Bespoke’s Morning Lineup – 12/22/22 – Back to Normal

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Make a game plan and stick to it. Unless it’s not working.” – Yogi Berra

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Today is looking like a back-to-normal 2022 day for US stocks as futures are trading lower. The gains were fun while they lasted. Looking on the bright side, there are only five trading days left in the year. Elsewhere in markets, the 10-year yield is down slightly to 3.65% while oil has been quietly rallying and is now just under $80 per barrel.

The economic calendar is busy today as many reporting agencies try to squeeze in this month’s reports before Christmas. Data released so far hasn’t been particularly market-friendly as revised GDP came in higher than expected (3.2% vs 2.9%) and Core PCE was revised higher (4.7% vs 4.6%). Jobless claims were also strong with initial claims coming in lower than expected (216K vs 222K) and continuing claims also coming in slightly better than expected (1,672K vs 1,675K). If they were to have any impact on Fed policy, none of these reports would suggest less of a hawkish stance.

The more things change, the more they stay the same. Even after two days of gains, sector performance over the last five trading days has been pretty poor and almost exactly in line with performance rankings on a YTD basis. As shown in the scatter chart below which compares YTD performance versus the last week, there has been a clear correlation between the two with an r-squared of 0.78. Heading into year-end, investors are following the game plan of selling their losers and buying the few winners.

Looking at a snapshot from our Trend Analyzer, four of the S&P 500’s eleven sectors are down over 4% in the last week, another four are down more than 2%, two are down over 1%, and only Energy is higher. In terms of where sectors are now trading with respect to their trading ranges, there’s still pretty much of an even split between sectors trading above and below their 50-day moving average with six above and five below. Consumer Discretionary is the only sector in oversold territory. While that may seem like an ominous sign heading into the Christmas season, it’s worth remembering that retailers usually underperform at this time of year. Also, Tesla (TSLA) makes up about 13% of the sector, so the stock’s weakness has been a drag on the overall sector.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Morning Lineup – 12/21/22 – Two in a Row?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The graveyards are full of indispensable men.” – Charles de Gaulle

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

As we get closer to Christmas, the pace of news starts to slow, so that’s why one of this morning’s headlines concerns a Twitter poll. After more people voted that they wanted him to step down as CEO of the social media company, Elon Musk announced that he will step down as CEO of Twitter once he finds “someone foolish enough to take the job!” Elon has also suggested in the past week that no one besides him with the ability to do so would take on the job of leading the company when he noted, “No one wants the job who can actually keep Twitter alive. There is no successor.”

We also had some positive (or not as bad as expected) earnings news after the close on Tuesday with Nike (NKE) trading up over 10% and FedEx (FDX) up close to 5%. Expectations heading into the Q4 earnings season next month have really been negative, but at least these companies are starting off with a good first impression.

On the economic calendar this morning, the only reports scheduled are Existing Home Sales and Consumer Confidence at 10 AM.

Even with US stocks on pace for their second straight day of gains, it hasn’t been a pretty December for stocks. What was an uptrend from the October lows has been broken in a convincing way, and the only hope for chart watchers now is that the June lows hold creating what could turn out to be a reverse head-and-shoulders pattern.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Mega-Caps Down $5 Trillion in Market Cap, AMZN Now Down $1+ Trillion

As we approach the end of 2022, below is an updated look at the drawdown in market cap that we’ve seen in the US equity space since major indices peaked on the first trading day of the year. Using the Russell 3,000 as a proxy, the US stock market has seen an $11.7 trillion drawdown from the peak on 1/3/22. The max drawdown was $13.6 trillion at the low on 9/30, so we’ve seen market cap increase by just under $2 trillion since then. In dollar terms, this drawdown has been more extreme than anything investors have ever experienced. That’s pretty deflationary if you ask us!

Of the $11.7 trillion drawdown in US equity market cap, just over $5 trillion of the drop has come from six companies! Below is a look at the six current and former “trillion dollar market cap” club members that have now collectively lost about $5.07 trillion in market cap from their peaks. As shown, Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta (META), and Tesla (TSLA) have all lost at least $750 billion in market cap from their highs. And Amazon (AMZN) is the first to lose more than $1 trillion in market cap! Just a few years ago, no company had a market cap of more than a trillion dollars, and now we have a company that has lost more than a trillion dollars in market cap.

