B.I.G. Tips – June Employment Report Preview

With just one day separating the July 4th holiday and the upcoming weekend, you probably figured that Friday would be a throwaway day. Not this time. With the market all but pricing in at least a 25 bps rate cut at the end of the month but many FOMC officials not on the same page (see Mester’s comments from Tuesday), Friday’s employment report will be even more important than normal. You can bet there will be a notable market reaction whether the report is good or bad!

Heading into Friday’s report, economists are expecting an increase in payrolls of 162K, which would be an improvement from May’s much weaker than expected reading of 75K. In the private sector, economists are expecting an increase of 153K, which represents a 63K increase from last month’s weaker reading of 90K. The unemployment rate is expected to remain unchanged at 3.6%. Average hourly earnings are expected to grow at a rate of 0.3% versus last month’s 0.2% reading. Finally, average weekly hours are expected to be unchanged at 34.4.

Ahead of the report, we just published our eleven-page preview of the June jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in June. We also include a breakdown of how the initial reading for June typically comes in relative to expectations and how that ranks versus other months.

For anyone with more than a passing interest in how equities are impacted by economic data, this June employment report preview is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Claims Healthy Despite Weak ADP

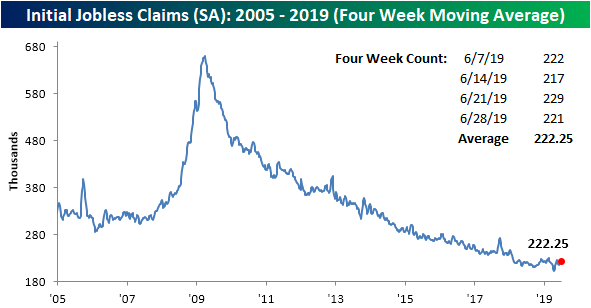

In what is a busy week of labor data, results so far have been mixed. Ahead of Friday’s Nonfarm Payroll Report for June, ADP payroll data released this morning missed forecasts of 140K, coming in at just 102K. While this set the stage for a potentially weaker NFP number on Friday, Initial Jobless Claims (released one day early due to the holiday) came in slightly stronger than forecasts and improved modestly from the previous week. While not making significant moves lower, claims continue to hold at healthy levels. Last week’s original print of 227K was revised up to 229K but this week saw an 8K drop to 221K. Claims were expected to fall to 223K. This stronger than expected print keeps the streaks going as claims have remained below 250K for a record 91 weeks and below 300K for a record 226 weeks.

The less volatile four-week moving average edged 0.5K higher to 222.25K this week. This is as an input of 219K from late May rolled off the average to be replaced by this week’s higher 221K. The moving average has stayed in the upper end of its range from the past several months and has not made any meaningful move lower since April.

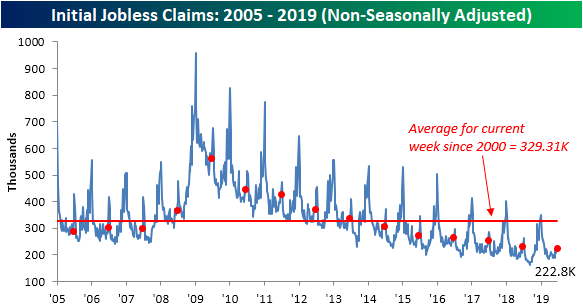

Turning to the non-seasonally adjusted (NSA) data, while the current week of the year typically sees an uptick in claims, the NSA number actually fell from 225.8K to 222.8K this week. For the current week of the year, this was the first time that claims fell week over week on an NSA basis since 2013. Headed deeper into the dog days of summer, claims data historically begins to see some seasonal increases so this drop is less likely to be repeated in the coming weeks. Regardless, this week’s number was the lowest reading for the current week of the year of the current cycle for what was all in all a healthy release. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Trend Analyzer – 7/3/19 – Solar (TAN) Keeps Running

