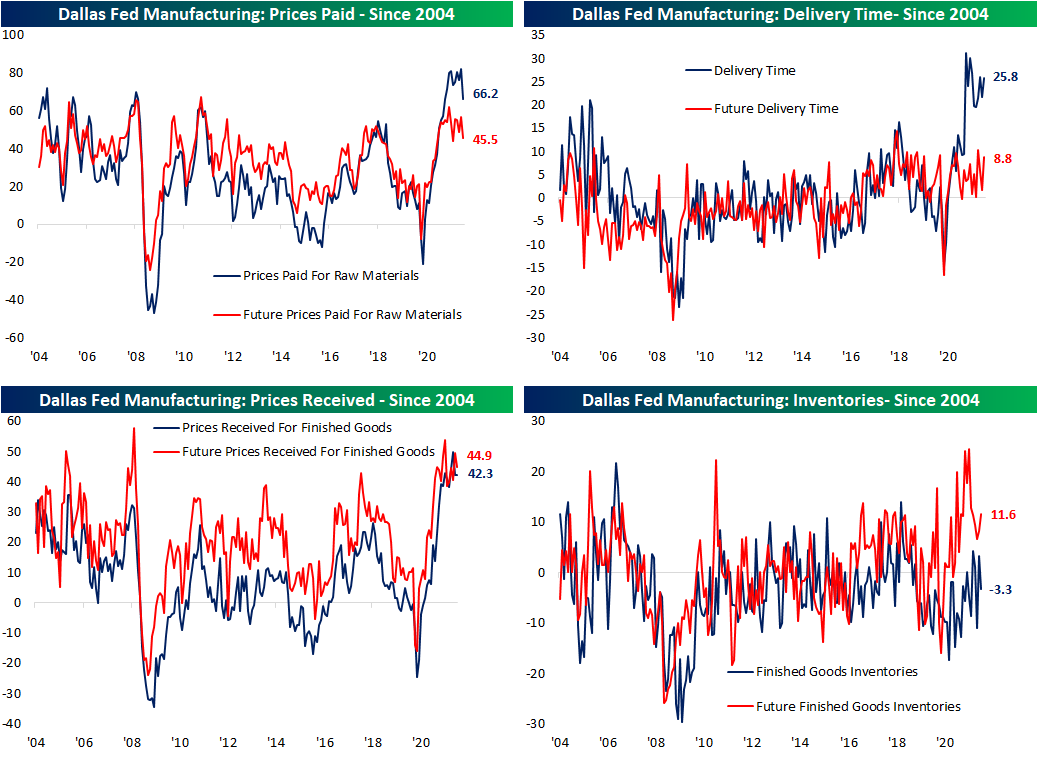

Texas Manufacturing Moderation

The only piece of economic data on the docket today was the Dallas Fed’s read on the region’s manufacturing sector for the month of December. Overall activity continued to grow albeit at a decelerated pace. The index last peaked this past April at one of the strongest levels on record. The grind lower since then that includes a 3.7 point drop in the most recent month leaves the index at 8.1.

That current reading is in the middle of the historical range, but many other categories of the report remain at far healthier levels from a historical standpoint. In spite of generally elevated readings and given the decline in the headline number, more components fell this month than moved higher. The declines in indices for expectations were both broader and more pronounced with several month over month declines ranking in the bottom decile of all monthly moves.

One general area of weakness in December was demand. New orders decelerated modestly while there was a more substantial decline in unfilled orders. That being said, unfilled orders remains one of the most elevated indices of the report. Shipments were also lower, but the drop in expectations is probably more notable, setting a new post-pandemic low.

The employment situation generally improved with the index for number of employees rising to the second-highest level on record behind the April 2021 reading. Although more people were hired, wage and benefit growth slowed, even as it continues to run at unprecedentedly high levels. Hours worked were little changed. Bigger and inverse moves were seen in expectations and current conditions of Capital Expenditures. The former saw the largest one-month drop since March 2020 while current conditions saw the largest one-month uptick since this past March. In other words, businesses continue to take on new workers, invest in capital, and pay higher prices for labor, but they do not expect this trend to be as strong in the months ahead.

The other notable area of this month’s report concerned prices. Prices Paid experienced the biggest single-month decline since March 2020. That decline ranks in the bottom 5% of all monthly moves and it also is off of a record high. Prices received, meanwhile, moved slightly higher gaining 0.1 point. As for some further insights into supply chains, while firms were paying less they were waiting longer as Delivery Times continue to rebound after declines in the spring and summer. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/27/21 – Beginning of the End

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Amateurs want to be right. Professionals want to make money.” – Alan Greenspan

Welcome to the beginning of the last week of 2021. It’s been quite a year and while in some ways, it’s ending just as it started, there’s change afoot as we head into 2022. US futures are trading higher this morning and bitcoin is rallying and gaining strength as it trades back above $51,000. The economic calendar is light today with the Dallas Fed Manufacturing report the only release on the calendar. As one might expect given the time of year, there’s not a whole lot of news driving markets this morning.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

While it didn’t quite hit a new record on an intraday basis last week, the S&P 500 did manage to close at a new record high last Thursday making for the 68th record closing high in 2021. While the all-time record of 77 from 1995 is now out of reach, 2021 is guaranteed to rank second in terms of the most record closing highs in a given year.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