For all six of these companies, their current drawdowns are easily their biggest on record. Apple (AAPL) has lost $880 billion, Alphabet (GOOGL) is down $846 billion, Meta (META) and Tesla (TSLA) are both down more than $760 billion, and Microsoft (MSFT) is down $784 billion even though it was down close to a trillion at its lows in November. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 12/20/22 – Japanese Jolt

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“To lose is to win” – Japanese Proverb

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

If the above statement is true, 2022 should end up as one of the best years ever. Right? Futures are mixed this morning, but there was still some big news overnight in central bank moves as the Bank of Japan raised the upper bound of its cap on the 10-year JGB yield by 0.25 percentage points to 0.50%. While the move wasn’t entirely a surprise, the timing was. Just yesterday, in our Morning Lineup, we discussed how this type of action would likely be taken in April when Kuroda retires from the BoJ.

While equity futures have seen little impact from the BoJ news, interest rates in the US are higher across the board this morning with the 10-year yield up to 3.66%. In economic news, the only data on the calendar today is Building Permits and Housing Starts at 8:30. Building Permits missed by a mile while Housing Starts actually posted a slight beat.

The Bank of Japan’s jolt to financial markets overnight had one of the most direct impacts on the value of the yen which surged 3% relative to the dollar. Besides just the last 24 hours, it has been a very strong two months for the yen. After the dollar peaked at 150 yen two months ago today, it has experienced a sharp move lower falling more than 10% versus the yen and looking at the chart in recent weeks, there have been a number of sharp single-day moves lower.

The USD/JPY cross is now significantly below its 200-DMA after closing below that level earlier this month for the first time since early 2021 – nearly two years earlier! Going back to 1972, that streak of 462 trading days was the longest streak of closes above the 200-DMA on record and just the fourth streak that lasted more than a year.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

B.I.G. Tips – Disney (DIS) Falls to COVID Crash Lows

Weaker than expected ticket sales for its new Avatar movie were part of the reason Disney (DIS) shares fell another 4.77% yesterday. As shown below, the stock has now round-tripped its entire post-COVID bull market run-up from $85.76 to a high of $201.91 seen on March 8th, 2021. At $85.78, DIS is now just two cents above its COVID Crash closing low.

Start a two-week trial to Bespoke Premium to read more about Disney’s current drawdown and how it compares to prior big moves lower.