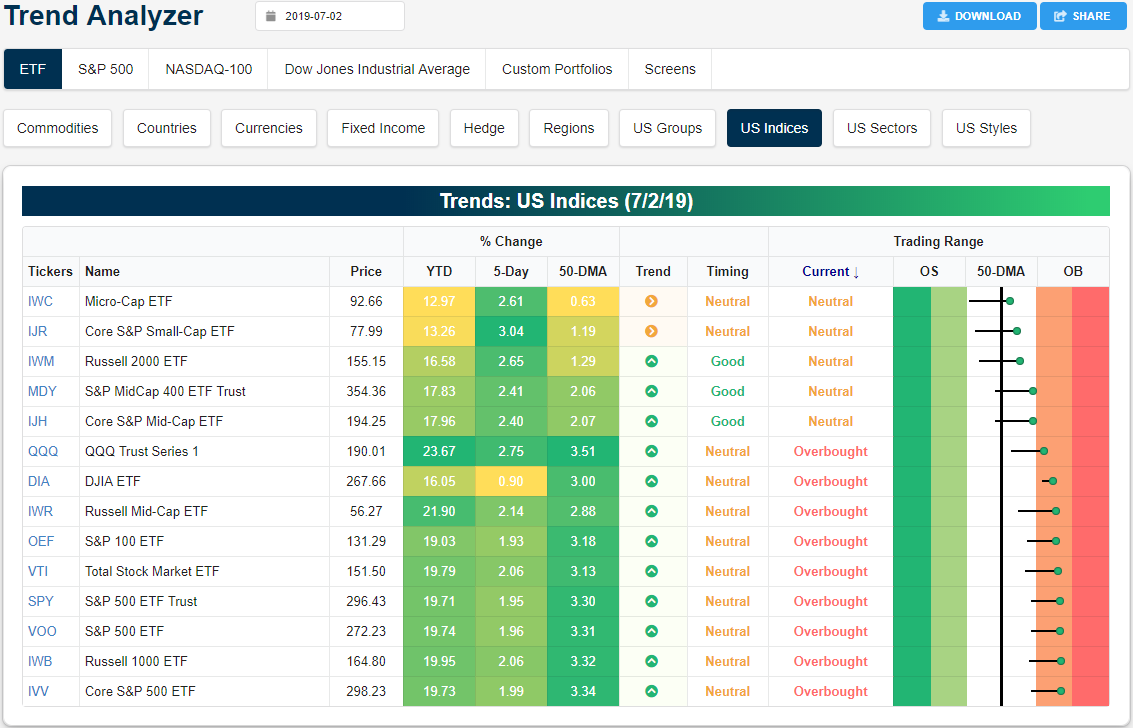

Gains have been strong across the board over the past week as the S&P 500 (SPY) finished at another all-time high yesterday. The only significant laggard has been the Dow (DIA) as it sits 0.9% higher from last Tuesday’s close. Otherwise, each of the major index ETFs has risen upwards of 3%. Small and mid caps have outperformed while the performance of large caps has been somewhat weaker. The Core S&P Small Cap (IJR) has done the best rising by 3.04%. The next best ETF is the Nasdaq (QQQ) with a 2.75% gain. In spite of these gains in the past week, there are actually fewer ETFs sitting at overbought levels than yesterday. Whereas there were 11 overbought major index ETFs at yesterday’s open, today there are only 9 as the S&P MidCap 400 (MDY) and Core S&P Mid-Cap (IJH) both moved to neutral on modest declines. Given their uptrends, this also gives them a good timing score in our Trend Analyzer tool.

