Green on the First Day of the Year

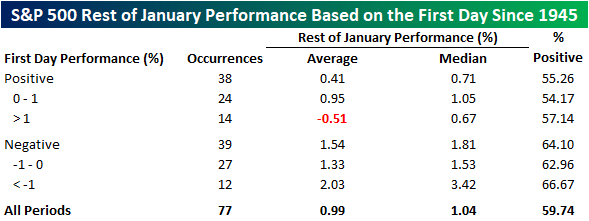

The S&P 500 opened higher on the first trading day of 2022 and is up about 20 basis points (bps) as of 11 AM. It’s widely assumed that positive starts to the year portend good things for the rest of the month, but the data doesn’t necessarily show that. The table below shows the S&P 500’s performance since 1945 for the remainder of January based on how it trades on the first day of trading. Based simply on whether or not the first day of trading is positive or negative, in the 38 years since 1945 where the year started off with a gain, the average rest of month performance was an additional gain of 0.41% (median: 0.71%) with gains just over 55% of the time. In the 39 years where the year started off with a decline, though, performance for the rest of the month was much stronger with an average gain of 1.54% (median: 1.81%) and positive returns 64.1% of the time.

When we filter out by years where the S&P 500 gained or lost 1% on the first day of trading in January, returns for the rest of the month were even more skewed. In the 14 years where the S&P 500 was up 1% on the first day of trading, the average performance for the rest of the year was a decline of 0.51% (median: +0.67%) and positive returns 57% of the time. Conversely, in the 12 years where the first day of the year experienced a decline of 1%+, the average rest of month performance was a gain of 2.03% (median: 3.42%) with positive returns two-thirds of the time. Broadly speaking, therefore, there is little evidence that strong starts to a year are a precursor of a strong January and vice versa.

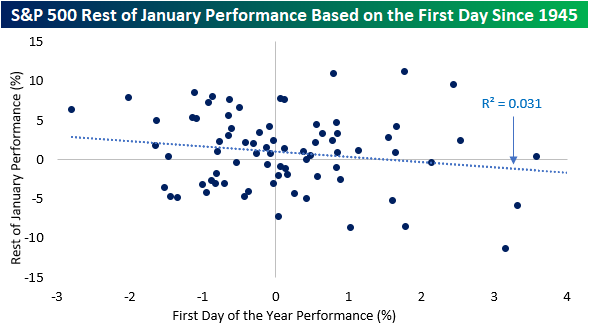

As you can see from the dot plot below, first-day performance tends to have a relatively minimal effect on the rest of the month’s performance. Only about 3.1% of the variance seen in the y variable (rest of January performance) is explained by movements in the x variable (first-day performance). Nonetheless, the slope of the linear line of best fit is still negative, so there is a slight negative correlation between the two variables. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 1/3/22 – Starting Over

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“For last year’s words belong to last year’s language and next year’s words await another voice.” – T.S. Eliot

It’s a new year, but things look a lot now like they looked in 2022 with markets in rally mode and COVID cases continuing to surge. There’s little in the way of catalysts driving this morning’s rally, and outside of the US, many international markets were closed in observance of the new year. The economic calendar is light today with Markit’s final read on the manufacturing sector scheduled for release at 9:45 while Construction Spending is on tap at 10 am.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

For the next several minutes, every sector is on an equal footing with respect to year-to-date performance, but below we wanted to provide a last look at where things stood to close out 2021. Topping the list in terms of sector performance was Energy (XLE) with a gain of more than 50%. Despite the strong year, though, Energy was one of just three sectors to finish below its 50-day moving average (along with Financials-XLF and Communication Services-XLC). Real Estate (XLRE), on the other hand, was the second-best performing sector of 2021, but it finished the year on a positive note gaining over 3.5% in the final week of the year and at more overbought levels than any other sector. At the other end of the spectrum, Communication Services, Consumer Staples (XLP), and Utilities (XLU) were the only three sectors to finish the year up less than 20%, but of those three, strong finishes for both Utilities and Consumer Staples left those two sectors among the most overbought of all the sectors.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 1/2/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID Country

