The Closer — Late Buyers, Backwardation, Auto Sales Around The World — 4/2/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we go over the lack of late day buying while crude oil has moved further into backwardation. We also note that amidst all the interest rate chaos and weak economic data, the VIX is falling to new lows. Moving on to macro data, we begin with a look at the February data on manufacturers’ new orders, sales, and inventories. We compare this hard data to the soft data seen in our Five Fed Manufacturing Index. We finish with an update on global autos sales.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

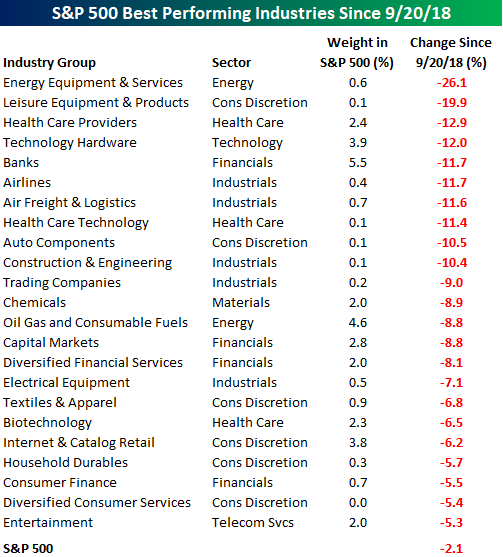

Best and Worst S&P 500 Industries Since 09/20 Peak

After all the ups and downs – or more accurately, downs and then ups in the market over the last six months, the S&P 500 is now just over 2% from its all-time closing high on 9/20. As you might expect, though, not all groups have seen the same moves over that time. During this span, a number of Industries in the S&P 500 have done very well while even more have fared poorly. In the tables below, we highlight the best and worst performing Industries since 9/20/18 along with their current weighting in the S&P 500.

First the bad news. On the downside, over a third of S&P 500 Industries are still down 5% or more from their closing levels on 9/20, and ten of those are down over 10%. The worst performers on the list include Energy Equipment, which has lost over a quarter of its value, and Leisure Equipment, which is down nearly 20%. Thankfully for the market, both of these Industries have rather small weightings in the index. The same, however, can’t be said for Health Care Providers, Technology Hardware, and Banks, which all have weightings ranging from 2.4% to 5.5% and together account for 11.8% of the entire index. In terms of sector representation, Consumer Discretionary, Industrials, and Financials are all well represented. The same is true for Energy as both Industries in the sector are on the list.

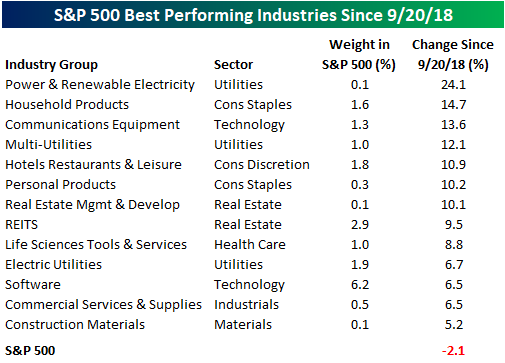

Shifting to the good news, seven Industries in the S&P 500 have bucked the trend and are up over 10% since the market peaked back on 9/20. Leading the way higher, Power and Renewable Electricity is up nearly 25%, but unfortunately, even after the move it still only accounts for just 0.1% of the entire index. Behind Power and Renewables, though, the next four Industries all have weightings of 1% or more. The biggest contributor to the upside on the list has been Software as it has risen 6.5% and accounts for 6.2% of the entire S&P 500. Start a two-week free trial to Bespoke Premium to access our interactive research portal. You won’t be disappointed!

