The Bespoke 50 Top Growth Stocks

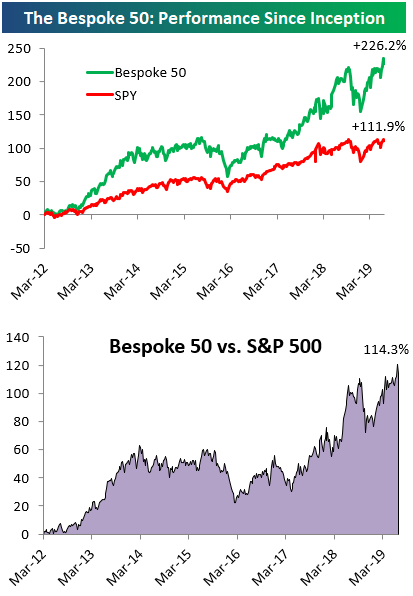

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 114.3 percentage points. Through today, the “Bespoke 50” is up 226.2% since inception versus the S&P 500’s gain of 111.9%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Jobless Claims Move Higher But Still Break a Record

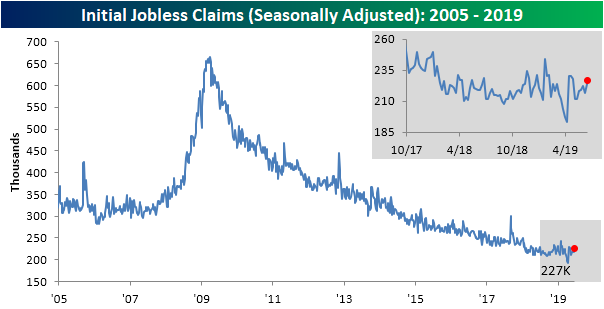

The Department of Labor’s weekly Initial Jobless Claims released this morning showed a 10K increase from last week’s upwardly revised reading of 217K. Now at 227K, claims are at their highest level since May 3rd when they were slightly higher at 228K. This brings the indicator towards the upper end of the past year’s range, but claims also still remain very low historically. This week marked a record 90 weeks that claims came in at or below 250K. The previous record stood at 89 weeks ending January 10th, 1970. Additionally, the streak of readings at or below 300K rises to its 225th consecutive week.

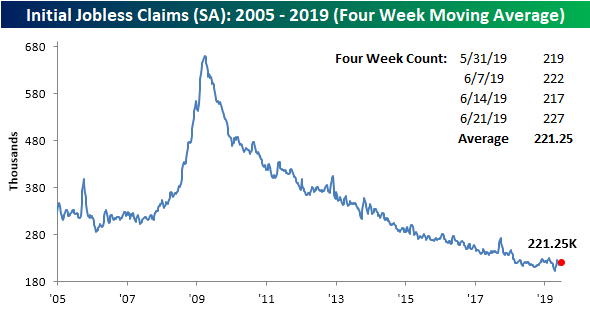

The less volatile four-week average also moved slightly higher this week rising to 221.25K from 219K last week. Like the weekly data, the moving average currently sits at the upper end of its range from the past year and the last time it made a new low was back in April. As the moving average is off of these recent lows, it has also moved higher YoY for the ninth week in 2019. In 2018, there wasn’t a single week with a YoY increase and over the course of all of 2017, there were only 5 weeks with YoY increases.

