Chart of the Day: Odds of 10 Year Yield Bounce Rise

Not Bad for a Five Week Losing Streak

The DJIA is entering this last full week of May riding a streak of five straight weeks of declines in what is the longest weekly losing streak for the index in just under eight years. While the current streak is the longest in years, it is also notable due to just how mild of a losing streak it has been. Over the five weeks in which the DJIA has been down, its total decline has been a mere 3.67%. To put that in perspective, the average decline for the DJIA during its 64 prior five-week losing streaks since 1900 has been a drop over 10%, and the last time the DJIA saw a smaller decline during a five-week losing streak was over 40 years ago in 1976!

While there have been 64 prior five-week losing streaks for the DJIA, there have only been eight prior streaks where the DJIA’s losses during the first five weeks of declines were less than 5% (table below), and there have only been three where the decline was less than the 3.67% we saw over the last five weeks. As shown in the table, of the eight prior mildest streaks, the DJIA went on to see a sixth straight week of declines more than half of the time for an average decline of 0.65% (median: -0.45%). For all five-week losing streaks, however, the DJIA saw an average gain of 0.35% during week six with gains just over half of the time (51%). Start a 2-week free trial to Bespoke Premium for full access to our research and interactive tools.

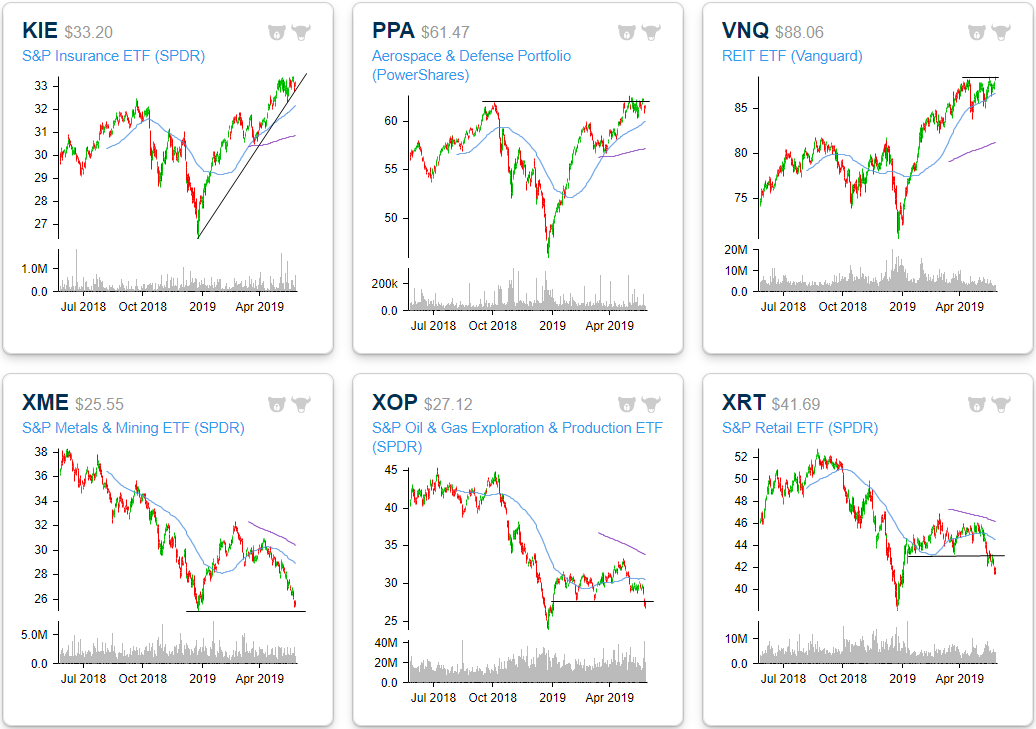

Some Cyclical Industries Nearing 52-Week Lows

Below we highlight charts for a half-dozen US equity ETFs as we start this holiday-shortened trading week. Over the past few weeks, investors have been largely turning away from stocks/ETFs that are more cyclical in nature. Meanwhile, defensives such as REITS, like the REIT ETF (VNQ), have held up better. In the case of VNQ, the ETF is actually headed into today right near a breakout of its 52-week high. The Aerospace and Defense ETF (PPA), while more of a cyclical industry, is also sitting near highs from the past year as it has for a couple of weeks now. The S&P Insurance ETF (KIE) is another industry that is looking promising as it has pulled back to the bottom of this year’s uptrend.