America’s Mixed Response to the Omicron Variant Comes Down to Geography by Jennifer Levitz, Jimmy Vielkind, and Nicole Friedman (WSJ)

Whether you’re cancelling plans and bunkering down or forging ahead as usual amidst a national surge in Omicron cases largely depends on which part of the country you’re living in. Northern urban areas that contain a very large share of the US population are being much more careful than Southern and more rural locales. [Link; paywall]

Beleaguered by Omicron, New York Operates at Half Speed by Andy Newmann and Dana Rubinstein (NYT)

While the latest COVID variant hasn’t led to a huge increase in deaths or even hospitalizations, that hasn’t stopped it from wrecking havoc on New York City’s rhythm, as infected workers are forced to stay home and the health care system struggles to digest the huge number of tests and new cases that are popping up. [Link; soft paywall]

COVInnovations

US Army Creates Single Vaccine Against All COVID & SARS Variants, Researchers Say by Tara Copp (Defense One)

Army researchers at Walter Reed have designed a novel vaccine which would allow recipients to be exposed to up to 24 different discrete pathogens, which could each be a distinct variant. Trials are very early, so this is a long way from being a usable inoculation. [Link]

To Track Covid-19 Surges, Scientists Are Studying Sewage by Josh Ulick (WSJ)

COVID patients excrete a steady stream of the virus when they’re infected, and changes in the background viral load from sewage can indicate the number of people in a population that are infected. The data is a useful real-time tracker for keeping an eye on the severity of outbreaks. [Link; paywall]

New Tech, Old Problems

Walmart drew one in four dollars spent on click and collect — with room to grow in 2022 by Melissa Repko (CNBC)

“Click and collect” or curbside pickup is a space dominated by Wal-Mart, with one of four dollars spent online for collection at stores captured by retail giant and equivalent to $20.4bn in total sales. [Link]

San Francisco-based DoorDash is requiring engineers to deliver food — and they’re furious by Joshua Bote (SFGate)

DoorDash employees are being told they have to use the tools they work on by stepping in to the driver’s seat and dropping off customer orders once per month. The practice is a return to the company’s roots, and was paused earlier in the COVID pandemic. [Link]

EV Industry

How Elon Musk’s Software Focus Helped Tesla Navigate Chip Shortage by Rebecca Elliott (WSJ)

Despite brutal semiconductor shortages that have wrecked havoc on the rest of the industry, Tesla has increased production by 80% this year. Software flexibility that allowed the use of alternative chips to fill supply gaps were a huge factor that allowed the company to keep factories rolling. [Link]

Rio Tinto Buys $825 Million Lithium Project in Battery Push by Thomas Biesheuvel and Yvonne Yue Li (Bloomberg)

Mining companies are scooping up supplies of lithium, copper, and other metal inputs that will help fuel the energy transition. The latest major transaction saw global giant Rio Tinto purchase an Argentinian lithium mine. [Link; paywall, auto-playing video]

Foreign Affairs

The Olympics Are Coming to China. So Is Omicron. by Louise Radnofsky, Rachel Bachman, and Ben Cohen (WSJ)

As Omicron floods across the world, the Winter Olympics in Beijing are facing an enormous public health challenge as they try to balance athletics with contained spread of COVID. [Link; paywall]

Turkey’s Currency Crisis Slams the Nutella Global Supply Chain by Jared Malsin (WSJ)

About 70% of the global hazelnut crop comes from Turkey, and the collapse of the lira is making it impossible for the country’s exporters to cover their costs of fertilizer, seeds, pesticides, and other inputs despite access to foreign currency revenues. [Link; paywall]

Bribery Doesn’t Pay

Minority Retort by Elsa Walsh (The NYer)

A 2005 profile of Nevadan Harry Reid, a giant of the state’s politics that passed this week. It includes a hilarious anecdote involving a sting operation against a casino man trying to bribe a much younger Reid. [Link]