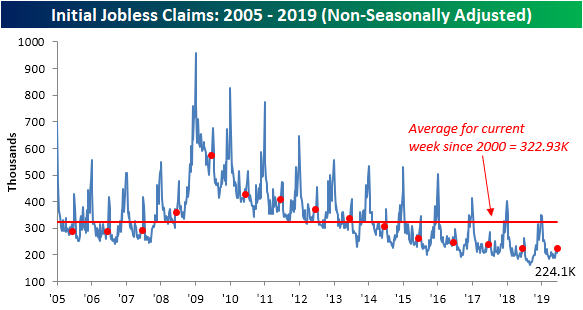

Non-seasonally adjusted (NSA) jobless claims saw yet another year-over-year increase as claims rose to 224.1K versus 222.8K one year ago. Now just about halfway through 2019, there have been ten weeks with a YoY increase in the NSA data (this is the same case for the seasonally adjusted data as well). Like the moving average, for this point in the year, this is a significant increase in the frequency of these increases from prior years. For reference, over the course of all 52 weeks in the entire year, 2018 only had two weeks and 2017 only had seven weeks with a similar YoY increase. In other words, labor market data is still at a strong level—NSA data is still well below the average for the current week since 2000, SA data has held onto impressive streaks, etc.—but it also has not been improving at anywhere near the same rate as we saw in 2017 and 2018. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

US Falls to the Bottom of the Pack

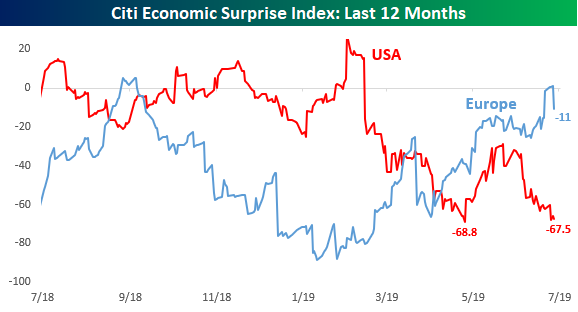

In a post earlier this week, we provided an update to the Citi Economic Surprise indices broken out by region. With economic data in the US continuing to disappoint this week, the Citi Surprise index (percentage of economic indicators that are beating vs. missing estimates) for the US is coming increasingly close to taking out its late April low and declining to its lowest levels in two years. What’s also notable about the current reading is that at the most recent reading of -67.5, the surprise index for the US is more negative than any other country or region that this series tracks.

Below we compare the Citi surprise reading for the US and Europe over the last twelve months, and what a reversal it has been. Heading into 2019, economic data in the US was coming in much better relative to expectations versus Europe, but ever since then, data in the US has been getting progressively worse relative to expectations, while data in Europe has been consistently improving. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and stay on top of all the latest economic trends.

Sentiment Still Not Buying the Highs

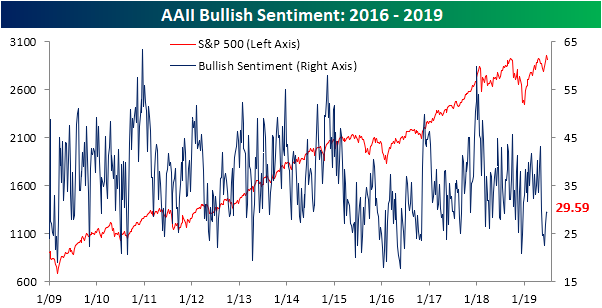

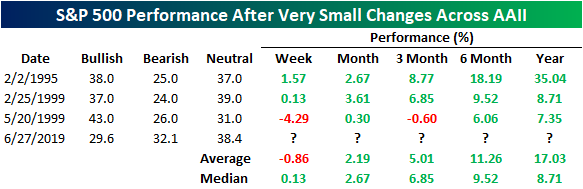

As the S&P 500 moved up towards an all-time closing high last week, we noted bullish sentiment levels were relatively muted in spite of this price action. We also highlighted that it is not exactly common for the market to reach new highs when sentiment is this subdued. But as the S&P 500 reached those new all-time highs one week ago today—followed by several sessions of selling—investors haven’t been excited by the new highs. This week’s AAII survey of investors showed hesitation more than anything with very small changes across the board. The percentage of investors reporting as bullish rose only 0.08% to 29.59%. Bullish sentiment saw a similar sized move only one month ago when it had risen from 24.71% to 24.79% in the final week of May. Given these readings, bullish sentiment remains at the lower end of its normal range sitting over 8.5 percentage points from the historical mean.

