B.I.G. Tips – Testing Uptrends

Chart of the Day – Confidence Grows

Bespoke Stock Scores — 6/30/20

Back to Average

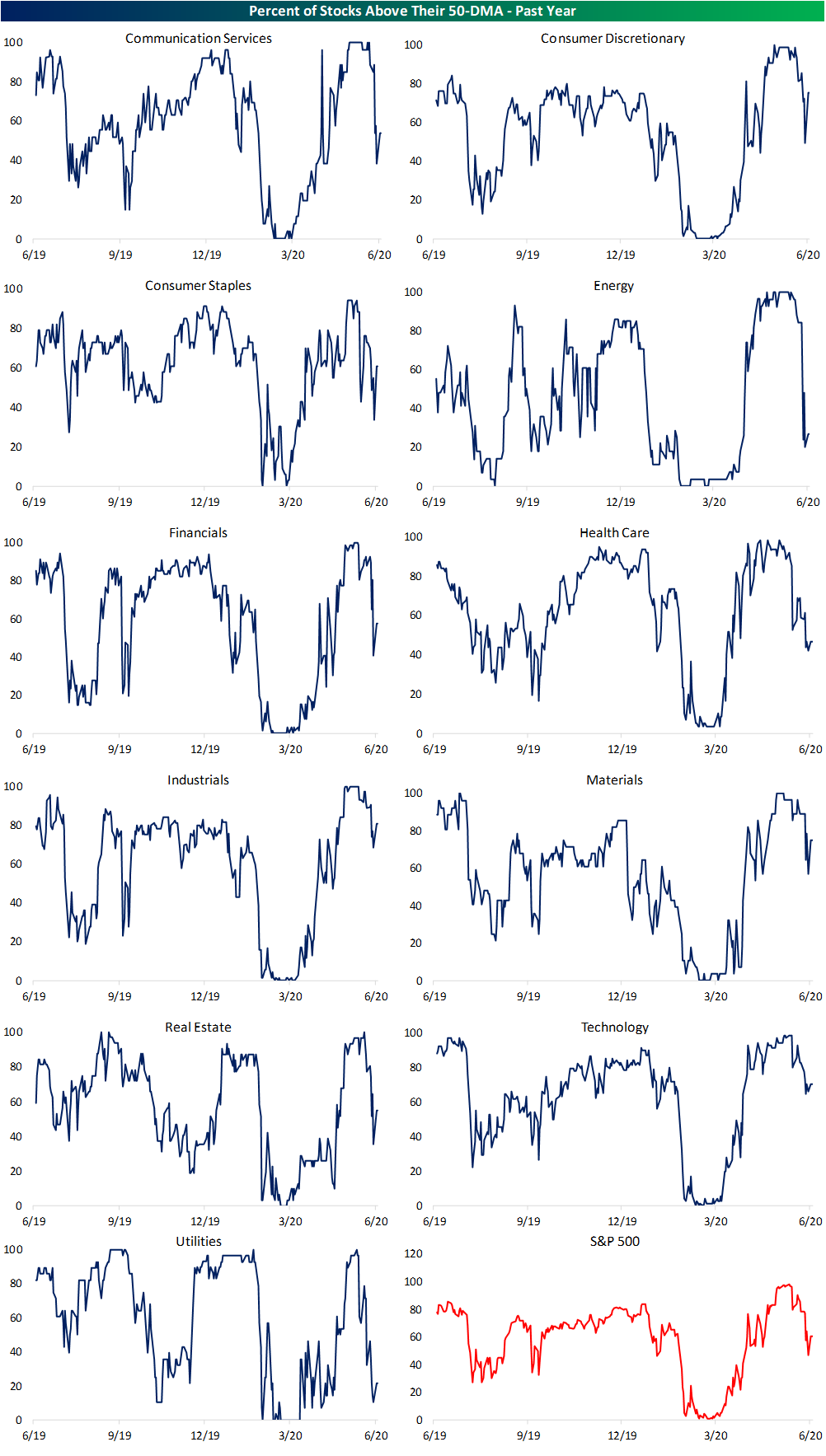

The S&P 500 is down just over 5.5% from its post bear market high set on June 8th. Just about every sector also set a high on that date with the exception of Communication Services (one day later on June 9th) and Technology who’s last high was as the most recent last Tuesday. At the time of those highs, each sector was deep in overbought territory as shown in the charts from our Daily Sector Snapshot below. But with each sector generally falling over the course of June, every sector is closing out the month in a more neutral area of their trading ranges with many hovering within a few percentage points of their 50-DMAs. At the moment, only the Technology sector remains overbought.

Most sectors are now within a few percentage points of their 50-DMAs, and that is a much more moderate reading than some observed in the past few months. As shown in the 50-DMA spread charts from our Daily Sector Snapshot below, the rally off the bear market lows saw some sectors like Energy and Industrials trade more than 20% above their 50-DMAs! For the broader S&P 500, the June 8th high also marked the most extended it got above its 50-DMA at 13.06%. Today that reading is a much more modest 2.33%.