Crypto

Crypto assets inspire new brand of collectivism beyond finance by Miles Kruppa and Hannah Murphy (FT)

Decentralized Autonomous Organizations, or DAOs, are a blockchain-powered form of social organization that goes beyond cryptocurrency in an attempt to improve on traditional forms of governance. [Link; paywall]

Demographics

2021 on track to surpass last year as nation’s deadliest by Mike Stobbe (AP)

The COVID pandemic sent the number of deaths in the US soaring and as a result life expectancy fell dramatically. As COVID has continued to rage, 2020 is likely to be surpassed by 2021 in terms of record deaths. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

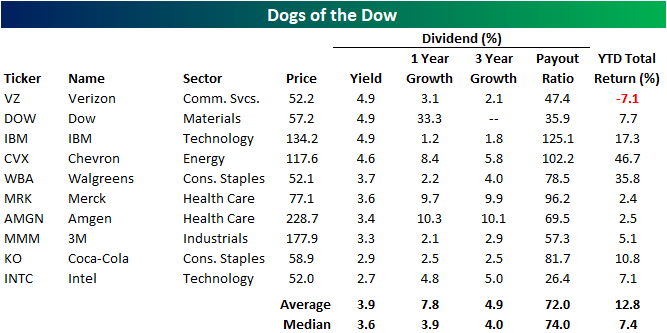

Dogs of the Dow End of 2021 Update

The Dogs of the Dow is a very simple and passive strategy with the basic concept being to buy the ten highest yielders of the Dow 30 at year’s end and repeating the process annually. In 2021, the only Dog of the Dow that did not finish the year higher was Verizon (VZ) which shed 7.53% on a total return basis. On average across these names, the strategy would have returned 16.3%. That compares to a 20.69% return for the rest of the index. As we close out 2021, the only change to the Dogs of 2021 for next year is that Cisco (CSCO) which now yields 2.33% will drop out and be replaced by Intel (INTC) with its yield of 2.70%.

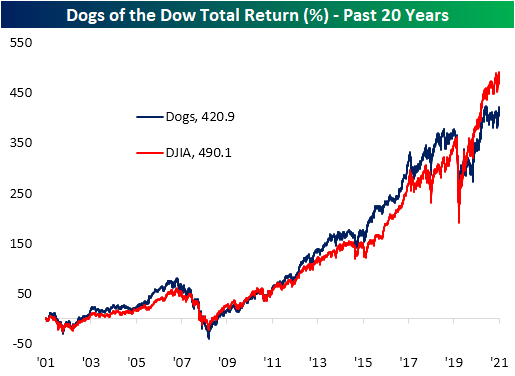

In the chart below, we show the cumulative total return of this strategy versus holding the entirety of the Dow going back over the past twenty years. Historically, the Dogs have tended to outperform the broader index, but since the pandemic hit, that has not been the case. Not only have the non-dogs been outpacing the highest yielding stocks in the index, but the dogs of the Dow have yet to break out (though they are getting close after the past few day’s rally) from the range that has been in place since early June. Click here to view Bespoke’s premium membership options.

Surprise Headlines — 2022

As a thought experiment, the Bespoke team got together this week and brainstormed over what could be some of the most contrarian themes to emerge in 2022. Rather than going along with prevailing thought or consensus sentiment as we enter a new year, the made-up headlines below are a fun and lighthearted way of getting readers to think outside of the box. This is simply an attempt to provide a contrarian perspective, and these headlines are not – we repeat – are not – predictions or recommendations, but rather a way to hammer home the line from the famous 18th-century proverb that “the best-laid plans of mice and men often go awry.”