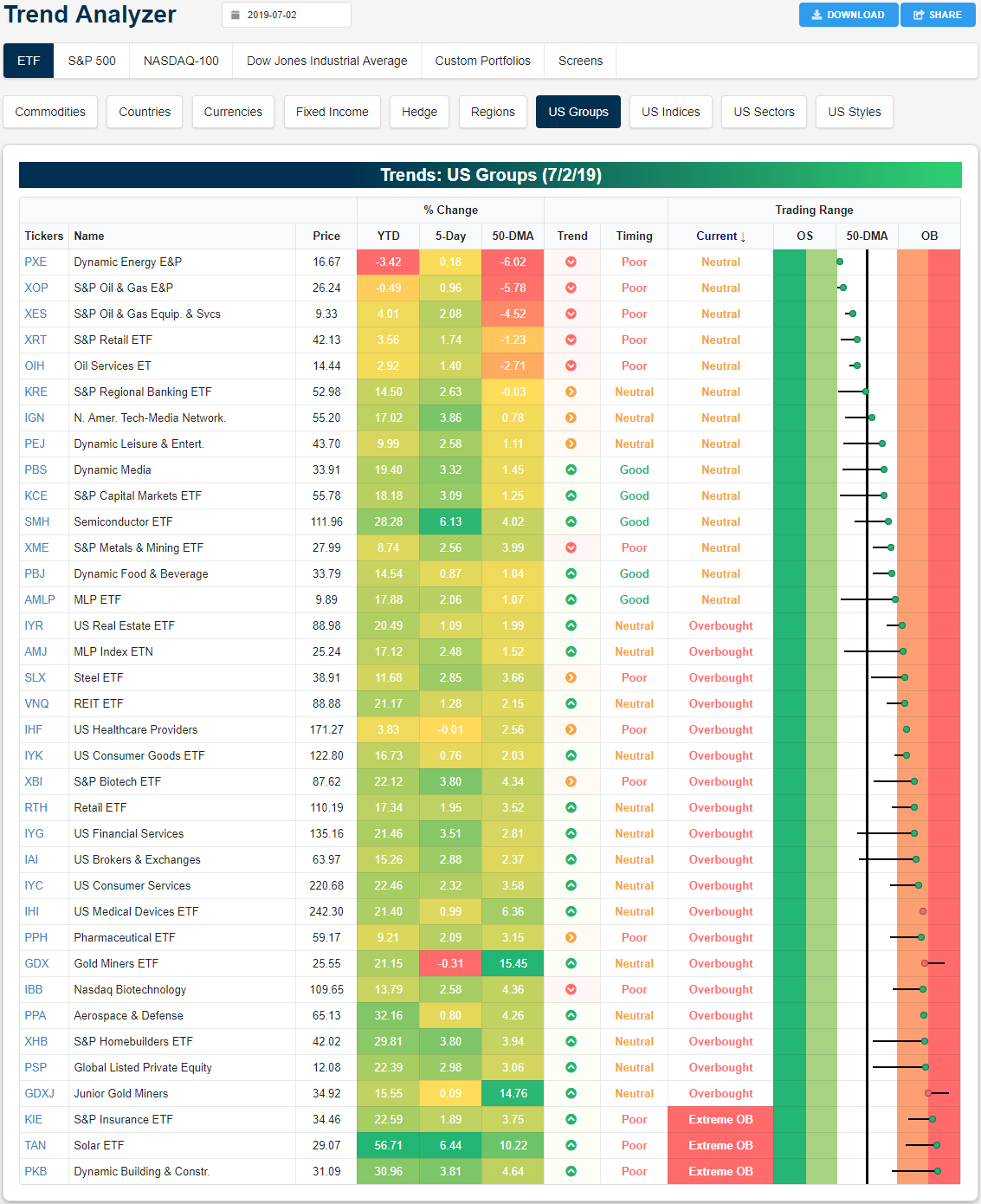

Looking at performance broken out by industry groups, the two best performers recently have been Semiconductors (SMH) and Solar (TAN). Both industries ripped over 6% higher in the past week. This brings SMH to be one of the top performing ETFs YTD. SMH also retook the 50-DMA in the past week but has yet to move into overbought territory, helping it to earn a good timing score. Meanwhile, solar has actually been the best-performing industry in 2019 by a wide margin as easing trade tensions have been a factor behind the rallies of both ETFs. TAN has now risen 56.71% YTD and is now trading at extremely overbought levels again.

