Chart of the Day – Economic Indicator Diffusion Index Modestly Positive

The Definancialization of US Equities

The huge underperformance for banks so far this year has helped the S&P 500 Financials sector see its share of weighting in that broad index continue to collapse. From just shy of one-quarter of market cap in the mid-2000s to the mid-teens share most of the past decade, the S&P is now to a large extent “definancialized” as the share of its market cap accounted for by financial sector stocks is about as low as it has gotten in the past forty five years. Longer-term, there’s precedent for further declines, though. As shown in the chart below, Financials were less than 5% of the index back in the 1940s. While we aren’t predicting a return to that level, it can’t be outside the range of possibility given the collapse in Financials’ share over the past few years. We’ve already seen the Energy sector’s weighting fall from 15% or so in the mid-2000s down to <3% as well. We discussed this chart and other retail enthusiasm indicators in last night’s Closer report, which is available to Bespoke Institutional members. Click here to start a two-week free trial.

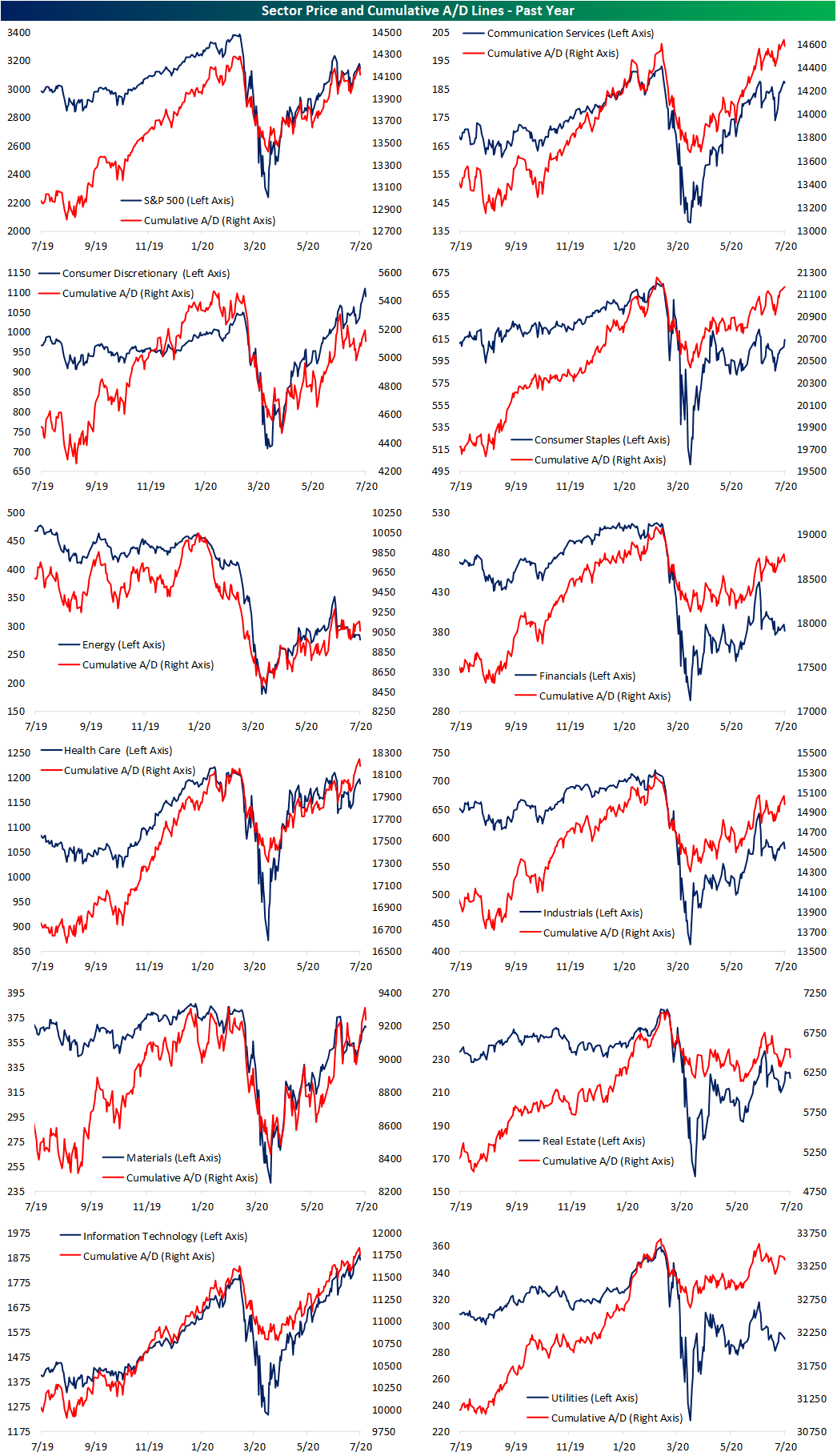

Cumulative A/D Lines Out of Sync

In the past few days, the S&P 500 has made a lower high, unable to reclaim its early June highs. While price has not made a push higher, the index’s cumulative A/D line has. The S&P 500’s cumulative A/D line reached its highest level since February 21st on Monday before yesterday’s weak breadth led to a slight drop. As for the individual sectors, Consumer Staples, Financials, Health Care, and Materials are all experiencing the same dynamic in which the cumulative A/D line has made a new high while price has not done the same.