COVID pandemic becomes the COVID nuisance as CDC eyes new bug

After more than two full years in a pandemic environment, the SARS-Cov-2 virus is now viewed as nothing more than a common cold. The combination of vaccination, previous infections, and new treatments that inhibit the virus mean the United States has returned to pre-pandemic norms. Scientists at the CDC are now monitoring a new bird flu that is spreading across South America.

~~~

Americans celebrate sub-$3 gas just in time for July 4th weekend

Surging US shale patch drilling and an aggressive output slate from OPEC have sent crude prices tumbling into the $40s. With oil collapsing, American drivers are getting relief and inflation has slowed.

~~~

Fed fears unrealized as rates unchanged in 2022

Weaker than forecasted first half inflation led to patience in the middle of the year, while the slowdown in global growth and US employment kept feet off the breaks at the FOMC in the second half. With US growth slowing dramatically into 2023, it’s not clear when the central bank will tighten policy.

~~~

Little fish eat big sharks as investors ditch mega-caps in favor of small caps

Despite ongoing growth, multiple contraction for large tech names has left many to lag the explosive re-rating of small-cap stocks that are able to grow with the rest of the US economy. Small-cap strength recalls the early-2000s unwind of the last great tech bubble.

~~~

China back on the map as ADRs roar in spite of regulation

While Chinese authorities have made it harder for companies to list abroad amidst concerns over data security and social control, those that remain on US exchanges have had a stellar year. A return to growth in 2022 along with reduced concerns about outright bans on US listings has made Chinese ADRs one of the biggest winners this year.

~~~

Euro soars as post-COVID boom pushes ECB towards rate hikes

A newly-hawkish ECB concerned with surging economic growth and plunging unemployment has driven up the value of the euro relative to the dollar this year. Falling oil prices have also helped the energy import picture on the continent.

~~~

Move over sewer socialism, there’s a new left-wing development model in Latin America

The ongoing renewables build-out has sustained copper and lithium prices which are fueling a strong peso and rapid economic growth. After the election of Gabriel Boric late in 2021, Chilean assets were supposed to pay the price of a left-wing policy slate. But politics has proven indifferent to larger trends at work in the global economy.

~~~

Brazilian assets soar in spite of right-wing collapse

The re-election of former President Luiz Inácio Lula da Silva and defeat of right-wing incumbent Jair Bolsonaro has been a boon for Brazilian stocks as leftward tilt proved to be largely priced in ahead of the election.

~~~

Outflows doomed ARK Invest to a weak 2021, but strong 2022 performance has lured investors back

Investors soured on ARK Invest and its hyper-growth focus as billions flowed out of the ARK family of ETFs. But by the end of Q1 2022, those outflows reversed, and stock-picking performance has driven a dramatic recovery.

~~~

Chips collapse as normalcy lowers multiples amidst a pause in the global semis cycle

After semiconductor names could do no wrong in the wake of the COVID crisis, prices soared. Supply and demand have since normalized and inventories have surged, leading to the selloff that has played out this year.

~~~

Newer EV manufacturers pummeled by legacy brands as Ford and GM capture more market share

Tesla’s established production and the constant drumbeat of new electric vehicle releases from major Detroit OEMs has crushed the valuation and attention placed on newer entrants. Factory lines are humming and dealer lots are jammed with buyers not content to wait for the slow ramp-up at companies like Lucid, Rivian, or Lordstown.

~~~

Cable box is the comeback kid; streamers lose steam to traditional TV

Even with streaming experiencing rapid growth overall, the proliferation of services and options has many consumers returning to old-fashioned cable and the reliability it brings. Household formation has also attracted customers for broadband internet, fueling a surprise in the number of internet customers cable companies attract.

~~~

Buffett takes profits in Apple after valuation appears ‘lofty’ sending the stock lower

With iPhone growth slowing, Apple has re-rated from its 35x multiple to much more reasonable levels. The billions wiped off its market cap following the revelation that Buffett’s Berkshire Hathaway sold its entire position have compounded as the company struggles to answer metaverse innovation from competitors.

~~~

Meta stock soars after Zuck goes into hiding

In a marketing ploy seemingly lifted from young adult novel “Ready Player One,” Meta has successfully ginned up interest in its Metaverse platform with a dynamic competition for new users: a $10 million prize for whoever tracks down Mark Zuckerberg’s avatar first. Unlike its mega-cap tech peers, Meta’s stock has reached new heights in 2022 as its market cap approaches $2 trillion.