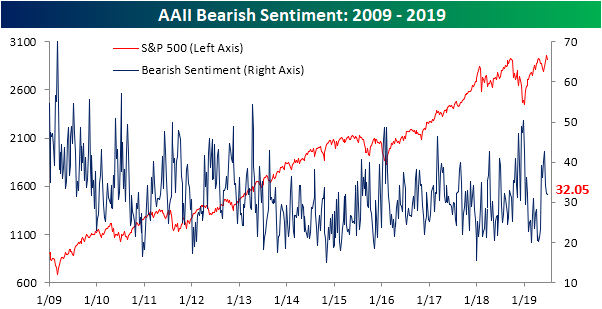

Bearish sentiment perfectly mirrored bullish sentiment this week as the percentage of investors pessimistic investors falling by just 0.08% to 32.05% and still above the historical average of 30.32%.

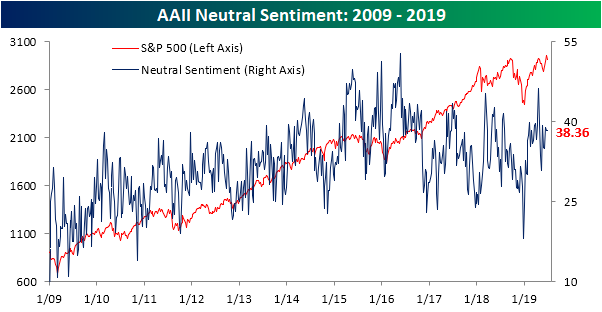

Neutral sentiment was completely unchanged this week. Holding firm at 38.36%, this was the first time that neutral sentiment saw no change since February 26, 2009. Like bearish sentiment, while off of recent highs, neutral sentiment remains elevated above the historical average of 31.5%.

Again, across the board, the changes in sentiment levels in the AAII survey were very small this week. In fact, bullish, bearish, and neutral sentiment all simultaneously moving less than 0.1% is something that rarely has happened in the history of the survey. This was the first occurrence in over 20 years. The prior times this has occurred, twice in 1999 and once in 1995, all saw no change in these readings week-over-week (prior to 2000, AAII readings weren’t expressed in decimals). While it is a small sample size, forward performance has generally leaned positive going forward, although we wouldn’t put much weight into it.Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

GDP Unrevised In Total, With Some Small Changes Under The Surface

This morning the BEA released its third and final estimate of Q1 GDP growth. Economists were expecting a small revision higher to 3.2%, but the final reading on GDP growth in Q1 was 3.1%, unchanged from the second estimate on a rounded basis and +6 bps actual. In the table below, we show the evolution of the release from Q4’s final reading to today’s release, with the prior estimate included as well. Notable revisions higher include non-auto durables consumption, software spending, some other categories of fixed investment, and state/local government spending. Notable downward revisions included autos, household services spending (ex health care, which was revised up), and output of non-profit institutions. Inventories were also revised down slightly. Start a two-week free trial to Bespoke Institutional to access our entire suite of research services.

Chart of the Day: Shareholders Footing The Bill

Morning Lineup – Conflicting Headlines

Dow futures are under a bit of pressure this morning due to weakness in Boeing (BA), which is trading down nearly 3%. S&P 500 and Nasdaq futures, meanwhile, are both indicating a positive open although they too are off the highs of the overnight session. The more optimistic tone earlier was due to some positive headlines regarding this weekend’s meeting between President Trump and President Xi, but some of the air was let out of the balloon following a less optimistic tone from the WSJ.

Please read today’s Morning Lineup to get caught up on everything you need to know ahead of the new trading day including the latest news on trade, Sentiment among Korean businesses and in the EU, as well as the latest on the Brexit saga.

In economic news, GDP was slightly worse than expected (3.1% vs 3.2%), while Jobless Claims were a bit higher than expected (227K vs 220K expected).

Bespoke Morning Lineup – 6/27/19

Semis have been one of the most negatively impacted groups from all of the trade disputes between the US and China, but yesterday the group got a reprieve on the back of Micron’s (MU) big 13%+ gain. Overall, the Philadelphia Semiconductor Index (SOX) rallied over 3%, and while the S&P 500 sold off in the afternoon, semis managed to hold up much better. In fact, all 30 stocks in the SOX traded higher yesterday, which was the fourth time this month that we have seen every stock in the index trade higher on the same day.

