May 19, 2022

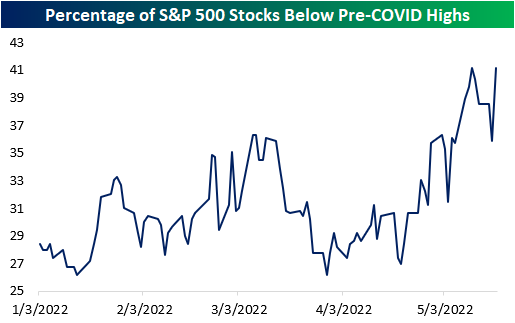

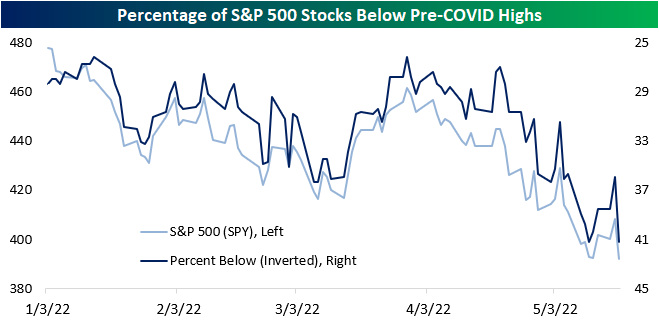

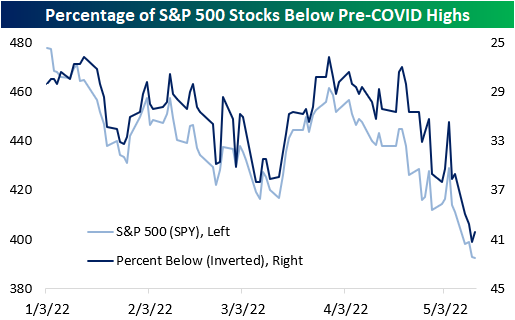

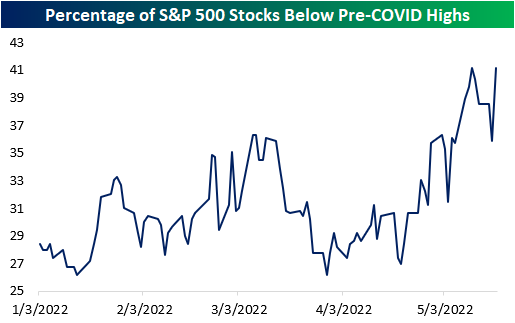

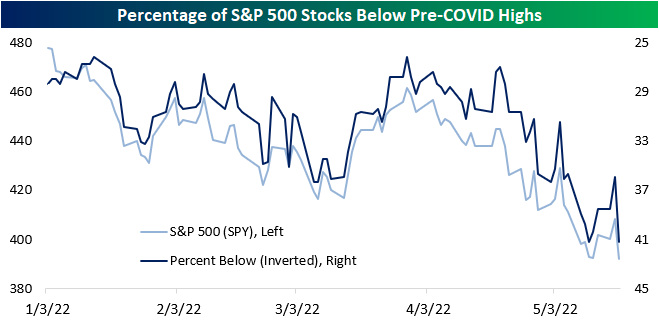

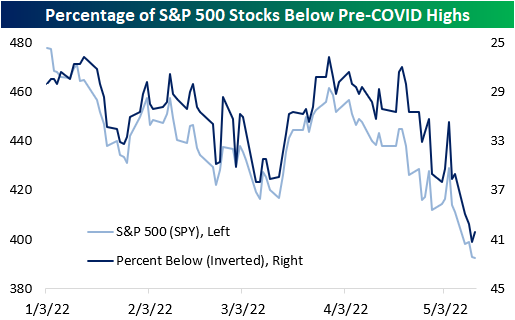

Last week, we outlined the percentage of stocks in each S&P 500 sector that had fallen below their pre-COVID highs to show that many of the stocks that surged due to pandemic effects have significantly fallen off, netting long-term holders a negative return since the onslaught of the pandemic. (Read it here.) Yesterday, the S&P 500 fell by over four percent to set a new 52 week low, breaking the 4,000 level. The index is still up over 15% relative to its pre-COVID high, but as of yesterday’s close, 41.2% of S&P 500 members were below their respective pre-COVID highs, as 26 members crossed below this critical level yesterday.