On the other hand, Consumer Discretionary has seen the opposite occur in which price has made a new high, but the cumulative A/D line has not confirmed the move as it sits firmly below its prior highs from early June. As for the other sectors like Technology, Real Estate, and Utilities, these have seen price and breadth moving hand in hand with one another. For Tech, those trends have been upwards while the more defensive Real Estate and Utilities sectors have been trending sideways at best in recent months. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 7/8/20 – Wednesday Lull

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

With earnings season not kicking off until next week, it’s an unusually quiet day in terms of data as there are no major earnings reports to speak of and the economic calendar is pretty much empty. Futures are modestly higher as we type this and have been vacillating above and below the unchanged level all morning. Gold is rallying to its highest levels since 2011, and copper isn’t far from 52-week highs.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, auto sales in China, global and national trends related to the COVID-19 outbreak, and much more.

Nasdaq futures are up considerably more than the S&P 500 this morning, continuing a trend of outperformance for the Nasdaq that has been in place for several months now. The Nasdaq 100’s decline yesterday ended a streak of five straight days where the index was up at least 0.5%. While that sounds impressive at face value, back in May, there was actually a streak of six trading days. Prior to that streak, the last time the Nasdaq 100 was up more than 0.5% for five straight days was in June 2019, and before that, you have to go all the way back to 2011 to find the last streak before that.

After five straight days of gains, one might think that the Nasdaq 100 was getting ahead of itself, and while a short-term pullback may be in the cards, these streaks of 5 or more days of 0.5% gains have been relatively common throughout the Nasdaq 100’s history. As shown in the chart below (on a log scale where each label on the y-axis represents a doubling in price), while there were a couple of occurrences near the 2000 peak, there were also loads of similar streaks in the entire runup of the 1990s.

Daily Sector Snapshot — 7/7/20

High Stock Scores Nearing Break Outs

Each Tuesday we publish an update of our Bespoke Stock Scores which ranks the constituents of the S&P 1500 based on our proprietary fundamental, technical, and sentiment indicators. This week, several of the top-scoring stocks are eyeing breakouts to new 52-week highs which we show in the charts below. Semiconductor manufacturer Axcelis (ACLS) took the number one spot in this week’s Stock Scores as it stopped just short of a breakout above its February highs yesterday. Although it reversed at that resistance, it remains above its moving averages and is in an uptrend over the past few months. It is a similar story for other stocks like Regal Beloit Corp (RBC), Molina Healthcare (MOH), Kroger (KR), and Domino’s (DPZ) which have also been sitting right around resistance at the past few months’ highs. KR, MOH, and RBC have even seen small breakouts that did not hold. Meanwhile, another name with a high Bespoke Stock Score – Conagra (CAG) – broke out slightly to new highs in the past week before a small pullback with former resistance acting as support. Today, CAG is headed higher off of its previous highs. Click here to view Bespoke’s premium membership options to gain access to our Stock Scores report.

Chart of the Day: Five Day Winning Streak on the Ropes

Bespoke Stock Scores — 7/7/20

June 2020 Headlines

Bespoke’s Morning Lineup – 7/7/20 – Rally Rests

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

You wouldn’t think that on a lucky day like 7/7 that the equity market would break a streak of five straight days with gains of 0.5% in the S&P 500 tracking ETF SPY, but that’s where we stand ahead of the opening bell today. Futures are slightly off their earlier lows but still indicating a decline of just 0.60% at the open. Besides the fact that the S&P 500 has been up for five straight days and could use a rest, there isn’t much in the way of a key catalyst responsible for the decline, although Industrial Production in Germany did come in significantly weaker than expected. While Europe has seemed to see better trends related to squashing the COVID outbreak, economic data hasn’t yet shown material outperformance.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, weaker than expected economic data out of Europe, global and national trends related to the COVID-19 outbreak, and much more.

We normally don’t show the same chart two days in a row, but yesterday saw a positive shift in the S&P 500’s cumulative A/D line. While breadth had been tracking price step for step, in yesterday’s rally the cumulative A/D line made a higher high in the short term even as the S&P 500 has yet to break above its June highs. That’s a positive short-term development.