Bespoke Morning Lineup — 12/17/19

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – International Flows, Europe Record Highs, Internationals, PMIs – 12/16/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we provide an update on international fund flows, highlight a breakout for European equity indices, and show how stocks with heavy international revenue exposure are outperforming since the latest trade deal was announced.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

2020 Outlook – Yield Curve & Fed

Our 2020 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better every year! In this year’s edition, we’ll be covering every important topic you can think of that will impact financial markets in 2020.

The 2020 Bespoke Report contains sections like Economic Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2020 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Yield Curve & Fed” section of the 2020 Bespoke Report, which looks at the slope of the yield curve, inversions, and Fed rate policy heading into 2020.

To view this section immediately and all other sections, become a member with our 2020 Annual Outlook Special!

Republicans and Democrats are Polarized but it has been Worse

The full publication of our 2020 Outlook report will be available this Friday (12/20), but below is an excerpt from the “Washington” section, which we published last week. To view this section immediately and receive the full Outlook report in your inbox later this week, sign up for a Bespoke Premium membership using our 2020 Outlook Special.

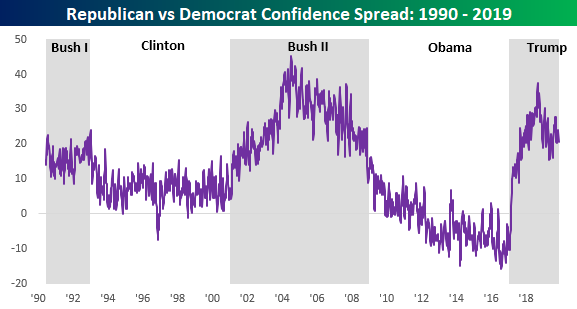

Bloomberg’s weekly poll of consumer comfort allows us to see how sentiment breaks down along political party lines. Below is a chart showing sentiment for Republicans and Democrats using Bloomberg‘s Consumer Comfort reading going back to 1990. In 2019, Republican confidence stood at some of the strongest levels since at least the 1990s. Given all of the polarization and butting heads in politics, you might expect the opposite to hold true for the confidence of Democrats. But in 2019 confidence among Democrats actually reached its highest level since 2000, although the upward trajectory has not been nearly as strong as that of Republicans; as could be expected when the opposing party occupies the Oval Office. The reading for Democrats is much higher now than it was at this point in Bush II’s Presidency.

Although both sentiment levels were strong in 2019, the spread between the two leans much more in the right’s favor. Albeit, the spread is also much lower than it was just over one year ago. But even at that peak earlier in President Trump’s term, that is not when Democrats and Republicans were most polarized. During the George W. Bush administration, the confidence spread reached as high as 45 percentage points. That is a nearly 8 percentage point difference from the recent peak of 37.7 in September of 2018 and about a 25 percentage point difference from the current level of the spread.

Still More Clicks Than Bricks

Friday’s retail sales report, which we discussed in a B.I.G. Tips report, was a disappointment with the headline and core readings missing forecasts. In spite of this overall weakness, one area of strength continues to be the Non-Store category. This essentially encompasses any online retail whereas the General Merchandise category includes retailers like physical department stores. For the past decade, shopping in brick and mortar stores has been steadily declining with online shopping picking up the slack as it has since the 1990s. Late last year, Non Store sales overtook General Merchandise for the larger share of sales for the first time ever. General Merchandise now only takes up 11.28% of retail sales which is a record low while the Non Store category takes up a record high of 12.89% of total sales.

As the dispersion between online and physical shopping continues to widen, Non Store sales have actually become the second largest category (as a percentage of total sales) of Retail Sales behind only Motor Vehicles & Parts, which takes up over 20% of sales as shown in the chart below. Online retail not only takes up a larger share of the total pie than General Merchandise, but it’s also larger than sectors like Food & Beverage Stores and Bars & Restaurants.

Another interesting dynamic has been the tendency to eat out rather than in. The November report showed 12.35% of sales from the Bars & Restaurants (eating out) category compared to 12.39% from Food and Beverage stores (eating in). The spread between these two categories has continued to narrow recently, and it’s only a matter of time before “eating out” overtakes “eating in” at this point. Start a two-week free trial to Bespoke Premium to access all of our B.I.G. Tips reports, Annual Outlook Report, interactive tools, and much more.

S&P 500’s Earnings Yield Is Average

While the price-to-earnings ratio is perhaps the most common valuation metric, the reverse of the ratio is another way to gauge valuations. Called the earnings yield, this is calculated by dividing earnings by price rather than the other way around which would result in the P/E ratio. In the Valuation Section of our Annual Outlook Report released last week, we took a look at the S&P 500’s earnings yield relative to corporate bonds. An excerpt is below. To view the entire section and gain access to all of the other sections (plus the rest of our research offering), join Bespoke Premium with this 2020 special offer.

