Jun 13, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Come what may, all bad fortune is to be conquered by endurance.” – Virgil

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s not a pretty picture for risk assets of any kind this morning as equity indices around the world are down over 2%, US futures are down by about the same amount, treasuries are selling off hard, and crypto prices are down sharply. Concerns over inflation and its impact on economic growth have become heightened over the last several days, and unlike prior periods in recent history where growth has come into question, with inflation pressures as strong as they are, there is little optimism that the Fed can help to cushion the blow.

In today’s Morning Lineup, there’s a lot covered this morning as we discuss prior streaks of 1%+ and 2%+ declines for the market (pg 4), the plunge in crypto prices (pg 5), overnight movements in the yen (pg 6), action in Asian and European markets (pg 6), overnight economic data in Asia and Europe (pg 7), and much more.

The first trading day of the week has already been weak for the market, but today’s 2%+ downside gap in SPY will be, by far, the largest downside gap to start a week of the year and the largest since March 2020.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Jun 2, 2022

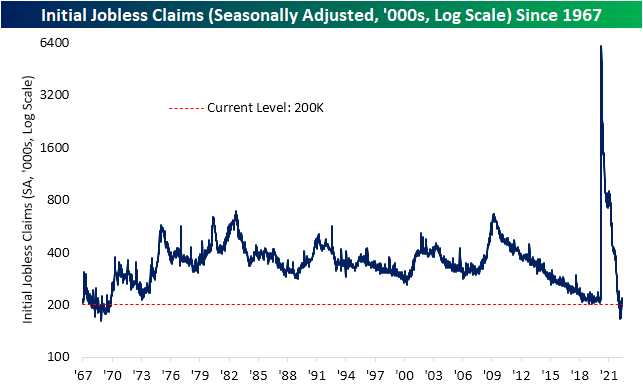

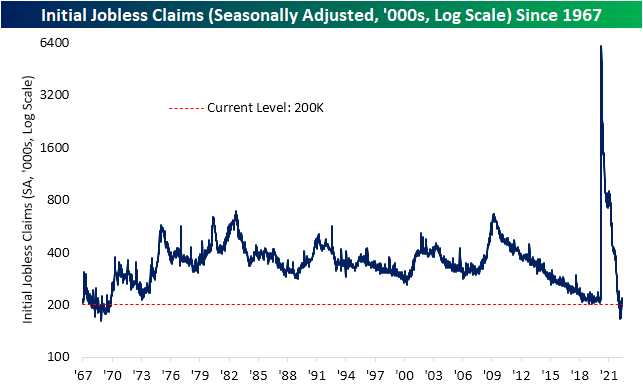

It was a mixed morning for labor market data. What could be a bad omen for tomorrow’s Nonfarm Payrolls number, ADP’s monthly payroll report showed the weakest month of job creation since the start of the pandemic. On the bright side, this week’s initial jobless claims number continued to reverse off of recent highs dropping back down to 200K. While the levels from February through April were even stronger, this week’s reading remains impressive nonetheless with the only comparable levels being during the two years leading up to the pandemic as well as all the way back in the late 1960s.

From a seasonal perspective, tailwinds are likely to become headwinds over the next couple of months. As shown in the second chart below, the current week of the year has historically been when unadjusted jobless claims have put in a seasonal low. That is typically followed by several weeks of consistent weekly increases that lead to a short-term peak usually in mid-July. In other words, it should not be surprising to see claims move higher in the weeks ahead, but regardless of any seasonal moves, this week did mark the lowest reading for the comparable week of the year since 1973. That reaffirms the seasonally adjusted reading in that claims are at impressively low levels.

Although initial claims have come off the lows and are likely to keep doing so as seasonal trends shift, continuing claims keep hitting new lows. This week’s reading fell all the way down to 1.309 million from 1.343 million last week. That is now the lowest level since the last week of 1969. Click here to learn more about Bespoke’s premium stock market research service.