Other industries that are more susceptible to global growth trends have been rolling over. Namely, the S&P Metals and Mining ETF (XME) has been in a downtrend for some time now. After running up to the top of its downtrend channel in February, XME has fallen through prior support and is now approaching this past year’s lows. The S&P Oil and Gas Exploration and Production ETF (XOP) and the S&P Retail ETF (XRT) are a similar story. After trading sideways for most of this month, XOP gapped lower on Thursday falling through support established at multiple points earlier this year. The S&P Retail ETF (XRT) has a comparable chart pattern. For XME, XOP, and XRT, the 52-week lows are the next critical support level to watch. Start a two-week free trial to Bespoke Institutional to access our interactive Chart Scanner and much more.

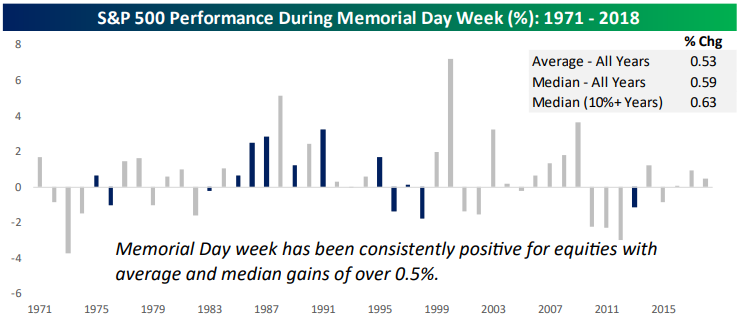

Memorial Day Week and Summer Stocks

Since 1971 when Memorial Day was officially designated as the last Monday of May, the S&P 500 has experienced an average gain of 0.53% during the 4-day Memorial Day week. On a median basis, the gains are slightly stronger at +0.59%. And in years when the S&P 500 is up 10%+ year-to-date heading into Memorial Day week (as it is this year), the median gain has been 0.63% during the week. In the chart below, we show the S&P’s change during Memorial Day week each year since 1971. Blue bars are years in which the S&P was up 10%+ YTD through Memorial Day.

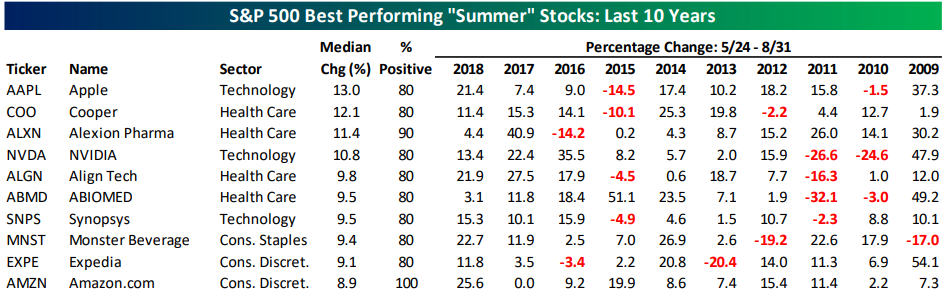

Now that “summer” has unofficially begun, we used our Stock Seasonality tool to find the S&P 500 stocks that perform the “hottest” during the summer months. Below are the ten stocks with the strongest median gains from Memorial Day through Labor Day over the last 10 years.

Somewhat surprisingly, Apple (AAPL) ranks first with a median gain of 13% over the last ten years with gains 80% of the time. AAPL has gained at least 7% in each of the last 3 summers, and the stock’s only decline of any significance came in 2015 when it dropped 14.5%. Cooper (COO) ranks second with a median gain of 12.1%, followed by Alexion Pharma (ALXN), NVIDIA (NVDA), Align Tech (ALGN), and ABIOMED (ABMD). Amazon.com (AMZN) also makes the cut with a median gain of 8.9% during the summer, ranking it 10th in the S&P 500. For AMZN, its median gain isn’t quite as strong as stocks like Apple or NVIDIA, but it hasn’t fallen once from Memorial Day to Labor Day over the last 10 years! Start a 2-week free trial to Bespoke Premium to access our Stock Seasonality tool and a wide array of investment research.

Morning Lineup – Easing in to a New Week

Welcome back from the long weekend. It’s looking like a modestly positive start to the trading week as US futures have been drifting higher as we head into the open, and after every Monday so far in May has been a weak one, bulls can be thankful that this week starts off with a Tuesday instead!

Looking ahead to today, Consumer Confidence for May will be released at 10 AM and the Dallas Fed Manufacturing report will come out a half hour later.

