Chart of the Day: High Frequency Indicators Tracking Stocks

Bespoke’s Morning Lineup – 7/16/20 – Data Dump

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

We just got a big slug of economic data, and overall the results were positive. After an enormous bounce in retail sales for May, June’s reading came in much better than expected once again. The Philly Fed Manufacturing report was also better than expected but fell slightly from June’s reading. The one fly in the ointment was Initial Jobless Claims. While this week’s reading declined for a record 15th straight week, it did miss expectations. Continuing Claims, however, managed to come in slightly below forecasts. All in all, this data looked positive at the top line.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, the latest earnings reports, global economic data, trends related to the COVID-19 outbreak, and much more.

In the whole ‘game’ of quarterly earnings, the general strategy for companies is that whatever earnings you report, just make sure it’s better than expected. Companies that beat estimates tend to see better share price reactions while companies that miss EPS forecasts tend to see adverse reactions to their stock prices. That’s the general pattern, but there are always exceptions, especially among the major brokers.

Take Goldman Sachs (GS), for example. Yesterday the company reported quarterly EPS $6.26 per share, which was $2.35 above the consensus expectation of $3.91, or an EPS beat of over 60%. Looking through our Earnings Explorer tool, yesterday’s report from GS was the third-largest EPS beat for the stock since at least 2001. Given the magnitude of the beat, how much do you think GS was up yesterday? 5%? 10%? How about 1.4%. That’s right. The third-largest EPS beat for the company in practically 20 years resulted in a gain for the stock of just 1.4%!

Looking through the Earnings Explorer at Goldman’s largest EPS beats shows an interesting trend. Including yesterday, on the earnings reaction day of the ten largest EPS beats for GS, the stock’s average change was a decline of 0.1% (median: +0.2%) with gains only six times. Even more interesting is the fact that the company’s two largest EPS beats in April 2009 and April 2011 were met with selling.

We also looked at Goldman’s stock price reaction following the nine times it has missed EPS forecasts (or reported inline EPS). Of the nine occurrences since 2001, the stock’s average one-day reaction to earnings was a gain of 0.7% (median: +0.2%). On an average basis, at least, Goldman has derived no benefit to its stock from reporting blowout numbers.

Daily Sector Snapshot — 7/15/20

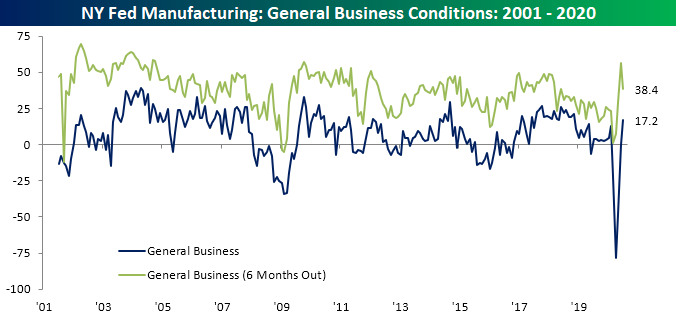

First Expansionary Empire Fed Since February

The New York Federal Reserve released its July reading on the manufacturing sector this morning and for the first time since February, the headline index indicated that activity rose month-over-month in the region. Not only was it the first expansionary reading (those above 0), but at +17.2, it was also the highest level of the index since November 2018 when it stood at +21.1. This month also marked a third consecutive monthly increase.

Although the index for present conditions is showing some of the strongest levels of the past couple of years with another uptick in July, optimism for the next six months pulled back. The index for general business conditions six months in the future fell to 38.4 from a multi-year high of 56.5 in June. That 18.1 point decline was the largest since March’s 21.7 point decline and the ninth-largest decline of all months.

