S&P 500 Leading and Lagging Industry Groups

Friday’s rally in the S&P 500 helped to bring the S&P 500 right back within spitting distance of its record closing high from right before Thanksgiving and back up above 25% in terms of its YTD gain. While the S&P 500 wasn’t quite able to close at a new high last Friday, a number of groups did, and in most cases, these are also the most extended groups in the market.

Topping the list is Health Care Equipment and Services. While the group has trailed the S&P 500 on a YTD basis with a gain of just below 21%, it is nearly 7% above its 50-day moving average and closed at a 52-week high on Friday. Besides Health Care Equipment and Services, the next five groups that are trading the furthest above their 50-DMAs also closed at 52-week highs on Friday. Two other groups also closed at 52-week highs on Friday but are less extended relative to the 50-day than the S&P 500. Consumer Durables is up 28.5% YTD but is just 3.3% above its 50-DMA, while the Food Beverage & Tobacco group is just 2.5% above its 50-DMA and sitting on a YTD gain of 18.8%.

While the groups mentioned above have been leading the market heading into this week, there are actually three times as many groups less extended than the S&P 500 as there are groups that are more extended (from their 50-DMAs). The biggest laggards have been Real Estate and Utilities. Both groups are more than 3% below their 52-week highs as well as below their 50-DMAs. The only other group below its 50-DMA is Retailing which is pretty disappointing given that Christmas is just eleven days away. While Retailing is still up over 21% YTD, it is one of just four groups that are down 5%+ from their 52-week highs. The others are Consumer Services, Autos & Auto Components, and Energy. Energy has by far been the biggest disappointment in the equity space this year as it’s down nearly 14% from its 52-week high and up only 3.26% YTD. Start a two-week free trial to Bespoke Institutional to access our research reports, interactive tools, and more.

Bespoke’s Morning Lineup – 12/9/19 – Quiet Start Just Below Record Highs

Friday’s rally took the S&P 500 just below its record high and helped to make what was heading into the day a negative week positive. Small caps led the charge with the largest gains, while the Dow (DIA), Nasdaq 100 (QQQ), and Russell Mid Caps (IWR) were the only losers. Relative to each index’s trading range, the picture is the same, though. The market is overbought, but no longer at extreme levels.

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Bespoke Brunch Reads: 12/8/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2020 Annual Outlook special offer.

Trainwrecks

Uber discloses 3,000 reports of sexual assault on U.S. rides last year in its long-awaited safety study by Faiz Siddiqui (WaPo)

2018 alone saw 3,000 sexual assaults during Uber rides in just the US, reflecting a staggering risk for riders. A recent safety report also tallied 97 fatal crashes involving riders, 19 fatal physical assaults of riders, and more chaos during trips. [Link; soft paywall]

“Peloton Husband” Speaks Out by Alec Beall (Psychology Today)

Social media users unloaded on the popular stationary bike brand this week, criticizing the framing of an ad that depicted a video log of a woman using a bike her husband got her as a gift. The actor published a response to the vitriol this week. [Link]

TeamHealth sent thousands of surprise medical bills in 2017 by Caitlin Owens (Axios)

Investigations into the practice of surprise billing revealed physician staffing firm TeamHealth used surprise bills to increase the rate at which it billed insurers. [Link]

Immigration

How McKinsey Helped the Trump Administration Detain and Deport Immigrants by Ian MacDougall (ProPublica)

Reporting by ProPublica and the New York Times reveals that consulting giant McKinsey played a critical role in developing practices which have attracted the greatest condemnation over the past couple of years: cutting food and medical care allocations, as well as detainee supervision. [Link]

Trump gave states the power to ban refugees. Conservative Utah wants more of them. by Griff Witte (WaPo)

While the Trump Administration is doing everything it can to reduce the number of refugees that the United States accepts every year, deeply Republican Utah is happy taking in more new arrivals. [Link; soft paywall]

Nuptials

Pinterest And The Knot Will Stop Promoting Wedding Content That Romanticizes Former Slave Plantations by Clarissa-Jan Lim (BuzzFeed News)

Two large online wedding platforms will no longer promote venues and content that romanticize weddings at plantations. [Link]

Tech Trends

Unintended Perk of the Online Mattress Boom: Never-Ending Free Trials by Stephanie Yang (WSJ)

With dozens of new mattress companies offering free trials that last more than three months, savvy consumers are taking advantage. [Link; paywall]

