Chart of the Day – 30% Drawdowns From Record Highs

Bespoke’s Global Macro Dashboard — 3/18/20

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The COVID Crash of 2020

Below is a snapshot of month-to-date and year-to-date returns for 72 country stock markets around the world (in local currency). As of this morning, the average country was down 20% month-to-date and 26% year-to-date. And this doesn’t even include the levels that North and South American equity markets are set to open at this morning, which looks to be 5-7% lower from yesterday’s close.

The country that has been hit the hardest in terms of equity market price destruction is Russia, which we haven’t heard from much regarding the COVID-19 virus. Month-to-date, Russia is down 34.67%, and it’s down 45.18% year-to-date. Seven other countries are down more than 30% month-to-date, including Italy, Greece, Austria, and Ireland. France and Germany are both down close to 30%, while BRIC countries like Brazil and India are down more than 24%.

Notably on the other side of the spectrum is China, where markets are down only 5% month-to-date and 10% year-to-date. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup – 3/18/20 – Limit Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Well, the St Patrick’s Day rally lasted long. Futures are once again trading limit down and poised to erase all of yesterday’s gains. On the bright side, despite the fact that futures are limit down, the major US index ETFs are only down about 6%, which isn’t much more than the futures. Imagine that. Only 6%!

Conditions remain dire, but we do have to stress the recent moves by the Fed should help to stabilize the credit markets and stem an even bigger disaster. That certainly doesn’t help with slowing down the pandemic and its spread, but it’s better than the alternative.

Read today’s Bespoke Morning Lineup for a discussion of the Fed’s latest moves to stabilize the credit markets, trading in Europe and Asia, as well as a recap of the latest case counts of the coronavirus.

The market’s volatility right now is truly unprecedented throughout history. Yesterday’s rally was the 7th straight trading day where the S&P 500 experienced a one-day move of more than 4%. That’s NEVER happened before, and the way things are playing out today, the S&P 500 is on pace for its 8th straight 4% move.

The Closer – Fiscal Flies Forward – 3/17/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at market reactions to the massive amount of stimulus announced around the world. We then show a few troubling signs for the labor market. Next, we show one of the reasons the Fed has stepped in to preserve credit flows. We also review the move in breakeven yields before finishing with the moves in derivative markets.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/17/20

Chart of the Day: Long Standing Dividend Aristocrats

Get Ready for a Reversal of This Trend

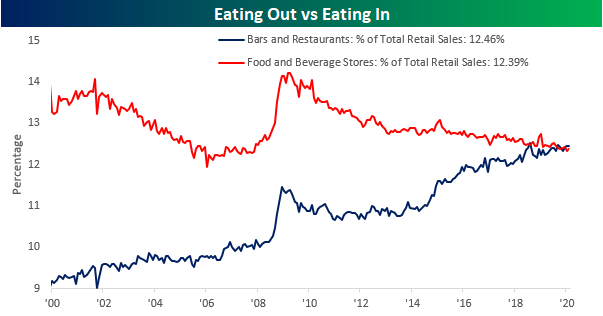

One of the trends we have been highlighting in the monthly retail sales report over the years has been the growing trend of eating out versus eating in. For years we have seen the Bars and Restaurants category of retail sales consistently gaining share at the expense of the Food and Beverage Stores category. Just last month, Bars and Restaurants saw their share of total sales rise to 12.46%, which was just below the record high of 12.47% from October 2018. That total share of sales was also 0.07% greater than the share of Food and Beverage Stores (12.39%) which is also right near record highs.

The run was fun while it lasted. With restaurants all over the country being forced to shut due to fears of the Covid-19 virus, even if American consumers wanted to go out to eat, the only way they can is by ordering takeout. With everybody stuck at home, more Americans will undoubtedly be eating at home in the coming months, and that is going to cause the share of total sales for Bars and Restaurants to come crashing down. The only question is whether other sectors besides Food & Beverage Stores will pick up the slack or if the pie will only get smaller as consumers reign in spending.