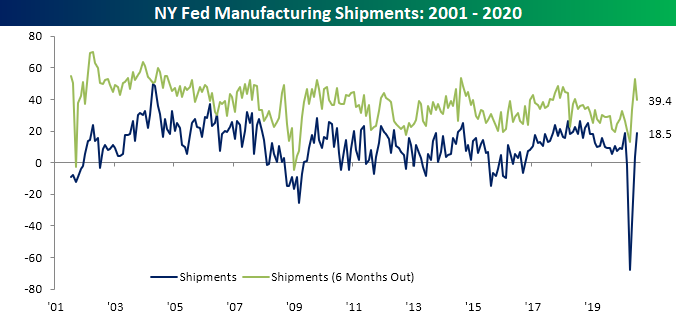

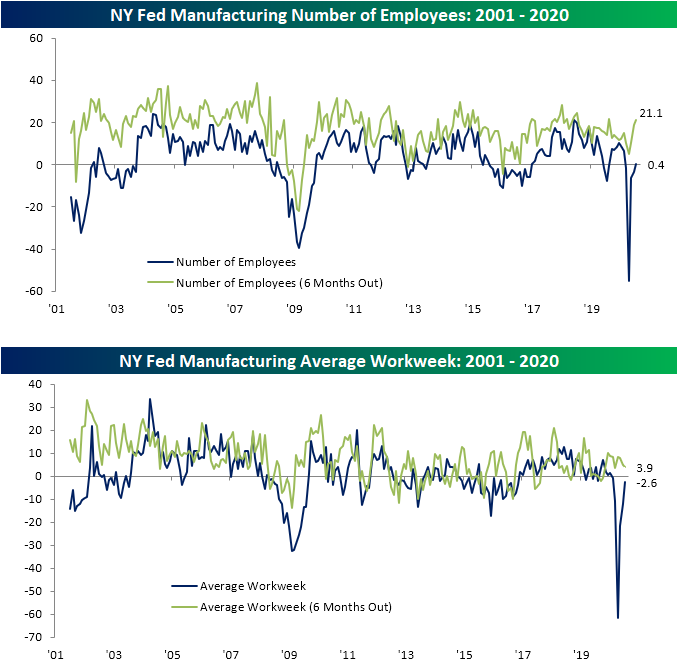

While the pickup in activity was not as large as last month, for multiple individual categories the gains were still in the 90th percentile or better of all periods. Conversely, the declines in the indices for expectations for General Business Conditions, New Orders, and Shipments were all in the bottom decile of all readings. This month’s report also marked a turn for a few components as they changed from contractionary to expansionary. This was the case for the indices for General Business Conditions, New Orders, and Number of Employees. Now more than half are expansionary.

The two indices that rose the most this month were those for New Orders and Shipments. For the index for New Orders, it was the first non-contractionary reading since February, and for Shipments, it marked back to back readings above 0.

One major positive of this month’s report was the reading on employment. After four straight months of a greater share of manufacturers reporting decreases in employment, July marked an equal share of companies reporting an increase in employment as a decrease (21.9%). Additionally, the reading for future expectations rose to its highest level since August of last year indicating companies are at least expecting to increase hiring in the near future. Although employment was stabilized, average workweek did continue to fall, albeit, not by as much as previous months. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

B.I.G. Tips – Nasdaq Hot Streak Continues

Chart of The Day: Next Up for Earnings: Netflix (NFLX)

The Most Volatile Stocks on Earnings

Bespoke’s Earnings Explorer tool is all an investor needs to navigate what is usually a messy period each quarter — earnings season. The Earnings Explorer tool provides a full calendar of upcoming reports along with detailed historical earnings information for individual stocks that ties the data up into a nice bow that you can use to make informed decisions. You can use the tool to search for historical reports and summary data for individual stocks, or use our screening page to find stocks that typically beat or miss estimates, raise or lower guidance, or trade higher or lower in reaction to earnings. It’s also a great way to track macro earnings trends to see how strong or weak reports have been coming in lately as well as how strong or weak share price reactions to earnings have been. We urge you to try out our Earnings Explorer if you have never used it. You can do so with a two-week free trial to Bespoke Institutional.

Below is a chart included on our Earnings Explorer page that shows the number of earnings reports by day over the upcoming month. As shown, the next three weeks will consistently see dozens of reports per day.

At the start of each earnings season, we provide a few lists of important stocks set to report in the coming weeks. Below is a list of the 35 largest stocks set to report over the next month. For each stock, we include its current consensus analyst EPS and sales estimate along with its historical EPS beat rate and its average one-day share price change on its earnings reaction day (on an absolute basis). This lets you see how volatile a stock typically is in reaction to its earnings report.