~~~

Democrats Ride Blue Wave to Bolster Majorities in House and Senate

After Covid burned out early in 2022 and oil prices dropped below $60 per barrel following a Q1 supply increase from OPEC+, increasingly confident consumers rewarded President Pelosi with firmer majorities in the House and Senate. Speaker Cortez and Majority Leader Sanders have pledged to hold a vote on Build Back Better before Thanksgiving.

~~~

Same old retailer, brand new optimism: how Bentonville’s finest is booming

Most of Wal-Mart’s business is still old-fashioned big-box retail, where results have been mixed this year. But tech-oriented partnerships designed to make the company more competitive with delivery and e-commerce apps are fueling growth and enthusiasm for one of the world’s largest companies.

~~~

All hail ride-hailing: UBER and LYFT soar as labor markets soften and riders return

With the fading burden of COVID, Americans are headed out for a night on the town, and they’re using ride-sharing to do it. The softening of labor markets with slower growth than expected is also making driver acquisition easier and improving take rates for the platform companies.

~~~

Forget Beeple and Bored Apes, collectors want Holden Caulfield and Gatsby

As interest has ebbed from NFTs, sneakers, and baseball cards, collectors are now flocking to rare first edition books with “fine” dust jackets. In the second half of 2022, first editions of 20th-century classics like Catcher in the Rye, To Kill a Mockingbird, and The Great Gatsby have shattered sales records.

~~~

Golden year for Gold

Still-low real rates have meant precious metals have turned in a big year. High inflation in 2021 didn’t help gold, but the reversal of planned rate hikes sent TIPS yields lower and boosted gold. Surging retail interest hasn’t hurt either.

~~~

Yen soars versus dollar amidst a booming Japanese export economy

As the dollar has dragged this year, the yen has gained, while Japanese exports have boomed. Normalizing natural gas prices and falling crude import bills have also served to flatter the Japanese balance of payments and added to the upward pressure on the yen that comes from a lower path of Fed hikes and flight in global risk appetite.

~~~

New Yorkers place bets on historic Jets/Giants Super Bowl

With both the New York Jets and New York Giants sitting atop their respective conferences as the 2022 season nears its end, a frenzy for 2023 Super Bowl tickets has emerged in the Big Apple.

(Okay, so maybe we’ve gone a little overboard with the Jets/Giants Super Bowl headline! That’s the biggest long shot of them all.)

Bespoke’s Morning Lineup – 12/31/21 – Like Shooting Fish in a Barrel (Sort of)

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Time sometimes passes quite quickly.” – Jimmy Page

With a decline into the close yesterday and modestly weaker futures this morning, US equities are limping into the close of 2021 after a strong year of gains. Maybe we would have all been better off if, like many countries in Asia and Europe, markets had decided to close today in observance of New Year’s Day tomorrow. Happy New Year!

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

It’s been a pretty incredible run for the market this year. It may not sound impressive at first, but through the end of the day Thursday the S&P 500 traded higher on just under 57% of all trading days this year. To put that in perspective, in sports betting, it’s practically unheard of for any professional to have a consistent winning percentage of even 55%. Not only has the S&P 500 traded higher on nearly 57% of all trading days this year, but last year (2020) more than 57% of all trading days were positive, and the year before that (2019) the winning percentage was just over 59.5%!