The trend of dining out is likely to take a hit in the coming months, but one trend that will only accelerate is ‘clicks’ over ‘bricks’. After overtaking the category of General Merchandise in September 2018, Nonstore retailers have been picking up share at a steady pace ever since. Through February, the current spread in share of 1.3 percentage points is not far from the record seen last September. Again, though, with physical stores all over the country simply closing for an indefinite period in recent days, online is going to become the only option for consumers whether they can leave their homes or not. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

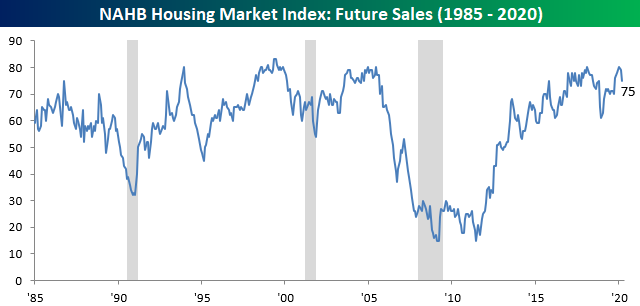

Homebuilders Not Worried Yet

This morning the NAHB released results from their monthly survey of homebuilders. The index showed some weakening in sentiment as it fell to 72 in March from 74 in February. As with many other recent indicators released, that is a fairly modest decline given the current environment and likely would not have captured the full extent of equity market declines and shutdowns to enforce social distancing. Granted, those effects are also not entirely absent either seeing as the NAHB noted half of the responses to the survey came after March 4th.

The headline index fell on lower readings pretty much across the board. Each of the sub-indices with the exception of the Midwest fell in March. Additionally, perhaps the biggest negative shift this month was for future outlook with that index falling 4 points. By comparison, the index for present sales only fell by 2 points. In other words, homebuilders seem to have experienced some slowdown in activity and are anticipating for it to get worse.

Again the index for the Midwest in March was a bit of an outlier. It was the only region to rise in March, but that is after it was a bit weaker than other regions recently. In fact, the rise to 67 also still leaves the index for the Midwest 6 points off of the December high of 73. Overall, as with the headline index, across different regions, sentiment has shifted lower although this is likely just the tip of the iceberg.

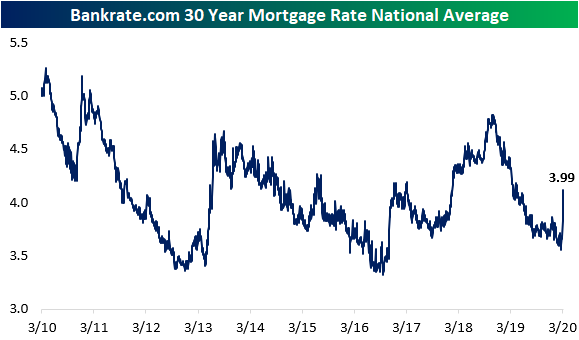

One factor at play that that may be balancing itself out is mortgage rates. The national average for a 30 year fixed rate mortgage was sitting at the low end of the past few years’ range earlier this month. In the past week, though, mortgage rates have moved sharply higher and are now at similar levels to where they were last year. In other words, while low rates may have temporarily bolstered homebuilder confidence earlier this month, given the move in the past week, those effects have likely eased. Turning to next month’s survey, there is likely to be a large downward shift lower in homebuilder sentiment, especially if rates continue to drift higher. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

GDP Forecasts Relative to History

Yesterday, Goldman Sachs’ lead economist cut the bank’s GDP forecasts for the first half down to 0.0% in Q1 and a decline of 5.0% for the second quarter. Based on how things are moving and in the direction they are going, 5% may sound like an optimistic scenario. While all sorts of numbers have been thrown around regarding just about everything lately, we wanted to help put in perspective just how severe a quarterly decline in GDP of 5% really is.

The chart below shows US quarterly GDP going back to 1950. First of all, negative quarters for GDP have been uncommon for the US economy over time. In the 291 quarters since 1950, the US economy has only contracted in 41 (14%) of those quarters. 5% declines, however, are incredibly rare. SInce 1950, there have only been six prior quarters where GDP declined by 5% or more with the most recent being back in December 2008.

Obviously, the circumstances surrounding each contraction in GDP is different, but prior quarters where there was such a large shock to the system were typically not ‘one and done’ events. In fact, all six of the prior quarterly contractions of 5% or more were either immediately preceded or followed by another quarter of negative growth averaging a decline of over 2%. Start a two-week free trial to Bespoke Institutional to access our full suite of research and interactive tools.