Holiday Hangover

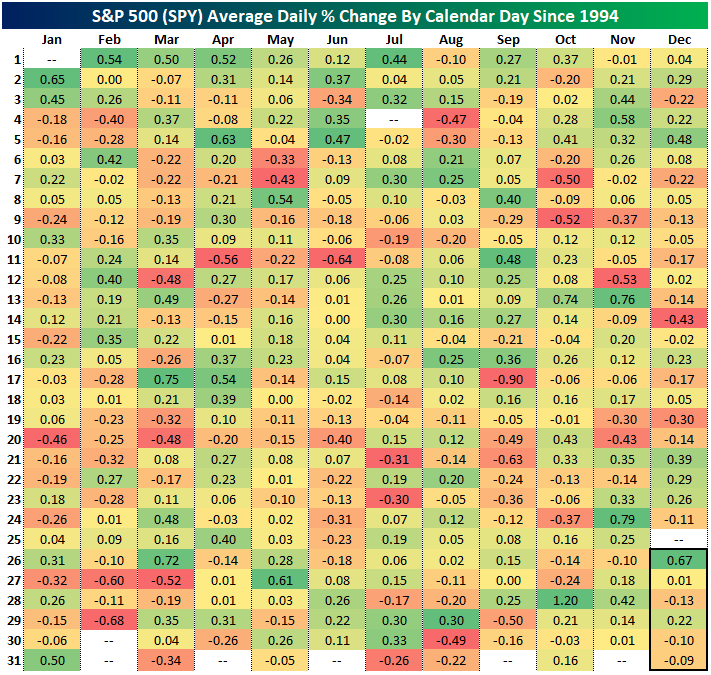

Although the S&P 500 gapped up at the open, it has traded lower throughout the morning and is on pace to fall to start out the final week of the year. As we noted last week, the final week of the year has not exactly been an overwhelmingly positive period for equities. In the table below, we show the average daily performance of the S&P 500 ETF (SPY) for each calendar day since 1994. Although December 26th has averaged the strongest gains of any day in December, this year that is a moot point with markets having been closed yesterday. As for performance through New Year’s, seasonality has been unremarkable.

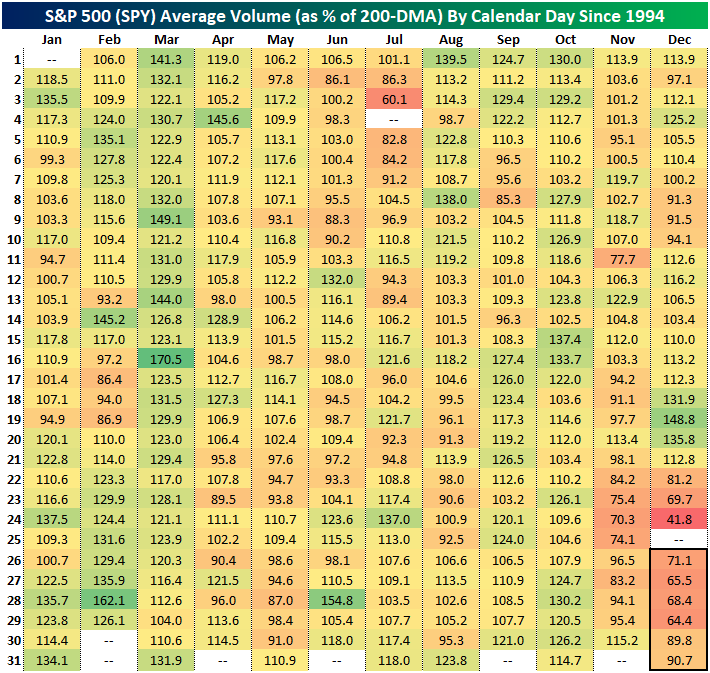

What is notable, albeit not exactly unexpected, is that this is typically the quietest period of the year. Similar to the table above, below we show the average daily reading on volumes in SPY expressed as the percentage of the 200-DMA. Since 1994, average volume in the final week of the year has been roughly two-thirds of the norm. Interestingly, those low volumes are sandwiched between what are typically elevated volumes in the days leading up to Christmas and the early days of January. In other words, from a purely seasonal standpoint, it is unlikely that the rest of the week will be overly exciting. Click here to learn more about Bespoke’s premium stock market research service.