Make sure to check out today’s Morning Lineup for recap this weekend’s EU elections and the latest confidence readings for the region.

After failing to convincingly break out to new highs in April, the latest pullback for the S&P 500 brought the index right down to an important support level, which held for the time being. As shown in the chart below, last week’s pullback is now the second time that the index has tested that support in the last two weeks. This is an important level to watch in the days ahead, as the more often support gets tested the weaker it becomes.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 5/26/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Assessing Achievement

IQ rates are dropping in many developed countries and that doesn’t bode well for humanity by Evan Horowitz (NBC)

IQ test results are starting to slide in a variety of developed countries, suggesting that the world is getting dumber, posing concerns about the ability to innovate…though interestingly American results buck that trend. [Link]

Many More Students, Especially the Affluent, Get Extra Time to Take the SAT by Douglas Belkin, Jennifer Levitz and Melissa Korn (WSJ)

An increasing number of students are getting extra time to take the SAT, and the doctors notes which allow for that advantage are easier to come by for the affluent. [Link; paywall]

What the Childhood Years of Tiger Woods and Roger Federer Can Teach Us About Success by David Epstein (Sports Illustrated)

An instructive comparison of two sports stars who took a completely opposite approach to early sports, yet both ended up at the absolute pinnacle of success. [Link]

The Peculiar Blindness of Experts by David Epstein (The Atlantic)

An obscure bet between a Malthusian scientist and a more hopeful economist offers a lens into the sometimes perverse incentives and frictions which have made long-term forecasting so unreliable in recent decades. [Link]

Tariff Trouble

New China Tariffs Increase Costs to U.S. Households by Mary Amiti, Stephen J. Redding, and David E. Weinstein (NYFed)

Previous research suggested that the average US household paid $414 more for goods based on 2018 tariff levels. The newest 15% tariff rate on $200bn of goods adds $831 to consumers’ costs, and notably the deadweight loss goes from 32% to 75% of the total tariff costs. [Link]

The US tariffs on China have been paid almost entirely by US importers: IMF study by Fred Imbert (CNBC)

An IMF study was also released this week suggesting that consumers have “borne almost entirely” the costs of tariffs levied by the Trump Administration. [Link]

Health Care

CVS to test unregulated vitamins and dietary supplements by Shamard Charles (NBC)

As a condition of stocking unregulated supplements, CVS will start requiring independent testing to make sure that what it sells to consumers will be what is advertised. [Link]

End-to-end lung cancer screening with three-dimensional deep learning on low-dose chest computed tomography by Diego Ardila, Atilla P. Kiraly, Sujeeth Bharadwaj, Bokyung Choi, Joshua J. Reicher, Lily Peng, Daniel Tse, Mozziyar Etemadi, Wenxing Ye, Greg Corrado, David P. Naidich, and Shravya Shetty (Nature)

Lung cancer screening that catches the disease early can lead to drastically lower mortality, so offering it at lower prices could have a major impact by broadening access. This paper demonstrates a deep learning technique that achieves a 94% success rate diagnosing lung cancer, offering a hope for cheaper access. [Link]

Climate Change

Geophysical constraints on the reliability of solar and wind power in the United States by Matthew R. Shaner, Steven J. Davis, Nathan S. Lewis, and Ken Caldeira (Royal Society of Chemistry)

Using 30+ years of data on weather and temperature patterns, the authors illustrate the physical constraints on operating a power grid exclusively on solar and wind technology, assuming no large-scale storage capable of matching electrical generation timing to demand timing. [Link]

Nudging out support for a carbon tax by David Hagmann, Emily H. Ho, and George Lowenstein (Nature)

The authors show that “nudge” efforts to reduce climate impact (fly less, reduce electricity or plastic consumption, etc) reduce support for larger climate change action because they are perceived as a burden. [Link]

Social Media

CrossFit, Inc. Suspends Use Of Facebook And Associated Properties (CrossFit)

After a large diet information sharing group was deleted by Facebook, CrossFit is abandoning the platform and all its properties. [Link]

Tech Dystopia

It’s Getting Way Too Easy to Create Fake Videos of People’s Faces by Samantha Cole (Vice)

Neural networks and other “AI” techniques are getting easier and easier to operate, leading to the possibility that video can be easily faked in order to deceive. [Link]

Hackers have been holding the city of Baltimore’s computers hostage for 2 weeks by Emily Stewart (Vox)

Hackers have taken control of computer networks operated by the city government, demanding about $100,000 in bitcoin to unlock them. [Link]