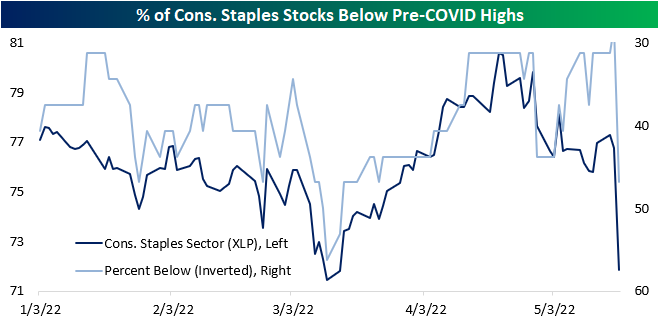

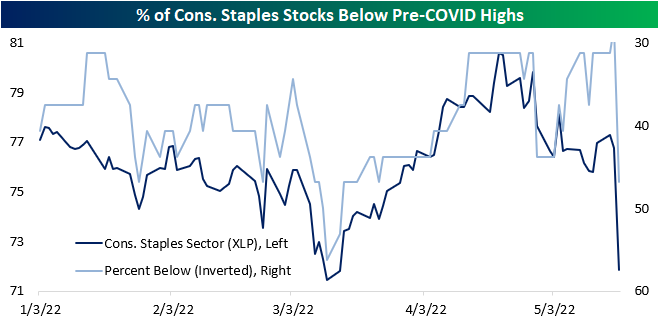

Notably, six of the 32 S&P 500 consumer staples stocks crossed below, moving the percentage from 28.1% to 46.9% on the back of weak earnings reports from Walmart (WMT) and Target (TGT). 66.7% of Communication Services stocks and 60.0% of Real Estate stocks in the S&P 500 are below their pre-COVID highs, but only 18.5% and 23.8% of Materials and Energy stocks are below this level, respectively. Additionally, 8.2% of S&P 500 members were within 5% of their pre-COVID highs, and 15.1% are within 10%.

Four S&P 500 stocks crossed below this critical level for the first time in a while yesterday: Cognizant Technology (CTSH), MGM Resorts (MGM), Tyler Tech (TYL) and Verisk Analytics (VRSK). This comes amidst weakness in the Technology sector (XLK) versus the broader S&P 500, as the sector is down close to 25% on a YTD basis versus the S&P 500’s drawdown of about 18%. However, XLK is still up close to 30% relative to pre-COVID highs.

Additionally, there are three stocks that entered a 2% channel above their pre-COVID highs for the first time in a while. Dexcom (DXCM) entered the channel amidst weakness in the broader energy space, and Pentair (PNR) extended the downtrend that is yet to break. Walmart (WMT) sold off significantly in two consecutive days after a weak earnings report and is now less than 1% from its pre-COVID high. A month ago WMT was 30% above this level. Click here to become a Bespoke premium member today!

May 13, 2022

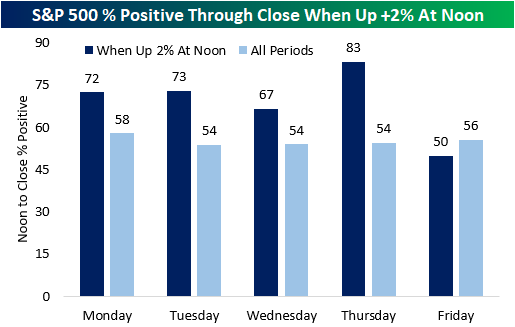

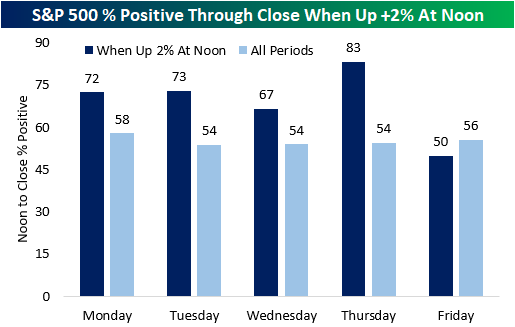

After a tumultuous week, the S&P 500 gapped higher this morning and continued to rip throughout the morning. As of noon, the S&P 500 was up 2.2%, a much-needed rally after a week of pain. Since the start of 1983, the S&P 500 has been up by 2%+ at noon 110 different times, 22 of which have occurred in the pandemic era. There has been only one occurrence this year (3/9) and two in 2021 (3/1/21 and 12/7/21). On a median basis, the S&P 500 averages a noon-to-close gain of 54 basis points (bps) when it rallies 2%+ in the morning, which is over ten times the median of all periods (5 bps). However, looking at just Friday occurrences, the S&P 500 has had a median drawdown of 9 bps from noon to the close, which is 11 bps weaker than that of all periods. Additionally, Friday was the only weekday with median noon-to-close returns below that of all periods when the index had gained at least 2% by noon.

Friday is also the only day of the week with lower than average positivity rates following 2%+ morning rallies. Thursday is the strongest with a positivity rate of 83%. Overall, the index has performed positively from noon to close 70% of the time following these occurrences. click here to become a Bespoke premium member today!