Of the 35 largest stocks set to report, Apple (AAPL), Facebook (FB), Johnson & Johnson (JNJ), Mastercard (MA), Cisco (CSCO), and AbbVie (ABBV) have topped analyst EPS estimates the most often at 89% of the time or more. In terms of share price volatility, stocks like Netflix (NFLX), Tesla (TSLA), and Amazon (AMZN) typically experience a one-day move of more than 8% (in either direction) on their earnings reaction days. On the flip side, stocks like JNJ, Verizon (VZ), Exxon Mobil (XOM), and Chevron (CVX) typically see a one-day change of less than 2% on their earnings reaction days.

On an average basis, the 35 largest stocks set to report over the next month are much less volatile on their earnings reaction days than all stocks set to report. Whereas all stocks set to report over the next month have historically seen their share prices average a one-day move of +/-5.57%, the average one-day move of the 35 largest stocks in reaction to earnings is just +/-3.84%. In terms of beat rates, the largest stocks typically exceed EPS estimates at a much higher rate than average as well (75% vs. 61.5%).

Moving on, below is our list of the 35 stocks set to report over the next month that typically see the biggest moves in reaction to earnings. To make the list, the stock must have at least five years worth of quarterly earnings reports. Each of the stocks listed below typically moves at least 11% up or down on its earnings reaction day (the first trading day following its earnings report). The Container Store (TCS) is the most volatile stock on earnings with an average one-day change of +/-16.8% after it reports. TCS is scheduled to report after the close on Tuesday, July 28th.

The next most volatile stocks in reaction to earnings which all average one-day moves of more than 15% are Enphase Energy (ENPH), Groupon (GRPN), and Infinera (INFN). While GRPN and INFN are both down 20%+ YTD, ENPH is up 113.9% on the year, which means expectations for its upcoming report on 7/30 will be sky-high.

Other notables on the list of most volatile stocks in reaction to earnings include Wayfair (W), Yelp (YELP), LendingTree (TREE), Chegg (CHGG), Twitter (TWTR), Netflix (NFLX), Etsy (ETSY), and Grubhub (GRUB).

As shown in the table, Netflix (NFLX) is by far the largest stock on the list with a market cap of $230 billion. The next largest stock on the list — Twitter — has a market cap that’s just a tenth of NFLX. Even though it’s now an established blue-chip S&P 500 company, NFLX still typically sees huge moves when it reports its quarterly numbers. We’ll get to see how the stock reacts to its Q2 2020 report soon as NFLX is set to report Thursday after the close. Earnings definitely do not usually give shareholders a chance to “Netflix and chill.” We urge you to try out our Earnings Explorer tool today! It’s a must-have during earnings season. One of the benefits of the tool is it allows you to create a custom earnings release calendar for just the stocks that you follow most closely. You’ll never be blindsided by an earnings report again. Simply start a two-week free trial to Bespoke Institutional to gain access to our Earnings Explorer tool now.

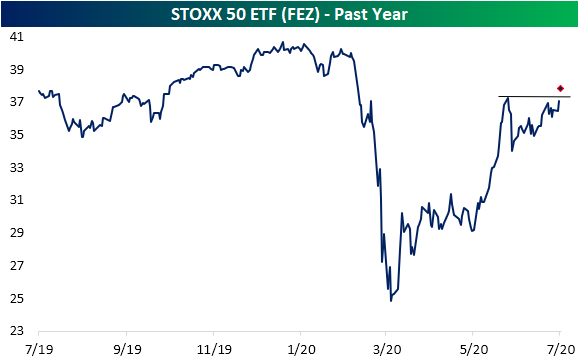

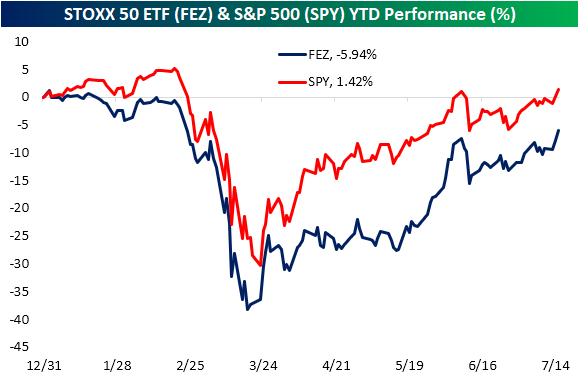

STOXX 50 Breaking Out

While there has been a great focus on the run-up of the largest American equities, the biggest European stocks have also been on the rise in recent weeks. The STOXX 50 (FEZ) is made up of some of the largest companies by market capitalization in the broader Euro STOXX index. In May and the first week of June, FEZ ripped higher before stalling out around 8.5% away from the January 1st 52-week high at $37.24. After sitting below that June high for the rest of June and first half of July, FEZ is finally looking to make a new high today. It is trading up over 2% pre-market which would send it over 1.5% above that June 8th high.

