Meme Stock Mania Anniversary

Last week was the most recent update of short interest data through mid-January, and that came on the one-year anniversary of the height of the meme stock mania when highly shorted stocks like GameStop (GME) experienced historic short squeezes. The year since then has not been kind to heavily shorted names. The Bloomberg High Short Interest index tracks the 100 US stocks with the highest short interest as a percent of float with monthly rebalancing. As shown below, since the height of meme stock mania on January 27th of last year, this basket has now been more than cut in half!

Although highly shorted stocks have performed terribly in the past year, the level of short interest across multiple industry groups is well below where it stood prior to last year’s short squeeze. As shown below, levels of aggregate short interest for each industry group were little changed in the first two weeks of the year, but are also a fraction of what they were at the end of 2020.

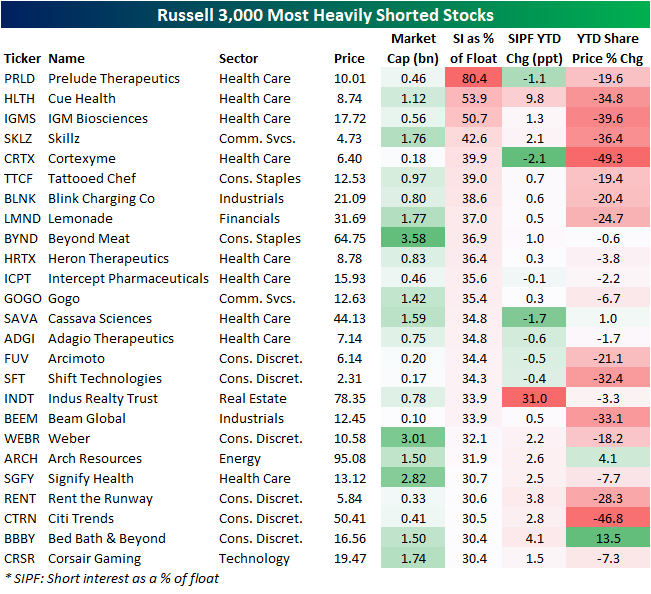

Below we show the stocks that currently have the highest levels of short interest of Russell 3,000 members. Prelude Therapeutics (PRLD) tops the list with more than 80% of float shorted. That is actually down slightly versus the last reading through the end of 2021. Cue Health (HLTH) and IGM Biosciences (IGMS) are the only other stocks with over half of their shares shorted. Those two, as well as several other highly shorted stocks, are down over 30% in January. The two worst decliners are Citi Trends (CTRN) with a 46.8% loss and Cortexyme (CRTX) which has nearly been cut in half. As for the meme stock mania posterchild GameStop (GME), it now ranks as the 209th most heavily shorted stock.

Indus Realty Trust (INDT) also finds itself high up on the list of highly shorted stocks, but that is a recent change. Its short interest has surged 31 percentage points in the first half of January on what has been a relatively small stock price decline in the same time. NETSTREIT (NTST), Codex DNA (DNAY), and Cresent Energy (CRGY) are the only other stocks to have seen double-digit percentage point jumps in short interest so far in 2022. Want more in-depth analysis from Bespoke? Click here to view Bespoke’s premium subscription options.

