The Closer – Shaky Gold, Gains Top-Heavy, Markets vs ISM – 1/6/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review multiple reasons why gold’s recent run may not be entirely durable. We also shed light on the concerns around 2019’s gains being too reliant on a few major stocks. We finish with a look at the relationship between ISM and stock performance.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

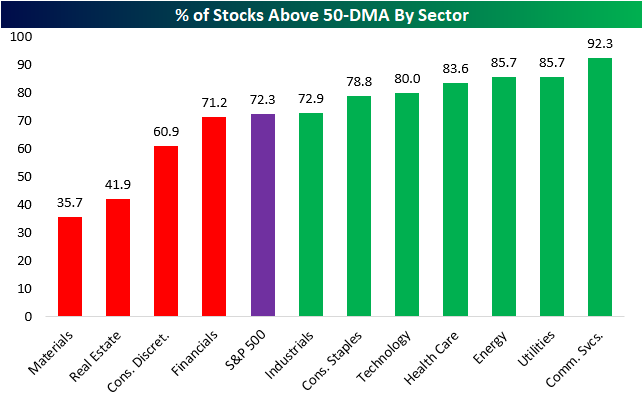

S&P 500 Breadth Levels — % of Stocks Above 50-Day Moving Averages

Tensions in the Middle East caused equities to experience a sell-off last Friday, and while markets opened lower to start the new trading week this morning, the bulls managed to take charge by day’s end with gains across all of the major indices. Below is a snapshot of the percentage of stocks above their 50-day moving averages in the S&P 500 by sector. We’ve included one-year charts of this reading for each sector as well.

In the broad S&P 500, 72.3% of stocks remain above their 50-day moving averages, which is a very healthy reading. Communication Services has the strongest breadth right now with 92.3% of stocks above their 50-DMAs. Another four sectors have readings of 80% or higher — Utilities, Energy, Health Care, and Technology. On the flip side, Materials has the weakest breadth with just 35.7% of stocks above their 50-DMAs. At the end of 2019, this reading stood at 85.7% for Materials, so the sector has seen a steep drop to start 2020. Real Estate, Consumer Discretionary, and Financials are the remaining sectors with breadth readings below the overall reading of 72.3% for the S&P 500. Start a two-week free trial to Bespoke Institutional to access our Morning Lineup and Closer which includes our Daily Sector Snapshot. Our Daily Sector Snapshot includes the charts below along with a number of other technical, fundamental, and relative strength indicators for the eleven major S&P 500 sectors.

Chart of the Day: Tech and CES

Bespoke’s Morning Lineup – 1/6/20 – Geopolitical Flares Continue

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Bespoke Brunch Reads: 1/5/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2020 Annual Outlook special offer.

The Times They Are A-Changin’

A Decade of Urban Transformation, Seen From Above by Emily Badger and Quoctrung Bui (NYT)

An incredible survey of the changing landscape of America, detailed with breathtaking satellite pictures of towns, cities, and the shifting physical environment of the country. [Link; soft paywall]

New York is losing residents at an alarming rate by Carl Campanile (NY Post)

Annual Census estimates saw New York State’s population fall 0.4% with over 180,000 residents shipping out for other states over the course of the year. [Link]

Market Calls

Dennis Gartman Says Goodbye With One Last Stock Market Warning by Mark Hulbert (Barron’s)

After 30 years of publishing, the widely read Gartman Letter is no more, and its publisher has a parting shot at markets which have defied numerous bearish predictions from Gartman over the years. [Link; paywall]

Almost Everything Wall Street Expects in 2020 by Sam Potter and Jeremy Scott Diamond (Bloomberg)

Your one stop shop for almost everything analysts and strategists are saying about what to expect from the markets and economy in the coming year. [Link; soft paywall]

College Football

Who’s Highest Paid In Your State? by Charlotte Gibson (ESPN)

A rundown of the highest-paid public employees by state, which in most parts of the company is the coach of the college football team at a state college. [Link]

Rise of the inverted Tampa 2: Clemson goes B12 on Ohio State by Ian Boyd (Sports Treatise)

An extremely detailed and well-informed rundown of the critical defensive adjustment that Clemson made at halftime which allowed it to stop the bleeding against Ohio State and ultimately shut down the Buckeyes’ offense in the second half. [Link]

Iran

How a Chase Bank Chairman Helped the Deposed Shah of Iran Enter the U.S. by David D. Kirkpatrick (NYT)

Amidst the current international conflict between the Islamic Republic and other regional powers, this critical piece of history deserves attention: an American banker engaged in a plot designed to prevent the re-election of the sitting President by sparking confrontation with Iran. [Link; soft paywall]

Online Flight Tracking Provides A Look At The US Build Up In Middle East Following the Attack on US Embassy In Iraq by Stefano D’Urso and David Cenciotti (The Aviationist)

Using publicly sourced data from flight tracking websites, enthusiasts have been tracking the logistics of US troop deployments into the Middle East and Persian Gulf. [Link]

The Sentence That Enabled Our Endless War Turns 17 Today by Gregory D. Johnsen (Buzzfeed News)

War powers are supposed to be the domain of Congress, but broad language open to interpretation passed by the House and Senate in the wake of the 9/11 attacks have given three administrations basically unconstrained power to wage war without asking for permission from Congress. [Link]

Medicine

Google AI Beats Doctors at Breast Cancer Detection—Sometimes by Brianna Abbott (WSJ)