While both of these ETFs have surged, most other industries have also moved higher as only the Gold Miners ETF (GDX) and US Healthcare Providers (IHF) are lower over the last week. The underperformance of GDX along with Junior Gold Miners (GDXJ) follows a surge where both become very extended from their 50-DMAs; both are still teetering on extremely overbought levels as well. While not in the red, with oil sliding, energy ETFs like the Dynamic Energy E&P (PXE) and S&P Oil & Gas E&P (XOP) have also been somewhat underperforming. These are currently the furthest below the respective 50-DMAs and the closest to oversold territory. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.

Bespoke’s Global Macro Dashboard — 7/3/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Morning Lineup – Mixed Data on Jobs

Happy July 4th! US futures are indicating a higher open this morning ahead of the holiday-shortened session. Treasury yields are lower, and the latest data hasn’t really done much to halt that slide. Mortgage applications slid, Private Payrolls released by ADP were weaker than expected, and Jobless Claims were only slightly lower than forecasts. There’s still a lot more data left on the calendar, though. Factory Orders, Durable Goods, and the ISM Services report will all be released at 10 AM Eastern. Stay tuned.

Read today’s Morning Lineup to get caught up on news and stock specific events ahead of the trading day, as well as updates on the latest Services PMI data around the world.

Bespoke Morning Lineup – 7/3/19

As mentioned above, the ADP Private Payrolls report missed expectations this morning coming in at a level of 102K versus forecasts for 140K. This month’s weaker print follows an even weaker reading of 41K last month. That takes the two-month rolling total of growth in private payrolls growth to 143K, which is the weakest two-month rate of growth since April 2010. Two months may not necessarily make a trend, but Private Payroll growth has fallen out of the longer-term range that it was in.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Trends, Auto Sales, Home Improvement Collapse – 7/2/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the trends in the 200-day moving averages of the S&P 500, WTI Crude Oil, the Russell 2000, and the 10-year. We then show the rarity of the S&P’s 200-day rising while other assets are not looking as optimistic. With little in economic data out today, we then show Eurozone and US auto sales and yesterday’s construction spending which continues to show collapsing home improvement.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Price Target Increases on the Way?

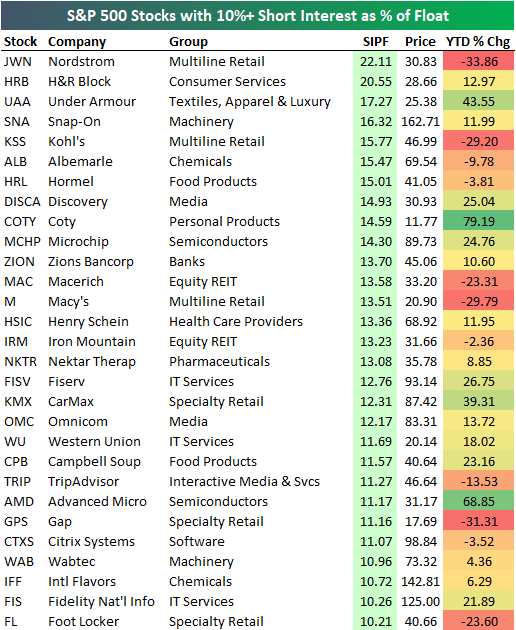

Most Heavily Shorted S&P 500 Stocks

Below is a list of the 29 stocks in the S&P 500 that have more than 10% of their share float sold short. Luxury retailer Nordstrom (JWN) currently tops the list with 22% of its float sold short. The stock is down 33.86% YTD and 55% from levels seen last November.

