Dec 18, 2024

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“All great and honorable actions are accompanied with great difficulties, and both must be enterprised and overcome with answerable courage.” – William Bradford

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To view yesterday’s CNBC segment previewing the Fed decision today, click on the image below.

There’s a positive tone in futures this morning, but what makes today slightly different from the last two weeks is that the Dow futures are slightly outperforming on the session, and the equal weighted S&P 500 is up slightly more than the cap-weighted index. Could this be the long-awaited day of positive breadth where the Dow avoids a 10-day losing streak? There’s still a long way to go between now and the closing bell, and in between, we still have a Fed decision to get through.

After today’s FOMC decision, we’ll also get important policy announcements from the BoJ on Thursday and PBoC on Friday. Ahead of these meetings from the two largest central banks in Asia, equities in the region were mixed with Japan down 0.7% and China up by a similar magnitude. In Europe, trading has taken on a more broadly positive, although muted, tone. The STOXX 600 is up 0.2% after headline CPI for the Euro region fell 0.3% which was right in line with expectations, and Core CPI fell 0.6% which was also right in line with estimates.

Back here in the US, the only economic reports on the calendar are Building Permits and Housing Starts. Both indicators have been weak in recent months partly due to the hurricanes in the southeast. While economists were expecting a rebound, the results relative to expectations were mixed as Building Permits came in significantly better than expected while Housing Starts missed by over 100K. Much of that weakness was a result of weakness in multifamily units.

