Oil and Stocks Mix It Up

Like oil and water, oil and stock prices generally don’t mix. A big jump in oil prices usually leads to lower stock prices, while stock prices often experience a boost when oil prices decline. That’s what makes the performance of both to start the week so interesting with the S&P 500 up over 5% week to date through Tuesday’s close while oil prices surged nearly 9% during that same span.

In the case of oil prices, two-day rallies of the magnitude we saw through Tuesday’s close have been common going back to the start of 1984 which is as far back as we have full-year data on a daily basis. You could even say that moves of this magnitude have been relatively common.

Two-day rallies in equity prices of the magnitude seen this week haven’t been nearly as common, but we wouldn’t call them rare either. Besides this week, there have been 23 other times since 1984 when the trailing two-day performance of the S&P 500 was greater than this week’s two-day rally.

Where things really start to get much less common is when both the S&P 500 and crude oil prices rally 5% or more at the same time. That has only happened six other times since 1984, and prior to 2008, it had never happened before. The chart below shows the S&P 500 since 2007 with the red dots showing every day that both the S&P 500 and crude oil rallied 5%+ over a two-day span. Four of those occurrences came during and coming out of the Financial Crisis, another was in August 2015 when China devalued the yuan, and the most recent occurrence before this week was right after the COVID crash lows. With the exception of the first occurrence right after Lehman’s bankruptcy in September 2008, every one of the other occurrences came either in the later stages of a bear market or coming out of a significant decline, and what they all have in common is that they occurred during periods of severe market dislocations.

One aspect of the first occurrence in September 2008 that has bears salivating is that the S&P 500’s pattern leading up to that occurrence looks very similar to the pattern now, and in each case was down by similar amounts from all-time highs (19.2% in September 2008 and 20.7% as of Tuesday’s close). Additionally, in both cases, the bounce came shortly after the S&P 500 broke below a prior low. Looking more closely at the two periods and overlaying them on top of each other, though, besides the fact that the S&P 500 was down sharply in the year leading up to both periods, the patterns don’t look all that similar after all and the correlation between closing prices is just 0.63. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/5/22 – Giving Back

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When nobody wants something, that creates an opportunity.” – Carl Icahn

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Equity futures are giving back much of yesterday afternoon’s gains and treasury yields are higher as markets reverse some, but certainly not all, of the moves from the last two trading days. ADP Private Payrolls increased 208K in September which was slightly above the consensus forecast of 200K. Oil is down marginally today ahead of an expected production cut announcement today, but crude rallied over 8% to start the week in anticipation of today’s decision. Overnight and this morning, we’ve seen the release of Services PMIs for a number of countries, and the general trend was of sequential declines suggesting that economic momentum continues to wane.

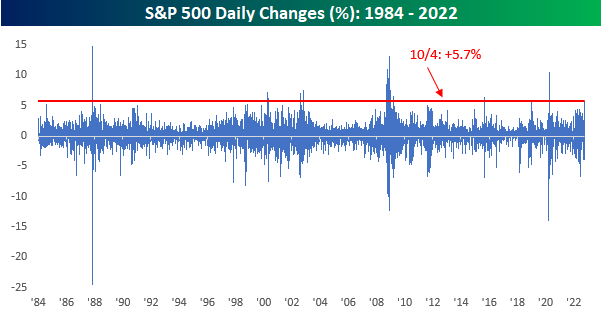

The S&P 500 rallied 5.7% in the first two trading days of the week, and while large, moves of this magnitude haven’t been unprecedented, and looking back over the last 50 years, there have been more than 30 other two-day rallies of 5%+. This week’s move was the largest since April 2020 and we saw a number of similar moves in the weeks coming off the COVID lows. Between those occurrences and the Financial Crisis, there was one occurrence in late 2018 and another in August 2015.

The red dots in the chart below indicate every prior day where the two-day trailing return of the S&P 500 was 5% or more. In recent years, a number of these occurrences came right or near market lows, but over the longer term, they have sprung up in all sorts of market environments like near market tops, early in a downturn, near market lows, or in the early stages of new bull markets. In other words, their level of significance is debatable.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

A Five Times in a Lifetime Moment

File this under “You Don’t See This Very Often.” Equities surged over 2% yesterday reversing a recent trend of relentless declines since late August. It wasn’t just equities that rallied though. Everything did. Crude oil gushed more than 4.5% and even Treasuries caught a bid as prices at the long end of the curve jumped 1.5%. Taken by themselves, yesterday’s moves in all three asset classes were large but hardly out of the norm. It was the 29th time this year that the S&P 500 rallied 1.5% or more in a single day, the 66th time that crude oil advanced at least 1.5%, and the long-bond future has now rallied more than 1.5% six different times this year. Again, nothing to raise eyebrows at.