While there have now been four days this month where every stock in the SOX traded higher on the day, there hasn’t been a single day where every stock traded lower. Going back to 2009, this is only the second month where we have seen a net of at least four days where breadth in the SOX was 100% positive. The one other month was back in July 2009 in the early stages of the bull market. Conversely, there has only been one month in the last ten years where there was a net of four days where every stock in the SOX traded down on four separate days in the same month. That month was March 2018 when the index also saw its high for 2018.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Oil Driving, Financial Conditions, Durables Slowing, GDP Tracking – 6/26/19

Log-in here if you’re a member with access to the Closer.

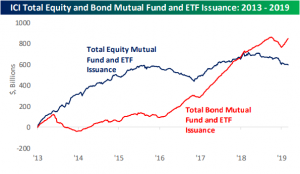

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the hit small caps have taken, but provide a reason for optimism in the space. Given the spike up in oil from geopolitical factors and today’s EIA data, we then show the strength of the energy sector and CAD. We also review how financial conditions are using a composite of indices from Goldman Sachs, Bloomberg, and the Chicago Fed. Further in economic data, we make sense of today’s messy durable goods release followed by a recap of the trade balance and inventories. We finish tonight with our weekly look at ICI fund flows.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

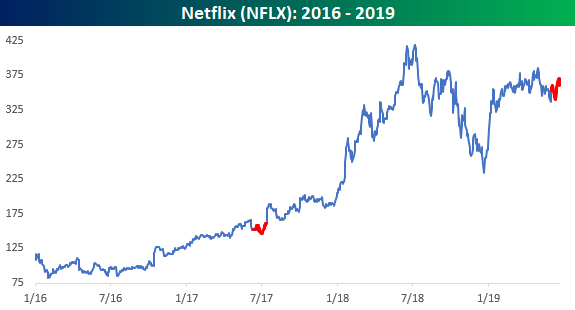

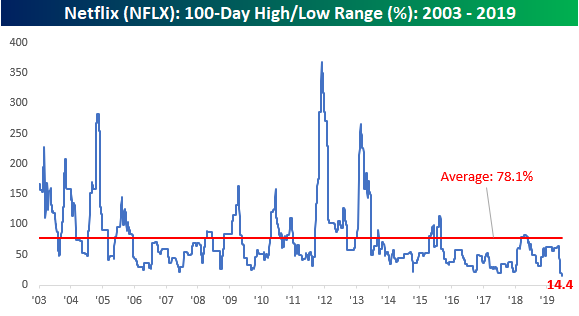

Netflix (NFLX) on Ice

Despite news that its most popular show would no longer be available on the streaming service beginning in 2021 and that one of its top creative directors was jumping ship for Disney (DIS), shares of Netflix (NFLX) have managed to rally today and are actually slightly outperforming the broader market. While NFLX is higher today, the stock remains stuck in a major trading range between the mid-$330s and mid-$380s. That may sound like a wide level, but believe it or not, the current 14% trading range that NFLX has been stuck in for the last 100 trading days is the narrowest in the stock’s history. For some perspective on how the current range compares to history, NFLX’s average 100-trading day range has been 78.1% or more than 5 times the current range! You may also recall that just two weeks ago, we also highlighted the narrow range in the stock, and since then the range has narrowed by another five percentage points.

So what happens following periods when NFLX trades in a narrow range? In the 16 years that NFLX has been public, there has only been one other time where the stock traded in a 100-trading day range of less than 20%. That one period was in 2017, and while it doesn’t get any smaller than a sample size of one, that period ended up being a short period of consolidation before continuing higher. A key difference between the two periods, though, is that back in 2017, the sideways range followed a new all-time high in NFLX’s price, while the current sideways range comes more than a year after the stock last hit a high. Start a two-week free trial to Bespoke Institutional to access our entire suite of research services.