Comparing the earnings yield of the S&P 500 to the yield on the 10-Year US Treasury (a so-called risk-free asset) has the potential to be an apples to oranges comparison as stocks are considered a risk asset and treasuries are considered a ‘risk-free’ rate of return. To help take that into account, the chart below compares the earnings yield on the S&P 500 to the yield on corporate bonds using the average yield of Moody’s AAA and BAA corporate indices.

The earnings yield of the S&P 500 relative to corporate bond yields is currently right inline with its historical average. Looking back at this relationship over time, pre-1960 this ratio was much higher than average. Then, it was much lower than average for the next 50 years. In the last decade now, the ratio has stayed pretty close to its historical average. Not too hot. Not too cold.

Chart of the Day – Borrowing From the Future?

Homebulilders Exuberant

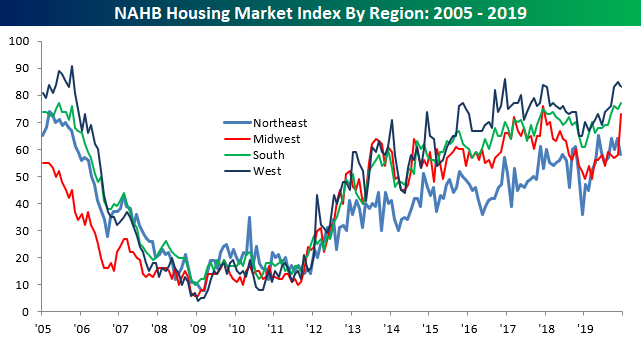

Bullish sentiment towards the stock market has been lacking for years now, but it looks like we finally found out where all the bulls went – to the housing market! This morning’s December homebuilder sentiment report from the NAHB blew the doors off expectations. While economists were forecasting the headline index to come in at a level of 70 (unchanged from November), the actual reading rose to 76 from a seasonally adjusted November reading of 71. Not only was December’s reading the biggest beat relative to expectations since March 2017, but it was the highest overall reading since 1999!

The table below breaks down this month’s report by its components. December saw big increases in Present Sales and Traffic, but even Future Sales saw a modest bounce. On a regional basis, sentiment in the Northeast and West declined as these regions still have a lot of exposure to high tax states, but sentiment in the Midwest surged by a record 15 points. The chart below the table shows trends in sentiment by region. With this month’s data, sentiment in the Midwest is back near its cycle highs, while sentiment in the South is at its highest level of the cycle. Meanwhile, sentiment in both the Northeast and West declined, but both regions are coming off levels that were near the highest of the recovery.

Finally, homebuilder sentiment has really taken a 180-degree turn in the last 12 months. Closing out 2018, housing was a big question mark as the impact of the tax bill and tighter monetary policy both acted as stiff headwinds. As the FOMC has pivoted, though, so too has the housing market, and this year’s 20-point jump in homebuilder sentiment will go down as the third-best year for sentiment in the history of the survey. The only stronger years were 2012 (26 points) and 1992 (21 points). Start a two-week free trial to Bespoke Institutional to access all of Bespoke’s equity market research and interactive investor tools.

Seasonality Tailwind

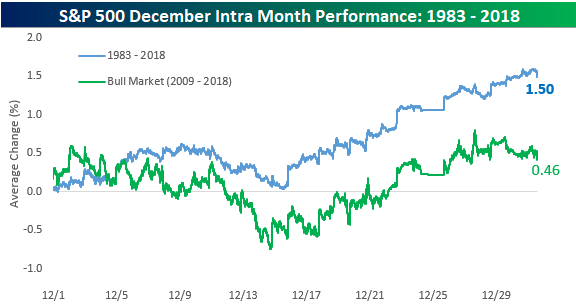

December has historically been a strong month for equities, although it certainly wasn’t last year. At this point in the month last December, the S&P was already down more than 5% month-to-date, and the index would fall another 9.6% over the next week and a half before making its YTD low on Christmas Eve. December 2019 looks a lot different than December 2018 so far at least, as the S&P is currently sitting on a month-to-date gain of just under 1%.

Below is a chart we published in our December Seasonality report sent to members at the end of November. It’s a composite intraday chart of the S&P throughout the month of December from 1983 through 2018 as well as from 2009 through 2018 (the current bull market). It basically shows the average path that the S&P has taken during the month of December. As you’ll notice, the first half of December has actually been the weaker half of the month for stocks, and it’s the second half of the month where the gains really kick in. We’re just past the halfway point of December 2019 now, so investors certainly have seasonality as a tailwind from here through year end.