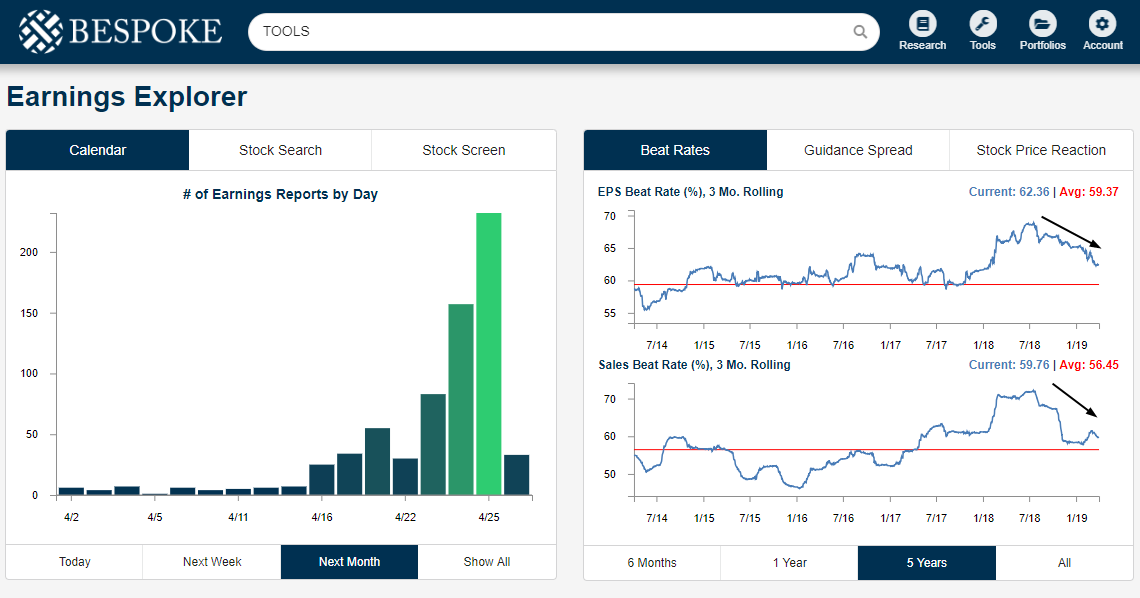

Q1 Earnings Season

Below is a screenshot from our Earnings Explorer tool available to Bespoke Institutional members. The chart on the left shows the number of earnings reports expected per trading day over the next few weeks. This chart is continuously updated. As you can see, we’ll be in a relatively quiet period through the first two-thirds of the month, but things really pick up during the week of April 22nd.

On the right side of the snapshot, you’ll see our “Beat Rate” charts. The top chart shows the percentage of US stocks that have beaten EPS estimates on a rolling 3-month basis. The bottom chart shows the percentage of stocks that have exceeded sales estimates on a rolling 3-month basis. In July 2018, we saw both the EPS and sales beat rate peak and begin to move lower. As we enter the Q1 2019 reporting period, the EPS beat rate is sitting 3 points above its historical average of 59.37%, while the sales beat rate is just over 3 points above its historical average. We’ll be watching closely as reports start coming in later this month to see if the downward sloping trend continues or not.

Our Earnings Explorer tool is extremely helpful for investors looking to monitor earnings at both the macro and individual stock level. You should definitely try it out if you follow markets closely. Start a two-week free trial to Bespoke Institutional to gain access now.

B.I.G. Tips – Bullish Chart Scanner Patterns

Chart of the Day: A New High In New Highs

Bespoke Stock Scores — 4/2/19

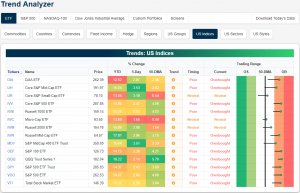

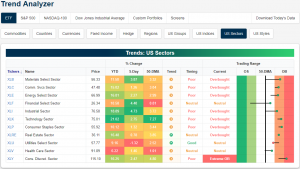

Trend Analyzer – 4/2/19 – Financials Back In

April got off to a strong start yesterday, moving the majority of major index ETFs out of neutral territory and into overbought levels. Currently, there are only three ETFs that are still neutral while the remaining eleven are overbought. These ETFs have made a fairly large push towards or deeper into overbought in the past week as seen through the long tails in our Trend Analyzer tool. Some, like the Core S&P Mid Cap (IJH) and S&P Mid Cap 400 (MDY), have even made it back to overbought after sitting below their 50-DMAs at this time last week. These two have also seen the strongest gains, rising more than 3.5%. While most of the small and mid caps still have some room to run until overbought levels are more of a concern, other ETFs are approaching extreme overbought territory. On the other hand, the Micro-Cap (IWC) has significantly lagged in the past week and is just barely above its 50-DMA. The Core S&P Small Cap (IJR) is in the same boat. Even though it has rallied more than 3% over the last week, it only sits 0.64% above its 50-DMA.

Taking a look at sector ETFs, it is broadly the same story. For the most part, things have moved towards overbought as eight of the eleven sectors sit in this range. The Consumer Discretionary Sector (XLY) has moved into extreme overbought territory after a large gap up yesterday. Meanwhile, Financials (XLF) have staged a turnaround after substantial declines in recent weeks. Yesterday’s rally of 2.45% not only helped to lift the sector out of oversold levels, but it also brought the sector back above its 50-DMA. XLF actually doesn’t hold the crown for the sector with the largest gains over the past five days. That title belongs to Industrials which have surged 4.73%. Conversely, Utilities (XLU), which had been one of the better sectors on the year up until a couple of weeks ago, has continued to fall out of favor. In the past week, XLU has exited overbought levels and is now in neutral after falling 1.4%. It is the only sector to be lower than where it stood one week ago.