Massive Month-End Buying of Biggest Losers

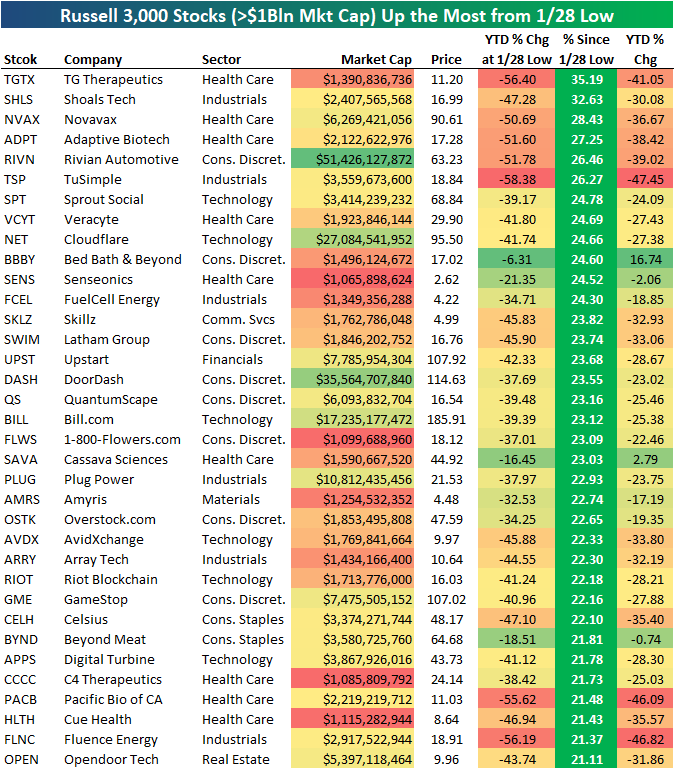

The average stock in the Russell 3,000 is now up 7% from the index’s low point last Friday (1/28) as we near the final close of January 2022. We have seen some massive rallies since Friday morning when US markets started the day in the red. Below is a look at the Russell 3,000 stocks with market caps >$1 billion that are up the most since their intraday lows last Friday. For each stock, we also show how it had performed on a year-to-date basis at its low point last Friday. What we see here is that the stocks that are up the most during this two-day month-end rally are generally the same ones that were down the most YTD heading into the rally. The six stocks that are up the most since their lows on Friday are up 26%+, but five of the six were down 50%+ YTD at their lows! A 50%+ YTD decline usually takes more than a month to play out, but not this year! And 25%+ rallies usually take more than two trading days to play out as well.

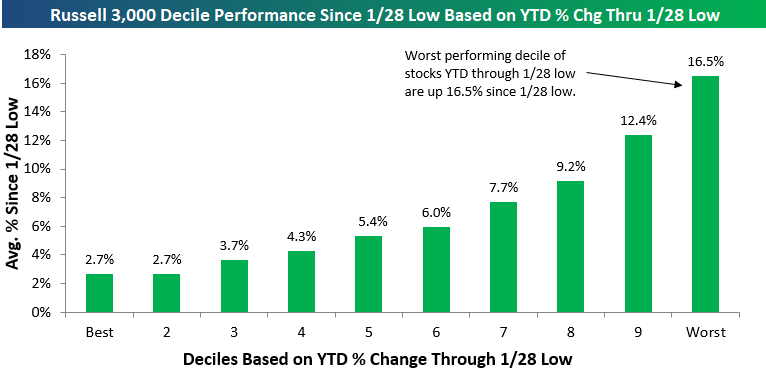

If we break the Russell 3,000 into deciles based on YTD performance through the low on Friday (1/28), we can clearly see that the stocks that were down the most YTD are the ones bouncing back the most. The 10% of stocks in the Russell 3,000 that were down the most YTD at the low on 1/28 are up an average of 16.5% since. Conversely, the 10% of stocks in the index that were doing the best YTD at their low point last Friday are only up 2.7% since then.

Below is a look at the rally off last Friday’s lows by sector. The average Health Care stock was down 25%+ YTD at last Friday’s low, but they’re now up more than 10% since then. Tech stocks were down nearly 20% YTD on average through last Friday’s lows, and they’re up 9.8% since.

We would note that the Energy sector is the only one that saw stocks up YTD through last Friday’s low, and they have tacked on a gain of 3.8% since then for a full-year average gain of 8.44%. Stay on top of market trends by becoming a Bespoke subscriber today. Click here to view Bespoke’s premium membership options.

The Rogan Rollercoaster

Any publicity is good publicity, right? When it comes to the world’s largest podcast and the company that hosts it, that seems to be holding true at least for today. As of this writing, Spotify (SPOT) is trading up double-digits versus Friday’s 52-week low for its fifth-best day on record since its IPO as the company has been in a whirlwind of headlines over the past week. Those headlines concern comedian Joe Rogan’s Spotify exclusive podcast, The Joe Rogan Experience, and the controversy it has caused due to artists like Neil Young pulling their music from the platform citing COVID misinformation on Rogan’s podcast. While there have been a slew of headlines in the past few days coinciding with huge moves in SPOT’s stock, it is not the first time this has happened.