Inside Larry Page’s Turbulent Kitty Hawk: Returned Deposits, Battery Fires And A Boeing Shakeup by Jeremy Bogaisky (Forbes)

Google co-founder Larry Page’s flying-car company promised that by the end of 2017, customers could purchase one of the light personal aircraft. Unfortunately, deployment hasn’t been so easy. [Link]

Trade Tales

Illegal gold flowing through Miami is a ‘direct threat’ to U.S. national security, Rubio says by Alex Daugherty and Nicholas Nehamas (Miami Herald)

Illegal gold miners in Latin America tend to route their product through Miami, and while the negative effects of the mining aren’t directly felt by Floridians that doesn’t mean they aren’t serious. [Link]

Visualized: Ranking the Goods Most Traded Between the U.S. and China by Asley Viens (Visual Capitalist)

A helpful point of reference: the categories of trade goods that are most-traded between the United States and China. US imports are dominated by cell phones, computers, and routers, while exports to China amount to soybeans, airplanes, and some cars. [Link]

Workplace Wonder & Woe

Starbucks Discloses Gender and Racial Pay Gap: There Isn’t One by Jeff Green (Bloomberg)

In a remarkable break from the norm, the nation’s largest coffee chain delivered a diversity report that showed no gap in pay between men and women and no racial pay gap either. [Link; soft paywall, auto-playing video]

Emotional Baggage by Zoe Schiffer (The Verge)

A remarkable catalogue of management failure and the excessive work culture of popular luggage brand Away, where workers were subjected to dramatic demands by a management desperate to grow. [Link]

Exclusive: CalPERS Fires Most of Its Equity Managers (Chief Investment Officer)

California’s public pension has fired most of the funds it uses to manage its external equity investment portfolio, taking the allocation to that space from $33.6bn to $5.5bn and reducing 17 managers to just 3. [Link]

Media Matters

Celebrities Seek Her Advice. M.B.A.s, Executives Line Up for Her Harvard Class. by Kathryn Dill (WSJ)

Harvard Business School offers a specific class on the business of stardom; this op-ed by the professor discusses her approach to the world of athletes and performers. [Link; paywall]

The Irishman Gets De-Aging Right—No Tracking Dots Necessary by Angela Watercutter (Wired)

A look at the intense technology required to make old actors young again, deployed to great effect in The Irishman. [Link]

The Kingdom, the Heavyweights and the $60 Million Prize Fight in the Desert by Joshua Robinson (WSJ)

This weekend featured a massive prize fight hosted by the Kingdom of Saudi Arabia, featuring a temporary 15,000 person stadium, a $60mm purse, and the kind of glitz only money can buy. [Link; paywall]

Economics

The myth of crowding out by Jamie Powell (FTAV)

A summary of a recent paper that contradicts the widely-held belief that government budget deficits “crowd out” private investment by soaking up capital that would otherwise go to private projects. [Link; registration required]

Science

Ford is making car parts—with waste from McDonald’s coffee beans by Amelia Lucas (CNBC)

The waste from coffee bean roasting at McDonald’s is being put to good use, getting included in auto parts used by Ford that reduce waste both during driving (the parts are lighter) and production (the parts use less energy to make). [Link]

How the 2010s Changed Physics Forever by Ryan F. Mandelbaum (Gizmodo)

A review of the biggest achievements of the decade in physics, from CERN’s Higgs bosons to the minute fluctuations caused by massive gravitational waves. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 12/6/19

2020 Outlook – Market Cycles

Our 2020 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better every year! In this year’s edition, we’ll be covering every important topic you can think of that will impact financial markets in 2020.

The 2020 Bespoke Report contains sections like Washington and Markets, Economic Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2020 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Market Cycles” section of the 2020 Bespoke Report, which focuses on market performance during the late stages of bull markets and bear markets.

To view this section immediately and all other sections, become a member with our 2020 Annual Outlook Special!

2020 Outlook – Economic Cycles

Our 2020 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better every year! In this year’s edition, we’ll be covering every important topic you can think of that will impact financial markets in 2020.

The 2020 Bespoke Report contains sections like Washington and Markets, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2020 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Economic Cycles” section of the 2020 Bespoke Report, which takes an in-depth look at historical expansions and recessions and how the current expansion stacks up.

To view this section immediately and all other sections, become a member with our 2020 Annual Outlook Special!