Golden Crosses Galore

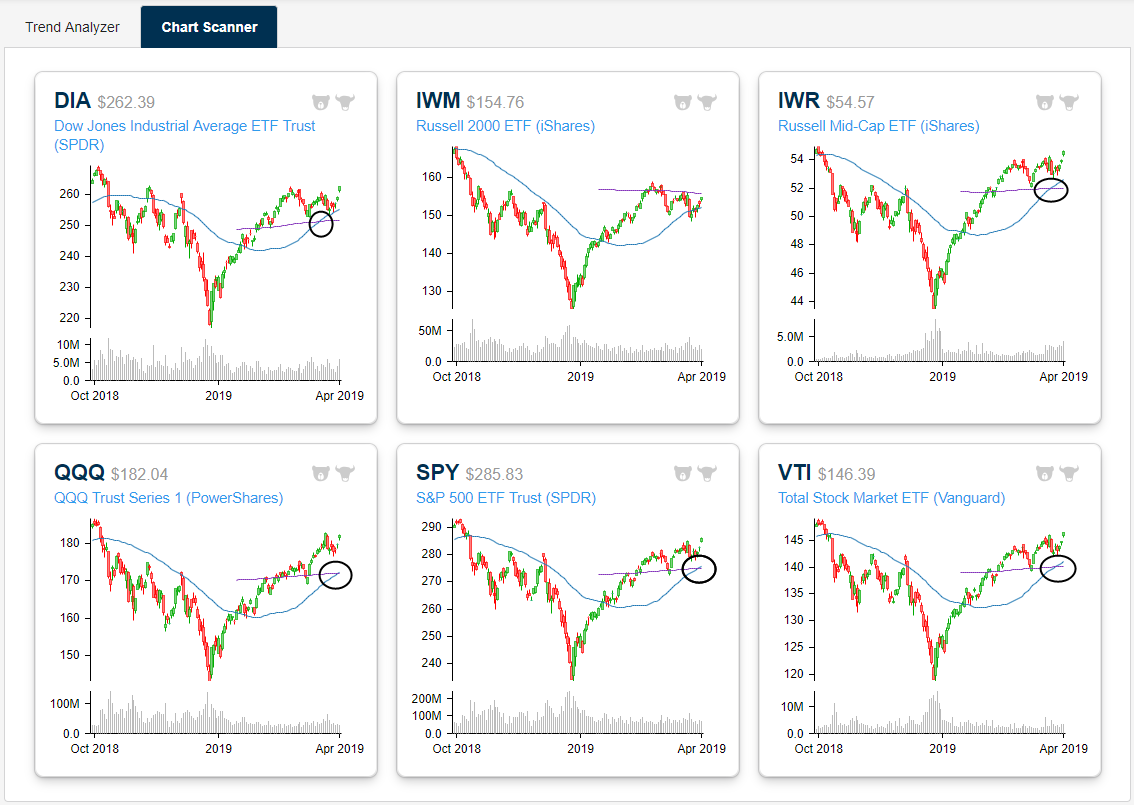

Yesterday’s 1%+ rally for US markets left the six major US index ETFs across market cap levels all back above their 50-day moving averages. As shown in the snapshot below pulled from our Trend Analyzer tool, all six of these index ETFs are up double-digit percentage points year-to-date, and they’re all up more than 2% over the last week as well.

Five of the six are trading in overbought territory, which means they’re more than one standard deviation above their 50-day moving averages. The Russell 2,000 smallcap ETF (IWM) is the lone one in the group that’s not overbought. Start a two-week free trial to Bespoke Premium to access our interactive research portal. You won’t be disappointed!

Using our Chart Scanner tool that’s available to Bespoke Premium and Bespoke Institutional members, below is a snapshot of the six US index ETFs highlighted above.

Five of the six have just recently experienced “golden cross” technical formations, which occurs when the ETF’s 50-day moving average crosses above the 200-day moving average as both moving averages are rising. While DIA (the Dow 30) and IWR (midcaps) experienced golden crosses a couple of weeks ago, the Nasdaq 100 (QQQ) and the S&P 500 (SPY) just saw golden crosses in the last two trading days. For analysis of how bullish or bearish a “golden cross” formation is, check out this report we published on the topic yesterday.

Morning Lineup – “It’s Just a Fad”

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

We have a quiet day of economic data today as the only reports of note are Durable Goods and Auto Sales. Durable Goods were just released and showed a decline of 1.6% for their third monthly decline in the last four months. Equity futures are trading right around the unchanged level, which is actually an improvement from where they were trading overnight as bulls try and keep up the momentum going from Monday’s strong start to the quarter. One of the bigger stories, though, is crude oil, which just topped its 200-DMA for the first time since last October.

The days of the internet and online shopping being “just a fad” have come a long way over the years, but February’s Retail Sales report (released Monday) highlighted another of many major milestones that the growth of online shopping has reached over the years. In this case, it was the total share of Retail Sales that Non-Store retailers account for. Over the years this sector has been sucking up share at the expense of just about every other sector seeing its total share of sales rise from under 5% in the late-1990s to nearly 12% today. In February, Non-Store retail accounted for 11.813% of total sales overtaking General Merchanside (11.807%) for the fourth largest sector overall. Sure, we had to go out to three decimal places, so the margin of different is extremely small, but looking at the chart the trend remains clear; the share of total sales for each sector are clearly going in opposite directions.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Curve Stops, April Starts Strong, Improvement Surge, Retail Wreck — 4/1/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the rapid bear-steepening of the yield curve. We provide the case that yields could have fallen further given the performance of Industrials versus Utilities and Copper versus Gold while also taking a look at how momentum driven the rates sell-off has been. Turning to equities, with today’s jump into Q2, we look at the at least neutral to bullish case given prior instances of strong Q2 starts. In macro data, we delve into the strong print of Construction data which rose 1% MoM versus the 0.2% decline forecasted before moving onto Retail Sales that continue to be a mess.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!