What was unique about yesterday, or at least used to be considered unique, was the fact that all three asset classes rallied 1.5%+ on the same day. All three asset classes tend to rally for different reasons, so what’s good for one isn’t always good for the others. Therefore, it’s very uncommon to see them all rally like that on the same day. It’s so uncommon, in fact, that since the late 1970s, it has only happened four other times, and one of them was last week on 9/28! The three other occurrences were on 10/7/88, 9/16/97, and 11/4/08.

Below we have included charts of the S&P 500 in the six months before and one year after each of the three prior occurrences. Again, these are the three times prior to last week that the S&P 500, the long bond, and crude oil all rallied more than 1.5% on the same day.

Back in October 1988, markets were concerned about Fed rate hikes and a weaker than expected non-farm payrolls report along with a downward revision to readings from prior months. These were the catalysts for the move as economic growth was still strong but at a pace that was not as strong as anticipated, which raised hopes that the FOMC would not have to be as aggressive in hiking rates. While the S&P 500 experienced a pullback of about 7% shortly after the one-day rally, the longer-term uptrend remained intact, and the S&P 500 was up more than 25% over the course of the next 12 months.

The move in September 1997 came right before the downturn from the Asia Financial Crisis and was spurred on by a weaker-than-expected CPI report. The S&P 500 was in the middle of a sideways range at the time of the simultaneous rallies and it remained there for the next three months. Over the next 12 months, the S&P 500 was up over 10% after rallying as much as 25%.

The third prior occurrence in early November 2008 capped off a six-trading day 19% rally in the S&P 500, and the index was back at new lows by the end of the month. The move came on Election Day, but polls had already shown a clear path to victory for Obama, so it wasn’t anything election specific that caused the move. More likely, the rally followed what had essentially been a waterfall decline where everything declined and declined sharply. From that close to the ultimate trough in March 2009, the S&P 500 lost a third of its value before finally bottoming, but one year later, the S&P still managed to gain just over 4% in total.

Again, the current period is unique relative to the prior three since we’ve seen it happen twice within the same week! Like the period in 2008, yesterday’s move followed a period in the market where everything was declining. Unlike the 2008 occurrence, though, both moves came the day after the S&P 500 closed at a 52-week low rather than just late in a near 20% rally in the S&P 500. Like the first two occurrences in 1988 and 1997, although the market isn’t in an uptrend this time around, the move was spurred on by weaker economic data, raising hopes that the FOMC would take a less hawkish approach to monetary policy.

While there isn’t a clear common link between the current period and the prior three, moves like yesterday where stocks, bonds, and crude oil all rallied sharply (1.5%+) have been extremely uncommon over the last 45 years.

Brazilian Equities (EWZ) Ripping

Of a number of country ETFs, Brazil (EWZ) has far outpaced the rest of the world as we noted last week. With some well-received news on the election front over the weekend, that outperformance has been amplified even as other global equity markets similarly have posted large gains. Whereas the average country ETF is down 20.73% year to date, Brazil is up over 17%. So far this week and in the month of October, EWZ has also left the rest of the world in the dust rallying nearly 11%; more than twice the average for other emerging markets.

As shown above and in the chart below, the past couple of days’ surge in price in the wake of the country’s election going to a runoff has sent the ETF smashing through its 50-DMA as well as its 200-DMA. Not only is that coming off of a lower low, but additionally it has now moved above the high end of the range since early August. That being said, the move has resulted in the ETF approaching extremely overbought levels.

As for just how large the move has been, below we show the daily moves in EWZ since its inception in July 2000. With a gain of 9.85% yesterday, there have only been a baker’s dozen other times with a daily move that was even larger. The most recent of these was March 24, 2020 (+12.06%); one day after the pandemic low for many equity markets around the world. However, earlier that month there were equally if not even more impressive daily moves of 10.1% on March 10th, 13.1% on March 17th, and 17.62% on March 13th. Prior to that, only 2008 and 2002 single-day moves of as large an amount.