In the chart below, we show Bloomberg and other major news agency headlines concerning Joe Rogan, his show, and Spotify over the past two years. Since Spotify and Joe Rogan first struck a deal to have the podcast exclusively on the platform in May 2020, headlines surrounding the show have at multiple points resulted in huge swings in the stock. When news of the deal first hit the tape, the stock soared and then soared again even more substantially roughly a month later as analysts upgraded the stock in response to the deal. In fact, that response to upgrades resulted in the stock’s third-best single-day gain on record. From May 2020 before the deal was announced to the highs later that summer in July, SPOT would rise from around $150 to a little under $300. After a few months of consolidation, including a sharp but short-term drop when Spotify staff gave pushback on Alex Jones’ appearance on Rogan’s show, the stock surged again on strong earnings partially accredited to the addition of the podcast. SPOT then erased much of those gains in early 2021, and more backlash over COVID “misinformation” again sent the stock lower last spring. While the last earnings report in the fall saw the stock spike higher, it quickly reversed lower and the recent onslaught of headlines resulted in a 52-week low on Thursday, leaving SPOT at similar levels to when the Joe Rogan deal first went through.

While there is some overlap with earnings, as previously mentioned, days in which Spotify and Joe Rogan find themselves in the news have coincided with some of the stock’s largest single-day moves or highest volumes. In fact, today is on pace to be the third-best day since the deal with Joe Rogan went through and volumes in the past several days have sat around the 90th percentile of all days since the stock’s IPO.

The most recent string of headlines have hit the tape with only a few days left before the company reports Q4 results. Using data from our Earnings Explorer tool, SPOT has historically traded weak in response to earnings. Since its IPO in 2018, there have only been four quarters in which the stock had a positive one-day reaction to its earnings report. One of those was last quarter when the stock rose 8.3%. When it comes to Q4 specifically, the stock has yet to react positively to earnings and the stock’s average decline has been the weakest of any quarter averaging a decline of 5.21%. Click here to view Bespoke’s premium membership options.

Nasdaq Drops Over 10 Percent in January

As of 10 AM this morning, the Nasdaq has shed over 10% in January, which would mark the first full-month decline of over 10% since March of 2020. Before the COVID-induced crash, the Nasdaq had not lost 10% in a calendar month since November of 2008. When the dot-com bubble popped at the beginning of the 21st century, 8 months saw declines of more than 10%.

Short-term forward performance has been relatively mixed following prior 10%+ monthly drops for the Nasdaq. On the first day of the following month, the Nasdaq has averaged a gain of 10 basis points with positive returns 54% of the time. The first week of the next month has seen the index average a gain 10 basis points as well with positive returns 54% of the time, while the next month has seen an average gain of 50 basis points with positive returns 50% of the time.

Looking further at next-month returns, the maximum upside seen since the index was created after one of these occurrences was +17.2% (Oct. 1974) and the maximum downside was -17.7% (Oct. 2008). The average absolute change for the next month is 10.7%, which is significantly above the average for all periods (+/-4.6%). Just like much of the research we have published over the last few weeks has found, this data suggests that more volatility should be expected in February.

Looking at the most recent 10%+ monthly drop in March 2020, the Nasdaq started April 2020 with a huge decline of 4.4% (on April Fool’s Day), but by the end of the month, the index was up 15% MTD. Prior to March 2020, the Nasdaq amazingly had back-to-back-to-back 10%+ monthly declines in September, October, and November 2008. Stay on top of market trends by becoming a Bespoke subscriber today. Click here to view Bespoke’s premium membership options.

Bespoke Brunch Reads: 1/30/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Biology

Frogs Regrow Missing Limbs in Lab Study, Advancing Key Effort of Regenerative Medicine by Aylin Woodward (WSJ)

A new drug cocktail is a small step forward, but a step nonetheless in the quest to regrow human limbs lost to disease or accidents. [Link; paywall]

Why we are living in an era of unnatural selection by David Farrier (BBC)

Evolution is an inexorable force framed by the environment living things inhabit. Humans have radically altered that environment and the results are as interesting as they are hard to believe. [Link]

Why The Animal Critic Gives The Panda An F (NPR)

Pandas are lazy, refuse to reproduce, and their primary source of food is one they are not able to properly digest. That compares to the noble octopus, which is highly intelligent and have strong memories. [Link]

