A Dow Without Boeing (BA)

For more than a year now, Boeing (BA) has been plagued by the 737 MAX crisis which has weighed on shares of the plane manufacturer with it now currently down nearly 20% from when the initial groundings took place on March 10th of last year. Despite this, while underperforming the broader market due to the 737 issues, the stock is actually still up just over 5% since the start of 2019.

Even though BA has lagged, it is still the highest-priced of the 30 stocks in the price-weighted Dow Jones Industrial Average. Currently trading around $338.50, the only stocks in the index holding a candle to BA are Apple (AAPL) and UnitedHealth (UNH), which also trade north of $300 per share. That means these stocks have the highest weighting in the index and therefore have a much larger impact than other stocks on the Dow’s performance.

With BA’s issues, a number of people have pondered the what-ifs for the Dow had the company not had the issues with the 737. Would we have already broken out the Dow 30K hats were it not for BA? In the chart below, we show the actual performance of the DJIA and have overlaid the performance of an ‘alternate Dow’ showing its performance if BA had not been in the index since the start of 2019. We used the start of 2019 instead of the actual date of the groundings as it is a little less arbitrary. By our calculations, while we would be a bit closer, even if BA wasn’t in the index since the start of 2019, we wouldn’t quite be at Dow 30K yet. As shown, our alternate Dow would be almost 1% or 266 points higher if Boeing was not included in the index since the start of 2019.

While BA has been a drag on the DJIA since last March, it also provided a big boost to the index in early 2018 before the 737 issues hit the stock. In fact, at the start of March 2017, BA was up over 36% YTD and the spread between the Dow’s performance with and without BA was around 700 points in the other direction as it is now!

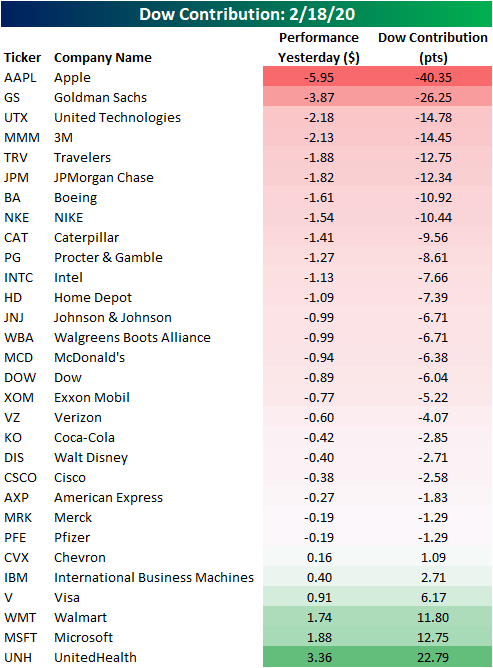

Another example of this dynamic in which high priced stocks have a greater impact on the index was observed on Tuesday when Apple’s (AAPL) stock fell after the company warned that Q1 revenues would be shy of prior guidance due to the coronavirus. The warnings sent shares down over 3% at its intraday lows, but the stock only finished down 1.83%. While there were equivalent or larger declines like Dow (DOW) or Walgreens Boots Alliance (WBA) in Tuesday’s session, AAPL’s declines by far weighed on the index more than any other stock. Of the Dow’s 165.89 point decline, AAPL contributed 40.35 points. Fortunately, UNH helped to mitigate some of those losses as it had a positive impact on the index of +22.79 points. Start a two-week free trial to Bespoke Institutional to access our Closer, full list of interactive tools, and much more.

Chart of the Day: Housing Accelerates

Bespoke’s Global Macro Dashboard — 2/19/20

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke’s Morning Lineup – 2/19/20 – Gold Glitters

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Housing data continues to show a strong foundation as this morning’s reports on January Housing Starts and Building Permits both exceeded expectations by more than 100K! The last time both reports exceeded expectations by more than 100K was last August’s report. Before that, though, you have to go back more than 10 years to find the next occurrence. That was the good news. The bad news was that PPI also exceeded expectations by a wide margin with the highest reported reading (0.5%) since October 2018. Futures haven’t budged much on the news, though, and are still indicating a positive open of about 0.25%.