As previously mentioned, the rally in Brazilian equities has been impressive, but so too has been the bounce here in the US as well as the rest of the world. As a result of the corresponding moves, the ratio of EWZ to SPY has moved up to the highest level since August 2021. In spite of the recent outperformance in 2022, from a longer-term perspective (the past five years), the ratio has been in a downtrend and essentially moved sideways during the post-pandemic rally. In other words, the past few days have been impressive for Brazilian equities, but one day does not necessarily make a trend. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/4/22 – Captain Macro Still at the Helm

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“So the last shall be first, and the first last: for many be called, but few chosen.” – Matthew 20:16

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The market is finally getting some positive follow-through for a change. After yesterday’s 2.5% rally, the S&P 500 is poised to gap up over 1.5% while the Nasdaq is looking at an even larger gain of 2.0%, and this comes despite no let-up in geo-political concerns as North Korea fired a ballistic missile near Japan. Traders have instead chosen to focus on central bank policy and a lower-than-expected rate increase from the Reserve Bank of Australia (25 bps vs 50 bps expected). The hope is that Australia’s easing off the gas pedal is a sign of things to come from other central banks around the world.

In addition to the spike in equity futures, treasury yields are lower again with the 10-year yield down below 3.6% and the 2-year now just a couple of basis points above 4%. Crude oil is up another 1% and getting closer to $85 per barrel. The earnings calendar remains quiet for the next few days, and the only economic reports on the calendar are Factory Orders and JOLTS (both reports for August).

Usually, when you get a rally following a steep market decline, the dogs of the downturn lead the subsequent rally. It’s called the dash for trash. The logic behind the trend makes perfect sense. The stocks that drop the most during a market decline are the ones that investors expect to be the most negatively impacted by the market catalyst, whether it be rising rates, economic weakness, geo-political concerns like a war in Europe, or weather events like a hurricane hitting a major population center. Once investors perceive that weight to lift, these stocks start to levitate.

Take the war in Europe. Surging energy prices from the near or complete shut-off of energy supplies to Europe from Russia have taken a higher share of the disposable income of consumers in that region and forced some European industrials to halt production since it’s become too expensive to keep the lights on. If the Ukraine war were to end, though, energy prices for the region would likely come back in, and these consumers and companies that have been hurt the most would have the most to gain.

In yesterday’s rally, though, the dash for trash was not evident. The chart below shows the performance of Russell 1000 stocks yesterday broken out by deciles based on their YTD performance through last Friday’s close. While the worst-performing stocks YTD (deciles 7 through 10) slightly outperformed yesterday, so too did the best-performing stocks YTD (decile 1), and the other five deciles barely underperformed. In other words, traders were not just buying the ‘losers’.

So, what happened? We’ve been highlighting the extreme daily breadth readings in the S&P 500 for weeks now, and this ‘all or nothing tone’ of the markets -more ‘nothing’ than ‘all’ lately – is reflective of a market driven by macro forces. Instead of specific sector/company fundamentals acting as the primary driver of performance, factors like central bank actions or the latest comments from a Fed official have taken precedence Captain Macro is still steering the ship.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

ETF Total Returns Across Asset Classes

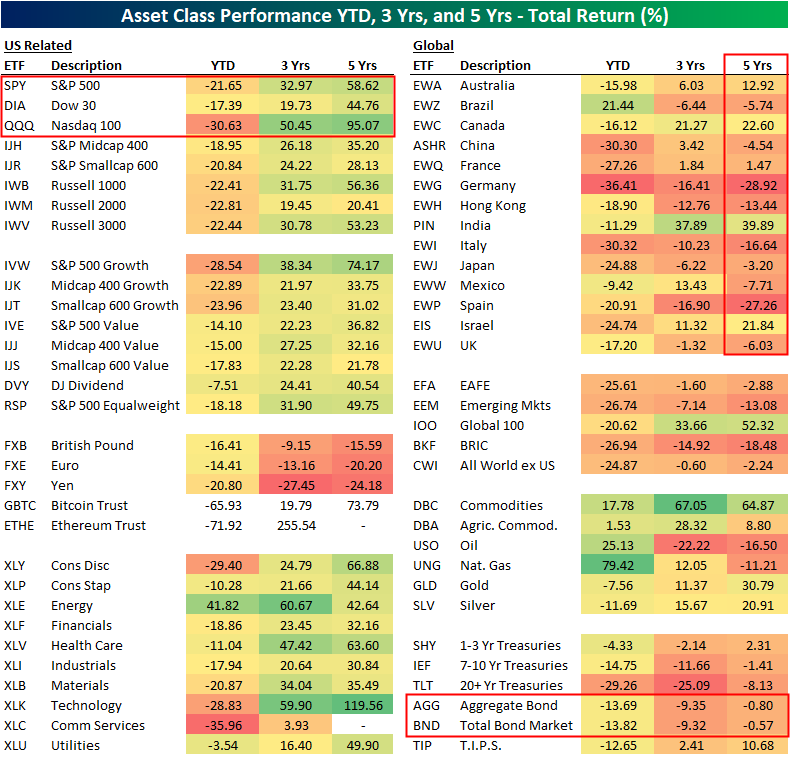

Below is a look at our key ETF matrix highlighting total returns over the last five years, three years, and year-to-date. What’s most remarkable to us is how bad five-year performance has gotten for quite a few asset classes. Significant drops in price this year have erased years of built-up gains, and now a lot of areas of global financial markets are actually looking at double-digit percentage declines going back to the late 2010s.