Renewables

Bumper year-end for Chinese offshore wind as feed-in tariff expires by Nadia Weekes (WindPower Monthly)

As subsidies for wind power farms were set to end, ten different 300MW+ Chinese wind farms entered service in December, with a combined capacity off 3.5GW; China is targeting 1.2TW of total wind and solar capacity by 2030. [Link]

McKinsey calculates the staggering capital spending required to reach net-zero by 2050 by Emma Newburger (CNBC)

The cost of transitioning to net-zero GHG emissions by 2050 would need $3.5trn per year in capital spending, equivalent to 7% of household spending in 2020. [Link]

Tesla

Elon Musk offers college student $5,000 to delete Twitter bot tracking his private jet over ‘security concerns’ – but the IT major refuses and asks for internship instead by Keith Griffith (Daily Mail)

A teenager collated data from a range of public sources to create a Twitter bot that keeps the world appraised as to what Elon Musk’s private jet is up to, leading to a very amusing offer and counter-offer. [Link]

Tesla Now Runs the Most Productive Auto Factory in America by Tom Randall and Demetrios Pogkas (Bloomberg)

While the entire auto industry has suffered from the semis shortage, Tesla’s Fremont, CA factory is churning out more finished cars than any of the more than 70 national auto manufacturing facilities. [Link; soft paywall]

Growth

ARKK’s Claims of an Anti-Innovation Market Ring Hollow by Robby Greengold, CFA (MorningStar)

An investigation of ARK Invest’s claims that weak performance has been due to a market-wide attack on innovation-related stocks more generally. [Link; registration required]

Startup Funding Triples to a Record $15 Billion in Latin America by Ezraa Fieser (Bloomberg)

2021 was a benchmark year for tech startups in Latin America as investors poured more than $15bn in to the region’s new companies, more than three times the prior record. [Link; soft paywall]

We Might Be in a Simulation. How Much Should That Worry Us? by Farhad Manjoo (NYT)

If we start to see the virtual world as just as “real” as the non-virtual one, what does that say about how “real” the non-virtual world is? [Link; soft paywall]

Fugitive Crystal Cruises’ luxury ship on the lam expected to stay in Bahamas’ safe haven by Jay Weaver, David J. Neal, and Anna Jean Kaiser (Miami Herald)

A cruise ship that is owned by a bankrupt company has become a federal fugitive, with an arrest warrant issued and US Marshalls in pursuit across the Caribbean. [Link]

Mobility

The cultural dynamics of declining residential mobility by Nicolas Buttrick and Shigehiro Oishi (NIH)

Declines in mobility are linked to significant changes in culture that create feelings of cultural stagnation and even concrete material costs to people who used to be able to move but now are stuck in place. [Link]

Gambling

Parlay Cards Prove to be Worst Bet Gamblers Make in Las Vegas Casinos in 2021 by Darren Rovell (Action Network)

Casinos keep 32% of the money that punters bet on parlays, which are a uniquely terrible wager in terms of the take for bettors looking for a long shot. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Equity Market Pros and Cons — Q1 2022

This week’s Bespoke Report is an updated version of our “Pros and Cons” edition for Q1 2022.

With this report, you’re able to get a complete picture of the bull and bear case for US stocks right now. It’s heavy on graphics and light on text, but we let the charts and tables do the talking!

On page two of the report, you’ll see a full list of the pros and cons that we lay out. We then provide slides for each “pro” or “con” that we’ve highlighted.

To read this report and access everything else Bespoke’s research platform has to offer, start a two-week trial to Bespoke Premium.

Heard on Conference Calls: Q4 Earnings Season

Below are some of the most interesting quotes pulled from our Conference Call Recaps since the start of the Q4 earnings season:

Supply Chain/Inflation

- According to Apple CEO Tim Cook, the logistics environment “is very elevated in terms of the cost of moving things around. I would hope that at least a portion of that is transitory, but…the world has changed.”

- In regards to supply chain issues, Intel CEO Pat Gelsinger added, “As we predicted, these ecosystem constraints are expected to persist through 2022 and into 2023, with incremental improvements over this period.”

