Futures have turned a little higher this morning ahead of what is an absolute flood of economic data. Retail Sales, the Philly Fed, and Jobless Claims were just released, and the results were mostly better than expected with Retail Sales coming in better than expected, Jobless Claims dropping to an astonishingly low level of 192K, but the Philly Fed slightly missing consensus forecasts. There’s still a lot more data to contend with, though, as Markit Flash PMIs, Leading Indicators, and Business Inventories are still on the docket. Tomorrow is a holiday for the stock market in observance of Good Friday, but both Housing Starts and Building Permits will be released at 8:30. If you are off, enjoy the three day weekend.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

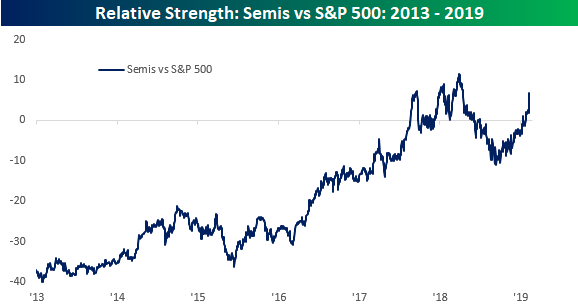

Following the recent settlement between Apple and Qualcomm (QCOM), we wanted to check up on the status of our comparison between the relative strength of semiconductors and the performance of the S&P 500. We have highlighted the leadership of semis numerous times in the last several weeks, and QCOM’s surge over the last two days has caused the group’s relative strength to soar to levels not far from last year’s high. As we have mentioned in the past, every major decline and rally of the last six years has been preceded by a move higher or lower in the relative strength of the semis. Emphasis is often placed on the importance of the transports in determining the direction of the market, but in recent years the semis have been a much better tell.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.