Tesla (TSLA) Loses Its Charge

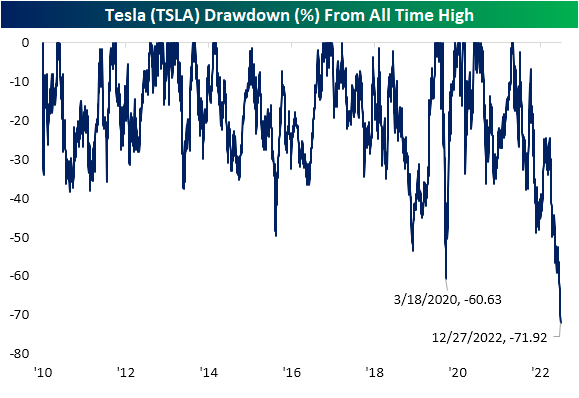

Whereas Tesla (TSLA) had been a darling of the growth trade posting gaudy returns in the first year and a half of the pandemic, since November of last year it has turned into a major pain trade. While the weakness really extends out for more than a year, only looking more recently, the stock has been in free fall and is on pace for its seventh consecutive decline in a row. As shown below, that is tied for the longest streak of consecutive declines since the IPO in 2010. The other streaks of a similar duration were in September 2018, December 2014, and January 2013, and none of those streaks extended to eight trading days. Although there is precedent for TSLA trading lower as consistently as the past week and a half, the current streak leaves the others in the dust in terms of severity. Over those past seven-day streaks, the stock never declined 14% or more, and during one of the streaks (January 2013) TSLA fell less than 7%. The decline in the stock during the current seven-day streak has been over 25%!

Again, that current stretch of weakness is not exactly new. Tesla has been grinding lower for over a year, and since peaking in November of last year, Tesla has seen its market cap dwindle from a high of over $1.2 trillion all the way down to only $363 billion today. The drawdown from an all-time high in the stock’s price reached nearly 72% today and is the largest in the stock’s history, surpassing the previous record drop of 60.6% during the COVID Crash in early 2020. To get back to its prior record closing high, the stock would need to rally more than 250% from current levels. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 12/27/22 – Easing Back into the Grind

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Anything worth doing is worth overdoing.” – Mick Jagger

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In case you missed it last Friday while you were out holiday shopping or stuck in an airport. We also emailed out our annual Bespoke Report which covers everything you need to know about the setup for financial markets and the economy heading into 2023. You can read it here.

It’s looking like a positive day to start the week…for now. Futures are still higher but off their highs of the overnight session. It’s going to be an exceptionally quiet week for economic data and earnings. Today’s only reports are Wholesale Inventories, the FHFA House Price Index, and the Dallas Fed, and there is nothing in terms of earnings.

Bulls are hoping that today’s rally in futures marks the arrival of the Santa Claus rally where stocks advance to close out one calendar year and into the start of the next. While the last several days of trading leading into the Christmas holiday were disappointing as the S&P 500 gave up both its 200-day and 50-day moving averages, the market is basically trading right in the middle of the range it has been trading in since mid to late April. For the S&P 500 tracking ETF (SPY), the high end of that range is 430 with the low end being around 350. With a mid-point of 390, the S&P 500 is poised to open this morning just below that level at around 385. That’s the good news. The bad news is that when the S&P 500 tried to trade back above its 50-DMA last Wednesday, the rally stalled just shy of that level and that lack of momentum is a clear trait of a weak market.

Unlike SPY which can still be considered ‘rangebound’, the Nasdaq 100’s chart resembles more of a downtrend. While the lows from October are still intact, the index is still just barely 5% above its October intraday low.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke Report — 2023 Annual Outlook

Our Bespoke Report – 2023 Outlook is now available for Bespoke subscribers. This report covers everything you need to know about the set-up for financial markets and the economy heading into 2023. If there’s ever a “must-read” Bespoke report, this is it!

You can read our 2023 Outlook by signing up for any of our three membership levels. Enter the coupon code “OUTLOOK” at checkout for a 20% discount on your first charge. You can review our membership levels here to help make your decision.

Bespoke Newsletter Monthly Payment Plan

Bespoke Newsletter Annual Payment Plan

Bespoke Premium Monthly Payment Plan

Bespoke Premium Annual Payment Plan

Bespoke All Access (Bespoke Institutional) Monthly Payment Plan

Bespoke All Access (Bespoke Institutional Annual Payment Plan