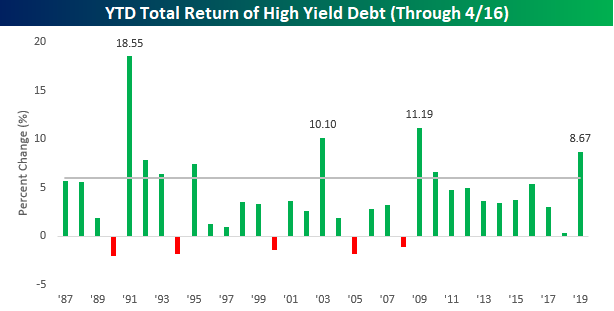

After a rough Q4 for the junk bond market, 2019 has turned into a banner year for the sector. As measured by the Merrill Lynch High Yield Master Index, the total return for the high yield market through Tuesday’s close has been a gain of 8.67%, making it the fourth-best start to a year for the sector on record and the best start since 2009. This year’s gain also marks the eighth time since 1987 that the high yield market had gained more than 6% through 4/16.

So how does the junk market perform for the remainder of the year after such strong starts like 2019? And how about the equity market as well? Below is a chart showing rest-of-year returns for junk bonds and the S&P 500 in all years since 1987. Years where junk bonds rallied 6%+ through 4/16 are shaded in grey.

Continue reading this Chart of the Day by starting a two-week free trial to any of our research membership levels.