Our Seasonality Tool shows similarly bullish prospects. When you visit our Seasonality page, you always see the gauges below which show the S&P 500’s median change over the next week, month, and three months (from the current day of the calendar year). As shown below, from today (12/16), the S&P has historically seen a median gain of 1.07% over the next week, a median gain of 2.94% over the next month, and a median gain of 5% over the next three months. All three periods rank in the 87th percentile or higher for market gains based on the calendar year. Our Seasonality Tool lets you track seasonal trends across asset classes. Try it now with a two-week free trial to Bespoke Premium.

Global Stock Breakout

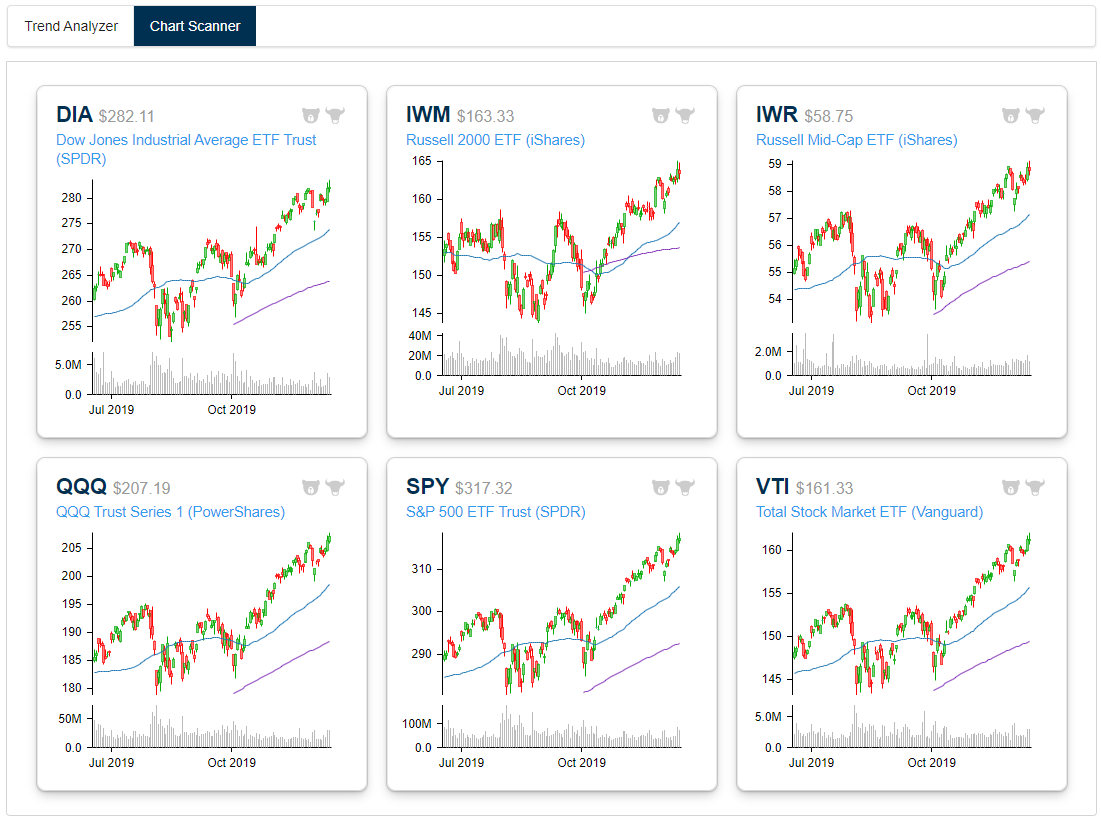

Bespoke’s Interactive Tools section available to members lets you easily track the underlying health of the market. One way to monitor internals is simply looking at the number of new 52-week highs and lows made each day in our huge database of stocks and ETFs. As shown below, on Friday we saw 596 new 52-week highs and just 36 new lows. That’s a huge number.

Looking at price charts across a range of US and country stock market index ETFs, we pretty much see breakouts everywhere. In the US, we saw large-caps (SPY, DIA, QQQ, VTI), mid-caps (IWR), and small-caps (IWM) all break out to new highs last week, while we saw the same for countries like Germany (EWG), Japan (EWJ), France (EWQ), and the UK (EWU). Below is a sampling of these charts pulled from our popular Chart Scanner tool. Our Chart Scanner lets users easily browse through hundreds of charts in a matter of minutes. If you like a chart or want to monitor it going forward, you can click the “bull” icon and it will go into a special folder that contains all of the charts you tag as bullish. You can do the same thing for charts you think look negative with the “bear” icon. If you use technical analysis as part of your investment strategy or simply like to look at charts to gauge overall trends for various asset classes, we can’t recommend the Chart Scanner tool enough. We use it every single day internally. Try it for yourself now by starting a two-week free trial to Bespoke Premium.