Tech Utopia

Driverless Cars Working Together Can Speed Up Traffic By 35% by Saravana (Gimate)

A new University of Cambridge study has shown that coordinated driverless cars could increase traffic volumes by 35% or more. [Link]

Personal Finance

Broke Millennials Are Flocking to Financial Guru Dave Ramsey. Is His Advice Any Good? by Kristen Bahler (Yahoo!/Money)

An evangelical radio host from Tennessee is offering tough love and uncompromising anti-debt messages to millions via the 15 hours per week he blasts from radios around the country. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – It’s All Relative

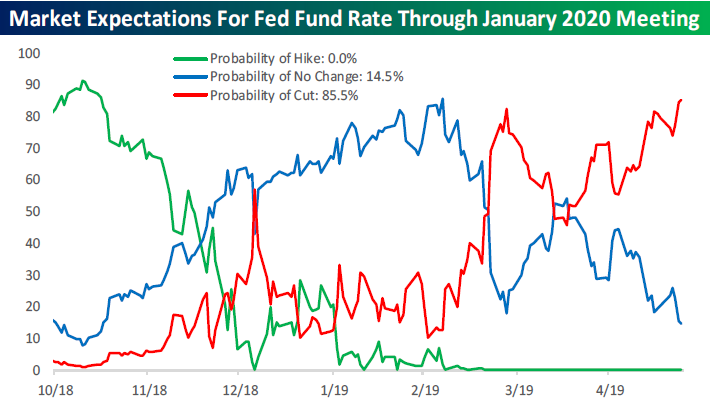

Hut, Hut, Cut! With weaker economic data to contend with this week on both a domestic and international basis, plus escalating tensions between the US and China, investors are increasingly pricing in a higher likelihood of rate cuts from the FOMC before the year is out. Through mid-day Friday, the Fed Fund futures market was pricing in over an 85% chance of a rate cut between now and the January 2020 meeting. Those are the kind of odds that would make James Holzhauer say “All in.”

This week’s Bespoke Report newsletter is now available for members. In this week’s report, we cover all the bases including the massive declines in semis, one of the shallowest five-week losing streaks for the DJIA on record, the shift to defensives, the disconnect between the market and the Fed, the widening gap between Internationals and Domestics, summer seasonality, sentiment updates, what the S&P 500’s flat 200-DMA means for equities, big gaps down on a daily basis, and more.

We cover everything you need to know as an investor in our weekly newsletter. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Corn Stop Out-Pocalypse

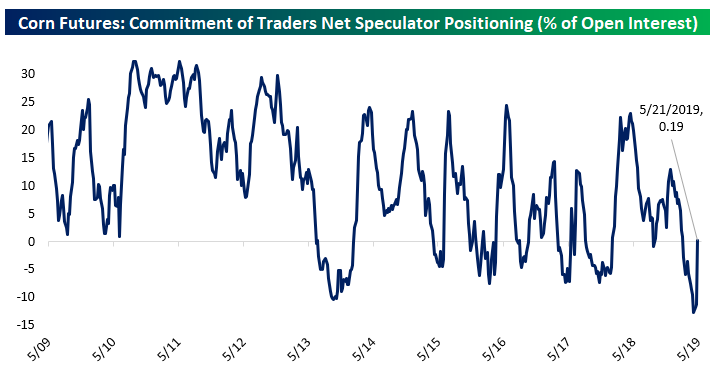

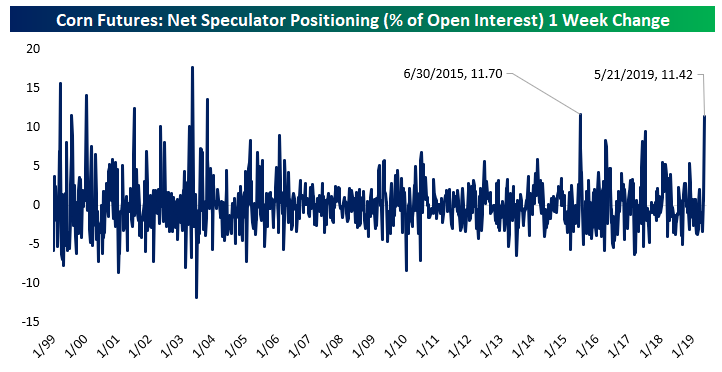

Earlier this week we discussed the very poor condition of the corn crop’s spring planting. Apparently, corn speculators are taking the data to heart. The chart below shows the percentage of outstanding open interest that represents the number of contracts speculators hold long net of their short positions. This data is released weekly in the CFTC’s Commitment of Traders report. As shown, corn speculators have abruptly about-faced from a historically large short position to a very small long. Start a two-week free trial to Bespoke Institutional to track futures positioning across asset classes.