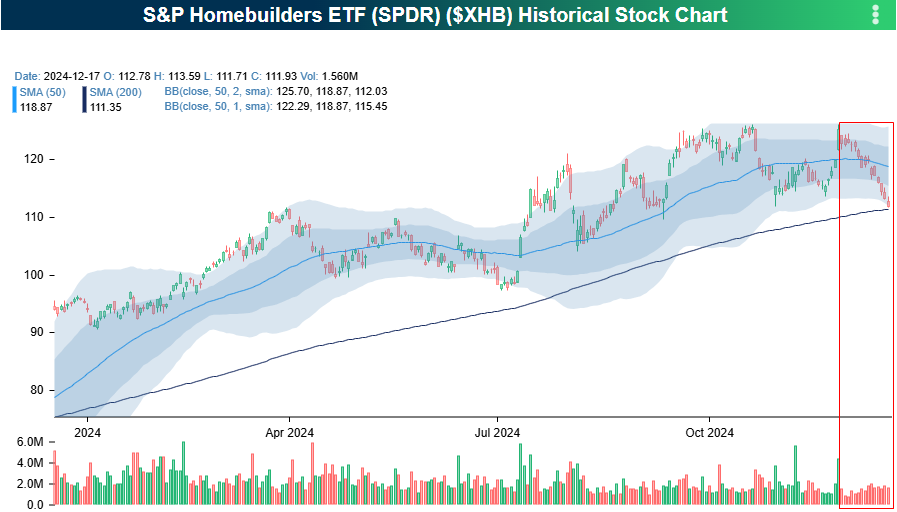

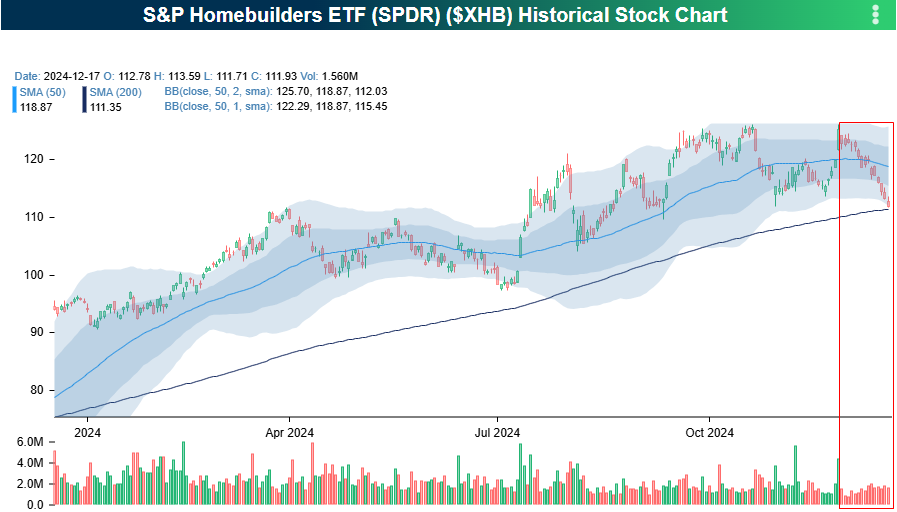

Speaking of housing, the homebuilder ETF (XHB) looks a lot like many other charts out there as there has been a consistent pattern of selling ever since December started. In the case of XHB, the selling started a little earlier on the Monday before Thanksgiving. Since then, if the market has been open for trading investors have been selling homebuilder stocks. If there’s any consolation to the recent weakness, it’s that XHB has remained above its 50-DMA, and the weakness has been on light volume. Since its high on 11/25, daily volume in XHB has been 39% less than it was in the prior eleven months.

As shown in the chart above, there has been a consistent trend of red bars in the chart of XHB over the last 15 trading days. In the entire history of the ETF, there has never been a longer streak where the ETF closed the session lower than it opened. If you think your kids can be persistent in asking for a specific holiday gift, they have nothing on the relentless selling in the homebuilders.

Dec 17, 2024

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If we all worked on the assumption that what is accepted as true is really true, there would be little hope of advance.” – Orville Wright

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Equity futures are firmly lower this morning even after headline Retail Sales for November came in better than expected. The S&P 500 is indicated to open down about 0.4% following more modest declines in Europe this morning and Asia overnight. There are additional economic data points on the calendar for today, including Industrial Production, Capacity Utilization, Business Inventories, and Homebuilder Sentiment, but the main area of focus will shift to tomorrow’s Fed decision and subsequent press conference where the market increasingly expects a more hawkish tone and dialing back of rate cut expectations.

There are too many memorable episodes to name when it comes to the show Seinfeld, but 27 years ago tomorrow (12/18/1997), the famous Festivus episode aired during the show’s last season. Everyone remembers the main Festivus plotline of the episode and the infamous airing of grievances. Another episode subplot concerned Jerry and his girlfriend Gwen, whom he met at his friend Tim Whatley’s (played by Bryan Cranston) Hanukkah party. As they see each other more often, and Jerry introduces Gwen to Kramer, he realizes that in some situations and lighting (like when he first met her at Tim’s party) Gwen looks great. In other situations and lighting, though, she looks entirely different and less attractive.

Gwen is today’s stock market. After closing within 0.3% of its all-time high yesterday and posting a month-to-date gain of 0.7% so far, the market looks great this month, just like a typical December.

Looking at it in another light, though, things look very different. On an equal-weighted basis, stocks in the S&P 500 are down an average of 3.2% this month, and the S&P 500 Equal Weight ETF (RSP) has closed lower than it opened for eleven straight days taking it below the 50-day moving average in the process.

Similarly, the Dow Jones Industrial Average has been showing similar weakness. Like the equal-weight S&P 500, the Dow has been consistently trading lower this month, and while it has managed to maintain its uptrend and hold above its 50-DMA for now, it has also traded consistently lower for most of the month.

In fact, through yesterday’s close, the ETF that tracks the Dow (DIA) has traded down on the day for eight straight sessions. That’s tied with three other streaks for the longest in the ETF’s history, and the three others that lasted as long ended in June 2006, August 2011, and most recently June 2018. There’s a lot to be thankful for in the market this year, but unless the internals can pull off some major feats of strength in the coming days, investors will have plenty of grievances to air at this year’s Festivus table.