May 13, 2022

Two days ago, we outlined the percentage of stocks in each S&P 500 sector that were below their pre-COVID highs to show that many of the stocks that surged due to pandemic effects have significantly fallen off, netting long-term holders a negative return since the onslaught of the pandemic. Over the course of the next few weeks, we will be outlining the S&P 500 stocks that are breaking below/above their pre-COVID highs, as we did yesterday. Yesterday, the S&P 500 fell by 10 basis points to close at a new 52-week low, but the index is still up over 15% relative to pre-COVID highs. As of yesterday’s close, 40.4% of S&P 500 stocks were below this critical level, an 80 basis point improvement relative to the close on 5/11. 71.4% of utilities and 66.7% of communication services stocks were below their respective pre-COVID highs as of yesterday’s close. On the other hand, only 18.5% and 23.8% of S&P 500 stocks in the materials and energy sectors were below their respective highs between the start of 2019 and the end of February 2020. Additionally, 7.8% of S&P 500 stocks were between 0-5% above their pre-COVID highs (39 members).

Only one stock crossed below its pre-COVID highs for the first time since breaking above that level: MGM Resorts (MGM). However, the stock gapped higher by over 3% today, thus returning above this level. The weak performance as of late is due to a variety of factors including China’s zero-Covid policy, the broader market drawdown, and a weak reaction to the latest earnings report, even though the company beat on the top and bottom line.

One stock traded lower to enter a +2% channel relative to pre-COVID highs for the first time in a couple of months: Jack Henry (JKHY). JKHY is a payment processing and lending firm and competes with the likes of Block (SQ) and Toast (TOST). To gain access to our chart scanner tool, click here to become a Bespoke premium member today!

May 12, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Money does not buy you happiness, but lack of money certainly buys you misery.” – Daniel Kahneman

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Today, the futures aren’t even attempting to sucker traders in with a rally, so maybe today, we’ll actually get a bounce. Treasuries are continuing to rally again this morning, while crude oil trades modestly lower and crypto plunges. Overnight, China pledged further support to its economy. On the geopolitical front, Finland has said it is preparing to apply for membership in NATO, and Russia has responded by threatening retaliatory steps of both military and ‘other’ measures.

We just got a chunk of economic data in the form of PPI and jobless claims. In terms of PPI. headline CPI was in line with forecasts at a m/m gain of 0.5%. Core PPI rose much less than expected at 0.4% vs 0.7%, but data for March was revised higher. In terms of jobless claims, initial claims came in 10K higher than expected 203K vs 193K while continuing claims showed another drop falling to 1.343 million versus forecasts for 1.372 million. Equity futures have seen little in the way of a reaction to the news while treasury yields remain lower.

In today’s Morning Lineup, we recap the recent developments in the crypto space (pg 4), overnight earnings (pg 5), economic data out of Europe (pg 6), and a lot more.

The year is barely more than a third over, but already the Nasdaq has had 24 different over the course of just 90 trading days. That works out to more than once a week! Again, we still have nearly two-thirds of the year left ahead of us, but already, the number of 2%+ daily declines this year ranks as the 8th highest in the Nasdaq’s history. The only years that were higher were 1999, 2000, 2001, 2002, 2008, 2009, and 2020. If, and this is a big if, the current pace of 2% declines continues, 2022 wouldn’t quite catch 2000 for the record number of 2% declines in a single year, but it would be a close second.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

May 11, 2022

The world changed dramatically with the onslaught of the COVID pandemic in early 2020. Businesses were forced to digitize, consumers saved at historic rates, the Federal Government and Federal Reserve flooded the economy with cash, new hobbies were picked up faster than a dropped hundred dollar bill, and consumers emerged from the lockdowns financially stronger than ever. Long story short, COVID appeared to permanently alter the ways in which consumers and businesses interact, and companies that stood to benefit from the new way of life saw their stocks surge while the old-economy stalwarts were crushed. That was then.

This is now. As the economy has emerged from COVID, the cost of inputs has skyrocketed, real buying power has diminished, supply chains have become strained, and geopolitical tensions are hot. Not only that, but whereas the rate of fiscal and monetary stimulus was stronger than ever during the pandemic, the headwind from their removal is as intense as it gets.

Given the shifts, a number of stocks that originally surged in the COVID world have been hit hard in the post-Covid environment, and some of the biggest COVID losers during the lockdowns have turned into market leaders. As things currently stand, 40.6% of S&P 500 members are below their pre-COVID highs (closing high price from the start of 2019 through the end of February 2020), even as the index is up 18.0% from its pre-COVID closing high on 2/19/20. Besides the fact that four out of every ten S&P 500 stocks are below their pre-COVID highs, 8.1% of the index members are within 5% of their pre-COVID high and another 7.1% are within 10% of their pre-COVID highs.

At the sector level, three sectors – Communication Services, Real Estate, and Utilities- have more than half of their components trading below their pre-COVID highs. In addition to those three sectors, in both the Consumer Discretionary and Financials sectors, more than 40% of components are below their pre-COVID highs, and another 10% of each sector’s components are within 10% of those former highs. At the other end of the spectrum, the original ‘losers’ from COVID like Energy and Materials have fewer than a quarter of their components trading below their pre-COVID highs. While it seems some days like COVID will never go away, the rallies that a large number of stocks experienced are now nothing more than memories. Click here to view Bespoke’s premium membership options.