Jun 2, 2022

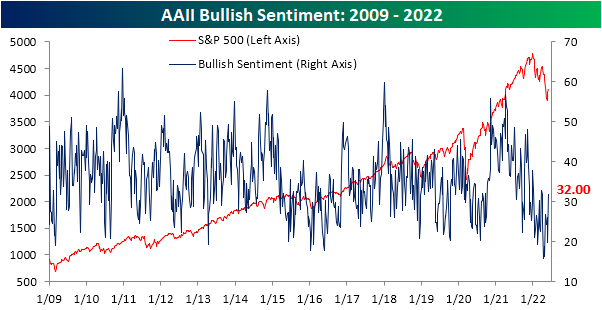

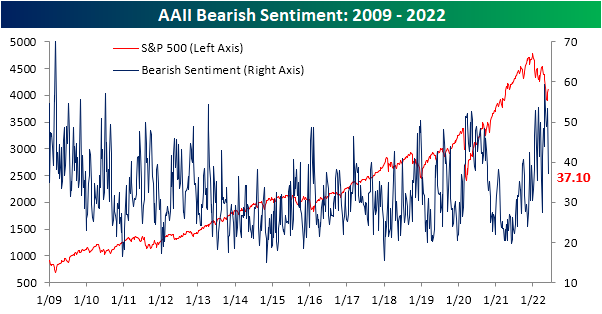

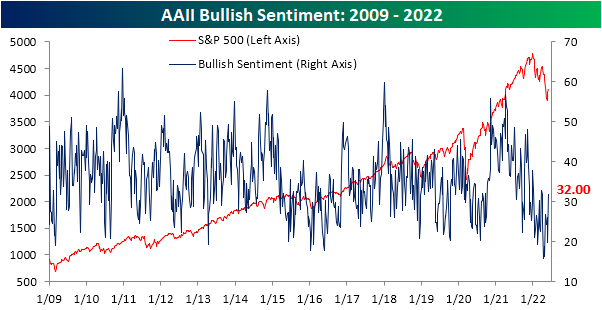

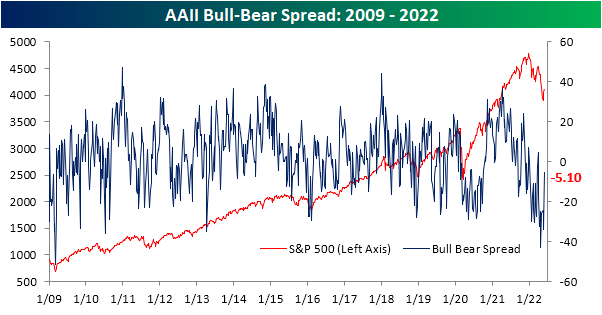

Sentiment has taken a big swing higher across surveys this week as the S&P 500 has experienced some upside mean reversion. The weekly AAII sentiment survey has seen bullish sentiment rebound from a sub-20% reading all the way back up to 32%. Relative to the historical average of 37.84%, that reading continues to show a depressed level of optimism for individual investors, but it is the strongest reading since the week of March 24th. As for the 12.2 percentage point jump in bullish sentiment week over week, it was the largest one week gain since the week of October 14th of last year when it rose 12.4 percentage points.

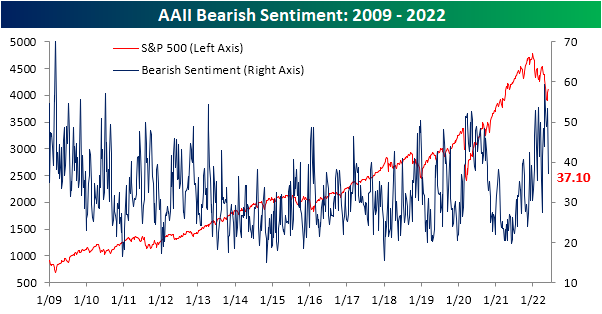

As bullish sentiment surged, there was a massive 16.4 percentage point drop in bearish sentiment. That was the largest one week decline in the reading on pessimism since July 15, 2010 when it fell 19.27 percentage points. Now at 37.1%, bearish sentiment is at the lowest level since the end of March.

Such a large decline in bearish sentiment in only one week has pretty much been unheard of in the post Financial Crisis years. Again, July 2010 was the last time bears fell by at least 15 percentage points and before that there are only about two dozen other occurrences without another instance in the previous three months. While it was a big decline, bearish sentiment remains fairly elevated at 37.1%, but that is inline with most other occurrences since the mid 2000s whereas bearish sentiment was generally lower from the occurrences before 2005.

As for how the S&P 500 has tended to do following these massive bearish sentiment shifts, the S&P 500 has generally tended to move higher with outperformance versus the norm on a median basis one week and one month out. Although again performance is consistently positive, the size of gains have tended to be below or more inline with the norm three, six, and twelve months out from these occurrences.

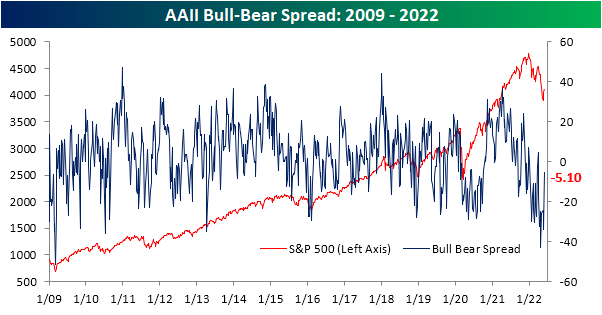

After the large moves in bulls and bears this week, sentiment continues to favor pessimism but to a much smaller degree than recent weeks as the bull bear spread narrowed to -5.1 points. Click here to learn more about Bespoke’s premium stock market research service.