As for the individual stocks within each sector, there has also been significant mean reversion. In the first couple of weeks of June, well over 90% of S&P 500 stocks were above their 50-DMAs. With equities broadly lower since the early month highs, only around 60% of stocks are now above their 50-DMAs. On a sector basis, Industrials have the highest share (80.8%) above while Utilities has the lowest share at only 21.43%. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 6/30/20 – It’s So Hard to Say Goodbye to Yesterday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

We certainly wish we could have more days like yesterday. Although the market didn’t rally enough to erase Friday’s losses, the strong rebound was a moral victory for bulls heading into the final day of the quarter. The rebound also helped to support the idea that last week’s declines were at least in part due to portfolio rebalancing. This morning, futures are mixed with the Dow and S&P 500 indicated modestly lower while the Nasdaq is higher driven by positive earnings reports and guidance from Micron (MU) and Xilinx (XLNX). In terms of data, Chicago PMI and Consumer Confidence will be the key reports to watch.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, European markets and data, global and national trends related to the COVID-19 outbreak, and much more.

It’s not only going to be hard to say goodbye to yesterday but also the last quarter. With a gain of over 18% heading into the last day, the S&P 500 is on pace for its best quarter since the last quarter of 1998. This quarter’s gain comes after last quarter’s swoon of 20%, so YTD the market is still in the hole by over 5%.

Daily Sector Snapshot — 6/29/20

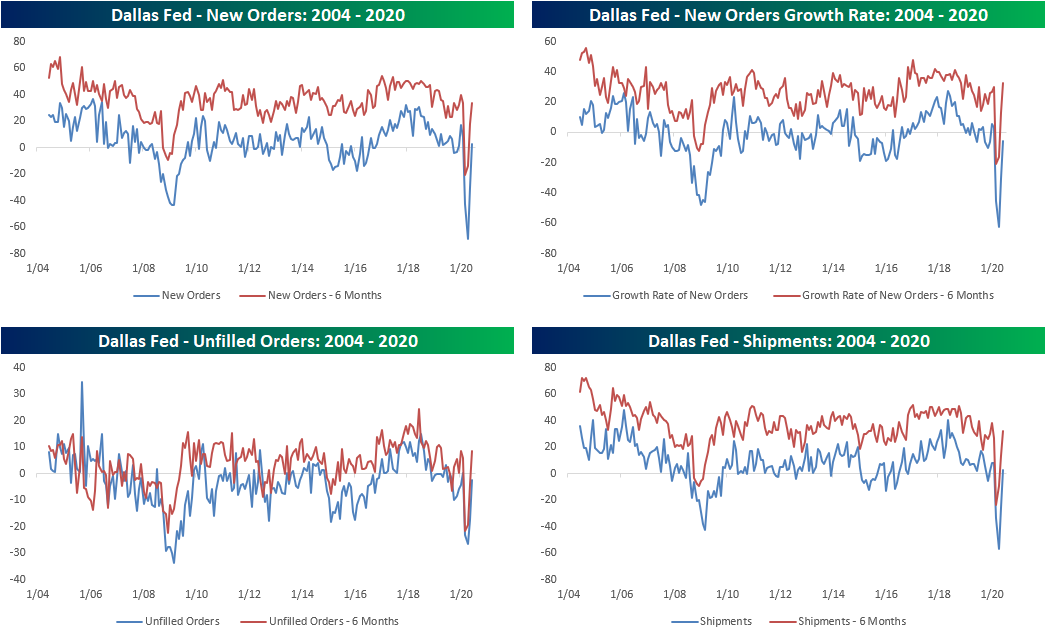

Rebounds Bigger In Texas

Today’s economic data saw several big beats, including the Dallas Fed’s reading on manufacturing activity. The index fell to a record low of -73.7 back in April, rebounded to -49.2 last month, and was forecast to show yet another very weak reading of -21.4 in June. While it still showed a contractionary reading, the actual level reported in Monday’s report was much better at -6.1. That was the biggest beat relative to expectations since at least 2009. One thing to note regarding this survey is that the collection period ran from June 16th to the 24th which was in the earlier stages of the Texas outbreak.

In addition to the headline number, several components rose by their most on record. That was the case for both outlook and current conditions. Additionally, whereas all but one index showed contractionary readings for current conditions in May, today things have improved with only half showing contractionary readings. Like many other regional Fed indices in June, conditions improved dramatically though they still point to an overall contraction in activity.