Read today’s Bespoke Morning Lineup below for the latest on the impact of the coronavirus (including an important milestone in reported cases), earnings data out of Europe, and Japanese trade data.

We’ve been highlighting the bullish pattern in the price of gold for several weeks now, and after bouncing at support in the prior couple of weeks, prices broke out overnight to their highest levels in about seven years. With price convincingly above the $1,600 level, look for that psychological level to provide support going forward.

What’s interesting about the recent rally in gold, and as we discussed in last night’s Closer, the current rally has coincided with a stronger dollar, which overnight rallied to its best levels since last summer, so it’s not a weaker dollar that’s causing the recent rush into gold.

The Closer – Commodities Corner, Contribution Season, TICS Flows, Trade Monitor – 2/18/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at gold’s rally across currencies and crude’s move back into contango. We then show just how much Apple (AAPL) contributed to the S&P 500’s declines today before turning to TIC flows. Switching over to international data, we also show Singapore trade and Hong Kong container data.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke Stock Scores — 2/18/20

Performance Throughout The Presidencies

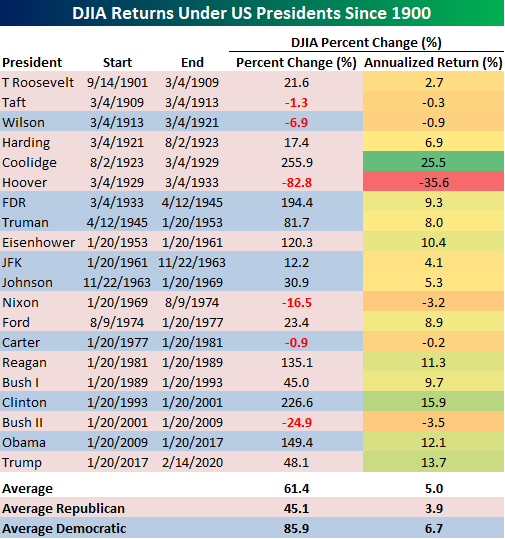

As markets were closed to observe Presidents Day yesterday and the 2020 Presidential election continues to ramp up, we thought it would be a good time to check up on stock performance during different administrations. In the table below, we show the performance of the Dow during the administrations of every US president since 1900 in addition to the annualized return. In the time since President Trump was sworn into office, the Dow has risen 46.9%. On an annualized basis, the 13.3% return places the current administration in 3rd place for the strongest performance. Only the Clinton administration in the 1990s and Coolidge administration in the 1920s have observed stronger annualized gains. The one caveat of course is that President Trump’s term (or terms) has yet to end. Comparing Democratic and Republican administrations since 1900, Democratic presidencies have tended to average stronger returns than their Republican peers, so the stock market’s returns under President Trump have deviated somewhat from the norm.

