the Bespoke 50 — 4/18/19

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 102.9 percentage points. Through today, the “Bespoke 50” is up 213.1% since inception versus the S&P 500’s gain of 110.2%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Trend Analyzer – 4/18/19 – Large Caps All Over

This morning there is one less overbought ETF bringing the total number of major index ETFs at neutral to three while the eleven others are overbought. Those that are overbought have fallen off of near extreme levels that we have seen over the past week as well. The ETF that has moved from overbought to neutral is the Russell 2000 (IWM) on a loss of 0.77% over the past week. Despite this loss, it now has a good timing score; the only one of the group that can boast this. IWM is not alone in sitting in the red on the week. The Russel Mid Cap (IWR), Core S&P Small Cap (IJR), and to a greater extent, the Micro-Cap (IWC) are all also down. IWC’s losses blow the others out of the water, shedding 1.93% over the past five days, bringing the year to date gain down to 13.61%, the second worst of the group behind the Dow (DIA). Large caps, in general, are a little all over the place. Ironically, while the large-cap Dow is up the least this year, over the past week it and the other large caps have outperformed.

Start a two-week free trial to Bespoke Premium to access our interactive Trend Analyzer tool and much more.

Turning to the individual sectors, like the large caps, things are a bit all over the place. Currently, there are four extremely overbought sector ETFs, four that are overbought, two neutral, and one that is extremely oversold. Financials (XLF) have surged over the past week rising 3.51% on the back of a string of strong earnings reports out of the big banks. While their gains have been more middling, Communication Services (XLC), Consumer Staples (XLP), and Consumer Discretionary (XLY) are the others that are sitting at extreme overbought levels. Over the past week, the Utilities sector (XLU) and Real Estate (XLRE) have seen losses, bringing both below their 50-DMAs. XLRE has been hit particularly hard and is now down 3.56% over the past five days. Believe it or not, this is still far from the worst performer. As we have repeatedly highlighted in the past week, Health Care (XLV) has been absolutely abysmal. Falling 6.53% since last Thursday, it is now negative on the year; the only ETF to be able to claim this by a wide margin. These declines have brought the sector to extremely oversold levels. So much so that it is basically off the chart of our Trend Analyzer.

Morning Lineup – A Flood of Data

Futures have turned a little higher this morning ahead of what is an absolute flood of economic data. Retail Sales, the Philly Fed, and Jobless Claims were just released, and the results were mostly better than expected with Retail Sales coming in better than expected, Jobless Claims dropping to an astonishingly low level of 192K, but the Philly Fed slightly missing consensus forecasts. There’s still a lot more data to contend with, though, as Markit Flash PMIs, Leading Indicators, and Business Inventories are still on the docket. Tomorrow is a holiday for the stock market in observance of Good Friday, but both Housing Starts and Building Permits will be released at 8:30. If you are off, enjoy the three day weekend.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

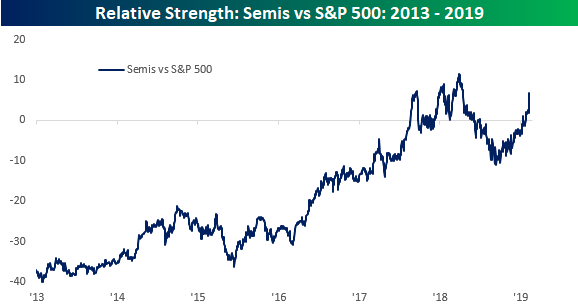

Following the recent settlement between Apple and Qualcomm (QCOM), we wanted to check up on the status of our comparison between the relative strength of semiconductors and the performance of the S&P 500. We have highlighted the leadership of semis numerous times in the last several weeks, and QCOM’s surge over the last two days has caused the group’s relative strength to soar to levels not far from last year’s high. As we have mentioned in the past, every major decline and rally of the last six years has been preceded by a move higher or lower in the relative strength of the semis. Emphasis is often placed on the importance of the transports in determining the direction of the market, but in recent years the semis have been a much better tell.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Health Care, Financial Conditions, HICP, Fund Flows, EIA — 4/17/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin by showing just how dramatic the health care sector’s underperformance has been. We also make note of the S&P 500’s 3rd straight gap up only to fall from open to close. We then show the loosening of financial conditions as indicated by the Chicago Fed’s data. Next, we see at how US inflation stacks up against European inflation by taking a look at US HICP data from Eurostat. Pivoting back to health care, we show the performance, estimated next twelve months EPS multiple, and EPS estimate revisions of the industries and sub industries. We finish with our weekly look at EIA and fund flow data.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Historic Underperformance From the Health Care Sector

Sector Charts – 4/17/19 – Consumer Staples

The Consumer Staples sector, while far from the best, has been on a solid run this year gaining 11.34% YTD. On a 1.42% gain over the past week, the sector, as seen through the XLP ETF, is now sitting in extremely overbought territory. Below we show several notable charts of stocks in the sector taken from our Chart Scanner tool.