While doctors still beat machines in some cases, Google’s health research unit has developed a system that can double-check their work and reduce errors. [Link; paywall]

China pneumonia outbreak raises spectre of SARS as number infected jumps to 44 by Laurie Chen, Christy Leung, Zhuang Pinghui, and Josephine Ma (SCMP)

A rising number of patients in China are exhibiting symptoms of a new viral strain that causes pneumonia and may be fatal. Human-to-human transmissions have not been confirmed so far. [Link]

Personal Essays

I ignored warnings from friends and family not to marry my husband. Was I making a big mistake? by Nancy French (WaPo)

A personal essay that finishes with an incredible twist, sure to get any reader laughing. [Link; soft paywall]

Pokemon Go

How Canada’s military reacted to seeing Pokemon Go players trespassing on its bases by Brett Ruskin (CBC)

Canadian enthusiasts of the Pokemon mobile game accidentally trespassed on military bases in an effort to catch rare finds, per new documents released by the Canadian Armed Forces; a uniquely Canadian military drama. [Link]

Renewables

Floating Wind Farm Starts Generating Power Off Portugal’s Coast by Will Mathis (Bloomberg)

A new project in the relatively shallow waters off Portugal is a test case for a form of wind power that could be more widely used around the world as countries race to develop zero-carbon electrical generation capacity. [Link; soft paywall]

Incarceration

Violence at Parchman, other Mississippi prisons: What we know by Harold Gater (Clarion Ledger)

Mississippi prisons have entered a prolonged lockdown as a series of inmate deaths caused by understaffing and gang activity prevents the orderly function of a prison system bursting at the seams and under-funded. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Closer: End of Week Charts — 1/3/20

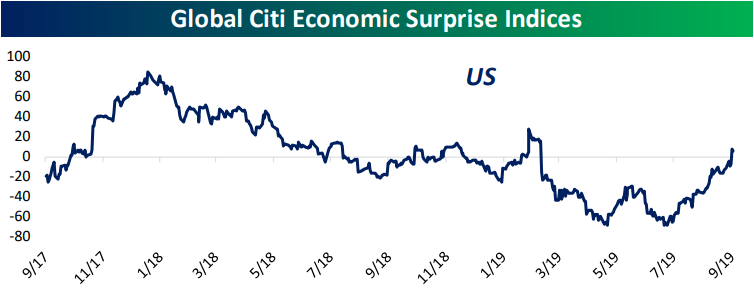

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Bespoke Market Calendar — January 2020

Please click the image below to view our January 2020 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

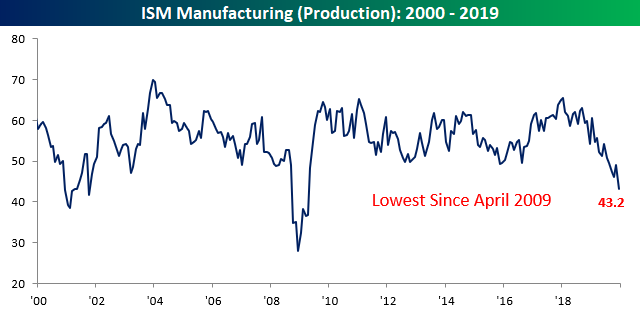

Manufacturing Sector Sinks Further Into Contraction

What’s the bright side to the market weakness from news overnight that a US drone strike in Iraq killed Iranian General Qassim Soleimani? It took all the focus off of the December ISM Manufacturing report which came in weaker than expected and was all around bad just about any way you look at it! At the headline level, economists were expecting the ISM Manufacturing index to rebound from 48.1 up to 49.0, but instead of a bounce, we actually saw a decline to 47.2, which was the lowest level since June 2009.

Commentary in this month’s report was also weak. Outside of Textile Mills, where the outlook is positive, commentary around every other sector highlighted was negative with descriptions like shrinking, sluggish, and on the defensive dominating the commentary.

Below we break down this month’s report by each of the individual sub-indices. The biggest decliners relative to November were Production and Employment while Prices Paid saw the largest decline. Weak activity with rising prices? That’s not an optimal combination!

As mentioned above, Production saw the largest decline in December, falling to 43.2 from 49.1. That’s the largest m/m decline since January 2012 and the lowest overall reading since April 2009.

New Orders were also weak this month, and while the m/m decline wasn’t large (less than a point), activity hasn’t been shrinking at this rate since April 2009.

On the employment front, activity also contracted from 46.6 down to 45.1. Employment in the manufacturing sector hasn’t been this weak since January 2016.

As if the weak activity in the Manufacturing sector wasn’t bad enough, it was accompanied by rising prices. As shown in the chart below, the Prices Paid component increased five full points to 51.7 in what was the largest m/m increase in over two years (September 2017). All in all, this was just a lousy report! Start a two-week free trial to Bespoke Institutional to access our quarterly Equity Market Pros and Cons report, economic calendar, and all of our other research tools.

Bespoke’s Morning Lineup – 1/3/20 – Geo-Political Flares

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Yields Capped, Volatility of Stocks, FAANG Flying, Claims, PMIs – 1/2/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin by reviewing the move in yields with regards to gold and utilities. We then take a look at total returns of equities and bonds adjusted for volatility. Next, we show just how rare it has been for the S&P 500 to close at an all time high on the first trading day of the year before reviewing the massive run for FAANG stocks recently. We finish with some macroeconomic data including jobless claims and global PMIs

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!