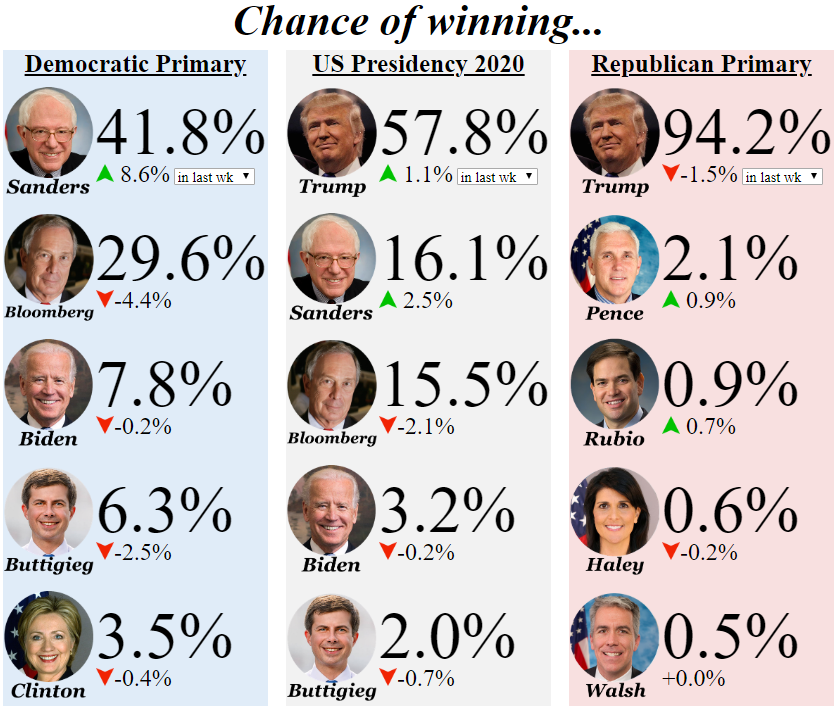

While it is impossible to say what a candidate’s election will mean for the market, at the moment betting markets favor the incumbent to win the presidency while Bernie Sanders and Michael Bloomberg go back and forth in taking the number 2 spot, hovering around 15%-16%. Come Super Tuesday (March 3rd) when we could finally see more clarity on the Democratic side, the back and forth between Bloomberg and Sanders might become more one-sided Start a two-week free trial to Bespoke Institutional to access our Bespoke Report and much more.

Multiyear Records Abound In Empire Manufacturing

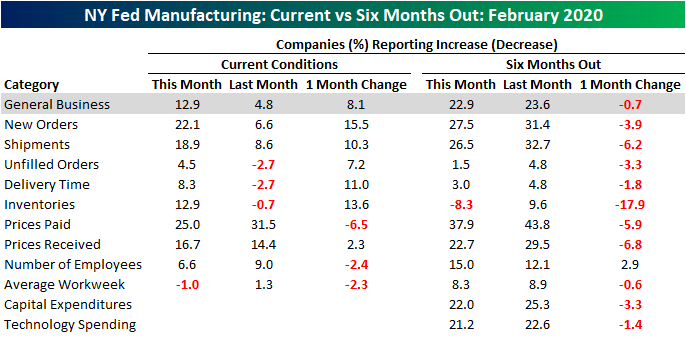

This morning, the New York Fed’s Empire State Manufacturing Survey showed the strongest reading since May of last year. The headline index surged 8.1 points from 4.8 in January to 12.9 in February. That was the biggest pickup in activity since July when the general business index rose 10.6 points following a massive 20.8 point decline in June.

Taking a look across the individual categories of the survey, there were multiple significant moves to multiyear highs as current conditions have broadly picked up across categories. The only area that saw some weakness in February was that of employment as the indices for Number of Employees and Average Workweek both fell. The index for Average Workweek was the only index to show more businesses reporting worsening conditions in February. That compares to January in which Delivery Time, Inventories, and Prices Paid all showed conditions worsening.

Forward-looking results did not share the same strength as the indices for current conditions. The index for Number of Employees was the only expectations index that rose from January. In other words, current conditions have improved much more dramatically than optimism for the future. That’s similar to a trend that we’ve been seeing in the Conference Board’s Consumer Confidence Index for quite some time now.