The major US index ETFs are sitting on 20%+ declines in 2022, but they’re still up nicely over the last three and five years. The Nasdaq 100 (QQQ) is down 30% YTD but still up 95% over the last five years. Only the Technology sector ETF (XLK) has done better on a five-year total return basis out of all the ETFs listed in the matrix.

On the flip side, an unrelenting rise in interest rates this year has caused the bond market to suffer its worst drawdown in decades. This has left the aggregate US bond market ETFs (AGG, BND) now lower on a total return basis over the last five years. The long-duration 20+ Year Treasury ETF (TLT) is down 25% over the last three years and 8% over the last five years.

Outside of the US, every major country ETF in our matrix has underperformed SPY over the last five years. India (PIN) is up the most (+39.9%) and the closest to SPY’s 58.6% five-year gain. Canada (EWC) and Israel (EIS) are both up just over 20% over the last five years, while Australia (EWA) and France (EWQ) are the only others in the green. Spain (EWP) and Germany (EWG) are down the most with five-year declines of more than 25%! Click here to learn more about Bespoke’s premium stock market research service.

Looking more closely at stocks vs. bonds, below is the five-year total return of the S&P 500 (SPY) vs. the US aggregate bond market (AGG). Historically there has been an expectation that bonds would cushion the blow when stocks fall, but 2022 has been uniquely painful for both asset classes. While SPY has fallen more than 20% this year, it has still posted a total return of nearly 60% on a five-year basis. The bond market, on the other hand, is now negative over the last five years. Click here to learn more about Bespoke’s premium stock market research service.

2%+ Starts to a Quarter: A Baker’s Dozen

With a gain of 3% heading into the last hour of trading, the S&P 500 is on pace for just the 13th day since late 1952 (when the 5-day trading week on the NYSE started) when it started a quarter with a gain of over 2%. The last time the index kicked off a quarter with a 2%+ gain was in Q1 of 2013, and the last time it started Q4 with a 2%+ advance was 19 years ago in 2003. If the S&P 500 manages to hold onto its current gains, it would be just the 6th such gain of 3%+ to kick off a quarter since 1953.

It’s nice to see stocks rally for a change, but does a strong start to a quarter imply anything about the rest of the quarter ahead? The table below lists the 12 prior quarters where the S&P 500 rallied more than 2% on the first day of a quarter. For each occurrence, we also show how the S&P 500 performed for the remainder of the quarter. Of the twelve different 2%+ rallies highlighted, the S&P 500 rallied an average of an additional 2.1% (median: 2.5%) for the rest of the quarter with gains two-thirds of the time. Of those twelve different occurrences, though, the range of returns varied widely with the best rest-of-quarter performance being a gain of 18.7% (Q1 1975) while the largest rest-of-quarter decline was 14.4% in Q1 2009. At the bottom of the table, we also show the average ‘rest of quarter’ returns after the first day of trading for all quarters since 1953. With an average gain of 2.0% (median: 2.7%) and gains 66.5%, the returns are nearly the same as returns following strong starts to the quarter. In other words, based on the results following the 12 prior occurrences, a strong start to the quarter tells you very little about the rest of the quarter’s performance. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke Market Calendar — October 2022

Please click the image below to view our October 2022 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 10/3/22 – New Start

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If I’ve made myself clear, I’ve misspoken.” – Alan Greenspan

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s a new quarter, and investors hope the clean slate leads to a more positive backdrop for equities. That being said, with S&P 500 futures indicated 1% higher at the open, it would only erase two-thirds of Friday’s decline, not to mention the losses from the rest of the week. Along with higher equity futures, oil prices are up around 5% on the news out this weekend of a potential million barrel per day production cut by OPEC+. Treasury yields are significantly lower this morning as the 10-year yield dipped below 3.70%. On the economic calendar, the big report to watch this morning will be the ISM Manufacturing at 10 AM. Economists are forecasting the headline number to drop modestly from 52.8 down to 52.4.