Dec 16, 2024

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Abnormally good or abnormally bad conditions do not last forever.” – Benjamin Graham

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

It’s been a weak start to the week for global equities in Asia and Europe. In Asia, Retail Sales in China came in weaker than expected while Industrial Production was in line with estimates. In response to the data, Chinese 10-year yields made another new low while policymakers hint at fiscal and monetary moves to help break the rut in the Chinese economy. European stocks are currently modestly lower in response to weaker-than-expected flash manufacturing reports and a Moody’s downgrade of France.

While international markets are lower, US futures remain undeterred with S&P 500 futures trading up by about 0.2% while Nasdaq futures are up by twice that amount. The only economic reports on the calendar this morning are Empire Manufacturing which is expected to pull back from November’s surge and flash PMI readings for the Manufacturing and Services sectors. The big event of the week will be Wednesday’s Fed decision. While a 25 bps cut is all but certain, the market will be intently focused on the statement, revised economic expectations, and Powell’s press conference. With inflation proving to be stickier than most would like, a ‘hawkish cut’ has become increasingly priced in.

Abnormally bad may be a good way to describe the performance of value stocks to start December. The chart below shows the performance of the S&P 500 Value (IVE) and S&P 500 Growth (IVW) ETFs over the last year. While the S&P 500 Value ETF has seen its share of ups and downs within a longer-term uptrend over the last year, December has been consistently weak with ten straight days where it has closed lower than it opened.

As shown above, while value has been consistently weak, growth has rallied to new highs powered by mega-cap tech stocks. As a result of the divergent performances between the two styles, the S&P 500 Value ETF has declined 4.0% over the last ten trading days while the S&P 500 Growth ETF has rallied 3.4%. The chart below shows the 10-day performance spread between the two ETFs since their inception in mid-2000.

Over the last four years, there have been other periods when large-cap value stocks significantly underperformed growth while large-cap growth significantly underperformed at other times. There were other periods of elevated volatility between the two styles around the dotcom peak and during the Financial Crisis, but neither lasted anywhere as close to long as the current period. The term has been thrown around often in the last decade or longer, but is this era of elevated volatility between the performance of the two investment styles a new normal?

Even with the wide swings in performance spread of Value and Growth, the current spread is extreme relative to recent history as there have been only a few times when the spread was this wide, and they have all occurred in the post-Covid period (mid-2020, March 2022, and June 2024).

Dec 13, 2024

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“In general, things either work out or they don’t, and if they don’t, you figure out something else, a plan B.” – Dick Van Dyke

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

gain of 0.40% with positive returns just under 62% of the time!

Before you go out and buy everything this morning, though, there’s a big caveat to that average; one of the better market days on record occurred on March 13th, 2020 when the S&P 500 rallied 9.3%! If you take that out, the average S&P 500 performance on Friday the 13th falls by more than half to 0.15%. Still not terrible, though.

The chart below shows the S&P 500’s performance on each individual Friday the 13th since 1999. Big downside moves on Friday the 13th have been uncommon with just three days out of 42 where the S&P 500 fell more than 1% (December 2002, April 2012, and November 2015) while there have been seven days that rallied more than 1%. Who knows? Since Friday the 13th historically hasn’t been that unlucky for the market, maybe we’ll finally get a day of positive breadth!

Dec 12, 2024

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You only live once, and the way I live, once is enough.” – Frank Sinatra

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Heading into today’s PPI report, US equity futures took a breather after yesterday’s rally. While S&P 500 futures were just marginally lower, Nasdaq futures were down by a more sizable amount, indicating a decline of nearly 0.5%. Yields are up by a couple of basis points across the curve, crude oil is back above $70, and Bitcoin has held above $100K overnight for now at least.

The just-released November PPI came in hotter than expected at the headline level (0.4% vs 0.2%) and October’s reading was revised up from 0.2% to 0.3%. Ex food and energy, producer prices were inline with forecasts at 0.2%. While inflation data was on the hot side, jobless claims were weak. Initial claims spiked up to 242K versus forecasts for a reading of 220K while continuing claims also came in 9K higher than expected at 1.886 million. In response to the data, equity futures added modestly to their pre-market losses while yields erased most of their morning increases.