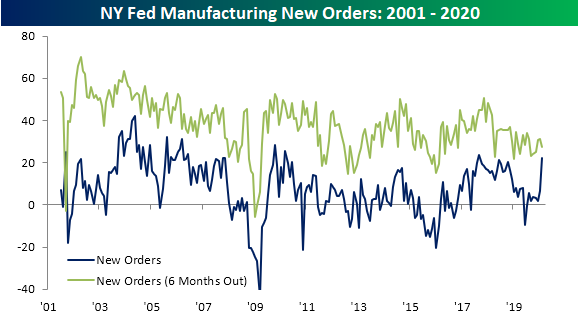

One of the more notable indices in February’s report was that of New Orders. The index rose 15.5 points to 22.1 which is the highest level since September 2017 when it was 23.7. That 15.5 increase was also the biggest one month jump since June of 2017 when it rose 18.3 points. Although the current outlook has dramatically improved, expectations for New Orders remain around similar levels to the past couple of years.

As New Orders surged, more NY businesses reported rising unfilled orders. This index came in with its first positive reading (4.5) since May of last year, reaching the highest level since September of 2018. Part of this increase is likely due to longer delivery times (more on this later).

Given the rise in New Orders and as businesses struggle to fulfill existing orders, Shipments have also picked up, rising 10.3 points to 18.9. That was the largest increase in this index since March of 2018, leaving it at its highest level since November of that same year. But as with other indices, the move in future conditions was much more subdued declining 6.2 points. Regardless, the combined move in Shipments, Unfilled, and New Orders indicate strong demand among New York state manufacturers.

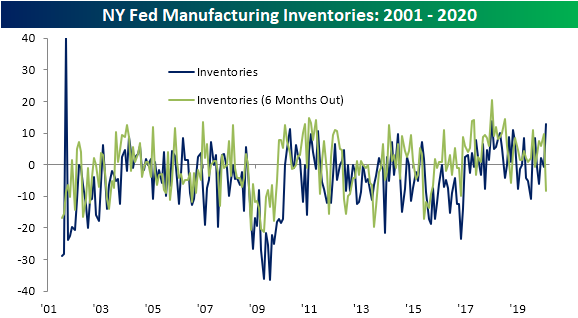

Despite this pickup, Inventories have continued to build with longer delivery times. In fact, the index for Inventories rose from a negative reading last month to 12.9 in February. It has only been higher in two other months since 2001: once in September of 2001 with an outlier reading of 40 and again in January of 2018 when it reached 13.8. At the same time, expectations for 6 months out plummeted to -8.3 which is the lowest reading since November of 2016. Meanwhile, Delivery Times surged 11 points to 8.3 which was the biggest one month jump in the index since June of 2010 and the highest level of that index since August of 2018. As with the index for Inventories, businesses do not appear to expect Delivery times to continue to grow as significantly over the next half year. Overall, this month’s survey seemed to show that while demand may not be an issue, New York manufacturers’ ability to get products out the door has hit a little bit of a roadblock. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Chart of the Day: Bank CDS Showing No Concerns

Bespoke’s Morning Lineup – 2/18/20 – Crab Apple

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Investors are returning from the three-day weekend in a bad mood after Apple (AAPL) announced that revenues for the quarter will be weaker than expected due to the impact of the coronavirus on both production and demand. The stock was trading down over 3% on the news, but analysts rushed in to defend it and it is now trading down less than 2%. Our favorite headline of the morning was the following in all caps on Bloomberg, “APPLE PREANNOUNCEMENT BETTER THAN EXPECTED.” A better than expected warning. Can’t say we see that often!

In other news, Wal-Mart (WMT) marked the unofficial end to earnings season this morning with a weaker than expected report. While the stock was initially lower, it has rebounded and is now indicated to open up about 1%.

For a recap of all the latest on the coronavirus, earnings, and economic data, check out today’s Morning Lineup.

Even though earnings season unofficially winds down this morning, there’s still quite a lot of other reports to come in the coming two weeks. As shown in the snapshot from our Earnings Explorer below, there are still some days where more than 100 companies will report on a given day. We would note, however, that most of these companies are small in scale.

As far as the results of this past earnings season are concerned, the main takeaway from this earnings season is the improvement in revenues relative to expectations. As shown in the lower right chart below, 61.2% of companies have topped sales forecasts in the last three months, and that’s the highest percentage of beats since early 2019.