- Tesla CEO Elon Musk stated, “In 2022, [the] supply chain will continue to be the fundamental limiter of output across all factories. So, the chip shortage, while better than last year, is still an issue.”

- Although Johnson & Johnson reported solid results, multiple segments were negatively impacted by “raw material availability” and “supply chain constraints,” according to CFO Joseph Wolk.

- 3M CEO Mike Roman commented, “we’re going to see a volatile environment in the first half of 2022. Things should get better in the second half, but I would not expect a big snap back on stability of supply in 1Q of 2022.”

- Procter & Gamble CEO Jon Moeller pointed out that “Higher commodity and freight cost impacts combined were a 460 basis points hit to gross margins.”

- Moeller continued, “Transportation and labor markets remain tight, availability of materials remain stretched in some categories and in some markets, inflationary pressures are broad-based with little sign of near-term relief.”

COVID related

- The Netflix management team blamed “COVID overhang and macro-economic hardships in several parts of the world like LATAM” as a factor hindering growth.

- Intuitive Surgical reported that “COVID-19 has had, and will likely continue to have, an adverse impact on the company’s procedure volumes.”

- United Health CFO John Rex commented, “In the most recent weeks inpatient hospitalization levels for our members are similar to the January 2021 levels, even with national COVID case rates about 4x higher.”

Technological Development

- In terms of the metaverse, Microsoft CEO Satya Nadella commented, “And as the digital and physical worlds come together, we are seeing real enterprise metaverse usage, from smart factories to smart buildings to smart cities.”

- Nadella continued, “As every company becomes a digital company, they will need a distributed computing fabric to build, manage, secure and deploy applications anywhere.”

- American Express aims to stay at the “leading edge of technology and digital payment solutions to make American Express an essential part of our customers digital lives,” as per CEO Stephen Squeri.

- In November, Netflix unveiled its mobile gaming experience globally, which allows members to “discover and launch games from within the Netflix mobile app.”

- Tesla CEO Elon Musk believes that “over time, we think Full Self-Driving will become the most important source of profitability for Tesla”.

Broader Economy

- American Express is forecasting “higher than long-term aspirational levels of revenue growth” through 2023 due to elevated levels of consumer spending, according to the investor presentation.

- Union Pacific EVP Kenny Rocker stated that the company “will face continued challenges in our energy-related market.”

- In regards to the energy market, Baker Hughes CEO Lorenzo Simonelli added, “As we look ahead to 2022, we expect the pace of global economic growth to remain strong although slightly moderate compared to 2021. We believe the broader macro recovery should translate into rising energy demand for 2022 and relatively tight supplies for oil and natural gas.”

- Simonelli continued, “growth rates are likely to moderate from 2021 levels as central banks are expected to begin tightening monetary policy in order to reduce COVID-related stimulus plans and quell growing inflationary pressures.”

- Automatic Data Processing CFO Don McGuire commented, “a gradual ongoing recovery in labor force participation will support job growth in the first half of the year.”

- Boeing CEO David Calhoun referenced the international markets, stating, “Recovery continues broadening in Europe and South America [but] further lockdowns have stagnated recovery in China.”

In summary, management teams anticipate operating in a continued inflationary environment, but the supply chain constraints are expected to ease in the back half of 2022. Since COVID emerged, there has been an increased focus on digitization, which certain companies are attempting to capitalize on. In regards to the energy market, supply is expected to remain tight while demand strengthens, thus implying a higher price point for related commodities.

To stay up to date with Corporate America’s rhetoric, become an Institutional Subscriber today to get full access to our Conference Call Recaps. Click here to view a sample of the conference call recaps that you would be receiving on a daily basis during earnings season.