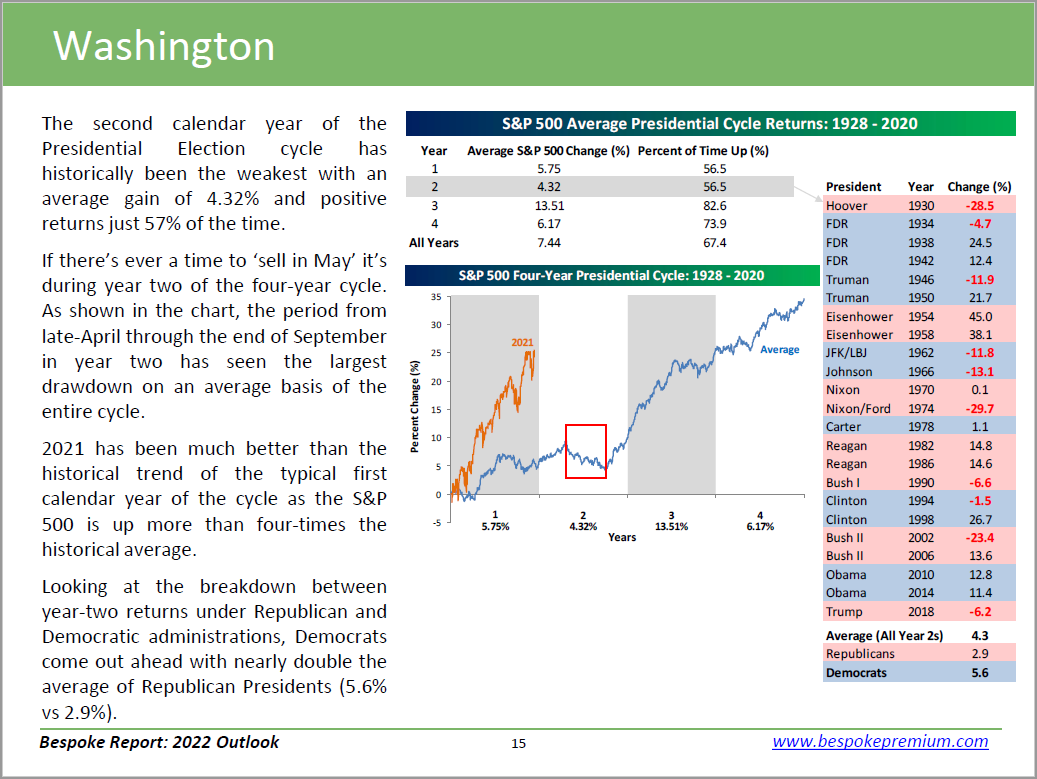

Bespoke Annual Report Teaser

In our 2022 Outlook, we cover numerous topics to both sum up the year and give insights into 2022. This report is available at all three subscription levels. If you are not yet a member, sign up below to get access to the entirety of the repot by clicking any of the links below:

Bespoke Newsletter — $395 annually or $49 monthly (includes 14-day trial)

Bespoke Premium — $995 annually or $99 monthly (includes 14-day trial)

Bespoke Institutional — $1995 annually or $195/month (includes 14-day trial)

If you’re already a member, click here for the whole report.

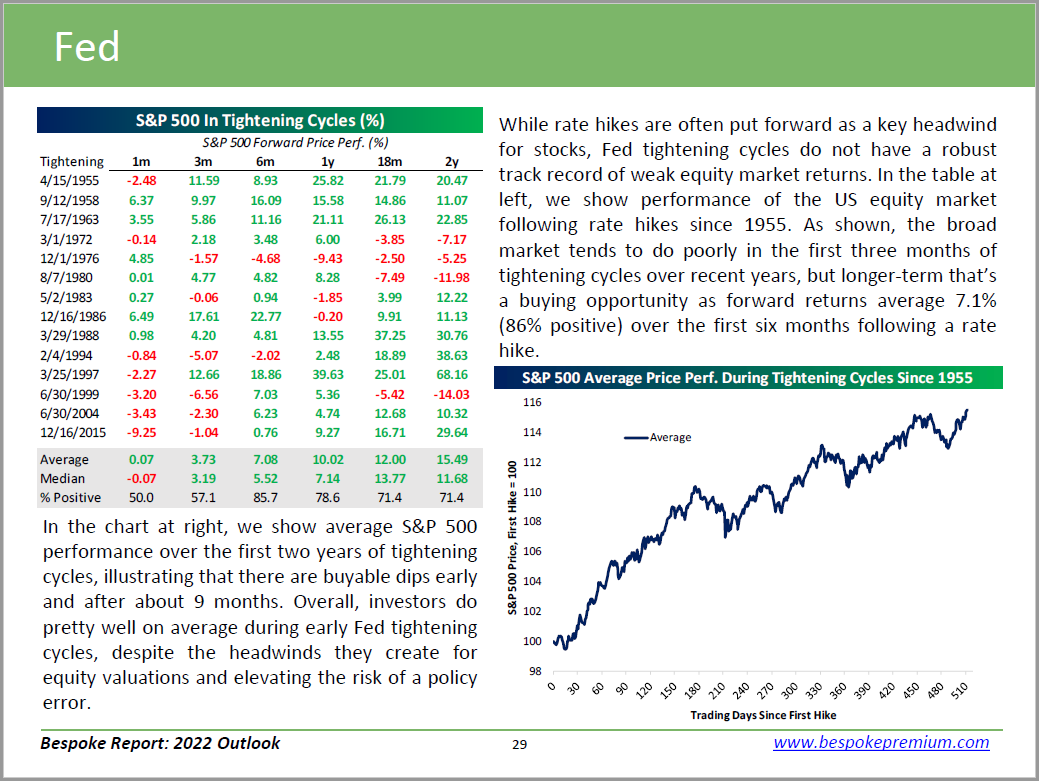

Below is a complimentary look at a handful of pages from our 2022 Outlook. You can view the table of contents below as well. Join our community today and give it a read!