Heading into the new quarter, the YTD losses for individual sectors and where they are trading relative to their 50-day moving averages are staggering. Year to date, four sectors are down over 25% and another three are down over 20%. Two more are down over 10%, and the 7% decline in Utilities seems like a win at this point. The only sector in the green YTD remains Energy, and with oil prices higher this morning on reports of an OPEC+ production cut, the sector is poised to add to those gains this morning.

While the YTD declines have been steep, the recent weakness has really put many sectors into deeply oversold territory. The fact that all but two sectors (Health Care and Energy) are at ‘Extreme’ oversold levels (greater than two standard deviations below 50-DMA) is illustrative enough, but it’s not often that you get seven sectors trading more than 10 percentage points below their 50-day moving averages.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 10/2/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

FT on LDI

LDI: the better mousetrap that almost broke the UK by Alexandra Scaggs and Louis Ashworth (FTAV)

An explainer on liability-driven investing (LDI), which is being fingered as the biggest factor in the collapse of the UK government bond market this week amidst new fiscal plans and a plunge in the pound. [Link; registration required]

Who exactly has the BoE bailed out? by Toby Nangle (FTAV)

When the BoE intervened to make sure the gilt market didn’t collapse under a mountain of margin calls, who was the ultimate beneficiary? Was it underwater pension funds or their counterparties? [Link; registration required]

Housing

The U.S. Rental Housing Market is Cooling Off Fast by Jay Parsons (RealPage)

Higher rates, inflation, and collapsing consumer confidence are destroying demand for housing as the process that creates new households slows down. As demand slows, so too will rents over the coming months. [Link]

Remote Work and Housing Demand by Augustus Kmetz, John Mondragon, and Johannes Wieland (FRBSF Economic Letter)

New research suggesting that the increase in remote work during the pandemic drove more than half of the overall increase in national home prices between November 2019 and November 2021. [Link]

10 Markets Where Sellers Are Cutting Home Prices the Most by Shaina Mishkin (Barron’s)

Price cuts are mounting across a US housing market that has been frozen by high rates. Sunbelt cities like Phoenix, Austin, and Las Vegas have the largest share of the market with cuts in price. [Link; registration required]

Florida

Hurricane Ian to add reinsurance rate momentum, disrupt Florida market: KBW by Steve Evans (Artemis)

Insurance analysts are growing increasingly concerned about the impact Ian will have on the Florida insurance market, with a price tag above $50bn most likely. For thinly-capitalized insurers who don’t have much reinsurance capacity, it could spell doom for the Floridian property insurance market. [Link]

Ukraine

The 90km journey that changed the course of the war in Ukraine by Henry Foy, Sam Joiner, Sam Learner and Caroline Nevitt (FT)

A step-by-step review of the lightning breakthrough which has led to a collapse in Russian lines across Eastern Ukraine, in a fantastic multimedia format. [Link; paywall]

Denmark, Germany and Poland warn of ‘sabotage’ after Nord Stream leaks by Richard Milne, David Sheppard, and Guy Chazan (FT)

Underwater explosions that led to ruptures in the Nord Stream pipeline complex have led multiple countries to identify Russia as the most likely culprit and likely to strike at other infrastructure as well. [Link; paywall]

New York

NYC Proposal Offers Cash for Spotting Parking Violations in Bike Lanes by Fola Akinnibi and Skylar Woodhouse (Bloomberg)

A new law in New York City would turn citizens into bounty hunters seeking cars that so often block bike lanes around the city. [Link; soft paywall]

Yankees’ threat of sitting Aaron Judge finally ended long rain delay with Red Sox by Brendan Kuty (NJ.com)

ESPN was desperate to air a final at bat for Aaron Judge in his pursuit of 61 homeruns and pressured MLB to extend a rain delay. In response, Yankees manager Aaron Boone threatened to sit the start. [Link]

New Jersey

Three men charged with fraud in $100 million New Jersey deli scheme by Mike Calia and Dan Mangan (CNBC)

A tiny deli ended up being listed as part of a $100mm market cap company that is now embroiled in a series of charges including securities fraud. [Link]

Political Science

Can nonviolent resistance survive COVID-19? by Erica Chenoweth (Journal of Human Rights/Taylor & Francis Online)

The COVID-19 pandemic did not reduce the number of mass protests around the world but those protests did show much less efficacy in achieving their aims. [Link]

Food

The story of white sauce, Virginia’s unique contribution to Mexican American cuisine by Mattew Korfhage (The Virginia-Pilot)

Virginia isn’t known for its Mexican food, but that hasn’t stopped the state from developing a unique contribution to the cuisine: a white sauce that won’t be found anywhere else. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!