The STOXX 50 is also breaking out in terms of relative strength versus the US—S&P 500 (SPY)—based on where FEZ and SPY are trading pre-market. For most of the past year, FEZ has underperformed SPY as shown in the relative strength chart below. That reversed sharply in May but the dynamic hit the pause button in June as the line trended sideways. With FEZ up over 3% this morning and SPY up 1.35% pre-market, the relative strength line is looking to finally make a new high.

While FEZ has been outperforming a bit recently, on a year to date basis the US remains the better performer of the two. In the first quarter SPY never fell as much as FEZ and the subsequent rally currently leaves SPY up on the year while FEZ is down just under 6%. The only day that FEZ had better performance YTD than SPY was on January 2nd. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke CNBC Appearance (7/15/20)

Bespoke’s Paul Hickey appeared on CNBC’s Worldwide Exchange this morning to discuss the latest news driving markets higher. To view the segment, please click on the image below. Like what you see? Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 7/15/20 – Fading Hope

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Futures are off to the races this morning with the S&P 500 indicated to open up over 1%. It started last night after the close with some positive trial results from Moderna (MRNA) related to its COVID vaccine. Then this morning, futures received another boost when Goldman (GS) reported much better than expected earnings driven by strength in its sales and trading unit. It looks like Robinhood traders aren’t the only ones stuck at home and coining money!

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, the latest earnings reports, global economic data, trends related to the COVID-19 outbreak, and much more.

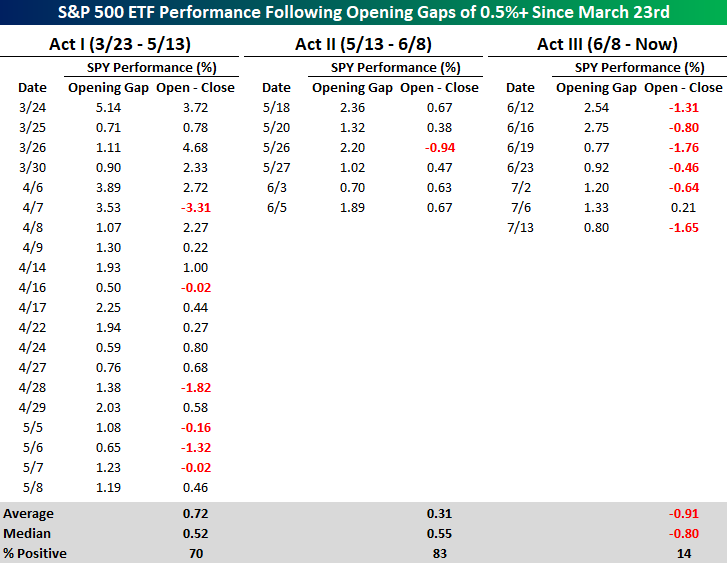

In last Friday’s Bespoke Report, we described the rally off the March lows as a series of three acts each represented by different market characteristics. With futures indicated higher this morning, we wanted to provide a snapshot of market performance following strong opens in each ‘act’ of the rally off the lows and how performance following these strong opens has differed in Act III relative to Acts I and II.

In both Acts I & II, strong opens were typically followed up with additional gains from the open to close. In Act I, the S&P 500 ETF (SPY) had 20 days where it gapped up at least 0.5%. On those days, SPY averaged an open to close gain of 0.72% (median: 0.52%) with gains 70% of the time. In Act II, performance was pretty much just as strong. In the six days where SPY gapped up more than 0.5%, SPY saw an average open to close gain of 0.31% (median: 0.55%) with gains five out of six times.

Act III, which includes the current period though (rightmost column), has been a completely different picture. On the seven prior days since June 8th where SPY gapped up over 0.5%, it has averaged an open to close decline of 0.91% (median: 0.80%) with gains only once. Whether the headlines related to COVID have been good or bad lately, investors have faded the initial market reaction.