Consumer product conglomerate Colgate-Palmolive (CL) was hit hard in the last quarter of 2018. After falling over 16% off of its highs all the way down to around $56 in the final days of October, the stock briefly rebounded back to summer lows before falling down again around $56-57 when the broader market bottomed. The stock rallied off of this double bottom and in January, it came back into this range and has broken out to the upside in late March. CL is now at its highest levels since this time last year. Estee Lauder (EL) similarly made a double bottom in late 2018 and has been in a decent uptrend, especially following a large gap up in response to its Q4 earnings. This uptrend has brought the stock up near 52-week highs.

There are a few other stocks within Consumer Staples that are also in solid uptrends: General Mills (GIS), Hershey (HSY), and Procter & Gamble (PG). While GIS has only really been rallying since the start of the year (after a range-bound 2018), HSY and PG have had their uptrends relatively uninterrupted for just about an entire year now. All three have been making 52-week highs recently, and while they are overbought at current levels, the general trend is still on their side.

On the other hand, Kellogg (K) has not been as fortunate to see these kinds of uptrends. The stock has been in a downtrend since the fall with a big dent coming in response to its November earnings report. Unlike most other companies, the start of 2019 was not a turning point. Fortunately, late last month the stock managed to break out above the downtrend line as well as the 50-DMA. It has made a higher low recently by bouncing off of the 50-DMA and has been working its way higher since.

Some other food-related stocks in the sector have seen some interesting movements in relation to resistance. Sysco (SYY) and Tyson Foods (TSN) have both broken out above resistance to new highs. SYY fell hard on its earnings report from last November, below prior support. In February, the stock failed to break out higher around these levels but on its next test of this resistance in the past couple of weeks the stock has surged; currently, it is pretty overextended as the most overbought stock in the sector. On the other hand, TSN was in a downtrend from December 2017 to December of 2018. This year it finally broke out of this downtrend and the stock has now come up to prior highs from late summer 2018. In the past few days, TSN has smashed through these levels and is at new 52-week highs.

Spice giant McCormick (MKC) is almost the opposite of TSN. After a solid rally through 2018, MKC held up in Q4 but eventually fell in December through late January. The stock rallied off of a bottom near $120 and has now run upon its prior highs at $155. On this test the stock is failing to break out, currently trading around $152 today. This is not necessarily a detrimental sign as the uptrend is still holding as of now. Like SYY, it could take another test of these levels for a breakout. Start a two-week free trial to Bespoke Premium to access our interactive economic indicators monitor and much more.

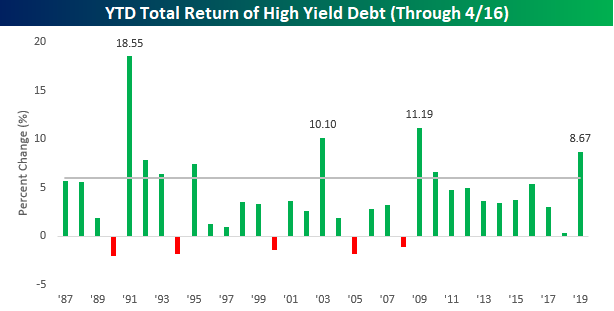

Chart of the Day: Fourth Best Start on Record in Junk Bond Market

After a rough Q4 for the junk bond market, 2019 has turned into a banner year for the sector. As measured by the Merrill Lynch High Yield Master Index, the total return for the high yield market through Tuesday’s close has been a gain of 8.67%, making it the fourth-best start to a year for the sector on record and the best start since 2009. This year’s gain also marks the eighth time since 1987 that the high yield market had gained more than 6% through 4/16.

So how does the junk market perform for the remainder of the year after such strong starts like 2019? And how about the equity market as well? Below is a chart showing rest-of-year returns for junk bonds and the S&P 500 in all years since 1987. Years where junk bonds rallied 6%+ through 4/16 are shaded in grey.

Continue reading this Chart of the Day by starting a two-week free trial to any of our research membership levels.