With this year’s 56%+ winning percentage, the last three years rank as just the second time since 1945 that the S&P 500 was up on more than 55% of all trading days for three straight years. The only other similar streak was from 2004 to 2006 (55.56%, 55.95%, and 55.78%), but during that streak, not one of the three years was as consistent to the upside as any of the last three years. Outside of one of the most tumultuous five weeks in history back in early 2020, for most of the last three years, the market has been on cruise control. Hopefully, it doesn’t run into any speed traps in 2022.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Small Caps vs Large Cap Spread When Yields Change

The recent underperformance of small caps has been partially attributed to rising current yields and assumed rate hikes in 2022. However, small caps have not historically always declined during periods when treasury yields have been on the rise. In fact, since 2000, the S&P 600 Small Cap Index has tended to outperform the S&P 500 during years when the 10-year yield rose. The first table below shows years when the 10-year yield increased, and for each year we also show the performance of the small-cap S&P 600 and the large-cap S&P 500. In the nine prior years where the 10-year yield increased, the S&P 600 outperformed the S&P 500 by an average of 6.0 percentage points (ppts) and a median of 3.6 over the course of the year with outperformance 70% of the time.

In the second table, we show years where the 10-year yield declined, and in those years small caps still outperformed but by a more modest 2.4 ppts (median: 0.2 ppts). This goes to show that not all small caps are negatively impacted by rates, but it is worth noting that the names in the S&P 600 tend to have positive earnings whereas the Russell 2000 has a larger number of unprofitable companies. The Fed has signaled multiple rate hikes in 2022, but based on historical trends it should not necessarily be interpreted as a negative headwind for small-cap stocks with positive earnings.

The worst year since 2000 for small caps relative to large caps was in 2019 when the group underperformed by 8.3 percentage points and in 2019, rates declined by 70 basis points. The best year for small caps on a relative basis was in 2000 when the 10-year yield dropped 148 bps and the S&P 600 outperformed the S&P 500 by 22.3 ppts. Click here to view Bespoke’s premium membership options.

Dogs of Major Indices

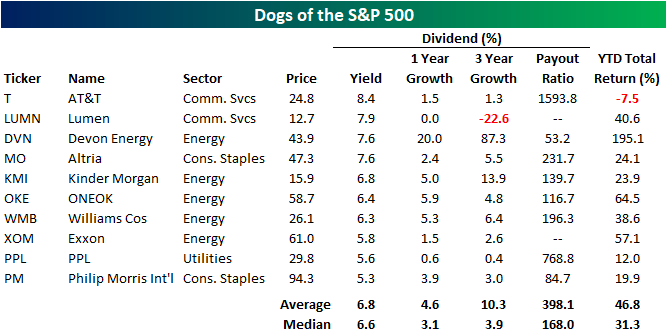

The Dogs of the Dow is a popular hands-off investing strategy that says to simply buy the 10 stocks in the Dow Jones Industrial Average with the highest dividend yield at the end of each year. As we approach the end of 2021, below is a look at the ten Dow stocks that would currently make up the Dogs of the Dow for 2022. As shown, Verizon (VZ), Dow (DOW), and IBM top the list with dividend yields of 4.9%, while Coca-Cola (KO) and Intel (INTC) have the lowest yields of the Dogs at just under 3%. On average, the 10 Dogs have a yield of 3.9%, and they’re only up 12.8% so far in 2021. Notably, every member of this list has increased or maintained their dividend over the last three years.

We thought it would be interesting to find the 10 “Dogs” of the S&P 500 and Nasdaq 100 as well. The table below shows the 10 highest yielding stocks in the S&P 500 at the moment. These ten stocks have an average dividend yield of 6.8%, and two of the ten are tobacco companies Altria (MO) and Philip Morris International (PM). It is worth noting that most of the members on this list have paid out more in dividends than they have taken in on a net income basis over the last twelve months, which seriously puts into question the sustainability of the dividend. And aside from AT&T (T) which is down 7.5% YTD, these stocks haven’t exactly been “dogs” when it comes to share-price performance recently. On a total return basis, these ten stocks have averaged a sizeable gain of 46.8% so far in 2021.