The change has been one of the largest in the last 20 years, equivalent to 11.4% of open interest. In other words, as corn prices have surged, positioning has been cleared out. That could be a good sign for where prices head next if you assume that speculators are going to keep pushing contracts higher by building longs. On the other hand, with positioning now cleaned out, the contrarian view is that markets are vulnerable to bearish moves now without large and vulnerable shorts that are sensitive to price moves higher.

The Closer: End of Week Charts — 5/24/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Next Week’s Economic Indicators – 5/24/19

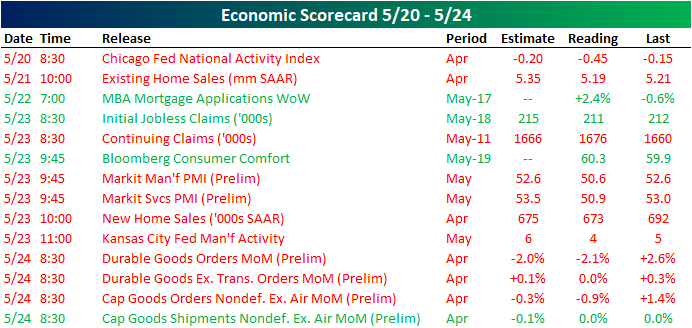

Despite a light data slate, there were not too many bright spots this week as only four of the fourteen releases showed improvements from the prior period or beat estimates; the rest came in weaker or missed forecasts. The Chicago Fed’s National Activity Index was the only release on Monday coming in weaker than both March’s reading and consensus estimates. Similarly, April Existing Home Sales was the only release Tuesday, and results were once again weaker than expected. While Initial Jobless Claims on Thursday were better than expected, Continuing Claims missed by 10K. Flash PMIs were very weak for both manufacturing and the services sectors. Friday morning, advanced manufacturing orders, sales, and inventories all disappointed (we covered in an earlier post). Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

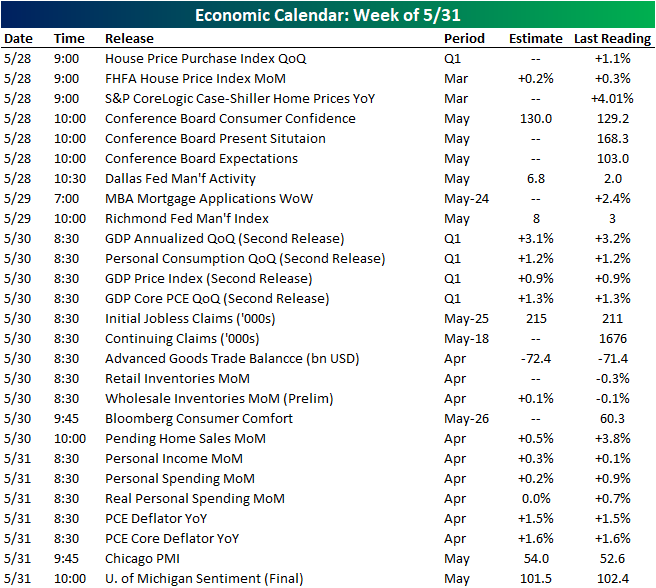

Activity picks back up next week with 27 releases on the docket. Due to Memorial Day holiday, markets will be closed, and no data is to be released on Monday. But on Tuesday things pick back up with multiple home price indices. The quarterly House Price Purchase Index for Q1 will come out in addition to the FHFA House Price Index and S&P CoreLogic Case-Shiller Index for March. More housing data will be out on Thursday with Pending Home Sales. The Conference Board’s Consumer Confidence for May and the Dallas Fed’s Manufacturing Activity Index will also be released Tuesday, and both are expected to show an increase. The Richmond Fed will follow that up with their own manufacturing index on Wednesday, similarly expected to increase relative to April. In addition to the typical weekly data on Thursday, the second release of Q1 GDP will be out. While consumption and inflation are expected to be unchanged from the initial release, GDP is expected to be 0.1% weaker. Personal Income and Spending for April is due out in what will be a busy Friday. While income is expecting an uptick, spending data is forecasted to be considerably weaker. The Fed’s favored inflation gauge, PCE, along with the Chicago PMI and University of Michigan Sentiment will round out the week on Friday.