Dogs of the Dow Dominating

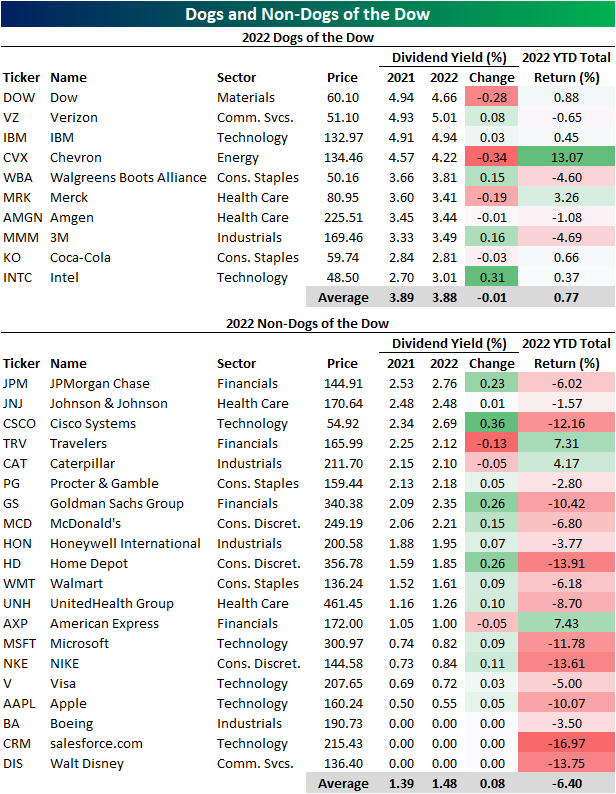

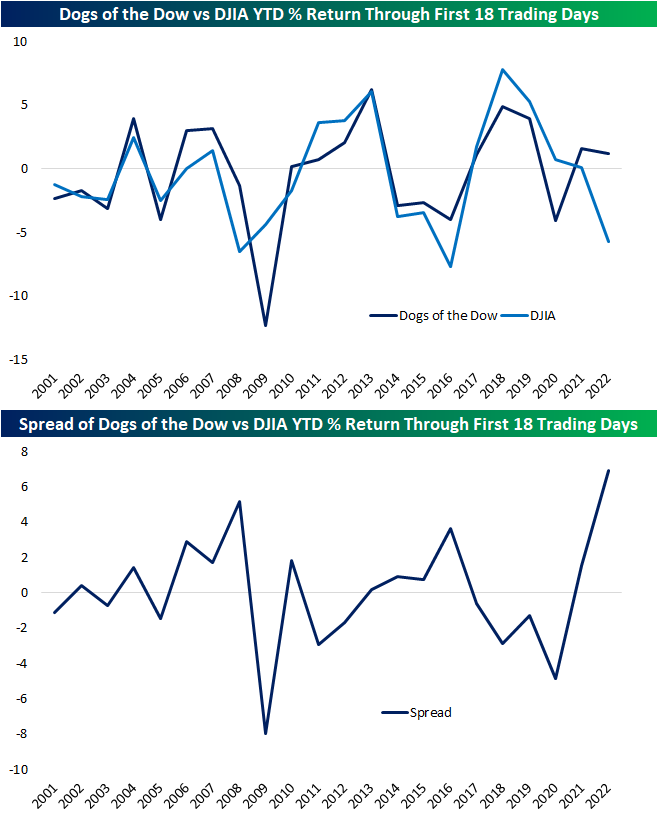

At the end of last year, we highlight the performance of the “Dogs of the Dow” in 2021. The Dogs of the Dow is a simple strategy that says to buy the ten highest yielding stocks in the Dow at the end of each year. In 2021, the Dogs underperformed, but so far in the new year, the complete opposite is true. As shown below, a little more than half of the Dogs are in the black year to date compared to only three (of twenty) non-dogs that are positive.

Taking a look at an index of the Dogs of the Dow going back to 2001, this year has marked the widest gap in returns between the Dogs and the broad Dow 30 through the first 18 trading days of the year. The only year that comes anywhere close to the gap in performance was 2008, and unlike this year, back then the Dogs were in the red at this point of the year. Click here to view Bespoke’s premium membership options.

Yield Curve Goes Flat

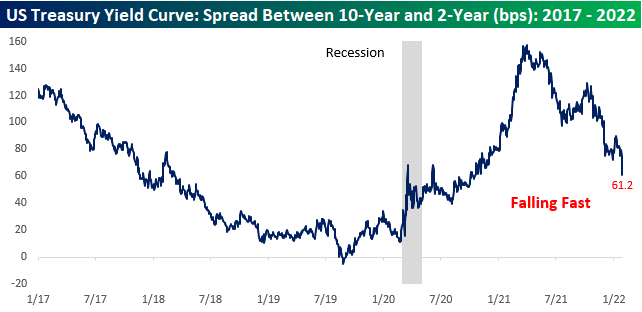

Even as the FOMC is still adding to its balance sheet, hawkish commentary from Powell and company has caused massive moves in the fixed income market resulting in a massive flattening of the yield curve. Today alone, the spread between the yield on the 10-year and 2-year US Treasuries has narrowed by nearly 10 basis points (bps). Even more extreme, is the fact that over the last three months the curve has flattened by more than 50 bps from well over 100 bps to just over 60 bps.