The Nasdaq broke out to a record high yesterday, and the S&P 500 finished within one-tenth of a percentage point shy of hitting its 58th record closing high this year, and the S&P 500 is up 27.5% for the year. With numbers like these, you can’t fault investors for being optimistic about the stock market. By just about every sentiment measure out there, investors have embraced the bull market, but many of the indicators we track seem somewhat restrained relative to the magnitude of the market’s gains.

Take the weekly sentiment survey from the American Association of Individual Investors (AAII). In the latest update this week, bullish sentiment declined from 48.3% to 43.3%. Bulls still outnumber bears by over ten percentage points, but current levels are hardly extreme, and the weekly reading has been higher on just over 20% of all other weekly readings since the start of 2009.

Taking a closer look at bullish sentiment during the current bull market, the peak sentiment reading was just under a year ago on 12/21/23 when bullish sentiment reached 52.9%. Back in July shortly before the August pullback, bullish sentiment got close to that December reading reaching a level of 52.7%. Since then, bullish sentiment has been gradually trending lower with multiple lower highs and lower lows.

One reason sentiment has remained contained lies in the fact that breadth has been incredibly weak in recent days. As noted yesterday, the S&P 500’s daily breadth reading has been negative for eight straight trading days. Just over the last five trading days, the S&P 500 is essentially unchanged (-0.03%), but nine out of eleven sectors are lower with five down over 2%! Not exactly what you would associate with a year-end rally.

Dec 11, 2024

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I certainly wouldn’t invest in the stock market. I never believed in it. Most people lose money because of the emotional difficulty involved.” – Bernie Madoff

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Equity futures and international markets were little changed headed into the November CPI report. The STOXX 600 was unchanged, and overnight the Nikkei was also unchanged. The CPI report continued the narrative that inflation remains sticky, but it wasn’t any worse than expected. For both the headline and core readings, the m/m and y/y readings were right in line with expectations. At 3.3% y/y, though, core CPI remains too high for the Fed’s liking. The lack of any upside surprises, though, has provided a boost to pre-market futures, bond yields have pulled back slightly, and Bitcoin has gotten a bump higher. The fact that the numbers were right in line with expectations, though, all but locks in a rate cut at next week’s meeting.

Remember when CPI reports were the only thing the market cared about? Back in late 2022 and early 2023 right in the middle of the Fed’s rate hiking cycle, the monthly release of CPI was to economists and traders what a Taylor Swift concert was to teenage and twenty-something girls (and a lot of other people). It was an event, and the S&P 500 regularly rallied or declined 1% or more in reaction to the monthly “drop”. As shown in the chart below, in late 2022 and early 2023, the 12-month average daily change in the S&P 500 on the day of CPI reports was a gain or loss of just under 2%. Dating back to the turn of the century, the only other time that market reactions to CPI reports were more volatile was during the financial crisis, but that was a period when overall volatility was a lot higher too, so moves of more than 1% were the norm on any day during that period.

As inflation data has become less ‘exciting’, the market’s infatuation with it has subsided. As shown in the chart below, the average daily change of the S&P 500 on CPI days has plummeted below the long-term average of 0.86% down to 0.71%.

The S&P 500’s daily change on CPI days since the start of 2022 when the Fed’s last rate hiking cycle kicked off, shows the declining importance of CPI data on the market. Over the previous six months, there has only been one month where the S&P 500 moved 1% on a CPI Day, and following last month’s report, the S&P 500 finished the day unchanged rising by just 0.02% or 2 basis points (bps). That was the smallest daily move on a CPI Day since 2019 and was a far cry from two years earlier when the S&P 500 rallied 5.54% in reaction to the October 2022 report which was the largest upside move in reaction to a CPI report since 2008 and the third largest since 1999.

One reason for the more muted reactions to recent CPI reports is that the data has become more behaved and less ‘exciting’. Whether that changes or not remains to be seen, but the recent stickiness of Core CPI relative to headline has economists speculating that there could be a second act.