Homebuilder Stocks Hold Steady In Spite of Sentiment

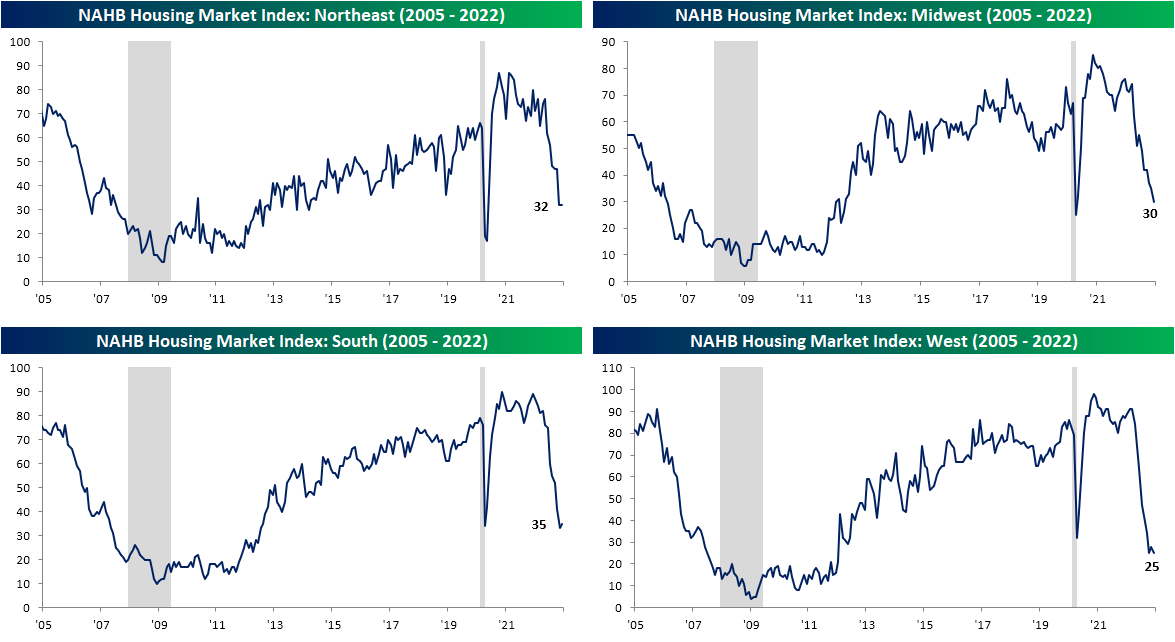

The economic calendar is particularly light today with the only release in the US being homebuilder sentiment from the NAHB. In spite of mortgage rates sitting 0.8 percentage points below their early November peak, homebuilder sentiment has continued to fall reaching a new low of 31 in December versus expectations for a modest increase to 34. December’s reading is now only one point above the spring 2020 low of 30.

The two-point drop in December was entirely a result of the decline in present sales. That reading fell from 39 to 36, matching the April 2020 low. Meanwhile, future sales saw a large increase rising from 31 to 35. That is only back up to the same level as October and a historically muted reading, but the month-over-month increase was the largest since September 2020. The index for Traffic went unchanged at 20 which is the lowest level since April 2020.

The regional readings on homebuilder sentiment echo the weakness from the headline levels, albeit there has been slightly more variability. For starters, the Northeast has seen sentiment hold up the best as current readings are a bit more elevated off of COVID lows. The Midwest is also handily above the spring 2020 lows, but there was massive deterioration with a 5-point drop this month. Meanwhile, the West dropped another 3 points to match the new post-COVID low and the weakest reading since January 2012. Finally, the South was the only region to see improvement in December with the index rising 2 points, but even with that, it is right near the lowest levels since the pandemic.

Homebuilder stocks, proxied by the iShare US Home Construction ETF (ITB), traded lower in the wake of today’s release after months of outperformance. As shown below, the ETF is trading well above its moving averages compared to the S&P 500 which has moved back below both its 50 and 200-DMAs in the past few days. As such, the relative strength line for homebuilders has continued to move higher. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 12/19/22 – Less Than Ten

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Humbug” – Ebenezer Scrooge

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

If there’s any consolation to this Monday morning, it’s that there are only nine trading days left to go in 2022, and it’s only fitting that the world was introduced to Ebenezer Scrooge 179 years ago today with the publication of A Christmas Carol by Charles Dickens. Futures are actually slightly higher this morning (but giving up ground as the morning goes on). News-wise, the next two weeks are likely to be rather quiet, and the only economic report on the calendar today is homebuilder sentiment at 10 AM. In international markets this morning, the only headlines of note are the fact that COVID cases in China are reportedly surging as the country rips the band-aid off of its zero-COVID policy, while in Japan, there is talk that the BoJ will finally revise its monetary policy to a more hawkish stance.

Last week was a disheartening one for bulls as the optimism of a break above the 200-DMA and the potential for a break of the S&P 500’s downtrend was quickly erased. Not only were bulls not able to break the downtrend, but the S&P 500 also gave up its 50-DMA as well.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 12/18/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Crypto

Exclusive: How a secret software change allowed FTX to use client money by Angus Berwick, John Shiffman, and Koh Gui Qing (Reuters)

A small change in FTX code allowed Alameda Research to borrow indefinitely, regardless of the value of collateral posted by the hedge fund to the exchange. [Link]

All the young dudes carry the bags by Louis Ashworth (FTAV)

Using data from bank customers, JPMorgan made some basic demographic estimates about who bought crypto when. The results are about what you would think. [Link; paywall]

C-Suite

Bob Iger vs. Bob Chapek: Inside the Disney Coup by Joe Flint, Robbie Whelan, Erich Schwartzel, Emily Glazer and Jessica Toonkel (WSJ)

An inside account of the downfall of Disney’s CEO to Disney’s previous CEO, fueled by investor angst over streaming losses and perceptions that Chapek was driving the company into the ground. [Link]

Musk Shakes Up Twitter’s Legal Team as He Looks to Cut More Costs by Ryan Mac, Mike Isaac, and Kate Conger (NYT)