Looking at the three-month rate of change in the yield curve, it hasn’t flattened this fast in at least five years. Last summer, we saw a similar but not as severe of a move.

Taking a longer-term look, flatter yield curves aren’t necessarily a negative economic signal, but there is an inverse relationship between the level of the yield curve and recession concerns i.e., the flatter the curve gets the more the market starts to price in the odds of a recession. As shown in the chart below, every recession since the late 1970s has followed an inversion of the curve.

In terms of the pace of flattening in the 2s10s curve, the current pace has been the swiftest since January 2015, and longer-term, there haven’t been a whole lot of periods where the curve flattened at a faster rate. Looking on the bright side, though, a rapid flattening of the yield curve by itself has not been a siren song for an impending recession. As shown in the chart below, there have been numerous times over the last 40 years where the curve steepened by as much (red line) or more than it has in the last three months and the economy was nowhere near a recession. Click here to view and sign up for Bespoke’s premium membership options.

Extreme Bearish Sentiment

As equities continue to sell off, sentiment continues to tank in a broad sense. That being said, there was actually a higher share of respondents to the AAII survey reporting bullish sentiment this week. Coming off the lowest level since July 2020, bullish sentiment rose slightly and remains historically low at 23.1%.

Bearish sentiment, meanwhile, has surged 22.4 percentage points in the past month with more than half of respondents falling in the bearish camp this week. At 52.9%, it was the highest reading since the week of April 11, 2013. In other words, sentiment this week among survey respondents was more negative than even the COVID Crash. In all weeks since the start of the survey in 1987, there have only been 40 other weeks with as high if not higher of a reading.

Given the massive increase in bearish sentiment, the bull-bear spread has also outright collapsed. At -29.8, bears outnumber bulls by the widest margin again since April 2013.

Given bullish sentiment was actually higher as bears surged, the difference came from a big drop in neutral sentiment. Neutral sentiment fell by 8.4 percentage points to 23.9%. That is only the lowest neutral sentiment reading since the first week of September of last year, but it was the biggest week-over-week decline since November 2020.

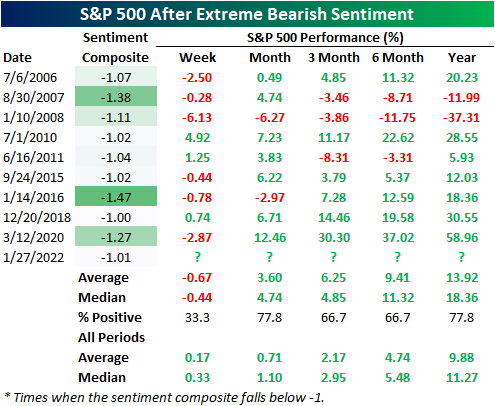

The AAII survey was far from being alone in indicating bearish sentiment. The Investors Intelligence survey of newsletter writers saw the most bearish readings since the spring of 2020 and the NAAIM Exposure index also saw one of the more modest readings of the past year. Using all of these readings combined, we created our sentiment composite below to get a more general feel for sentiment across these indicators. This week, that composite fell below -1 meaning on average sentiment indicators are a full standard deviation below (or in a bearish direction) their normal reading. Of course, that was the first time such a reading has been observed since the COVID crash.

With data beginning in 2006, there have only been nine other times in which the sentiment composite has fallen below -1 for the first time in at least three months. In the table below, we show those instances and how the S&P 500 has performed going forward. Overall, that bearish sentiment proves to be correct in the next week as the S&P 500 has declined two-thirds of the time. One month to one year later, though, returns have been biased to the positive side with positive returns at least two-thirds of the time. Click here to view Bespoke’s premium membership options.