Fixed Income Weekly – 4/17/19

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we review strong performance and momentum of credit.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

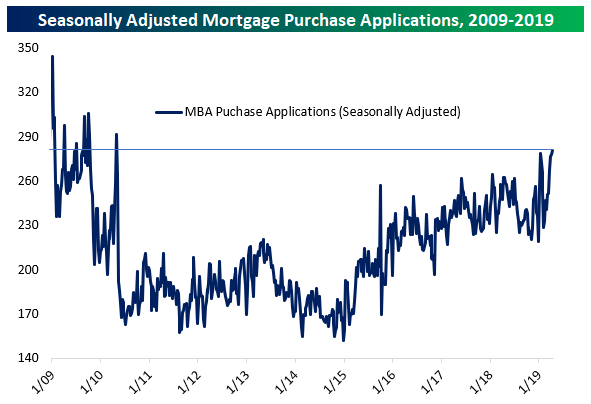

Mortgage Applications Hit Nine-Year High

This morning the Mortgage Bankers’ Association (MBA) reported mortgage application volumes for the week ending April 12th this morning. Refinancing volumes dropped over 8% after an 11.4% WoW drop last week. Refinancing is still running at a strong pace (roughly twice the pace where they finished last year), but the more economically relevant result was the strong purchase application data. Applications for purchase are a leading indicator of home sales, so the new cycle high in purchase application volumes posted this week is a good sign that the housing market remains in a much better position than where it stood last year.

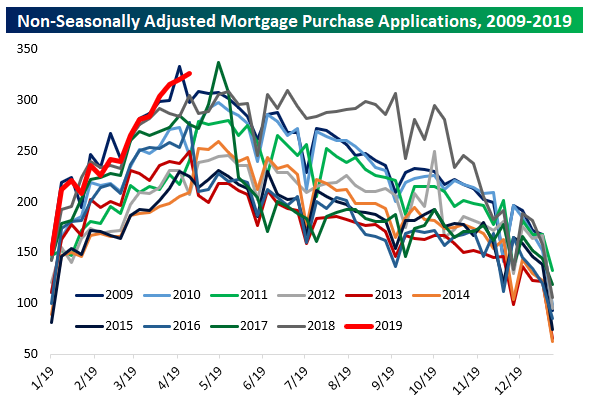

Weekly data can be tricky to seasonally adjust, so it’s also worth taking a peek at weekly data without seasonal adjustments. As shown, we’re right near the typical seasonal peak for application volumes, and as-of this week, only two weeks since 2009 have recorded stronger purchase application volumes. That confirms the basic message of the seasonally adjusted index, which is that mortgage applications are running at a very strong pace.

On a YoY basis, purchase application volumes are not extremely strong, but it’s pretty clear there’s a healthier trend than the period in the second half of last year. Since week-to-week applications can be pretty volatile, it helps to smooth things out with a rolling 4-week average. Using this approach, the 4-week average of purchase applications is up 8.2% YoY, the best pace since the week ended February 9th of last year. Start a two-week free trial to Bespoke Institutional to unlock the full Bespoke interactive research portal.

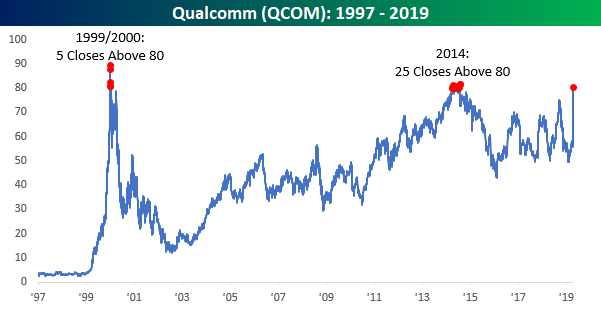

Qualcomm (QCOM) and $80 Meet Again

It’s happening again. After a 40%+ gain in less than 90 minutes of total trading (last hour on Tuesday and first half hour on Wednesday), shares of Qualcomm (QCOM) are once again back above $80, which is a level that it hasn’t had a whole lot of success holding in the past. In the 25+ years that QCOM has been public, it has only closed above $80 (on a split-adjusted basis) 30 prior times. The first date with $80 came back in late 1999/early 2000 at the height of the tech bubble as the stock closed above $80 on just five days. From there, 14 years passed before the stock ever got back to that level again when there were 25 days in 2014 where the stock managed to close above $80. Fast forwarding another five years and here we are again as QCOM traded back above $80 earlier this morning but has since traded back down below that level. Will the third time be the charm, and can QCOM finally trade and hold above $80? It’s certainly been quite a trip! Start a two-week free trial to Bespoke Institutional to unlock the full Bespoke interactive research portal.