Dec 7, 2022

Banking stocks had been outperforming the broader market throughout most of the fall, but that reversed in a big way in November and even more so this month. The largest stock in the S&P 500 Banking Industry, JPMorgan Chase (JPM), however has been a notable outperformer. As shown below, relative to other S&P 500 banks, JPM has seen its relative strength rip higher.

Although it has reverted lower more recently after trading well above its 50-DMA, the stock has experienced a notable moving average crossover as its 50-DMA has risen above the 200-DMA. That is the first time the 50-day has been higher than the 200-day since the start of the year. From a technical perspective, these types of patterns are considered positive, especially when both are rising (golden cross).

In spite of that bullish reputation, the actual performance following past moving average crossovers where the 50-DMA trades above the 200-DMA is not particularly noteworthy nor should it generate a massive amount of optimism. As shown below, on an average basis, JPM has fallen one week and one month after past occurrences that have happened without another instance in the prior three months. That compares to gains of 0.25% and 1.05%, respectively, for all other periods. Looking further out, average performance has only been notably better than normal three months later albeit that is paired with less consistency to the upside. In other words, moving average crossovers to the upside are not necessarily the positive technical pattern many chart watchers consider them to be. As always, past performance is no guarantee of future results. Click here to learn more about Bespoke’s premium stock market research service.

Dec 7, 2022

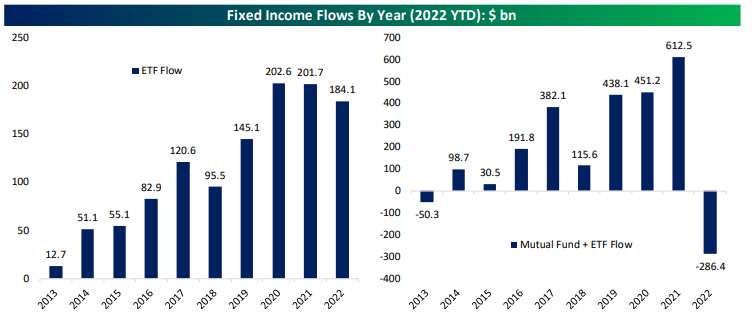

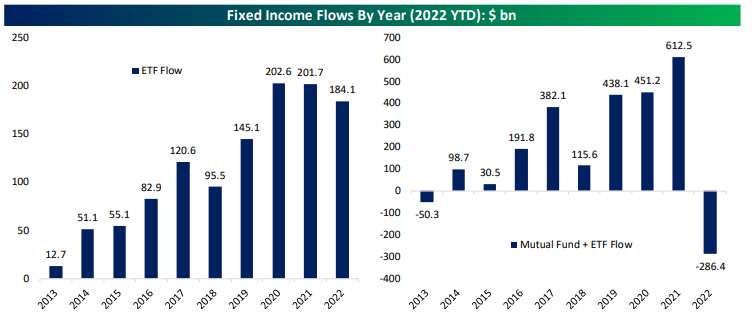

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report, we discuss the evolution of fixed income flows this year.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Dec 7, 2022

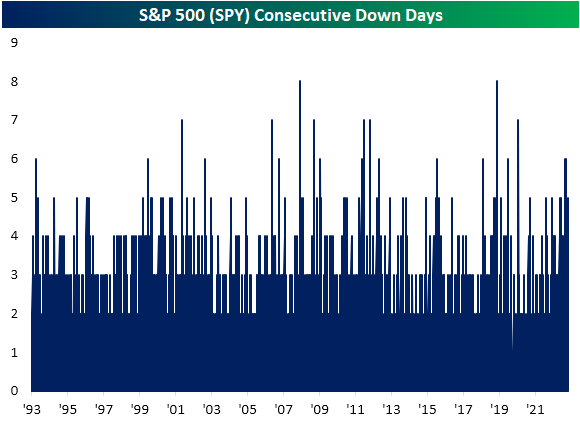

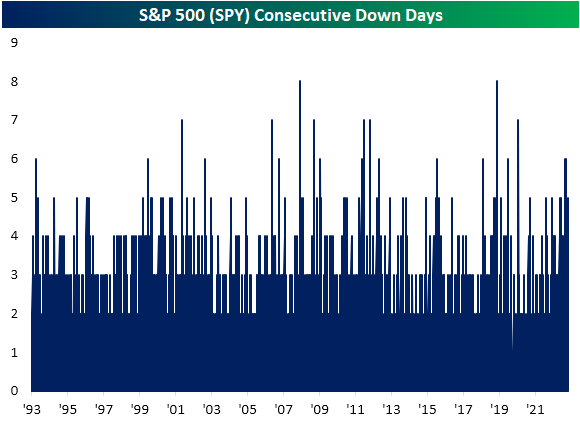

The S&P 500 (SPY) has struggled to pick a direction so far this morning but at least as of this writing, it is on pace to finish lower yet again. From a technical perspective, the index is at a cross roads having formed a wedge in the past couple of months. During the recent rally, SPY did manage to move back above its 200-DMA, but it couldn’t quite get above the past year’s downtrend line. After the streak of declines in the past week, it has returned to the bottom of the rough uptrend line that has been in place off the October lows.

Again price action has been choppy so far today, and while further declines could result in a break down, it would also mark an impressive, but not exactly unheard of, streak of declines. As shown below, it would be the fifth daily decline in a row. From a historical perspective, that is not particularly rare with 65 other streaks of 5 days or more since SPY began trading. As recently as October and September, there were two streaks that even extended to 6 days long.

What is more rare is for these streaks to start at the beginning of a new month. In fact, this month’s 3.5% drop to start December is on pace to be the 20th worst start of a month for the S&P 500 ETF (SPY) since inception, and there have only been two other times in which all of the first five trading days of a month have seen declines: February 2002 and June 2011. As shown below, those streaks of declines actually came in what were the middle of periods of consolidation while the following few months went on to experience further downside. As for the actual size of the declines, both of those previous instances saw larger drops (roughly around 4.5%) than the 3.5% decline currently.

Dec 7, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Theory is splendid but until put into practice, it is valueless.” – James Cash Penney

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

December just keeps getting lousier and lousier as futures are negative, putting the S&P 500 on pace for five straight losses to kick off what has historically been one of the more positive months of the year. The culprit for this morning’s weakness is negative trade data out of China, and the action in oil over the last couple of days has been signaling that weakness. The just released reports on Nonfarm Productivity and Unit Labor Costs came in better than expected providing a boost to futures but at this point, not enough to push them into positive territory.

It hasn’t been a healthy start to the month of December for the market, but the Health Care sector has held up better than a lot of others with its decline of less than 1.3%. The sector has had a strong run from its October lows, and technicians are salivating over the impending ‘golden cross’ for the sector. A golden cross occurs when a security’s short-term moving average crosses above a longer-term one as both are rising, and it’s considered a positive technical pattern. In the case of the Health Care sector, we’re looking at the 50 and 200-day moving averages and barring any major moves, that crossover will occur tomorrow.

With a lot of technical patterns, the theoretical doesn’t always translate to reality. The table below lists the thirteen prior golden crosses for the Health Care sector since the start of 1990, and for each one, we list the sector’s performance following that occurrence. As shown at the bottom of the table, while median returns over the following week and month were better than the average for all periods since 1990, median returns three and six months later were actually below the long-term average for all periods. One year later, the Health Care sector was positive 12 out of 13 times for a median gain of 9.2%, and while the consistency of positive returns was better than average, the median return of 9.2% was basically right in line with the historical average. Historically speaking, golden crosses for the Health Care sector haven’t been bad, but they haven’t necessarily been followed by better-than-average returns either.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.