Tax-prep company H&R Block (HRB) is the second most heavily shorted stock with 20.55% of its float sold short. HRB is followed by sports retailer Under Armour (UAA), Snap-On (SNA), and Kohl’s (KSS). While JWN and KSS are both down big YTD, HRB, UAA, and SNA are all up nicely on the year.

There are plenty of other notables on the list, including Macy’s (M), Campbell Soup (CPB), TripAdvisor (TRIP), Gap (GPS), Western Union (WU), and Foot Locker (FL), but one common characteristic among many of them is that they are retailers.

On average, these stocks with 10%+ short interest as a percentage of float are up 8.5% on the year, which is well below the 17% gain that the S&P 500 has seen.

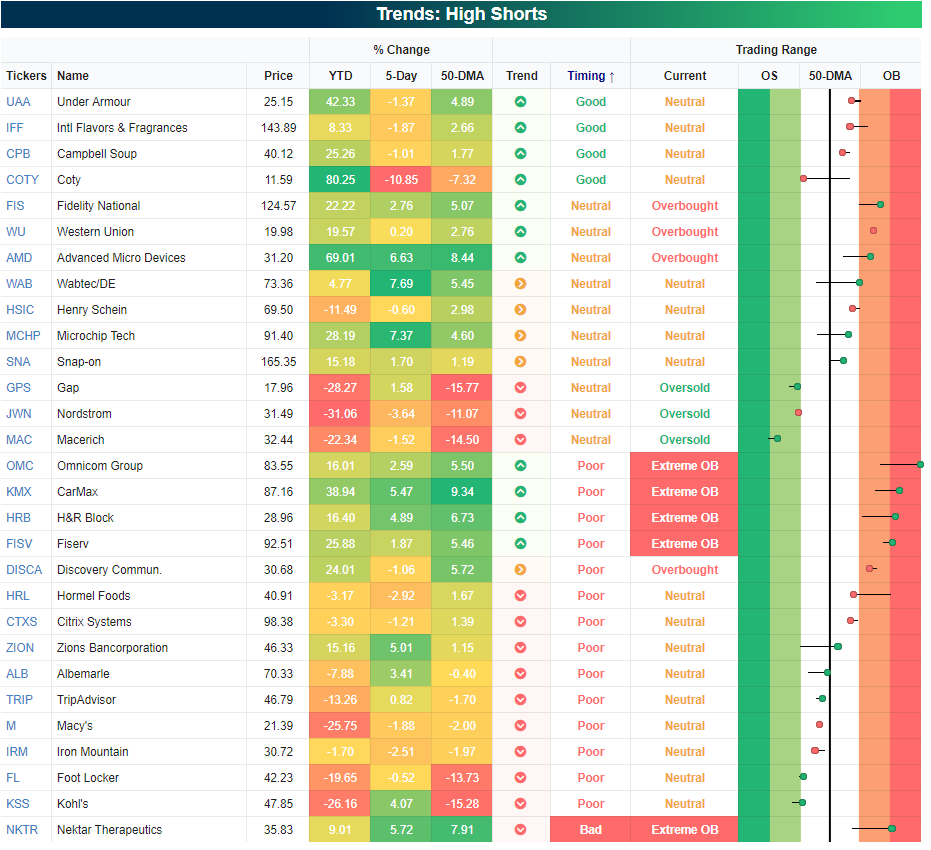

Below we have input the list of heavily shorted stocks into a custom portfolio that Bespoke members can create when they’re logged into our website. We’ve sorted the list by our algo-driven “Trend” and “Timing” scores. There are currently four stocks on the list that are in Bespoke “uptrends” with “good” timing scores — Under Armour (UAA), Intl Flavors & Fragrances (IFF), Campbell Soup (CPB), and Coty (COTY).

If you’re a Bespoke Premium or Bespoke Institutional member already, you can import this list of heavily shorted stocks into a custom portfolio by clicking here. We use these tools as starting points when we’re trying to find new long or short ideas, and our members can too! Start a two-week free trial to Bespoke Premium to build your own custom portfolios today.