Looking across indicators of demand like New Orders and Shipments, there were massive improvements with MoM changes all in the upper 90th percentiles of all periods. As with the headline index, even though there was a massive rebound, the indices also still sit at the lower end of their historical ranges. While New Orders and Shipments are both now showing expansionary readings for the first time in four months, New Orders Growth and Unfilled Orders are still in negative territory. In other words, activity did improve in June but some measures remain more mixed.

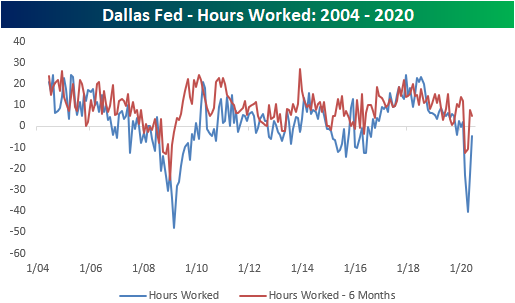

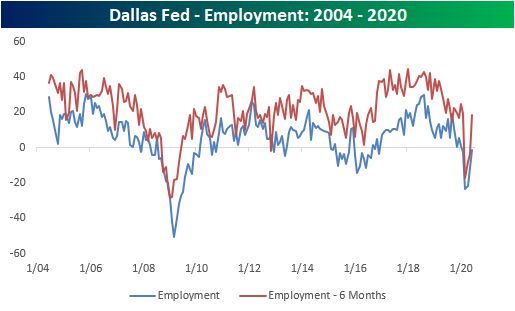

Another area that remains mixed is that of employment. Both indices for Hours Worked and Employment rose in June, but they have continued to show a further shrinking in hours worked and increase in layoffs. Click here to view Bespoke’s premium membership options for our best research available.

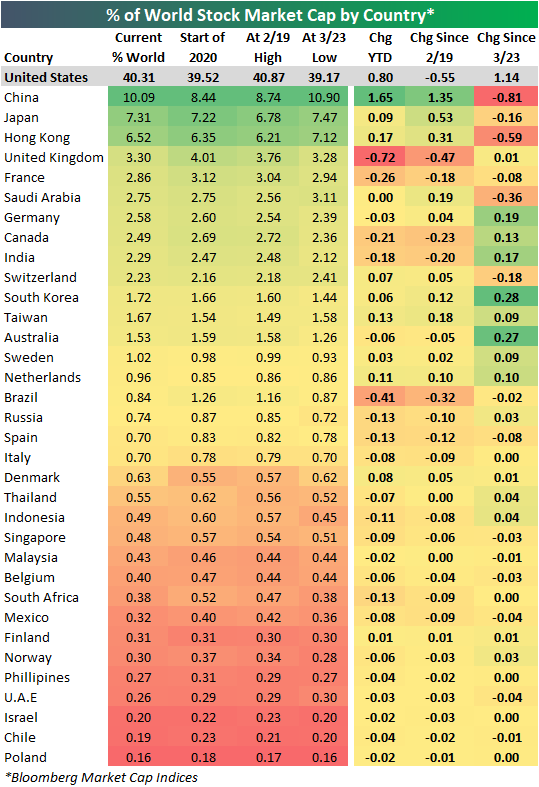

US Percent of World Market Cap Dips a Bit

Back at the start of the year, the US equity market made up 39.5% of total global equity market cap. That means the US was and still is by far the largest stock market. In the nearly six months since the start of the year, even with a bear market in between, the US has actually gained share now with 40.31% of the world’s market cap. Even at the bear market low, the US didn’t lose much only falling as low as 39.17%. While the US continues to sit the throne, China is the only other country to have seen their share of global market cap rise in a significant manner since the start of the year having gained 1.65 percentage points; the most of any country YTD. Whereas it began 2020 with 8.44% of world market cap, it now holds over 10%. It is the only country other than the US to boast double digits.

Since the S&P 500’s last all-time high made on February 19th, the US has lost 0.55 percentage points of share, while China has gained 1.35 percentage points over the same time frame. If we look at just since the March 23rd lows for the S&P, the US has gained 1.14 percentage points while China has lost 0.81 percentage points. Other countries that have lost share since the start of the current rally (the lows of the Covid Crash) include Hong Kong, Saudi Arabia, and Switzerland. Countries that have gained share during the rally include Germany, Canada, India, South Korea, and Australia.

In addition to the US and China, Japan and Hong Kong are the only other two equity markets taking up more than 5% of global market cap at the moment. Below are ten-year charts of each country’s percent of world market cap.

Taking a look at more recent trends, even though the US has gained share since the March 23rd lows, it has begun to lose steam since late May with China picking up at least part of what the US has lost. Hong Kong has similarly seen its share recovering alongside China after a sharp drop in late March and April. Unlike China, Hong Kong has yet to clearly break out from the past few months’ downtrend. Meanwhile, Japan has been fairly stable basically in the middle of the past year’s range. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Fireworks for Fourth of July Week?

Bespoke Matrix of Economic Indicators – 6/29/20

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!