Below is a look at the ten highest yielding stocks in the Nasdaq 100 at the moment. While Nasdaq 100 names aren’t typically thought of as attractive dividend payers, these ten stocks have an average yield of 3.2% at least. That’s not much less than the average yield of 3.9% for the ten Dogs of the Dow. Kraft Heinz (KHC) is at the top of the list with a yield of 4.5%, but this stock has seen its dividend growth actually decrease over the last three years, and its payout ratio is pretty high at 85.1%. Four more names have yields between 3 and 4% — Gilead (GILD), Walgreens (WBA), American Electric (AEP), and Amgen (AMGN). Broadcom (AVGO) has the lowest yield of the 10 Nasdaq 100 Dogs, but it has increased its dividend by 23.6% over the last three years and by 10.8% over the last twelve months. Click here to learn about Bespoke’s premium research services where you can get more in-depth reports and analysis of markets.

Breadth Disconnects

As we mentioned in today’s Sector Snapshot and yesterday’s Chart of the Day, breadth for the S&P 500 has ripped higher recently. In the charts below, we show the price and cumulative advance/decline (AD) lines for each of the eleven sectors and the S&P 500. The cumulative advance/decline line measures the daily number of advancers minus decliners within a sector or index over a given time frame. Bulls want to see this reading make new highs when the index or sector’s price makes new highs. Right now, every sector but Communication Services and Energy is seeing new highs in the cumulative AD line. Three sectors have seen their cumulative AD line make new highs this week even though the index’s price has not yet made a new high — Consumer Discretionary, Financials, and Industrials. That’s a hugely positive divergence. Click here to view Bespoke’s premium membership options.

Bulls Bounce Back

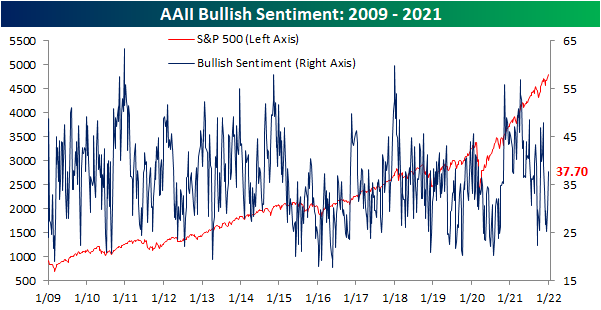

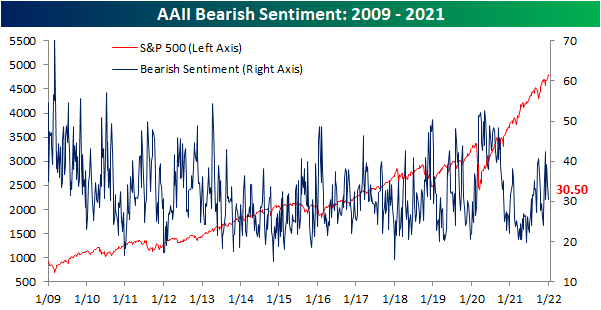

Only two weeks ago, bullish sentiment according to the AAII had collapsed to some of the weakest readings of the post-pandemic period. Over the past two weeks, sentiment has gradually recovered with a significant pick up in this final week of the year. Now at 37.7%, bullish sentiment gained 8.1 percentage points this week for the largest increase since October. While recovered, the actual level of bullish sentiment is far from notable essentially in line with the historical average of 38%.

The increase in bullish sentiment over the past two weeks largely borrowed from bears. Bearish sentiment fell 3.4 percentage points in the most recent week following a 5.4 percentage point drop last week. Now at 30.5%, the share of respondents reporting as bearish is right in line with the historical average.

Given the inverse moves of the two readings, the bull-bear spread is now back into positive territory after five weeks of negative readings. At 7.2, the spread is not particularly elevated and only 0.2 points away from the historical average of 7.4.

Not all of the gains to bullish sentiment have come from former pessimists. The share of respondents reporting neutral sentiment has also unwound this week falling from 36.6% to 31.8%. That is the lowest reading since the first week of the month when exactly 31% of respondents reported neutral sentiment. Click here to view Bespoke’s premium membership options.