The Closer: End of Week Charts — 12/6/19

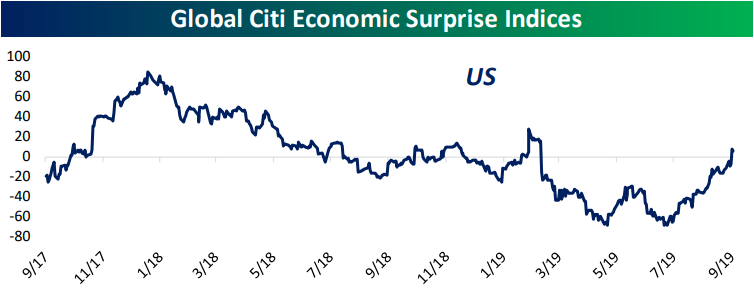

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

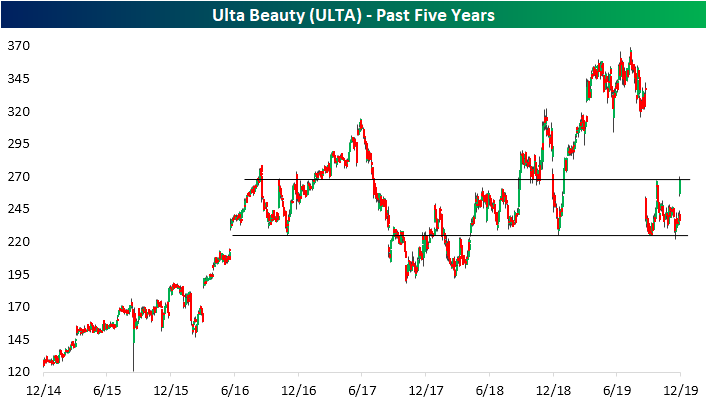

Earnings Give Ulta (ULTA) The Chance To Fill The Gap

In August, Ulta Beauty (ULTA) missed EPS and sales estimates while also lowering guidance. The stock experienced its worst decline on earnings since it began trading in 2009 with a gap down of over 25% and further downside throughout the day. Ultimately, the stock closed 29.55% lower. ULTA reported third-quarter earnings last night after the close, and the stock has seen quite the turnaround. Although it once again missed revenue estimates, the company beat EPS estimates by 12 cents and guidance was inline. In response today, Ulta is having its single best day since March 11th, 2016 (another reaction to earnings), rising over 12.5%.

Earnings are not the only catalyst for ULTA as the stock has traded around multiple significant support and resistance levels. The massive drop in August brought ULTA down to support in the mid-$220s range. This can be traced back to multiple points throughout the past few years including last December’s lows. Given just how oversold the stock had gotten in August, ULTA experienced a brief run higher before successfully retesting these levels again in the past several days. The jump on earnings today has marked a considerable rebound off of that support and has brought the stock up to resistance in the mid-$260s range. This is another interesting level as it marked the October 1st high following the last earnings report, support in the fall of 2018, and the highs in October of 2016. Assuming the stock manages to break above this resistance, it has the ability to fill the massive August gap. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorers and much more.

Gaps Higher On Jobs Gains Tend To Run

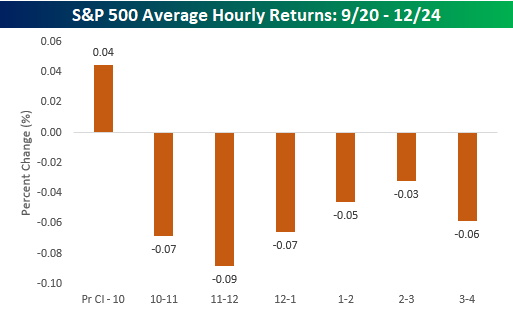

When the monthly Employment Situation Report delivers positive news, equities tend to keep moving higher in the aftermath. The chart below shows the S&P 500’s average intraday performance for the 21 days since 2009 when the S&P 500 gapped up at least 50 bps at the open on NFP days, as it did today. As shown, the morning usually sees a lot of back and forth after the initial gap up, but then we see a major ramp higher from noon to 1 PM ET. From 1 PM to 3:30 PM, the S&P tends to trend lower, and then we see a final batch of buying in the final 30 minutes of trading. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.

Bespoke’s Consumer Pulse Report — 12/6/19

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.