Jun 2, 2022

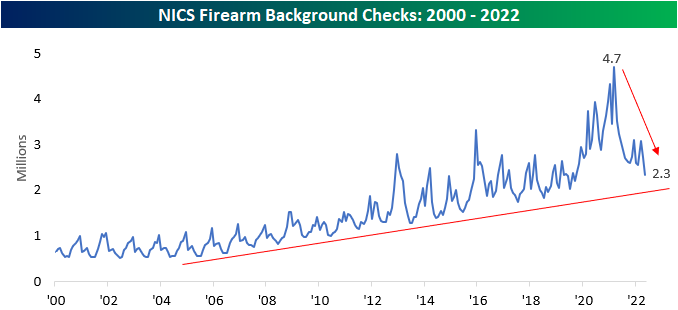

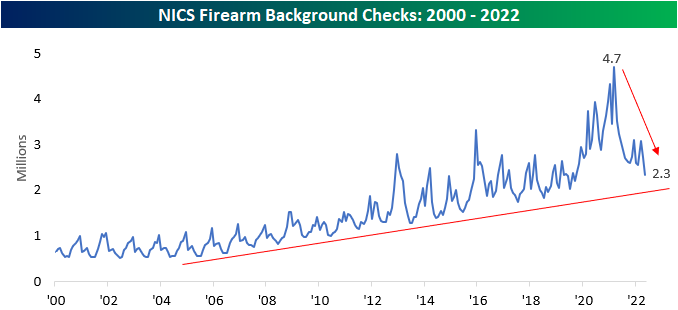

Although not a widely accepted indicator, we like to look at the number of NICS firearm background checks as a barometer for fear and geopolitical volatility for the United States. In uncertain times (like the beginning of government-imposed COVID lockdowns), background checks tend to spike. Inversely, when times are good, background checks tend to decline. An additional causal factor of background check spikes is the outlook on gun policy. When the public feels as if gun policies are going to become stricter, Americans tend to rush to purchase firearms, which is evidenced by the record y/y increase after President Obama was reelected. Recently, several mass shootings have brought gun control regulations back into the news cycle, so one would expect to see background checks tick higher. Granted, much of this rhetoric really picked up towards the end of the month, so any effects will likely be seen in June (or later) numbers. Nonetheless, background checks declined for the second consecutive month after briefly spiking earlier this year. In May, checks declined by 27.4% y/y to just 2.3 million.

On a YTD basis, background checks have fallen by 30.7%, the largest first five-month decline since at least 2000.

Although the decline is certainly significant, monthly background checks are still comfortably above their longer-term trend line. To summarize, although checks are down significantly y/y, the long-term uptrend that was in place prior to the COVID surge is still largely intact.

Although we like to think that the market is forward-looking, the price action of gun manufacturer Sturm Ruger (RGR) tends to be highly correlated with the number of background checks over the prior twelve months. Since the start of 2000, RGR’s end-of-month close and the trailing twelve-month background check figure has held a correlation coefficient of 0.90, a near-perfect positive relationship. Therefore, a reversal in the downside momentum of background checks as Americans step up purchases in advance of perceived or actual new regulations in gun ownership would leave room for upside in RGR.

Looking at the last twelve-month price charts of two firearm manufacturers, a relatively similar pattern emerges. RGR and Smith and Wesson (SWBI) are both in sustained downtrends. However, both have seen consolidation as of late, and SWBI is even testing its trendline. The decline has been warranted due to the significant decrease in background checks (and in turn firearm purchases), but a reversal higher in checks would likely provide a tailwind for both companies. Click here to become a Bespoke premium member today!

Jun 2, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We should take comfort that while we may have more still to endure, better days will return.” – Queen Elizabeth II

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The quote above from Queen Elizabeth was from a speech in the early days of COVID, and with life getting back to ‘normal’ in most western economies, she was definitely right. The Queen’s comments from two years ago can also be attributable to the current market environment. 2022 hasn’t been enjoyable, and it’s more likely than not that investors will still have further volatility and losses to endure, but better days will come, even if – like COVID – those better days take longer than expected to return.

It’s been a busy morning of economic data today with ADP Employment missing expectations and showing the smallest level of job growth since April 2020. Unit Labor Costs were also revised more than a full percentage point higher, while the revision of Non-Farm Productivity showed a slightly less negative number. Jobless Claims were also just released, and on both an initial and continuing basis, the reported readings were lower than expected.

Heading into this morning’s data, futures were already higher, but they’ve given up some of those gains as interest rates ticked higher following the releases.

In today’s Morning Lineup, we discuss recent trends in the oil market (pg 4), activity in Asian and European markets (pg 4), and selected economic data from Asia and Europe, and the US (pg 5).

When it comes to semiconductors, we typically focus on the group’s relative strength versus the S&P 500 as a leading indicator for the broader market. This morning, however, we wanted to highlight the actual price chart of the Philadelphia Semiconductor Index (SOX). The group has been a steady outperformer in recent weeks, and unlike the major averages which are nowhere near their 50-day moving averages (DMA), the SOX has actually traded above that level in each of the last three trading days. The only problem is that it also closed below that level all three times. In market downtrends, declining moving averages often act as resistance, so the failed rallies of the last three days leave the bulls somewhat discouraged.

We were curious to see how common it is for the SOX to repeatedly run into resistance at its 50-DMA, so the chart below shows streaks where the index traded above its 50-DMA intraday but finished the day below that level. The current streak of three trading days is the longest streak since August 2018, and to find a longer streak you have to go all the way back to August 2007. While the current period has often been compared to the early 2000s, bulls can take some solace in the fact that there was never a similar streak in the years from 2000 through 2003.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.