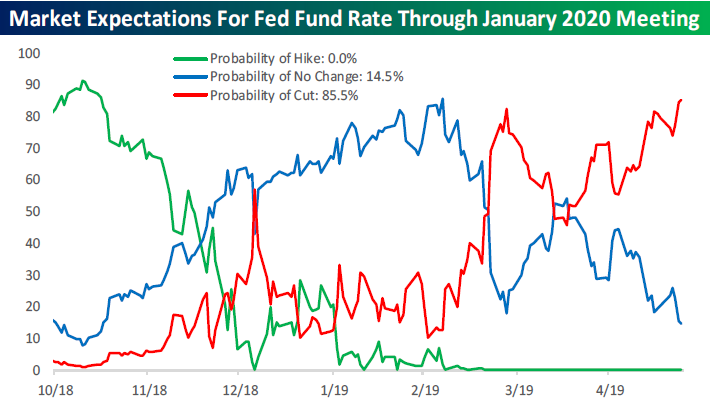

Hut, Hut, Cut! With weaker economic data to contend with this week on both a domestic and international basis, plus escalating tensions between the US and China, investors are increasingly pricing in a higher likelihood of rate cuts from the FOMC before the year is out. Through mid-day Friday, the Fed Fund futures market was pricing in over an 85% chance of a rate cut between now and the January 2020 meeting. Those are the kind of odds that would make James Holzhauer say “All in.”

This week’s Bespoke Report newsletter is now available for members. In this week’s report, we cover all the bases including the massive declines in semis, one of the shallowest five-week losing streaks for the DJIA on record, the shift to defensives, the disconnect between the market and the Fed, the widening gap between Internationals and Domestics, summer seasonality, sentiment updates, what the S&P 500’s flat 200-DMA means for equities, big gaps down on a daily basis, and more.

We cover everything you need to know as an investor in our weekly newsletter. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!