As turmoil mounts at Twitter, the company has stopped paying rent, refused to pay charter flight bills, and mulled the possibility of not paying severance promised to employees fired since the takeover. [Link; soft paywall]

Housing

Why This Housing Downturn Isn’t Like the Last One by Ben Eisen and Nicole Friedman (WSJ)

Few low quality mortgage loans, big equity cushions, and lots of people waiting for a dip in prices make this period of falling prices look very different from the subprime mortgage collapse. [Link; paywall]

Why Are Market Rents Decelerating? It’s Probably Not Because Of The Fed by Alex Williams (Employ America)

Rents started to slow before the rapid interest rate hikes of 2022 started, making them unlikely to be a consequence of Federal Reserve policy to slow the economy. [Link]

EU Politics

EU strikes deal with Hungary, reducing funding freeze to get Ukraine aid approved by Paola Tamma (Politico)

Hungary will see less of its EU funding frozen in exchange for lifting a veto on Ukrainian aid, part of a complicated process of negotiations that is par for the course when it comes to European Union legislating. [Link]

Emergencies

Gun Violence Is Falling In 2022 by Jeff Asher (Jeff-alytics)

National statistics showed a widespread uptick in shootings during the pandemic, but that spike appears to be reversing in 2022 as society returns to something more like normal. [Link]

Calling 911 in Charlotte? Your ambulance might show up without lights and sirens. by Genna Contino (The Charlotte Observer)

Ambulances are starting to run without sirens and lights in an effort to make emergency calls safer in the vast majority of calls to 9-1-1 that do not involve life-threatening emergencies. [Link; soft paywall]

Electric Vehicles

Ford increases F-150 Lightning price, now starts at $56,000 by Fred Lambert (Electrek)

The lowest-priced tier of Ford’s electric pickup now goes for 40% more than its original base price thanks to huge demand and soaring materials costs; higher-end versions are significantly more expensive. [Link]

Trading Education

School of Quant: At $29,000, a Public NYC College Outclasses Princeton by Heather Perlberg (Bloomberg)

An NYC resident will pay less than $30k for a Masters that will let them earn nearly $170k before bonus fresh out of graduation. [Link; soft paywall]

Accounting

The $80tn “hidden debt” and what it really means by Daniel Davies (FT)

When trying to assess financial vulnerability, labels matter. That’s especially true when it’s not entirely clear how those labels should be applied. [Link; paywall]

Grammar

Solving grammar’s greatest puzzle by Tom Almeroth-Williams (University of Cambridge)

A complicated system of 4,000 rules has finally been unlocked in full, with the 2,500 year old algorithm of Sanskrit word assembly’s last rule determined by a Cambridge PhD student. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 12/16/22

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

View this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

Bespoke’s Morning Lineup – 12/16/22 – Brace Yourself, It’s Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It isn’t what we say or think that defines us, but what we do.” – Jane Austen

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

A bad week just keeps getting worse as futures are continuing their post-FOMC sell-off. Heading into this week, the thought of weaker CPI and the Fed signaling a step down to 25 bps hikes at future meetings would have been considered a positive. That’s exactly what we got, but after an initial surge following Tuesday’s CPI, equities have been doing nothing but trading lower. Hawkishness from the FOMC and ECB has investors concerned that rates will be higher for longer raising the odds for a hard landing.

Well, 2022 you’ve finally done it. If there was any doubt about how bad of a year it has been, today’s decline in the S&P 500 will move 2022 into the lead for the largest number of 1% declines to close out the trading week going back to 1952 when the NYSE started the current five-trading day workweek. Heading into today, there were 15 declines of at least 1% in the S&P 500 on the last trading day of the week which was tied with 1974 and 2008 and one ahead of 2000 for the most in a single year.

Despite the record number of 1%+ declines to close out the week, the S&P 500’s cumulative decline this year on the last trading day of the week has been a decline of less than 9%. The reason is that not only has this year seen the highest frequency of 1%+ declines to close out the week, but it also tied with 1999 for the highest number of 1%+ gains (14).

All in, including today, the S&P 500 has ended the week with a gain or loss of at least 1% 30 times this year, or 60% of the time! Talk about an emotional market. And there are still two Fridays left after today!

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.